Trump Tariffs: Impact & Opportunities in Indian Pharma

Indian pharma is exempt from Trump’s 2025 tariffs — for now. Specialty & biosimilar firms hold strong, but generics-heavy players face margin, regulatory risk.

Table of Content

Impact of Trump’s Reciprocal Tariffs on Indian Pharma Industry

Indian Pharma Industry’s Strategic Response to Tariff Risks

Hidden Growth Opportunities for Indian Pharma Amid Trade Tensions

Winners & Losers in Indian Pharma Post-Tariffs

1. Impact of Trump’s Reciprocal Tariffs on Indian Pharma Industry

1.1 Current Tariff Status: Indian Pharma Temporarily Exempt

Pharmaceutical products (formulations, APIs) are currently excluded from the 26% tariffs imposed by the U.S. on a wide range of Indian imports.

However, Trump has previously signaled discomfort with low-cost generics flooding the U.S. market and has pushed for “Buy American” healthcare policies.

Implication: The exemption may be temporary or politically reversible. Future tariffs, restrictions, or non-tariff actions are very possible.

1.2 U.S. Dependency of Indian Pharma Exports

The U.S. is the #1 market for Indian generics, with annual exports > $10 billion

The U.S. accounts for ~30-35% of India’s pharma exports, particularly in generic formulations.

Leading exporters like Aurobindo, Dr. Reddy’s, Lupin, and Sun Pharma derive a major chunk of revenues from the U.S. generics market.

Implication: Even indirect disruptions (e.g., lower demand from U.S. buyers or tighter regulation) can significantly affect toplines.

Risk Level: High for generics-heavy exporters with >35% U.S. share

1.3 Tariffs and Margin Risk in Indian Generic Drugs

Generic drugs in the U.S. already operate on razor-thin margins due to:

Intense price competition

Buyer consolidation (e.g., Walgreens, CVS, Cardinal, McKesson)

Regulatory costs

A 10–15% price hit from tariffs could wipe out margins on many low-value generics.

Many Indian pharma players won’t be able to pass on cost increases

Companies with branded generics or specialty drugs (e.g., Sun Pharma’s Taro, Biocon’s biosimilars) are better insulated.

1.4 Regulatory Risk as a Non-Tariff Barrier

Even in the absence of direct tariffs, the U.S. administration may use non-tariff barriers such as:

Stricter FDA inspections

Delays in drug approvals

Increased scrutiny of Indian manufacturing facilities

Implication: Regulatory pressure can serve as a de facto tariff by slowing down business operations and adding compliance costs.

Impacted the most: Companies that rely on single-site filings or have prior FDA warnings (e.g., Lupin, Aurobindo have had issues in past)

1.5 Supply Chain Localization Pressure on Indian Pharma

U.S. policymakers are pushing for domestic manufacturing of critical drugs and APIs, citing supply chain security and strategic autonomy.

While Indian companies still dominate the generics market, there's growing U.S. interest in reshoring production.

Most Indian pharma companies do not have significant U.S. manufacturing bases. A few exceptions:

Sun Pharma: Taro Pharma (U.S.)

Cipla: Some capacity via acquisition (InvaGen)

Dr. Reddy’s: Limited, but exploring local alliances

Implication: Indian pharma faces long-term pressure to localize manufacturing, invest in U.S.-based facilities, or partner with American CDMOs.

1.6 Why Product Mix Will Define Pharma Winners & Losers

Biocon and Cipla are pivoting toward biosimilars, specialty inhalers, and value-added generics to escape the price war.

Sun Pharma is investing in dermatology, branded formulations, and specialty assets in the U.S.

Policy-wise, Indian pharma associations (like IPA, Pharmexcil) are lobbying for continued tariff exemption based on healthcare affordability arguments.

Signs of proactive adaptation, but not universal across the sector

High Risk:

Oral solids (tablets/capsules)

Off-patent, non-differentiated generics

Low-barrier-to-entry APIs

More Resilient:

Biosimilars and specialty drugs (e.g., injectables, oncology, respiratory)

Branded generics

CDMO/CRAMS services for global innovators

Implication: Firms moving up the value chain will better withstand global trade and regulatory shocks.

1.7 Trade Uncertainty & Impact on Pharma M&A Strategy

Trade uncertainty makes U.S. acquisition targets more expensive and riskier

Pharma partnerships with U.S. firms may slow down due to regulatory bottlenecks or nationalistic preference shifts

Indian companies may need to invest in U.S. facilities to hedge against future barriers

1.8 How Tariff Uncertainty Affects Pharma Valuations

Even if tariffs don’t materialize immediately, the fear of future barriers creates:

P/E multiple compression

Reduced foreign fund interest in U.S.-heavy pharma stocks

2. Indian Pharma Industry’s Strategic Response to Tariff Risks

The Indian pharma industry sees the Trump tariffs more as a diplomatic hurdle than a structural threat. They are confident in their competitive moat, cautious about making big reactive changes, and leaning on policy resolution while staying focused on long-term strategy.

2.1 Indian Pharma Sees Tariffs as Temporary, Not Structural

Most managements are not overreacting to the threat of tariffs. The consensus is that:

Tariffs are temporary and politically driven, not structural.

Business decisions—like setting up U.S. facilities—should not be reactionary.

"I'm not sure tariffs should dictate what we should be doing as players, because there is a risk that four years later, those tariffs may go away," Cipla Global CEO Umang Vohra

"I don't know how much difference it (tariffs) will make to us... and will not justify relocating our manufacturing," Sun Pharma MD Dilip Shanghvi.

2.2 Why Indian Pharma Remains Confident in Cost Competitiveness

There’s broad confidence that Indian generics will remain competitive, even with a 26% tariff:

Indian pharma has strong cost advantages and scale.

Dr. Reddy’s MD G.V. Prasad called out that relocating to the U.S. isn’t viable due to high costs and lack of infrastructure.

2.3 Will Tariffs Be Passed to U.S. Consumers?

Companies like Sun Pharma indicate that additional costs may be passed on, especially in non-competitive segments:

There's a belief that the U.S. still depends heavily on Indian generics.

Price increases are inevitable in some areas.

"Ultimately, it (tariff impact) will be passed on to consumers," Sun Pharma MD Dilip Shanghvi.

2.4 Role of Government Diplomacy in Defending Pharma Exports

The industry is collectively banking on government-to-government negotiations:

The Indian Pharmaceutical Alliance and major companies are coordinating with policymakers.

There's optimism that pharma will remain exempt or get preferential treatment due to its critical nature.

“I welcome the US government’s decision to exempt Indian pharmaceutical products from tariffs, which underscores the strong bilateral relationship between India and the US, as well as the critical role of the Indian pharmaceutical sector in enhancing public health,” Biocon Chairperson Kiran Mazumdar-Shaw

2.5 No Immediate Shift in Indian Pharma Manufacturing Strategy

Despite U.S. pressure for domestic manufacturing:

No major company is planning to shift supply chains or build new capacity in the U.S.

Indian players believe their current base can handle global demand efficiently.

“Building domestic manufacturing capacity to meet these needs will take years of investment, regulatory adjustments, and workforce development. It’s heartening to see our longstanding partnership with the US being recognized—this relationship has fostered an environment where open dialogue can lead to mutual growth.” Sheetal Arora, CEO & Promoter, Mankind Pharma

3. Hidden Growth Opportunities for Indian Pharma Amid Trade Tensions

3.1 India’s Advantage as an Alternative to Chinese API Suppliers

If U.S. keeps penalizing China (via tariffs, blacklists, or ESG filters), India becomes the default alternative for API sourcing

Opportunity: Gain share in paracetamol, antibiotics, anti-diabetics, oncology APIs

Beneficiaries: Divi’s, Laurus Labs, Aarti Drugs, Neuland

3.2 Biosimilars and Specialty Products: The Next Growth Engine

U.S. biotech and specialty pharma companies need cost-effective, trusted partners

India’s contract development & manufacturing sector (CRAMS/CDMO) is gaining traction fast

Opportunity: Long-term, high-margin partnerships

Beneficiaries: Syngene, Suven, Gland Pharma, Laurus

3.3 Growth in Biosimilars and Specialty Products

U.S. needs cost-efficient alternatives to biologics — but manufacturing and regulatory costs are high domestically

Indian firms with biosimilar pipelines can break into high-value, low-competition markets

Beneficiaries: Biocon Biologics, Dr. Reddy’s, Zydus Lifesciences

3.4 Nearshoring Manufacturing Hubs

These can serve U.S. buyers tariff-free and reduce geopolitical friction

Beneficiaries: Companies with capital flexibility and global compliance systems

3.5 PLI Scheme Driving Domestic Pharma Capex

India’s Production Linked Incentive (PLI) scheme is driving capex in:

Key APIs

Complex generics

Domestic manufacturing

Beneficiaries: Mid-tier players upgrading capabilities, especially in API backward integration

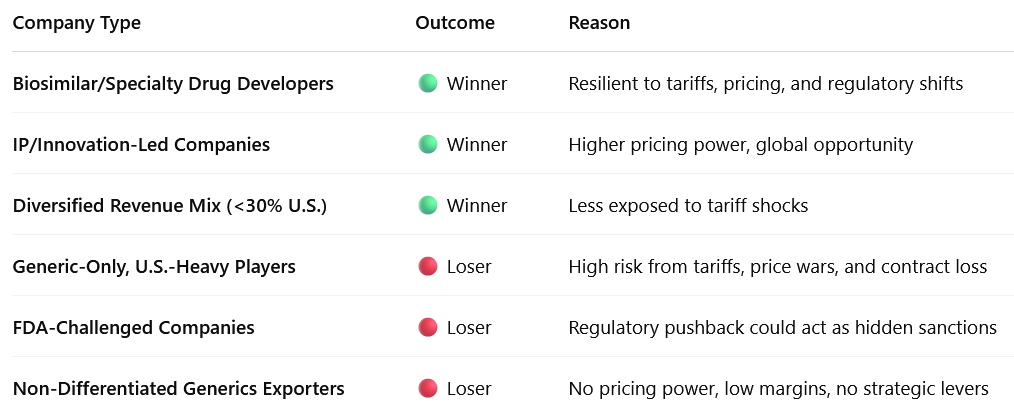

4. Winners & Losers in Indian Pharma Post-Tariffs

4.1 Winners: Specialty Drug Makers and Biosimilar Leaders

Why: These products are higher-margin, harder to commoditize, and less price-sensitive. U.S. payers and hospitals need them.

Traits:

Strong U.S. pipeline of inhalers, injectables, oncology, dermatology, etc.

Not reliant on high-volume, low-margin generics

Diversifying toward Europe and emerging markets

Examples (by model, not recommendation):

Biosimilar-focused: Biocon Biologics

Specialty-focused: Sun Pharma (via Taro, dermatology)

Respiratory play: Cipla (inhalers, complex generics)

4.2 Winners: Diversified Pharma Companies with Low U.S. Exposure

Why: Less exposed to direct or indirect policy shocks

Traits:

U.S. share <30% of total revenue

Balanced presence in EU, Africa, India, and RoW

Manufacturing flexibility outside India

Examples (by model):

Domestic-heavy: Torrent Pharma

Well-diversified: Cipla, Biocon

4.3 Winners: IP-Driven and R&D-Led Pharma Players

Why: Tariffs and pricing pressure hurt commodity businesses, not IP-led ones

Traits:

Strong R&D pipelines

Differentiated delivery platforms (e.g., nano-formulations, fixed-dose combos)

Partnerships with MNCs or U.S. healthcare systems

Examples (by model):

Niche R&D players: Syngene, Laurus (CDMO)

Global partnerships: Glenmark (with partners in EU/US)

4.4 Losers: Generics-Heavy, U.S.-Dependent Pharma Exporters

Why: Tariff hikes, buyer consolidation, and FDA risks hit this model hardest

Traits:

40–50% of revenue from U.S.

Portfolio dominated by oral solids and commoditized generics

History of FDA compliance issues

Risk Example (by model):

Aurobindo, Lupin, and other generics-heavy exporters

4.5 Losers: Pharma Firms with FDA or Compliance Challenges

Why: Trump-era FDA could be used as a non-tariff weapon (e.g., increased inspections, warning letters)

Traits:

Plants with ongoing or unresolved warning letters/import alerts

Heavy reliance on 1–2 FDA-approved sites

Reactive instead of proactive compliance

Implication: Disproportionate scrutiny, approval delays, and export disruption

4.6 Losers: Companies Without Innovation or Market Diversification

Why: Tariffs + price pressure + regulatory fog = death spiral for me-too generic companies

Traits:

No differentiated products or platforms

Poor visibility outside U.S. market

No strategic shift toward complex generics or branded exports

Disclaimer

Content Accuracy and Reliability: This summary of the earnings call is generated using an artificial intelligence large language model (LLM). While every effort has been made to ensure the accuracy and completeness of the information, the summary may not fully capture all nuances or details of the original earnings call. The content provided is for informational purposes only and should not be construed as financial advice or a recommendation to buy or sell any securities. Verification: Readers are encouraged to refer to the official earnings call transcript, company filings, and other authoritative sources for comprehensive and accurate information. The creators of this summary do not guarantee the accuracy, completeness, or timeliness of the information and accept no responsibility for any errors or omissions. No Liability: The use of this summary is at your own risk. The creators and distributors of this content disclaim any liability for any loss or damage arising from the use of or reliance on this summary. Consult Professional Advice: For investment decisions or financial advice, please consult a qualified financial advisor or other professional

We did a similar deep-dive. Good to see we are aligned on the big picture risks!

https://nordicedge.substack.com/p/patents-pills-and-protectionism-the