Transformers & Rectifiers India Q1 FY26 Results: PAT up 223%, On track to $1bn Revenue by 2028

Revenue growth of 73% in FY26. Revenue CAGR of 61% for FY25-28. Order book, capex & backward integration support growth outlook. Fully priced in the short term

1. Transformer & Reactor manufacturer

transformerindia.com | NSE: TARIL

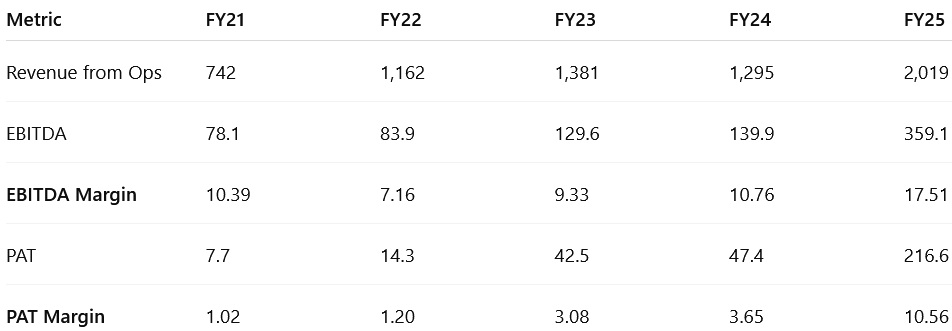

2. FY21-25: PAT CAGR of 130% & Revenue CAGR of 28%

Backward integration (CRGO processing, insulation units, bushings) began reflecting in margins from FY25.

Product mix evolution: shift toward extra-high voltage (EHV), STATCOM, and export-grade transformers.

Operational efficiency gains: reduced debtor days from 156 to 114; better working capital management.

Capital infusion: ₹500 Cr via QIP in FY25 used for expansion and deleveraging (Debt/Equity dropped to 0.21).

FY21–25 marks a transformation era for TARIL

From a low-margin, low-scale business, TARIL has emerged as a high-margin, capital-efficient enterprise with global visibility. Strong operating leverage, profitability, and execution capabilities have laid the foundation for its next phase — a US$1B revenue target by FY28.

3. FY25: PAT up 357% & Revenue up 56% YoY

Growth Inflection: FY25 marked TARIL’s breakout year with triple-digit growth in profits and margins.

Operational Scale-up:

28,882 MVA transformers produced (vs 16,425 MVA in FY24)

Executed landmark ₹740 Cr GETCO order

Backward Integration:

Acquired CRGO processing unit

Localized production of bushings and insulation materials

Well-Funded Expansion:

₹500 Cr QIP raised

₹550 Cr capex planned over next 15 months to reach 75,000 MVA capacity

Strong execution + higher-value products (EHV, exports, STATCOM) → sustainable margin profile

FY25 profit and order momentum firmly supports TARIL's ambition to cross US$1 billion revenue within 3 years (by FY28)

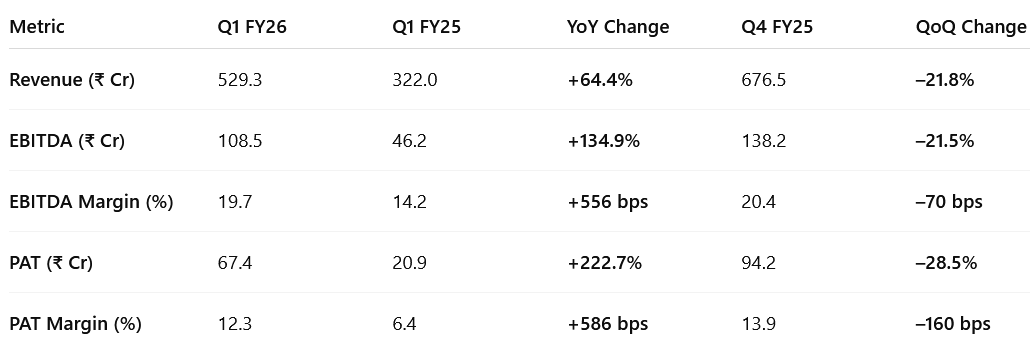

4. Strong Q1-26: PAT up 223% & Revenue up 64% YoY

PAT up 70% & Revenue up 21% QoQ

Exceptional YoY Growth

Strong revenue surge (+64%) driven by execution of high-value, export-grade and EHV transformer orders.

EBITDA and PAT more than doubled, with margins improving due to scale benefits, better product mix, and rising operational efficiency.

Expected Sequential Softness

QoQ decline in revenue and profitability stems from:

Seasonality (Q4 typically strongest for dispatches)

Normalization post exceptional Q4 FY25 high-margin order execution

Importantly, margins remain resilient, highlighting structural improvements.

Operational Discipline

Capacity utilization rose from ~65% in FY25 to ~80% in Q1; FY26 target: 85–90%

Margins are now considered structurally sustainable:

EBITDA: 17–18%

PAT: ~10%

Order Book Strategy Shift

Order inflow (₹665 Cr) was lower QoQ — by design, not weakness.

Management is now selectively bidding for high-margin, fast-turnaround orders rather than chasing volume.

Targeting ₹5,000–5,500 Cr order book by FY26-end (down from ₹8,000 Cr earlier), but of superior quality.

Global & Product Focus

Exports contributed significantly in Q1 (e.g., $16.6M Botswana order), but TARIL will cap exports at ~10% of revenue.

Green hydrogen transformer still in R&D; market potential of ₹500–₹550 Cr identified over next few years.

Q1 FY26 affirms that TARIL’s breakout FY25 was not a one-off.

With strong YoY financial performance, sustained margin strength, and a disciplined, high-ROCE growth approach, TARIL is executing confidently on its roadmap to ₹8,000–₹8,500 Cr revenue by FY28.

5. Business metrics: Return ratios are not exceptional

FY25 ROCE =22.76%

6. Outlook: Strong Revenue growth & margin expansion supported by order book

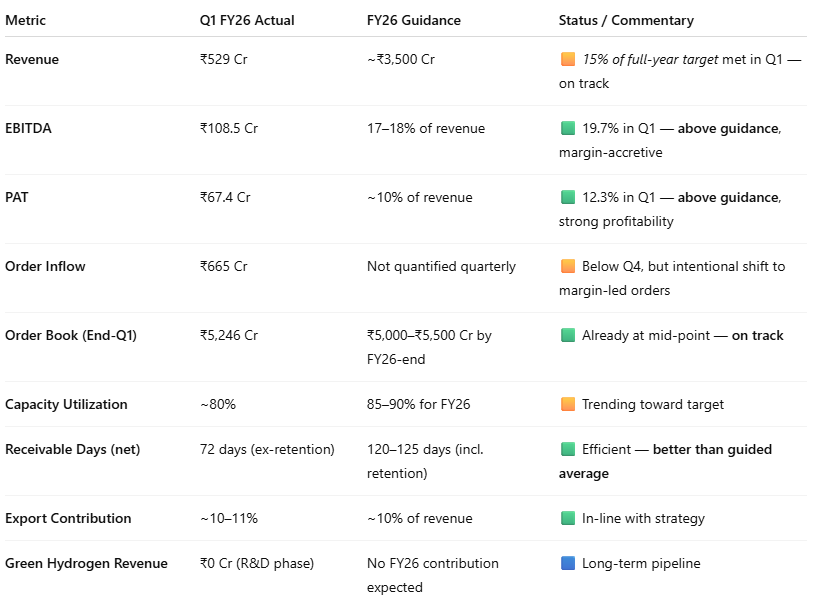

6.1 Management Guidance – FY26 and Beyond

Revenue & Order Book

FY26 Revenue Target: ~₹3,500 Cr

Order Book (End-FY26): Targeting ₹5,000–₹5,500 Cr of high-margin executable orders

Vision 2028: US$1 billion (~₹8,000–8,500 Cr) in revenue within 3 years

Margins

EBITDA Margin: Sustainable at 17–18%

PAT Margin: Consistently guided at ~10%

Gross Margin: 35% is becoming the new normal due to operating efficiency, pricing power, and backward integration

Capacity & Execution

Moraiya Plant Expansion (22,000 MVA): Online by Q2 FY26

FY25 Capacity Utilization: ~65%; FY26 Target: 85–90%

Focus: Operational efficiency over order volume; avoiding low-margin bulk orders

Export Strategy

Inquiries: 25% of pipeline

Execution Plan: Exports to remain ~10% of annual revenue

No U.S. exposure currently; cautious due to strategic classification of transformers

Product Innovation

Green Hydrogen Transformers:

Currently in R&D stage

Potential market ~₹500–550 Cr over 4–5 years

Long-term upside once viability and scale are established

Competitive Landscape

New entrants expected, but PQ qualification takes 18 months

Backward integration gives TARIL cost, quality, and delivery edge

Demand environment can accommodate multiple players

Working Capital & Liquidity

Receivable Days: Sustainable at 120–125

Retention Receivables: ~₹180 Cr in non-current assets

Net Debt-Free Target: Within 18–24 months

TARIL is evolving into a margin-led, capital-efficient manufacturer focused on premium orders, long-term client relationships, and self-reliant operations. The roadmap to ₹8,000+ Cr revenue is backed by discipline, capacity, and demand visibility.

What’s Changed Q4-25 vs Q1-26?

Order book volume guidance scaled down from ₹8,000 Cr to ₹5,000–5,500 Cr — to focus on margin quality over quantity.

Export ambition lowered to 10% share, citing domestic demand and better payment terms.

6.2 Q1-25 Performance vs Management Guidance

Margins (EBITDA & PAT) are trending above full-year guidance, indicating continued operational leverage and pricing power.

Revenue pacing is consistent with target: Q1 contributed ~15% of annual revenue, typical in a back-loaded infra business.

Order inflow looks low, but management clarified the shift toward quality over volume, choosing high-margin orders over scale.

Receivable efficiency, balance sheet strength, and capacity ramp-up suggest TARIL is building toward sustainable scale.

TARIL’s Q1 FY26 performance is well-aligned with or ahead of guidance across all key metrics.

The company is balancing scale and profitability while preparing for its $1B revenue ambition by FY28.

7. Valuation Analysis

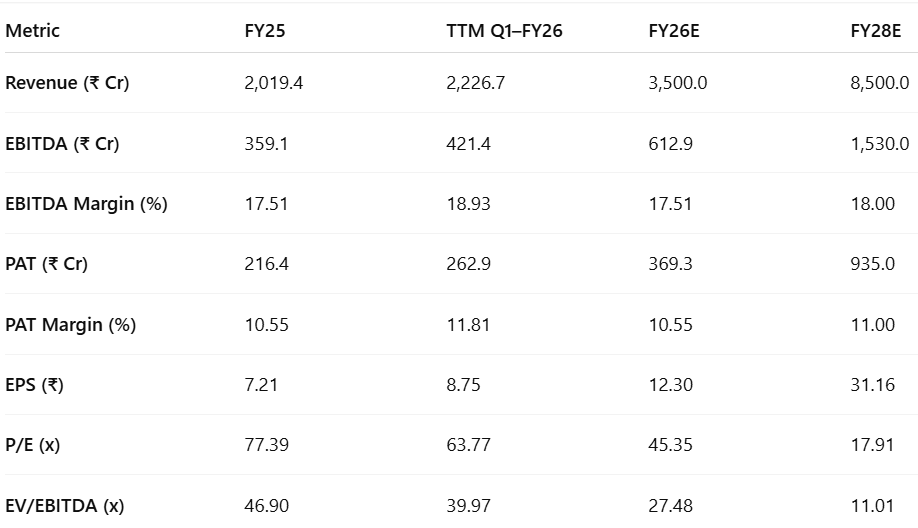

7.1 Valuation Snapshot — Transformers & Rectifiers India

Assumptions: Market Cap: ₹16,749 Cr | EV: ₹16,842.5 Cr

Valuation Compression

P/E contracts from 77× (FY25) to 17.9× (FY28E) — despite strong earnings growth, implying valuation de-risking.

EV/EBITDA drops from 46.9× to 11.0×, indicating the stock is moving toward reasonable multiples as it scales.

What This Implies

FY25–FY26: Market priced in early growth. Stock ran up sharply; valuations were rich.

FY26–FY28: With earnings compounding ~50–60%, valuations normalize, while fundamental performance improves sharply.

FY28 multiples (P/E ~18×, EV/EBITDA ~11×) are reasonable for a capital-efficient infra manufacturer with 18% EBITDA margins and global scale.

TARIL is transitioning from a rerating story to an earnings-compounding story.

At current valuations (~45× FY26E P/E), the stock looks expensive optically — but the PEG ratio (P/E to Growth) is attractive given a ~60% PAT CAGR.

By FY28, earnings catch up with valuation, supporting further upside — especially if execution stays on track and demand remains robust.

7.2 Opportunity at Current Valuation

Robust revenue visibility: ₹5,246 Cr order book and ₹18,000+ Cr inquiries provide ~15–18 months of execution visibility. FY28 target of ₹8,500 Cr appears well-anchored.

Execution-led margin expansion: PAT up 223% YoY in Q1 FY26; EBITDA margin improved to 19.7%, with PAT margin expanding to 12.3% — both above long-term guidance.

Valuation cooling off: P/E moderating from 77× in FY25 to ~45× in FY26E and ~18× by FY28E. EV/EBITDA compressing from 47× to ~11× over the same period, with earnings compounding rapidly.

Backward integration moat: Internal CRGO processing, insulation, and bushing units will improve cost control and protect margins as capacity utilization scales from 65% to 90%.

Focused bidding strategy: Management now prioritizes high-margin, quick-turnaround orders (~₹5,000–5,500 Cr target book), rather than chasing volume, improving capital efficiency.

Export leverage & optionality: Export orders (e.g., $16.6M Botswana) show capability; although capped at 10% of revenue, they offer margin tailwinds and insulation from domestic cyclicality.

New product optionality: Green hydrogen transformers in R&D; medium-term potential of ₹500–550 Cr could support non-linear growth beyond FY27.

Execution ecosystem in place: FY25 working capital days improved to 72 (ex-retention), net debt to equity <0.2×. With improved conversion cycles, future growth appears self-funded.

Opportunity Rating: HIGH

TARIL offers rare visibility on growth, margins, and capital efficiency. With EBITDA margins near 18%, PAT compounding >50%, and valuation multiples compressing, it’s well positioned to scale to ₹8,500 Cr revenue by FY28. Backward integration, export wins, and margin-led order selection further strengthen the long-term upside.

7.3 Risk at Current Valuation

Valuation still elevated on near-term multiples: FY26E EV/EBITDA at 27× and P/E at 45× still imply modest buffer for downside, especially if execution slips or orders defer.

Execution concentration risk: ₹1,000 Cr+ quarterly run-rate requires disciplined project management, material flow, and subcontractor readiness — slippage in 1–2 quarters can hit PAT sharply.

Order inflow variability: Q1 FY26 order inflow (₹665 Cr) was lower QoQ; though strategic, any sustained weakness or misjudgment in high-margin bidding could constrain forward revenue.

Export scale constraint: While margins are strong, management is deliberately limiting exports to ~10% of revenue — caps optionality unless strategy changes.

Limited operating leverage upside post FY27: Once utilization reaches 90% and backward integration is absorbed, margin expansion headroom may flatten unless product mix further improves.

Emerging competition: PQ qualification for new entrants (esp. in 400–765 kV) could normalize margins in 18–24 months. TARIL’s edge may erode if industry pricing softens or capital cycles peak.

Risk Rating: MODERATE

Current valuation reflects strong execution and structural margin gains. Near-term risks include order flow volatility, Q2–Q3 seasonality, and potential pricing pressure in high-value bids. However, high PAT visibility, tight working capital, and improving asset turns mitigate downside in the medium term.

Previous Coverage of TARIL

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer