Trump Tariffs: Winners & Losers in India's IT Services

Trump’s tariffs hit India’s IT services. AI-driven firms better placed to win, while US-focused players face pressure from visas, budgets & procurement shifts.

Table of Content

How Trump’s Reciprocal Tariffs Threaten Indian IT Services

AI: The Secret Weapon Helping Indian IT Beat the Tariff Fallout

Hidden Risks Indian IT Investors Can’t Afford to Ignore

The Real Winners and Losers in Indian IT Post-Tariffs

1. How Trump’s Reciprocal Tariffs Threaten Indian IT Services (Infosys, TCS, Wipro, HCL, Tech Mahindra etc. )

Indian IT firms won’t feel the first-order tariff hit, but the second-order ripple effects could be substantial, especially if U.S. clients enter a cost-cutting mode. Margins may stay intact short term, but growth visibility in FY26 could weaken unless macro sentiment improves.

1.1 No Direct Tariff, But Real Indirect Effects

Services aren’t tariffed, but Indian IT companies are deeply tied to U.S. corporate clients.

U.S. clients facing higher import tariffs (especially manufacturers, pharma, retail) may cut IT budgets or delay new tech/digital projects.

Example: A U.S. retailer hit by tariffs on APIs or packaging may delay a planned planned contract with an Infosys or Wipro.

1.2 Client Discretionary Spending May Shrink

Many Indian IT firms derive 50–70% of revenue from U.S. clients.

Tariff-led economic uncertainty, higher operating costs for clients, and potential slowdown in U.S. GDP growth could reduce:

New contract awards

Expansion of existing projects

Digital transformation deals (cloud, AI, data)

Effect: Slower revenue growth in FY26, especially in:

Retail

Manufacturing

Pharma/life sciences

1.3 Hiring Pressure: Reinvigorated “Hire American” Push

Trump’s trade moves are typically aligned with:

Stricter visa scrutiny (H-1B/L-1)

Push for onshore/U.S. hiring

IT firms may face:

Increased compliance costs

More local hiring mandates

Risk of higher wage bills in the U.S.

TCS, Infosys, and HCL already have large U.S. workforces (30–40% of U.S. employees), but the cost differential versus India is still material.

1.4 Risk of Regulatory or Political Blowback

Anti-outsourcing sentiment may gain momentum.

Contracts with government agencies or sensitive sectors (e.g., defense, infrastructure) could come under scrutiny.

Watch for:

Negative press or political noise around outsourcing

Reputational risk in U.S. elections/PR cycles

1.5 Increased Push for Diversification

Indian IT firms likely to accelerate expansion into:

Europe

Asia Pacific

Latin America

Also building nearshore delivery centers (e.g., Mexico, Poland, Canada) to de-risk U.S. concentration.

2. AI: The Secret Weapon Helping Indian IT Beat the Tariff Fallout

2.1. AI-Led Demand = Secular Growth Engine

Across sectors, generative AI, machine learning, and automation are driving new demand in:

Cloud modernization

Business process transformation

Customer experience platforms

Intelligent operations

U.S. companies are investing in AI even as they cut traditional IT spends. This creates a bifurcation:

Old projects = frozen or delayed

AI projects = accelerated

2.2. Tariffs = Pressure on Traditional Spend

Trump’s reciprocal tariffs are:

Raising costs for many U.S. companies (retailers, pharma, manufacturers)

Increasing macroeconomic uncertainty

Encouraging conservative IT budgets — except where tech is seen as essential or ROI-positive

That hurts:

Large infra deals

ERP migrations

Non-core digital spending

2.3 AI Seen as Cost-Saving — Not Just Spending

While tariffs increase costs, AI adoption is often a cost-efficiency lever:

Automate customer support (vs outsourcing)

Optimize supply chains (tariffed goods become costlier)

Improve decision-making amid margin pressure

So paradoxically, tariffs may actually accelerate AI spending in sectors hit hardest (like retail, logistics, pharma).

2.4 Indian IT Firms: Dual-Speed Opportunity

Firms like Infosys, TCS, and Wipro are aggressively building out AI CoEs (Centers of Excellence) and partnering with hyperscalers (Microsoft, AWS, Google).

2.5 Implications for Investors

Prioritize firms that:

Have large AI-focused deal pipelines

Offer AI + automation + cloud as integrated packages

Are focused on value-creation, not just headcount-driven billing

Be cautious with firms:

Over-indexed on low-end BPO

With weak AI/IP portfolios

Dependent on U.S. manufacturing/retail clients with tariff pain

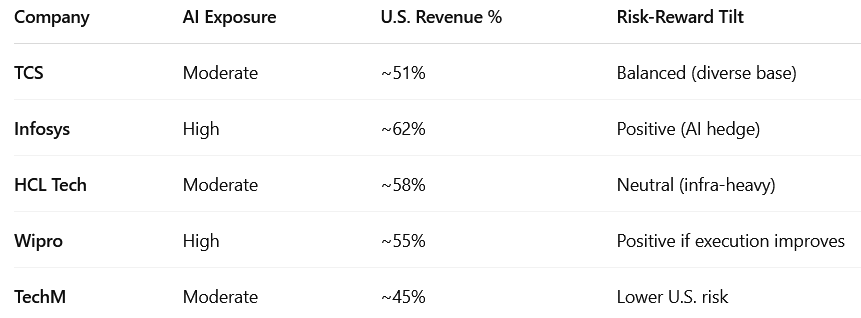

2.6 Company Snapshot (AI Readiness vs U.S. Risk)

3. Hidden Risks Indian IT Investors Can’t Afford to Ignore

The headline narrative is that Indian IT services are "safe" from tariffs. That’s technically true — but the sub-surface shifts in procurement behavior, visa strategy, compliance, and political noise could reshape the sector's operating environment in the U.S.

3.1 U.S. Enterprise Procurement Shifts

Tariffs could accelerate “Buy American” or “Local First” mandates within U.S. enterprise procurement policies — even for services.

This may not be legally binding, but perception and political optics will matter, especially in regulated industries (healthcare, defense, BFSI).

What to watch:

Shift toward local consultants and U.S.-based firms (e.g., Accenture, Cognizant, domestic SI players).

Increasing preference for contracting local delivery centers over India-based delivery, even if costlier.

3.2 Risk of Security/Compliance Barriers

In a high-tension trade environment, data privacy, cybersecurity, and compliance become geopolitical tools.

Expect stricter scrutiny over:

Cross-border data flows

Remote access from offshore teams

Use of Indian developers in U.S. critical infrastructure work

This could:

Slow down project execution

Increase compliance-related cost of service delivery

Impact public sector or critical infra contracts (cloud, AI ops, telecom)

3.3 Potential for Unofficial Quotas or Soft Sanctions

Trump’s policy machine often uses non-transparent tools: targeted audits, immigration slowdowns, or federal contract restrictions.

Indian IT majors that serve U.S. government or defense-adjacent clients could face soft pushback (delayed approvals, red tape).

Undiscussed risk: A company might technically qualify for a deal but lose out on "strategic preference" grounds.

3.4 Re-Weaponization of Visa Regime (H-1B / L1)

While H-1B visa restrictions are not part of the tariff order, they’re closely aligned with Trump’s “America First” agenda.

Expect:

Lower visa approval rates

Longer processing times

More scrutiny on wage levels and job roles

That means higher blended cost per employee for Indian IT firms operating in the U.S., especially mid-size players with less local bench strength.

3.5 M&A Slowdown Risk in U.S. Market

Indian IT firms have been acquiring U.S.-based companies (digital agencies, ER&D players, niche cloud firms) to build onshore capabilities.

Trade tensions and political scrutiny may slow M&A approvals or inflate deal premiums for “safe” assets.

Watch for:

Drop in U.S. acquisitions announced by Indian firms in next 6–12 months

Shift to nearshore buys (e.g., Mexico, Canada, Eastern Europe)

3.6 Valuation De-Rating Risk

Even if business fundamentals hold, Indian IT stocks could face:

Multiple compression due to perceived geopolitical risk

Global fund flows moving away from emerging market IT/outsourcing plays toward “safe” geographies

This is about sentiment, not numbers. Even high-quality firms could suffer from being “India-based, U.S.-dependent.”

4. The Real Winners and Losers in Indian IT Post-Tariffs

✅ 4.1 AI-First and IP-Led Companies

Why: AI & automation = cost-efficiency for U.S. clients → immune from budget cuts

Traits:

Strong internal AI tools and platforms (e.g., Infosys’ Topaz, TCS’ Cognix)

Partnerships with Microsoft, AWS, Google Cloud

Dedicated AI/ML delivery units

Examples:

Infosys (Topaz, strong AI GTM)

TCS (AI + cloud convergence at scale)

Persistent Systems (IP-led, BFSI + healthcare focused)

✅ 4.2 Well-Diversified Geographically

Why: U.S. pressure? Offset by Europe, APAC, Middle East

Traits:

<60% revenue from the U.S.

Recent deal wins in Europe, Australia, Japan, etc.

Examples:

Tech Mahindra (telecom + Europe-heavy)

LTIMindtree (growing Europe pipeline)

TCS (broadest international footprint)

✅ 4.3 High Onshore/Local Hiring Readiness

Why: Reduces exposure to H-1B visa tightening and optics of “outsourcing”

Traits:

30% of U.S. headcount is local

U.S. delivery centers or acquisitions

Experience with U.S. federal/state clients

Examples:

Infosys (multiple U.S. hubs + large local talent pool)

Cognizant (technically U.S.-based but India delivery)

Wipro (investing in U.S. digital studios + acquisitions)

❌ 4.4 Mid-Tier Firms Overexposed to the U.S.

Why: No buffer if discretionary spend drops or clients delay projects

Traits:

70% revenue from U.S.

Low visibility in other markets

High client concentration

Examples:

U.S. BFSI exposure is high

Vulnerable to retail/mid-market

Heavily reliant on few verticals

❌ 4.5 Body-Shopping / Low IP Firms

Why: Trump policy and enterprise procurement may turn hostile to headcount-based, low-value offshore deals

Traits:

Low-margin, people-heavy delivery

Lack of automation/IP to defend pricing

No distinct value proposition beyond cost arbitrage

Examples:

Small IT staffing/contracting players

Tier-3 firms with <₹1,000cr revenue and no platform strategy

❌ 4.6 Heavily Dependent on BPO / Voice Work

Why: These services are easy political targets and vulnerable to automation

Traits:

Voice-based customer support, collections, back-office ops

No move toward AI or intelligent automation

U.S. clients in telecom, retail, or consumer finance

Examples:

Voice-heavy BPO, healthcare/finance exposure

Any legacy BPO without AI/analytics evolution

Disclaimer

Content Accuracy and Reliability: This summary of the earnings call is generated using an artificial intelligence large language model (LLM). While every effort has been made to ensure the accuracy and completeness of the information, the summary may not fully capture all nuances or details of the original earnings call. The content provided is for informational purposes only and should not be construed as financial advice or a recommendation to buy or sell any securities. Verification: Readers are encouraged to refer to the official earnings call transcript, company filings, and other authoritative sources for comprehensive and accurate information. The creators of this summary do not guarantee the accuracy, completeness, or timeliness of the information and accept no responsibility for any errors or omissions. No Liability: The use of this summary is at your own risk. The creators and distributors of this content disclaim any liability for any loss or damage arising from the use of or reliance on this summary. Consult Professional Advice: For investment decisions or financial advice, please consult a qualified financial advisor or other professional

Very informative and simple language with examples is very useful. Great read.