Varun Beverages: PAT up 25% & Revenue up 21% in H1 of CY24 at a PE of 87

Guidance by VBL management is very conservative. CY24 execution is ahead of guidance. Strong track record of compounding PAT at 45% & Revenue at 23% in the last 5 years expected to carry forward

1. Why is VBL interesting?

varunbeverages.com | NSE: VBL

VBL's has a track record of strong growth in both revenue and profits, with expanding margins. This sets the stage for its next growth phase through territorial expansion in Africa and venturing into snack food production in Morocco, despite its premium valuations.2. Largest franchisee of PepsiCo in the world (outside USA)

Franchises for various PepsiCo products across 27 States and 7 Union Territories in India

India is the largest market and contributed ~79% of revenues from operations (net) in Fiscal 2023.

VBL has also been granted the franchise for various PepsiCo products for the territories of Nepal, Sri Lanka, Morocco, Zambia, Zimbabwe, South Africa, Lesotho, Eswatini & DRC and distribution rights for Namibia, Botswana, Mozambique and Madagascar.

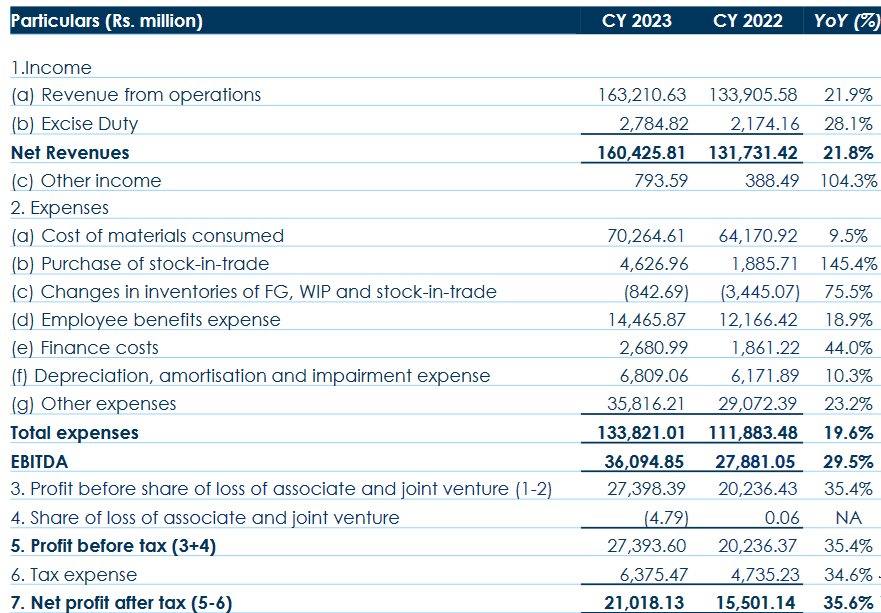

3. CY19-23: PAT CAGR of 45% & Revenue CAGR of 23%

4. Strong CY23: PAT up 36% & Revenue up 22% YoY

5. Q2-24: PAT up 26% & Revenue up 28%

Quarter ending Jun-24

6. H1-24: PAT up 25% & Revenue up 21% YoY

Quarter ending Jun-24

7. Business metrics: Strong & Improving return ratios

8. Outlook: Management guidance is conservative

i. FY25: Growth guidance is conservative

Double-digit growth means anything greater than 10 which is very conservative given the 25% bottom line growth in H1 of CY24

With strong performance in a key quarter, we are on track to deliver healthy double-digit growth in this calendar year

ii. FY25: Margins guidance is conservative

H1 of CY24 has delivered 25.9% but VBL management is sticking to its 20-21% EBITDA margin guidance

We think 20-21% is a fairly high EBITDA margin in our industry and we would like to stick to that

iii.CY24: Strong growth outlook

In nutshell, we have additionally fuelled 3 growth engines which will gradually and consistently contribute to revenue and profitability growth in the company.

First growth engine is the South Africa's combined territory with Lesotho, Eswatini, Namibia, Botswana, Mozambique and Madagascar.

Second growth engine is entry into new territory of DRC where PepsiCo is not present at all as of now, the commercial production here from our new state-of-the-art greenfield plant is expected to start from the next quarter.

The third growth engine is entry into snack food production by May 2025 in Morocco.

9. PAT growth of 25% & Revenue down 21% in H1 of CY24 at a PE of 87

10. Do I stay?

If I hold the stock then one may continue holding on to VBL

The outlook for VBL in CY24 is strong

Our Q3 is also growing in double digits, and we are quite happy with our growth.

While the guidance is conservative, the VBL is indicating that the business momentum of CY19-23 with PAT CAGR of 45% & Revenue CAGR of 23% will be maintained in the foreseeable future.

The growth outlook stays no way different from the past few years

Our strategic investment in enhancing production capabilities and making new acquisitions have significantly strengthened our global presence. These initiatives have established a solid platform for sustained growth in the foreseeable future.

11. Do I enter?

If I am looking to enter VBL then

VBL has delivered PAT growth of 25% & with Revenue growth of 21% in H1 of CY24 at a PE of 87 which makes the valuations quite expensive in the short term.

Outlook for business momentum of CY19-23 with PAT CAGR of 45% & Revenue CAGR of 23% being maintained by VBL at a PE of 87 creates opportunities only from a longer term perspective.

While VBL business is a strong compounder, the stock may have run ahead of the business. Margin of safety in VBL is limited. Entry in VBL can be made over a period of time when the stock may give some opportunities with a correction.

PAT margins improving from 6.6% to 13.1% over the last 5 years.

Net worth growth at a CAGR of 21% for CY19-23

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer