Transrail Lighting FY25 Results: PAT Up 40%, Eyes 25% Growth in FY26

Strong order book offers 24-month revenue visibility and margin stability for Transrail, but most of the FY26 execution upside appears priced into current valuations.

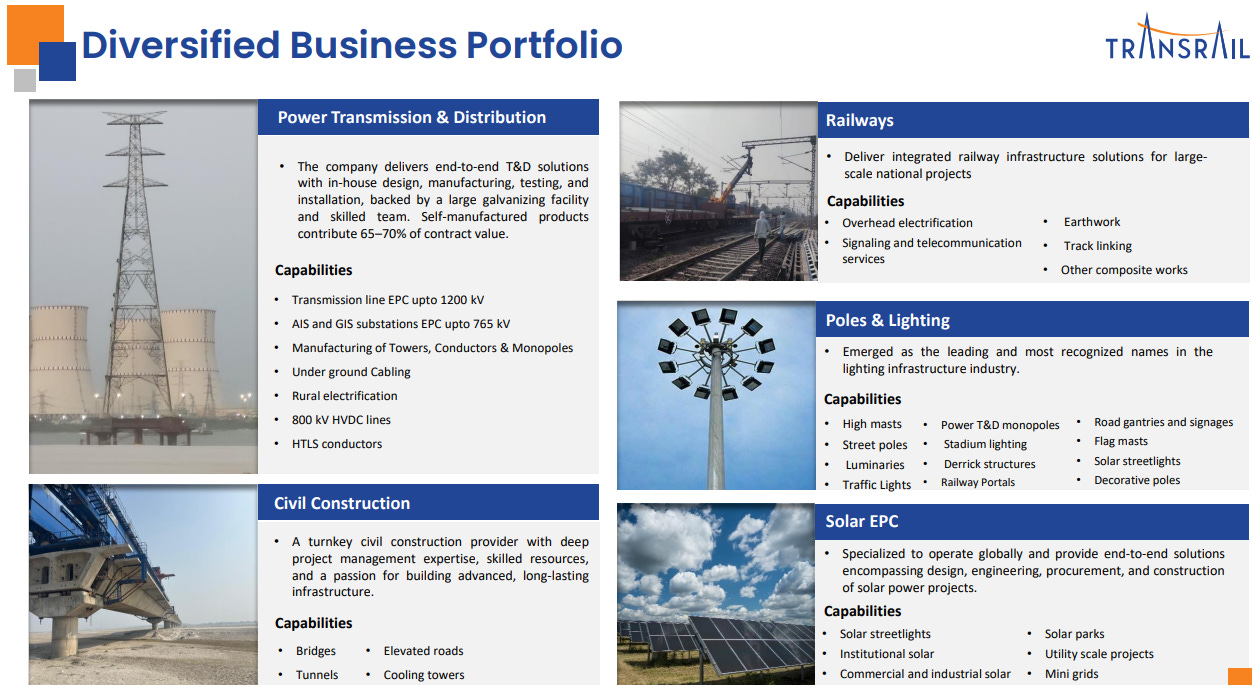

1. EPC Company with Manufacturing of Towers, Conductors & Monopoles

transrail.in | NSE: TRANSRAILL

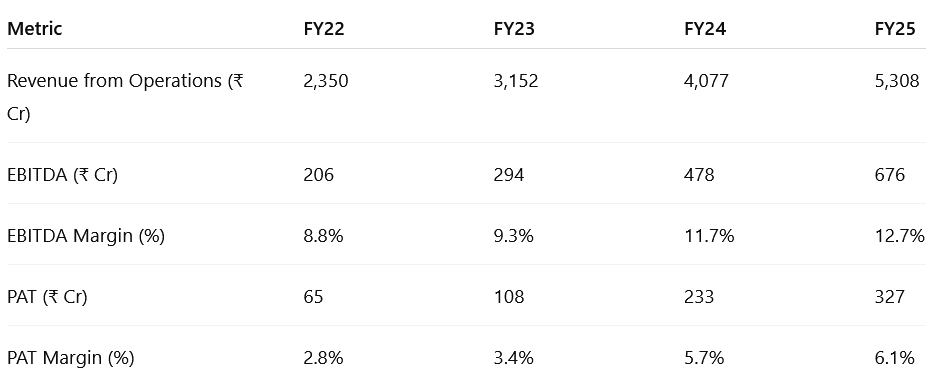

2. FY21–25: Revenue CAGR of 34% & EBITDA CAGR of 37%

2.1 What Changed Between FY22–25

From EPC contractor to fully integrated infra player

From India-centric to balanced global presence

From volume-led to margin-first growth with discipline

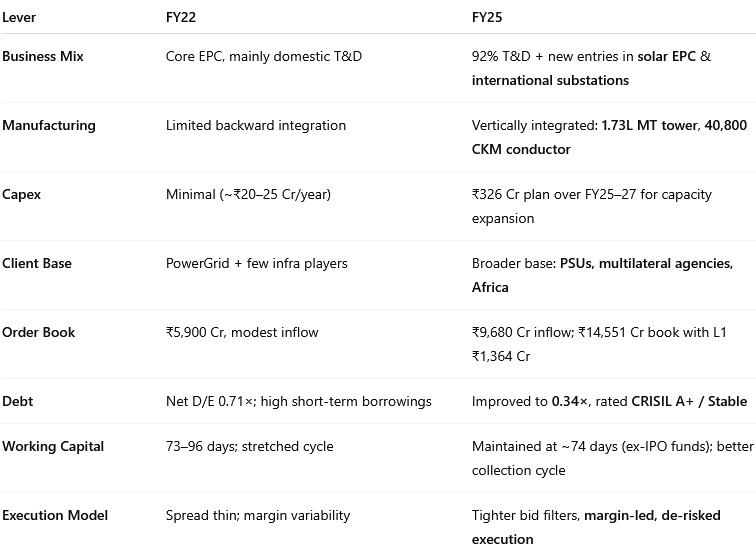

3. Q4 FY25: PAT up 27% & Revenue up 40% YoY

PAT up 36% QoQ & Revenue up 43% QoQ

Bid Selectivity: Focus on profitable geographies and EPC-type jobs

Capex Utilization: Tower & conductor ramp-up began contributing

Execution Peak: ₹580 Cr+ delivered, strong finish to FY25

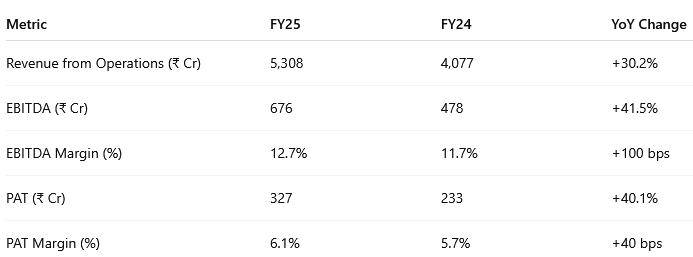

4. FY25: PAT up 40% & Revenue up 30% YoY

All-Round Growth: Revenue +30%, PAT +40% on steady execution

Margin Discipline: EBITDA uplift backed by design-to-delivery integration and cost discipline

Healthy Balance Sheet: Net D/E down to 0.34×; IPO-funded capex

Order Visibility: ₹14.6K Cr order book ensures 2-2.5 years runway

Model Shift: Fully integrated EPC player with tight capital discipline

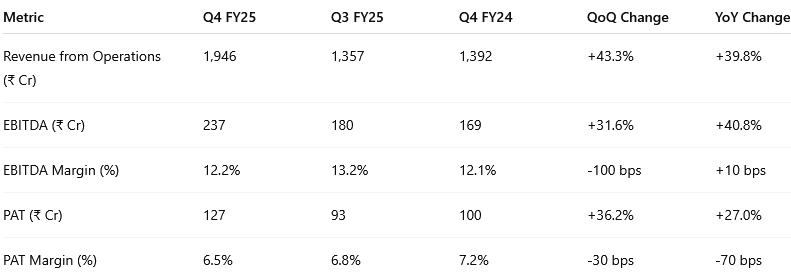

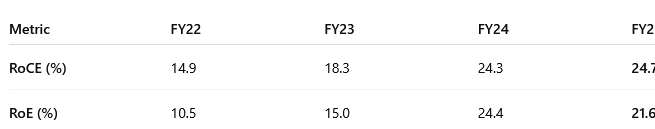

5. Business Metrics: Return Ratios Driven by Execution Strength and Capital Efficiency

RoCE held steady

Strong execution & high asset turnover post capacity expansion with margin stability from backward integration and tighter bid discipline

6. Strong Outlook: Revenue growth of 60%+ in FY26

6.1 FY25 Expectations vs. Performance

✅ HITS – Transrail FY25

Revenue Growth: FY25 revenue rose 30% YoY to ₹5,308 Cr, driven by strong Q4 commissioning across India, Africa, and Nepal.

Margin Expansion: Consolidated EBITDA margin improved 100 bps YoY to 12.7%, aided by in-house tower/conductor supply and execution scale.

Profit Growth: PAT increased 40% YoY to ₹327 Cr, reflecting operational leverage, lower interest burden, and margin discipline.

Capex Activation: Phase 1 capacity ramp-up underway; Phase 2 expansion funded and aligned to demand visibility in FY26.

⚠️ MISSES – Transrail FY25

Client-Side Delays: Commissioning delays in non-EPC orders due to land acquisition and grid connectivity issues, especially in Q3.

Bangladesh Exposure Risk: Project execution stable, but macro uncertainty led management to reduce future bidding; still ~12% of backlog.

Execution Cost Spike: Q4 subcontracting intensity temporarily elevated cost base, mildly impacting incremental margin flow-through.

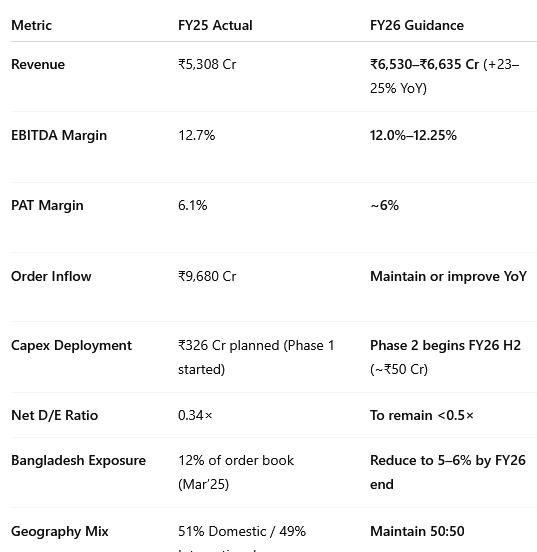

6.2 FY26 Guidance – Transrail Lighting

23-25% revenue growth with stable margins in FY26

Order-book gives strong revenue visibility for the next 24 months

Un-executed Orderbook + L1 of Rs. 15,915 crores as on 31st March 2025 …. which provides us a strong revenue visibility in the next 24 months.

Our guidance is that we will grow our revenue by 23% to 25%

Our guidance remains the same at 12% to 12.25% EBITDA

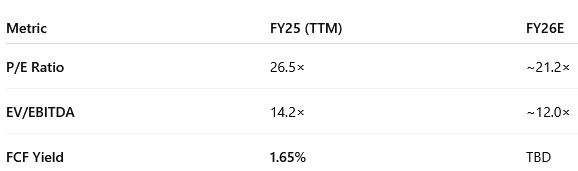

7. Valuation Analysis

7.1 Valuation Snapshot – Transrail Lighting

Valuation Commentary:

Current multiples — 26.5× P/E and 14.2× EV/EBITDA — reflect strong FY25 delivery: 30% revenue growth, 40% PAT growth, and 24.7% RoCE.

Forward valuations (~21× P/E, ~12× EV/EBITDA) are justified if FY26 guidance is met.

Order book provides an earnings floor; margins look stable at 12–12.25%.

FCF yield at 1.65% is low due to capex, but may rise as working capital normalizes.

Re-rating requires outperformance on execution or margin.

Execution delays or cost overruns in non-EPC projects could compress margins and limit upside.

7.2 What’s in the Price?

Execution Visibility: Market is pricing in full delivery of the ₹14,551 Cr order book at guided growth and margin levels.

PAT Forecast: ~₹400 Cr PAT (~21× forward P/E) is implied assuming no major delays.

Revenue Certainty: 2 years of execution visibility supports earnings stability.

Capital Efficiency: RoCE (24.7%) and RoE (21.6%) justify premium multiples.

Integrated Model: In-house tower/conductor capacity supports margin defense — factored into valuation.

7.3 What’s Not in the Price? (Upside Triggers)

L1 Conversions: Faster conversion of ₹1,364 Cr L1 or new wins in solar/rail EPC can improve revenue certainty for beyond 24 months .

International Mix Upside: Margins improve 1–2% with higher Africa/SAARC share (>49%).

Capex Leverage: Full Phase 2 utilization (FY27–28) could cut subcontracting and raise EBITDA.

Valuation Compression with Growth: PAT >₹400 Cr could justify forward P/E compression to 18–19×.

Working Capital Release: Days outstanding (~74) offer room to unlock cash and improve FCF yield.

7.4 Risks and What to Monitor

Key Risks

Execution Risk: Non-EPC orders may face delays due to land/grid readiness.

Cost Pressure: Subcontracting spike during peak execution can squeeze margins.

Geo Risk: ~49% order book is international; disruptions in Africa/Bangladesh are possible.

Working Capital Strain: Global scale-up may stretch receivables and dampen FCF.

Client Concentration: Heavy dependence on PGCIL and multilateral agencies limits pipeline diversity.

What to Monitor

L1 Conversion: Timely execution of ₹1,364 Cr L1 is key to meeting targets beyond FY26.

EBITDA Margin Stability: Holding 12–12.25% margin range amid cost fluctuations.

Bangladesh Exit: Smooth wind-down to 5–6% of backlog without execution spillover.

Capex Absorption: Phase 2 ramp-up and utilization into high-margin orders.

Free Cash Flow: Sustained improvement in FCF yield signals execution efficiency.

8. Implications for Investors

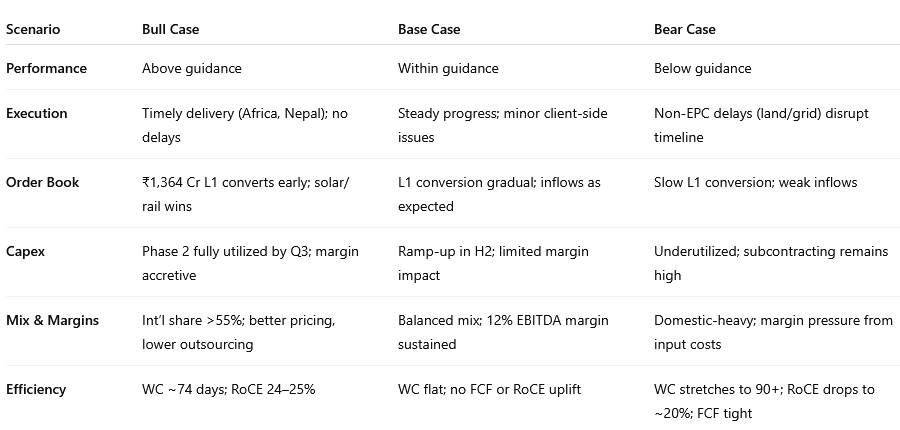

8.1 Bull, Base & Bear Case Scenarios – Transrail

8.2. Overall Margin of Safety: Low to Moderate

Transrail Lighting offers a low-to-moderate margin of safety. Strong RoCE, execution visibility, backward integration, and a lean balance sheet underpin quality — but much of the FY26 upside is already embedded in current valuations.

What the Market Has Priced In:

FY26 visibility (~₹6,530–6,635 Cr) backed by ₹14,551 Cr order book + ₹1,364 Cr in L1.

Base-case PAT of ₹390–400 Cr, assuming 23–25% growth and ~6% PAT margin.

EBITDA margin >12%, supported by in-house tower/conductor capacity.

No working capital upside or free cash flow re-rating yet.

Valuation fully reflects execution: ~21× forward P/E, ~12× EV/EBITDA — leaving little room for multiple expansion.

Upside Optionality (Not in the Price):

L1 Order Conversion: Quick conversion could lift revenue visibility.

International Mix Benefit: 1–2% higher margins if Africa/SAARC share increases beyond 50%.

Capex Leverage: Phase 2 ramp-up could reduce subcontracting and lift margins in FY27.

Working Capital Gains: WC days (~74) offer FCF upside; yield may improve from 1.65%.

P/E Re-rating with PAT Growth: ₹400+ Cr PAT may justify P/E compression from 21× to 18–19×, improving risk-adjusted returns.

Downside Protection Factors:

Order Book Visibility: 2+ years of secured revenue execution.

Integrated Manufacturing: In-house supply ensures cost control even under inflation.

Deleveraged Capital Structure: Net D/E at 0.34× lowers financial risk.

High RoCE Profile: >24% RoCE supports capital efficiency under base-case outcomes.

Selective Bidding Discipline: Multilateral and PSU-focused order mix limits execution and credit risk.

Bangladesh Exit Strategy: Controlled wind-down from 12% to 5–6% reduces geopolitical exposure.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

In depth analysis as usual