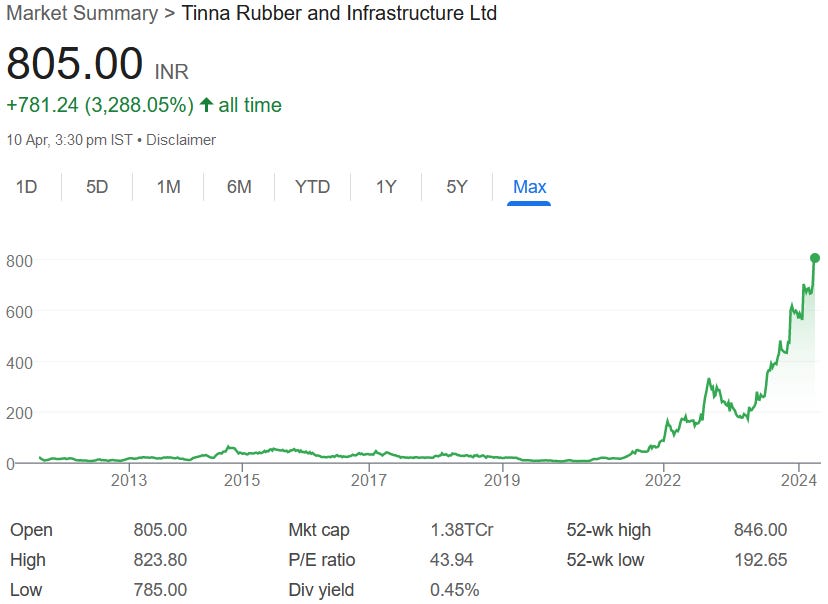

Tinna Rubber & Infrastructure: PAT growth of 64% & Revenue growth of 14% in 9M-24 at a PE of 44

Tinna has a strong outlook till FY27 with revenue CAGR of 25%+, profitability growth of 33% and EBITDA margin expansion from 12.4% to 18% with a target ROCE of 30%

1. Recycler of End of Life Tyres

tinna.in | BOM: 530475

on the micronized rubber powder, we have probably more than 80% market share in India.

2. FY20-23: EBITDA CAGR of 107% & Revenue CAGR of 34%

Profitability from FY22

3. Strong FY23: PAT up 29% & Revenue up 29% YoY

4. Strong H1-24: PAT up 43% & Revenue up 9% YoY

5. Strong Q3-24: PAT up 113% & Revenue up 24% YoY

PAT up 32% and Revenue up 17% QoQ

6. Strong 9M-24: PAT 64% & Revenue up 14% YoY

7. Business metrics: Strong & Improving return ratios

8. Outlook: 25%+ Revenue CAGR & 33%+ Profit growth

i. Vision 2027: Revenue CAGR of 25%+; Profitability Growth of 33%+

We work closely with our customers to provide them customized and diversified product solutions which is why we have approvals from all major tyre companies India. Capitalizing on these moats and the industry tailwinds, we have embarked upon an ambitious growth plan with our vision 2027 to achieve a 25% plus revenue CAGR to reach INR 900 crores by FY27. We are going to aim for EBITDA margins of 18% plus.

ii. Capacity expansion in place to support Vision 2027

9. PAT growth of 64% & Revenue growth of 14% in 9M-24 at a PE of 44

10. So Wait and Watch

If I hold the stock then one may continue holding on to Tinna

Based on 9M-24 performance, Tinna looks on track to deliver the strongest yearly performance in terms of revenue and PAT in its history

Tinna is in the middle of a strong run and has delivered sequential QoQ growth in PAT for 5 consecutive quarters starting Dec-22

Tinna looks on track to meet its guidance of Rs 340 cr of revenue in FY24

We expect our FY24 number to be at around 340 odd crores and we are very much progressing towards that and

Tinna is guiding for a strong FY25 with Rs 500 cr revenue i.e a 47% growth over the Rs 340 cr of revenue expected in FY24.

FY25 number we are expecting roughly 500 crores of revenue

11. Or, join the ride

If I am looking to enter Tinna then

Tinna has delivered PAT growth of 64% & Revenue growth of 14% in 9M-24 at a PE of 44 which makes valuations quite fair in the short term.

Tinna has a strong outlook till FY27 with revenue CAGR of 25%+ & profitability growth of 33% and ROCE of 30% at a PE of 44 which makes valuations quite reasonable from the long term

In the short-term there may not be margin of safety in Tinna at a PE of 44. Even a single weak quarter could trigger a strong reaction on the price.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

Gensol eng