Utssav CZ Gold H1 FY26 Results: Profit Up 198%, On-track FY26 Guidance

Utssav Gold guides for 70%+ revenue growth in FY26 with stable margins after delivering a strong results in H1 FY26. Available at attractive forward valuations

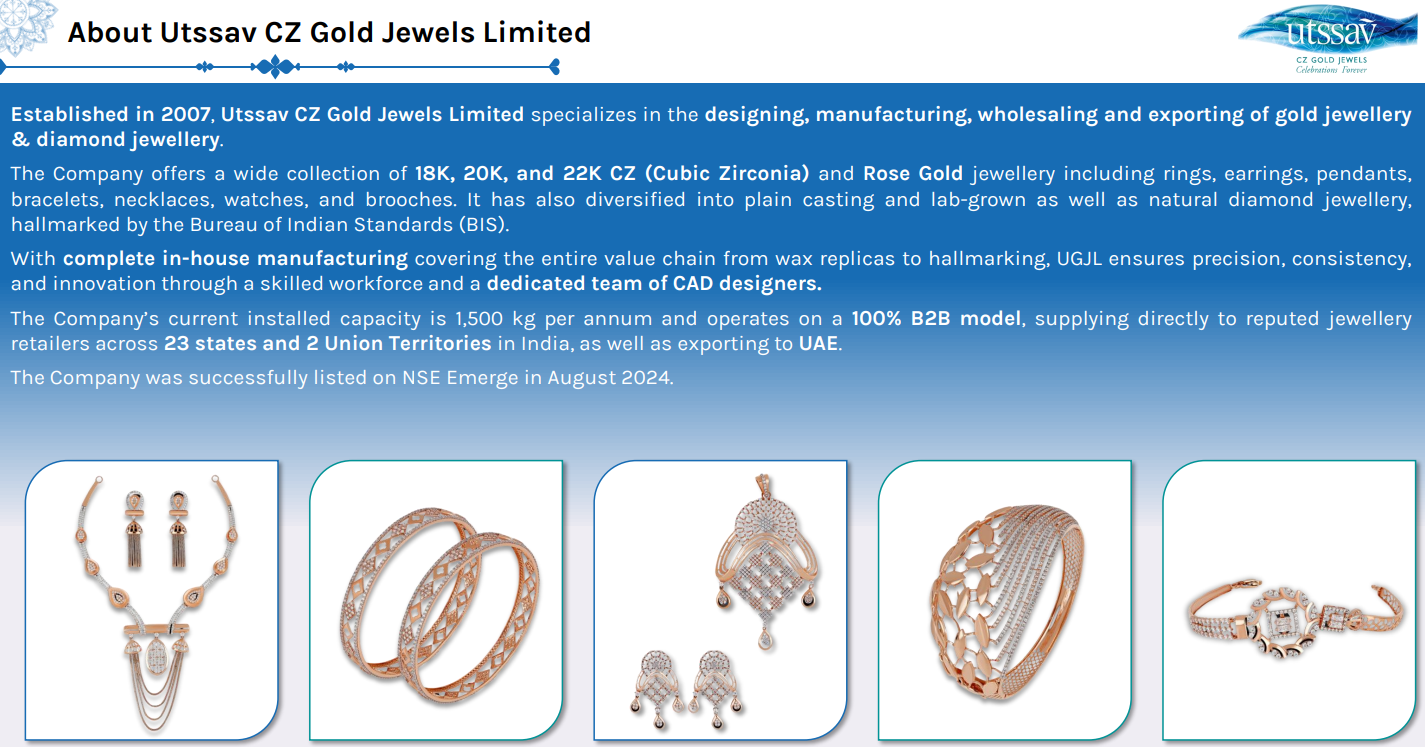

1. Designs & Manufactures Gold Jewellery

utssavjewels.com | NSE - SME: UTSSAV

Utssav CZ Gold Jewels Limited - designing, manufacturing, wholesaling and exporting of gold jewellery & diamond jewellery.

Manufactures 18K, 20K, and 22K CZ (Cubic Zirconia) and Rose Gold jewellery

Diversified into plain casting and lab-grown as well as natural diamond jewellery,

Current installed capacity is 1,500 kg per annum

Operates on a 100% B2B model — supplying directly to jewellery retailers

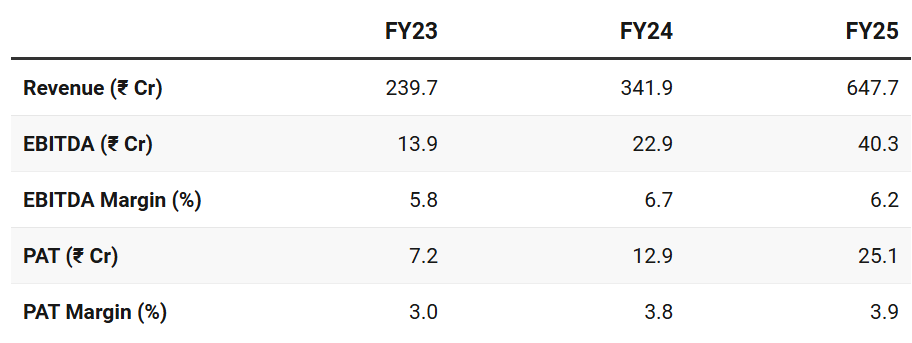

2. FY23–25: PAT CAGR of 87% & Revenue CAGR of 64%

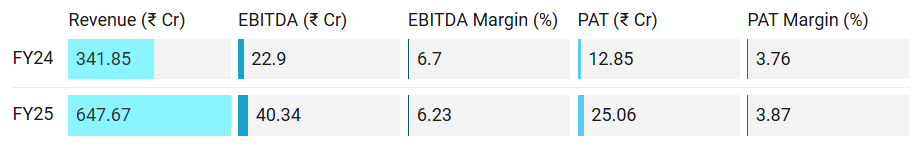

3. FY25: PAT up 89% & Revenue up 95% YoY

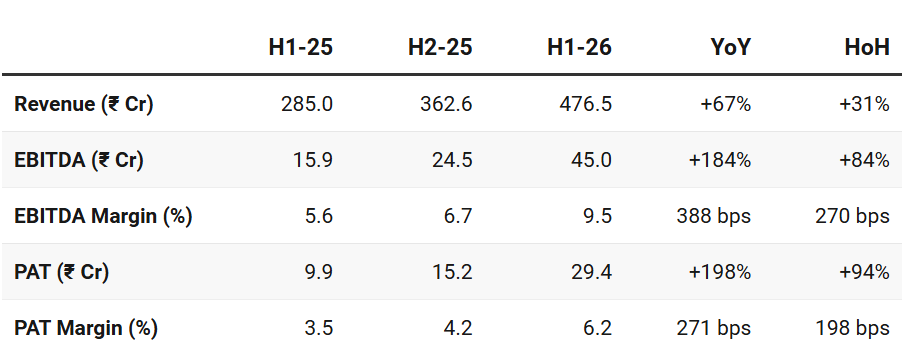

4. H1-26: PAT up 198% & Revenue up 67% YoY

PAT up 94% & Revenue up 31% HoH

Growth H1 FY26, driven by

Strong volume growth up 25%,

Higher gold prices supporting value growth

Strong festive + wedding season demand beginning in Q2

Margin expansion driven by

Designer jewellery and watches now forming higher mix

New natural + lab-grown diamond jewellery with superior margins

Operating leverage benefits

~1% margin expansion due to higher gold prices (as margins are % of gold value)

Higher-margin segments gained traction:

Designer lightweight jewellery

Diamond jewellery (2% of sales now, but fast-growing)

Expects diamond revenues to grow ₹200–500 Cr in 2 years, materially lifting margins.

Receivable days elevated (70–80 days) due to on-boarding new large retailers.

Short-term borrowings rising in FY26 to support growth.

Expects WC cycle to normalise within 3–4 months.

Current utilisation: ~67% | Installed capacity: 1.5–1.6 tonnes

Expansion to 2.5 tonnes to go live within Q3 FY26

Revenues from expanded capacity expected in H2 FY26

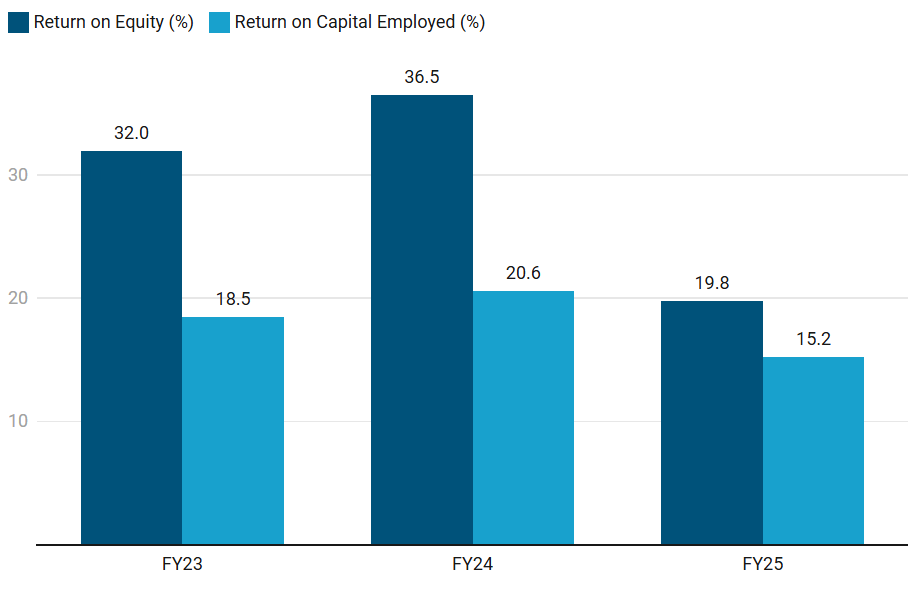

5. Business metrics: Strong Return Ratios

Return ratios muted by funds from IPO in FY25

6. Outlook: FY26 Growth of 70%+

6.1 FY26 Guidance

We are confident of closing the year in the range of INR1,100 crores to INR1,200 crores

9% to 10% should be EBITDA sustainable.

FY 2030, we look around INR4,000 to INR5,000 crores

With same margins. Or maybe a better margin if, because we recently started Real Diamonds. As their sales will increase and percentage starts growing in our company, so margins might improve

Annual capacity: Approximately around 6 to 7 tons.

Margin Drivers — PAT Margins: 4.5-5%

Product Mix Shift: Shift towards higher-margin categories like designer jewelry and the recent entry into Real Diamond jewelry.

Diamond Margins:

Plain gold jewelry yields ~4% margins, diamond jewelry yields 10-15%.

As diamond jewelry increases, overall margins expected to improve further

Capacity and Operational Expansion

Capacity Increase: Increased installed capacity from 1.5 tons to 2.5 tons.

New capacity are expected to begin in Nov/Dec 2025.

Future Capacity Requirements: To achieve FY30 revenue goal of ₹4,000–5,000 crores — need to expand capacity to 6 to 7 tons annually.

6.2 H1 FY26 Performance vs FY26 Guidance

Revenue, margins In-line, and capacity expansion on schedule

Revenue: Required run-rate of ~₹620-720 Cr vs ₹476 Cr in H1

H2 is always stronger (festive + wedding demand) and new 2.5-tonne capacity contributes in H2.

Margins: Within the 9-10% guidance range in H1-26

Already within guidance band despite:

WC build-up

Diamond still at early share

Capacity expansion not fully operational yet

Margins to improve in H2 as:

Diamond share rises

Designer mix strengthens

Full capacity utilization kicks in

Volume: Up 25% YoY

Receivables: Receivable days increased to 70–80 days due to on-boarding 70–80 new customers.

Inventory inflated by gold price

Needs to be watched carefully

7. Valuation Analysis — Utssav CZ Gold

7.1 Valuation Snapshot

Current Market Price= ₹223.50; Market Cap = ₹532.33 Cr

Attractively priced on a FY26 basis

Opportunity to re-rate to ~15× P/E based on FY26 EPS

Cheaper than Sky Gold on FY26 valuations

Utssav is much smaller than Sky Gold

Utssav CZ Gold Jewels appears undervalued on FY26 metrics — with re-rating potential as it delivers on FY26 guidance

7.2 Opportunity at Current Valuation

Attractive Forward Valuations: At FY26 P/E of ~8×, EV/EBIDTA of ~6× the valuations don’t seem to be discounting H1 FY26 performance and FY26 guidance

Potential for re-rating of multiples based on FY26 execution

Forward Valuations are not demanding: With a FY26 P/E of ~9× there is a margin of safety in the stock even if guidance is not fully met

Conservative FY26 estimates: Valuations are based on lower end of guidance. If performance exceeds lower end of guidance it creates an opportunity

Large Headroom for Growth:

Transition toward organized jewellery retail is a structural tailwind

New Capacity coming in during H2 FY26 to support near-term growth

Vision of ₹4,000-5,000 Cr revenue by FY30 provides a longer term story in Utssav

Global Optionality:

Expanding exports to UAE etc will improve margins

7.3 Risk at Current Valuation

Untested Management: H1 FY26 was the first management call where a guidance of ₹1,100-1,200 Cr revenue for FY26 was given. We haven’t yet seen the track record of Utssav management delivering against guidance.

Typical risks with any small-cap with limited track-record of management as public company persist

Quality of Earnings — Receivables have increased significantly,

with debtor days stretching to 70–80 days (compared to peers who are often at 30–40 days).

Attributed to acquiring 70–80 new customers and offering them credit leverage to build relationships.

Due to the extended receivables, cash flow has tightened.

Management admitted that cash flow is currently stretched (”going little above the time”)

Expected to normalize in 3–4 months.

No Fixed Order Book: There is “nothing like an order book” or long-term contracts with quantity commitments.

Utssav operates on a “spot” basis where clients (B2B retailers) place orders as needed, with a short fulfillment cycle of 7–10 days.

Without a confirmed order book, revenue visibility is low and highly dependent on immediate market sentiment and the success of the wedding/festive season.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer