Transrail Lighting Q1 FY26 Results: PAT Up 105%, On track FY26 Guidance

Revenue growth guidance of 22-25% with stable margins supported by order book offering 2 years visibility. At current valuations, FY26 execution is mostly priced in

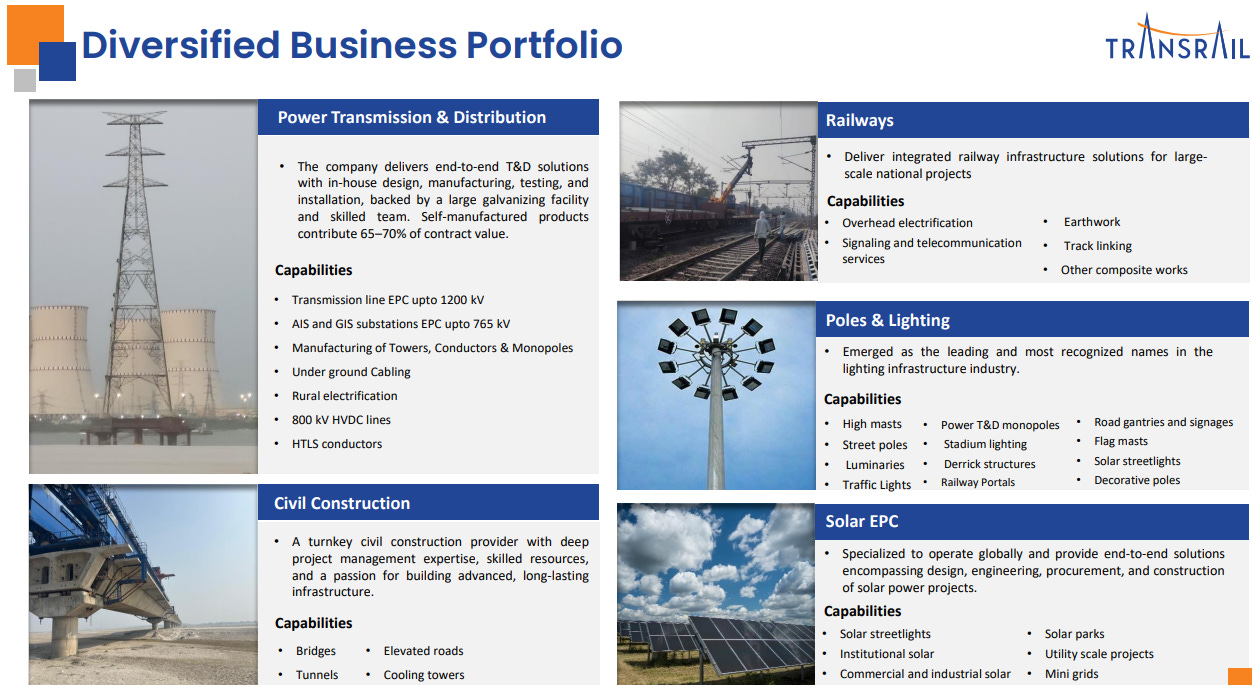

1. EPC Company with Manufacturing of Towers, Conductors & Monopoles

transrail.in | NSE: TRANSRAILL

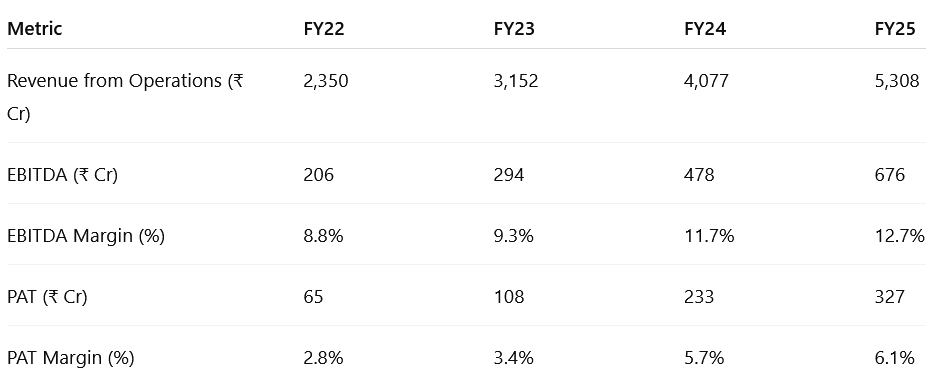

2. FY21–25: Revenue CAGR of 34% & EBITDA CAGR of 37%

From EPC contractor to fully integrated infra player

From India-centric to balanced global presence

From volume-led to margin-first growth with discipline

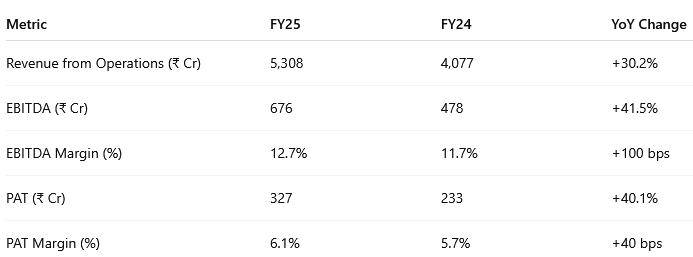

3. FY25: PAT up 40% & Revenue up 30% YoY

All-Round Growth: Revenue +30%, PAT +40% on steady execution

Margin Discipline: EBITDA uplift backed by design-to-delivery integration and cost discipline

Healthy Balance Sheet: Net D/E down to 0.34×; IPO-funded capex

Order Visibility: ₹14.6K Cr order book ensures 2-2.5 years runway

Model Shift: Fully integrated EPC player with tight capital discipline

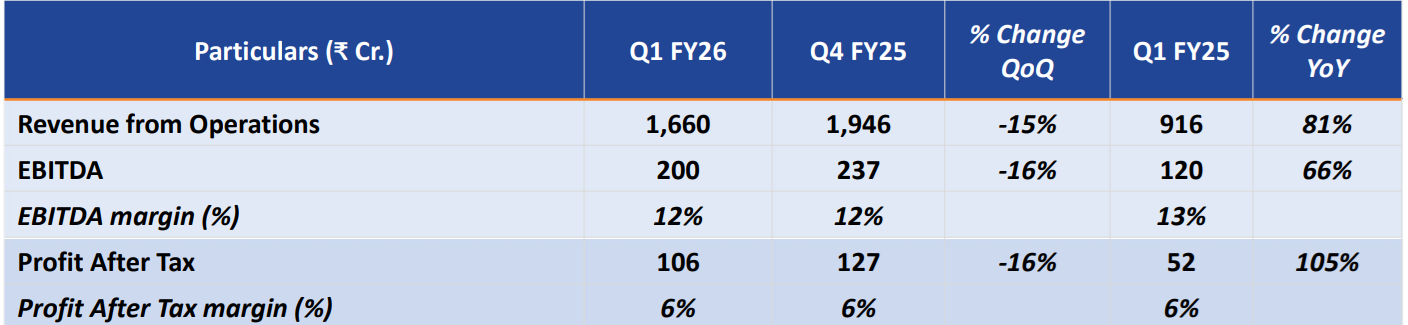

4. Q1-26: PAT up 105% & Revenue up 81% YoY

Strong Start to FY26

Revenue: ₹1,660 Cr (+81% YoY, -15% QoQ) – led by timely execution across domestic and international EPC projects.

EBITDA: ₹200 Cr (+66% YoY, EBITDA margin: 12.03%) – margin in line with historical trends and guidance (11.5–12.5%).

PAT: ₹106 Cr (+105% YoY, PAT margin: 6.4%) – sharp jump in bottom line, aided by operational leverage.

Execution Momentum

Key projects completed:

765kV DC lines (Khavda–Lakadia, Khetri–Narela)

400kV lines in Solapur for ReNew

132kV project in Eswatini (Africa)

Execution discipline: Full ramp-up in several large projects entering the build-out phase.

Backed by internal supply chain:

In-house tower and conductor capacity met 95–100% of internal demand

Margins remained stable despite rise in subcontracting expenses (linked to international project mix).

Order Book & Pipeline

New Orders (Q1 FY26): ₹1,748 Cr (+72% YoY)

Unexecuted Order Book: ₹14,654 Cr (revenue visibility till FY27)

Total with L1: ₹15,637 Cr

93% of orders in core T&D segment

60% domestic, 40% international

Execution Visibility: Order book supports 24–30 months of revenue at current run-rate.

Capacity Expansion

Capex Plan: ₹520 Cr across FY26–FY27

Tower capacity: 84,000 MT → 1,96,000 MT

Conductor capacity: 24,000 KM → 49,500 KM

Execution Timeline:

Phase 1 to be completed by Q4 FY26

Phase 2 by Q2 FY27

Funded via:

₹90 Cr IPO proceeds

~₹300 Cr debt + internal accruals

International Strategy

Africa, Southeast Asia are focus geographies.

Bangladesh: Execution on track, exposure reducing (from 20% of order book in Dec’24 to ~6% by FY26-end).

No new bids planned in Bangladesh; focus is on completion.

PQ qualifications in place for HVDC and global T&D bids.

Transrail delivered a strong Q1 performance, comfortably aligned with full-year guidance despite execution-heavy quarters typically being Q3 and Q4. The core T&D business remains the growth engine, backed by disciplined bidding, operational execution, and capacity ramp-up.

The company is well-positioned to maintain margins, handle rising demand (both domestic and international), and fund growth through efficient capital structure.

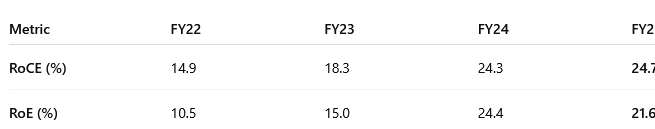

5. Business Metrics: Return Ratios Driven by Execution Strength and Capital Efficiency

RoCE held steady

Strong execution & high asset turnover post capacity expansion with margin stability from backward integration and tighter bid discipline

6. Strong Outlook: Revenue growth of 60%+ in FY26

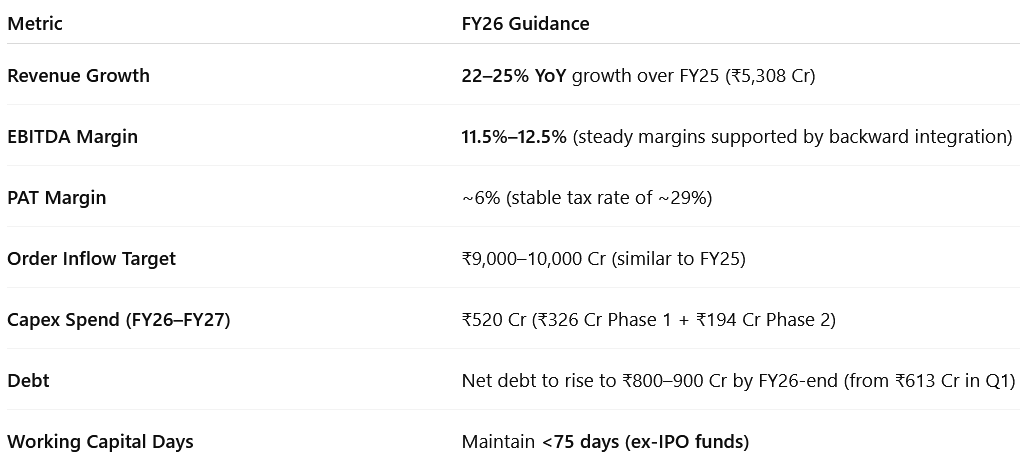

6.1 FY26 Guidance — Transrail Lighting

FY26 Guidance (Reiterated Post Q1 FY26)

Revenue Growth 22–25% YoY: Growth over FY25 (₹5,308 Cr)

EBITDA Margin 11.5%–12%: (steady margins supported by backward integration)

PAT Margin: ~6% (stable tax rate of ~29%)

Order Inflow Target: ₹9,500 Cr (similar to FY25)

Capex Spend (FY26–FY27): ₹520 Cr (₹326 Cr Phase 1 + ₹194 Cr Phase 2)

Debt: Net debt to rise to ₹800–900 Cr by FY26-end (from ₹613 Cr in Q1)

Working Capital Days: Maintain <75 days (ex-IPO funds)

Beyond FY26: Structural Outlook & Growth Drivers

Capacity-Driven Growth (FY26–FY27)

Towers: Capacity to increase from 84,000 MT → 1,96,000 MT by March 2026

Conductors: Capacity to grow from 24,000 KM → 49,500 KM by June 2026

Will drive both internal EPC fulfillment and incremental product sales (currently only 4–5% of production is sold externally)

Geographical Expansion

Africa: Core market with presence in 15 countries; large HV lines and substation jobs being pursued

Southeast Asia: Emerging opportunity zone; margin-led selective bidding strategy

Bangladesh: No new bids until existing project (currently ~6% of order book) is completed by mid-FY27

Middle East: Under evaluation; no meaningful exposure yet

Product and Segment Diversification

HVDC Execution Capability: Already executing 400 Cr+ project (KPS2–Nagpur)

Monopoles & Underground Cabling: Growing importance in urban transmission

Solar EPC: First 80 MW project secured; selectively scaling this vertical

Civil & Railways: Bidding ₹2,000 Cr+ in FY26; margin-focused expansion

Target areas: bridges, cooling towers, bullet train infra, electrification

Bidding Strategy & Pipeline

Bid Pipeline (next 3–4 months): ₹25,000 Cr

Annual Market Opportunity: ₹1,00,000 Cr+ (India + global T&D)

Target Win Rate: 8–10%

L1 Position: ₹1,000 Cr as of June 2025, expected to convert in 2 months

Operational Focus & Execution Discipline

Capex tightly aligned to order book visibility

No plans for aggressive diversification outside core EPC

High subcontracting in Q1 to taper as more domestic jobs ramp up

International execution tightly governed via risk matrix (5/10 projects filtered out)

Strategic Focus Areas

Maintain leadership in transmission EPC with high selectivity

Expand backward integration benefits into margin accretion

Increase export share and secure multilateral-funded international jobs

Strengthen presence in high-voltage and complex transmission jobs (800kV, 1200kV, HVDC)

Leverage manufacturing scale to build a product-led revenue stream beyond EPC

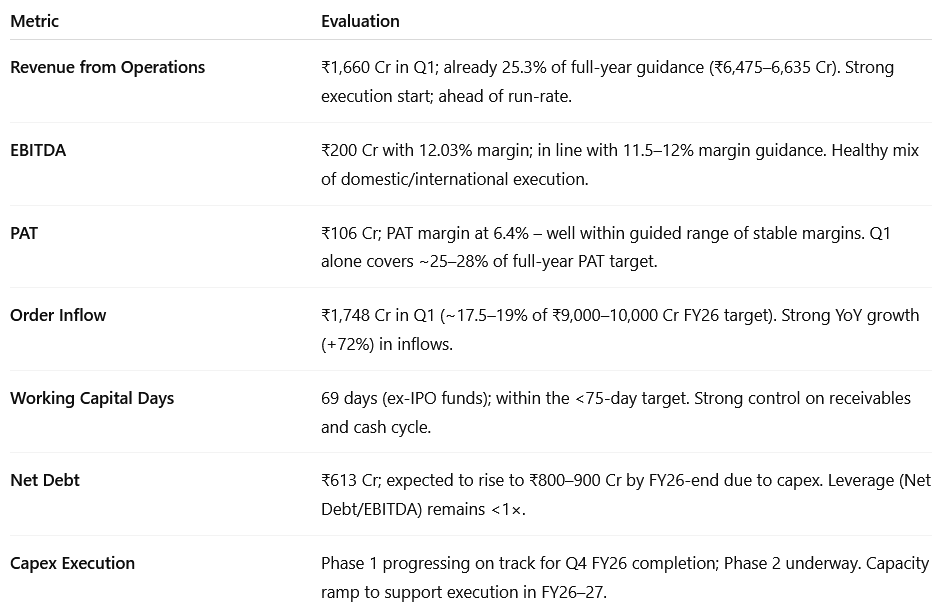

6.2 Q1 FY26 vs FY26 Guidance – Performance Evaluation

Transrail is firmly on track of its FY26 targets.

7. Valuation Analysis

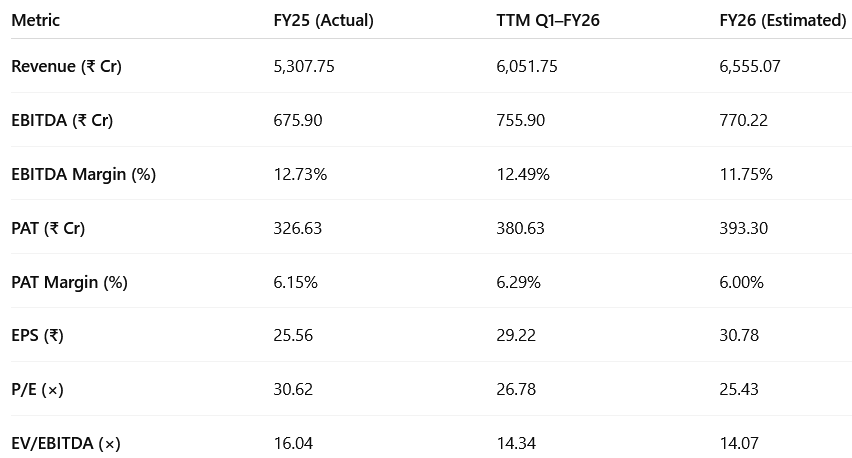

7.1 Valuation Snapshot – Transrail Lighting

Valuation Compression = Upside Potential

Metric FY25 TTM Q1–26 FY26E P/E (×) 30.6 26.8 25.4 EV/EBITDA (×) 16.0 14.3 14.1

Both P/E and EV/EBITDA multiples have compressed, despite growth in earnings.

What the Multiples Are Telling Us

A forward P/E of ~25.4× for a business delivering 20%+ PAT growth and ~12% EBITDA margins is reasonable in the context of:

Strong ROCE (27.5% as of Q1 FY26)

Robust 2.5-year order visibility (₹15,637 Cr order book)

Best-in-class execution in the T&D EPC space

The EV/EBITDA of ~14.1× reflects the premium for:

Backward integration

High-margin order pipeline

Low net debt (Net Debt/EBITDA < 1×)

Transrail's valuation indicates:

Earnings visibility is intact

Execution risk is low

Margins are stable

Multiples are compressing

7.2 Opportunity at Current Valuation

Strong revenue visibility

₹15,637 Cr unexecuted + L1 order book (2.5× FY26E revenue) provides ~2.5 years of execution cover. Order inflow in Q1 already hit ₹1,748 Cr, tracking toward the FY26 inflow target of ₹9,000–10,000 Cr.Execution-led earnings momentum

PAT up 105% YoY in Q1 FY26 with PAT margins expanding to 6.4%. FY26E PAT expected to grow ~20%, with operating leverage from large-scale projects in India and Africa.Valuation multiples moderating

Forward P/E has compressed from 30.6× to 25.4× and EV/EBITDA from 16.0× to 14.1×, despite healthy earnings growth — indicating a possible re-rating setup.Capex-driven capacity boost

Tower and conductor capacity to more than double by FY27; backward integration expected to drive margin defense and supply-chain control, even under tight execution timelines.Strong capital discipline

Working capital at 69 days (ex-IPO funds); Net Debt/EBITDA at 0.77× despite ongoing capex. FY26-end net debt expected at ₹800–900 Cr but remains manageable relative to cash flows.Optionality from export and product sales

International bids (Africa, SE Asia) continue to gain traction. Product sales (monopoles, HTLS conductors) could contribute incremental revenue once new capacity is live.

Opportunity Rating: MODERATE-HIGH

While valuation is not deeply discounted, Transrail’s business quality, visibility, and execution strength justify a moderate-high rating — especially for long-term investors betting on India’s transmission capex and export-led EPC growth.

7.3 Risk at Current Valuation

Valuation still elevated vs peers

EV/EBITDA at 14.1× and P/E at 25.4× leave limited room for error in FY26 delivery. Further re-rating likely hinges on >20% PAT CAGR delivery and post-capex asset sweating.Execution dependency

Over ₹6,500 Cr in FY26 revenue requires timely mobilization of subcontractors, equipment, and material. Delays or overruns in 1–2 large projects can materially impact earnings.Capex overhang in near term

₹520 Cr in capex over FY26–27 may dilute FCF and pressure short-term return metrics. Capex execution risk remains, especially around new greenfield expansion.Exposure to international markets

While international orders are margin accretive, geopolitical risks (e.g., Bangladesh, Mali) and payment lags must be monitored. International receivables stand at ₹300–400 Cr.Low external product sales share

~95% of current manufacturing output is internally consumed; success of product sales scale-up is yet to be proven and forms part of the growth narrative from FY27 onward.Tender-driven industry dynamics

Delay in bid finalizations or aggressive pricing by competition (esp. Chinese players in Africa) may impact strike rate or margins, particularly in international markets.

Risk Rating: MODERATE

Transrail’s strong execution and robust order book support earnings visibility. However, high execution dependency, capex overhang, and modest valuation buffer warrant a balanced view. Long-term re-rating potential remains, but near-term delivery and capital discipline will be key.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer