Transformers & Rectifiers India Q3 FY26 Results: PAT up 37%, On-track FY26 Guidance

FY26 guidance of 25% growth. Strong tailwinds, order book, capex & backward integration support growth. Fully priced in the short term. Long-term opportunity

1. India’s Largest Transformer Manufacturer

transformerindia.com | NSE: TARIL

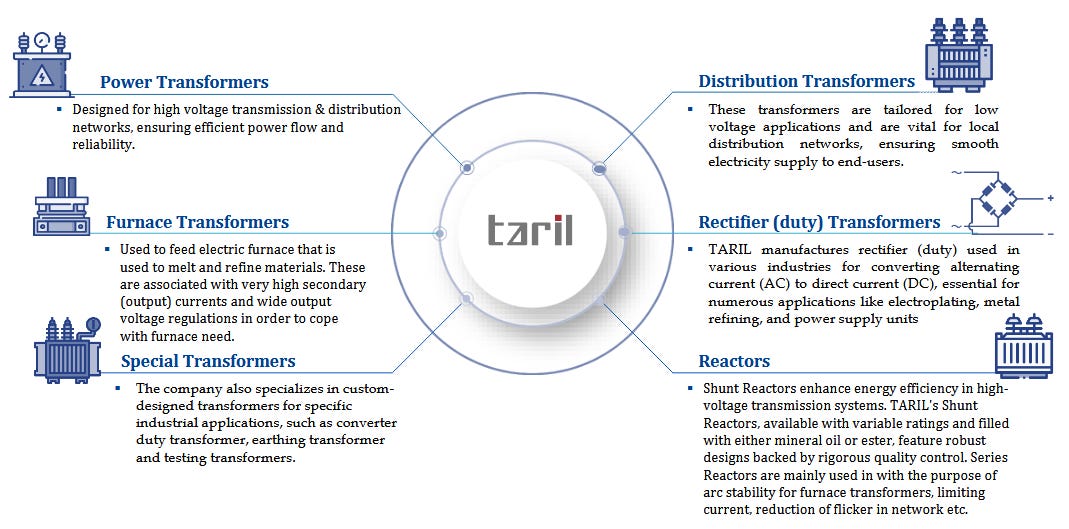

Product Portfolio

Power Transformers

Distribution Transformers

Furnace Transformers

Rectifier (Duty) Transformers

Special Transformers

Reactors

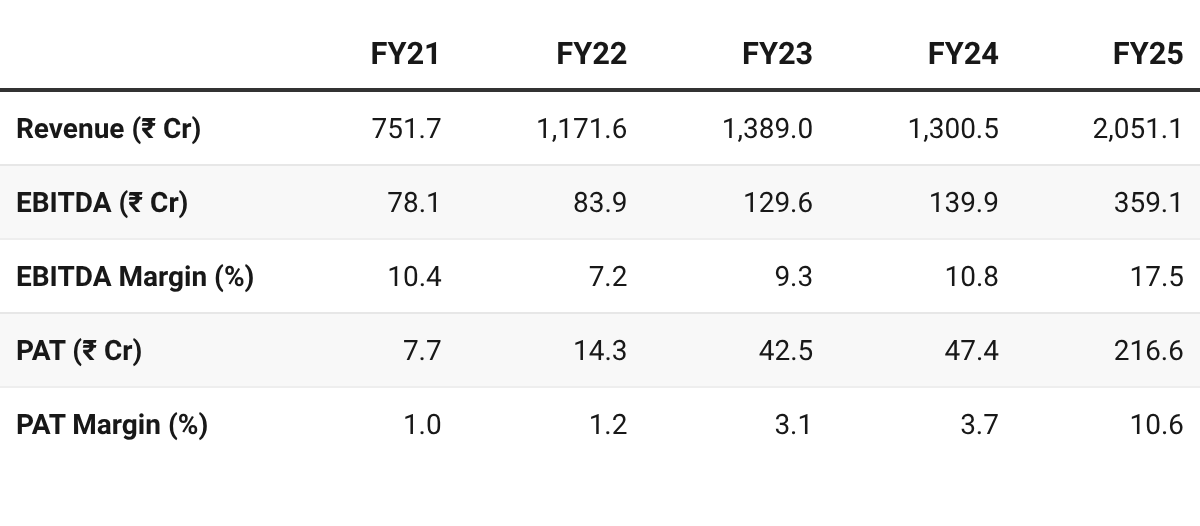

2. FY21–25: PAT CAGR of 131% & Revenue CAGR of 29%

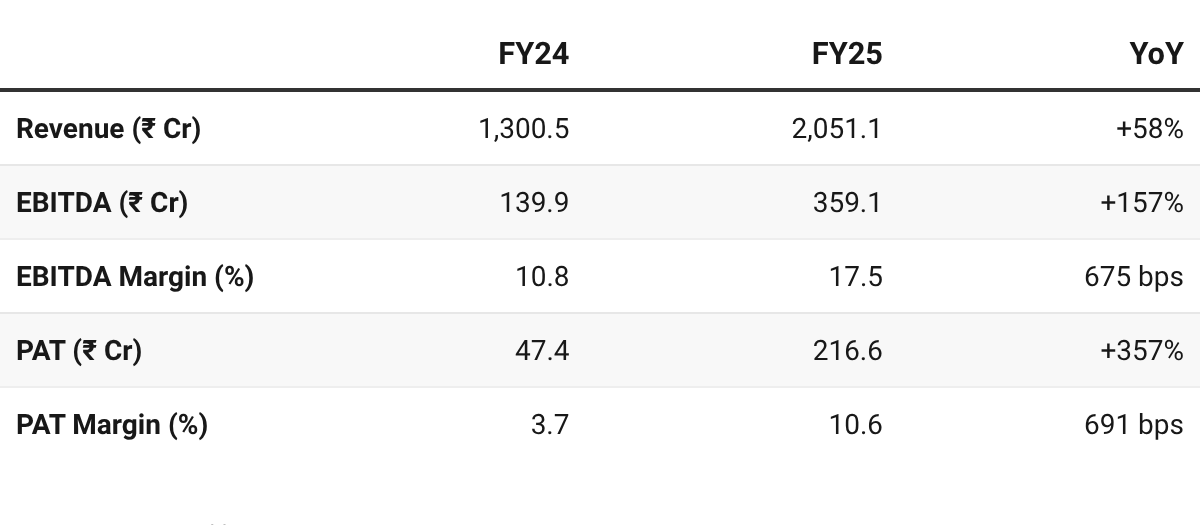

3. FY25: PAT up 357% & Revenue up 58% YoY

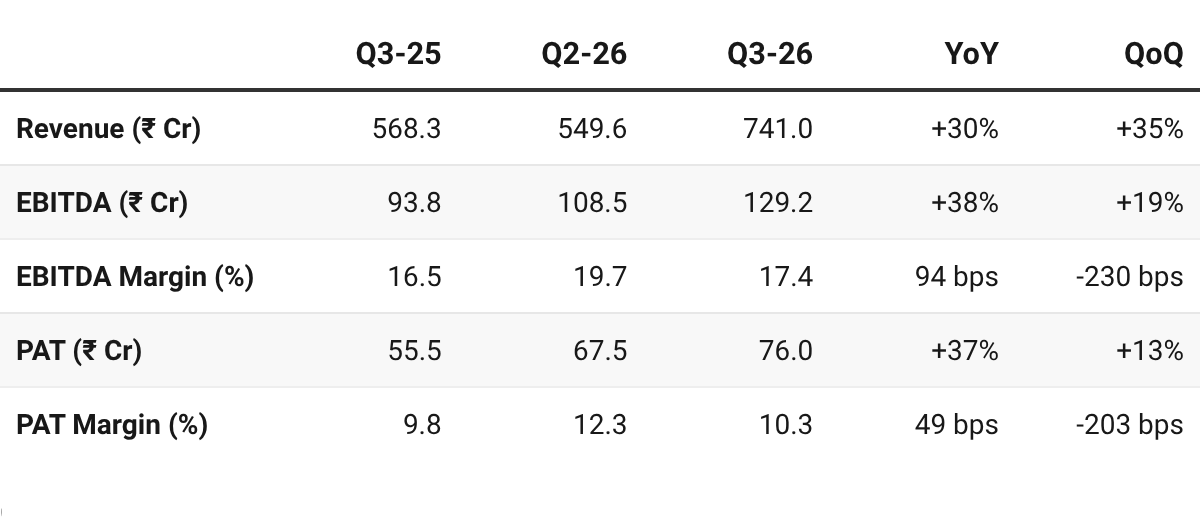

4. Q3-26: PAT up 37% & Revenue up 30% YoY

PAT up 13% & Revenue up 35% QoQ

After facing temporary challenges in Q2, Q3 demonstrated a sharp recovery across all key financial and strategic parameters.

Supply Side Normalisation: Shortages of key raw materials like Copper Transformer Conductor (CTC) and bushings, which delayed production in previous quarters, have normalised.

Monsoon Impact: Recovered revenue deferred from Q2 due to monsoons

~₹40 crores revenue could still recognised in Q3 and will carry over.

Progress on Infrastructure — Scheduled for commissioning in FY27

Expected to expand gross margins by 200 basis points.

Civil works for all facilities have commenced

Equipment orders are firmly in place.

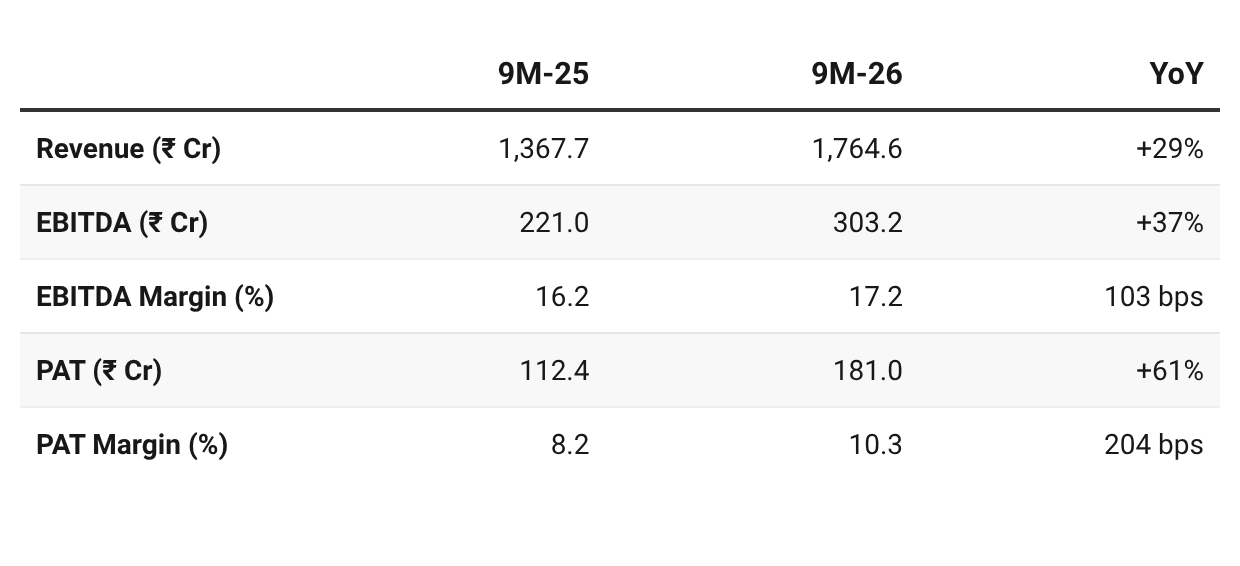

5. 9M FY26: PAT up 61% & Revenue up 29% YoY

6. Business Metrics: Improving Return Ratios

FY25 ROCE =22.76%

FY25 ROCE =21%

7. Outlook: Revenue growth of 25%

7.1 Management Guidance

Short-Term Financial Guidance (FY26)

Revenue: ₹2,600 Cr — at least 25% growth over FY25.

Profitability: EBITDA margin of 16-17%.

Order Book: FY26 end order book of ~ ₹8,000 Cr.

Expects strong inflow in H2

Strategic Operational Roadmap

Backward Integration Schedule (FY27):

CTC Plant: Targeted for commissioning in Q1 FY27.

Press Board Facility: Expected in Q3 FY27.

RIP Bushing Plant & Fabrication Facility (Phase 1): Targeted for Q4 FY27.

Capacity Expansion: — will increase total capacity to 75,000 MVA

Changodar Facility: Completion is on track for Q1 FY27.

Moraiya Facility: Expected to be operational by Q2 FY27

Long-Term Vision (FY28-29)

Goal of $1 billion (₹8,000 Cr) in revenue by FY28-29 — growth driven by:

Expanding Product Segments:

Entry into the HVDC (High Voltage Direct Current) ecosystem.

TARIL aims to qualify for its own indigenous HVDC technology by 2027.

Margin Expansion — Backward integration and operational excellence

Gross margins could eventually reach 35-40% by FY28.

Financial Health: Net debt-free within the next 18 months

Market and Industry Outlook

TARIL anticipates a sustainable growth for the next 7-10 years

Expecting 15% CAGR in the Indian transformer industry.

Demand is expected to remain strong due to

grid expansions

rise of electric vehicles

upcoming requirements for green hydrogen applications.

To mitigate commodity risks and ensure viability, TARIL has adopted a policy of limiting its order book to an 18-month execution cycle.

7.2 9M FY26 Performance vs FY26 Guidance

Revenue on-track for after a significant downward revision in Q2 FY26

FY25 Exit (Q4 FY25): Management projected FY26 revenue of ~₹3,500 Cr

Q1 FY26: Management reaffirmed ₹3,500 crore target

Q2 FY26: Guidance revised downwards to ₹2,600 Cr

Q3 FY26: Revised target of ₹2,600 Cr reaffirmed

supply side issues normalized

EBITDA Margin Guidance

Q4 FY25: EBITDA Margins 16-17%

Q1 FY26: Upgraded to 17-18%

Q2-Q3 FY26: EBITDA margin target back at 16-17%

Impact of fixed costs on reduced Q2 FY26 revenue

Clearance of the final “low-margin”

Reaching ₹8,000 Cr in revenue by FY29 remains the core objective, supported by a planned capacity of 75,000 MVA and total backward integration

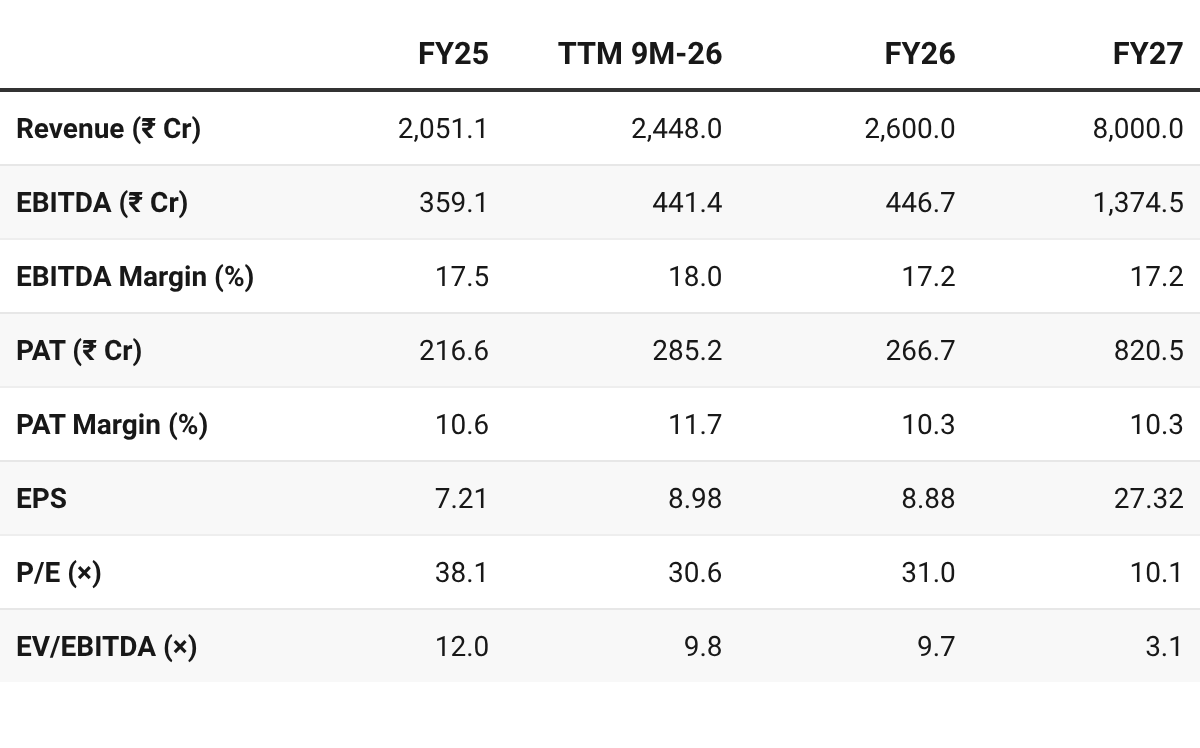

8. Valuation Analysis

8.1 Valuation Snapshot – Transformers & Rectifiers India

Current Market Price = ₹275 | Market Cap = ₹4,166.7 Cr

The impact of a weak Q2 which lead to a significant downward revision in revenue is clearly seen on both the stock price and valuations

At FY26 forward earnings, FY26 performance is already in the price

The valuations at $1 billion revenue target look very attractive but that is too far in the future

8.2 Opportunity at Current Valuation

The $1 billion USD target is not fully priced in even thought is targetted for FY28-29

The demand tailwinds remaining strong for the next 7-10 years creates a long-term opportunity in TARIL

The backward integration which would drive margin expansion from FY27 onwards is not full priced in

In the short-term from a FY26 perspective — opportunities are limited.

Those holding the stock would need to wait till Q4 end and review based on the guidance for FY27

8.3 Risk at Current Valuation

Margin of safety in the short-term is quite thin as seen from the weakness seen in the stock price.

The thesis of TARIL is based on long-term targets — a weak quarter at current valuations like Q2 FY26 can seriously damage the stock price

Previous coverage of TARIL

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer