TCS Q4 FY25: Low Growth, AI Bets—What’s Next for Investors?

Reasonable valuation & strong free cash flow offer solid compounding for patient investors. AI-led transition & stable margins give TCS strength amid slowing growth

1. TCS Q4 FY25 Earnings Breakdown: Financial Performance, Growth, and Cash Flow

Tata Consultancy Services (TCS) wrapped up FY25 with resilient margins, strong free cash flow, and a record deal pipeline, even as revenue growth moderated amid global uncertainty.

Revenue growth has moderated, especially in North America and discretionary verticals.

Despite that, margins remain robust, FCF is strong, and TCV momentum is healthy, setting up for a potential rebound in FY26.

TCS’s financial engine is intact—even as it prepares for AI-led transformation at scale.

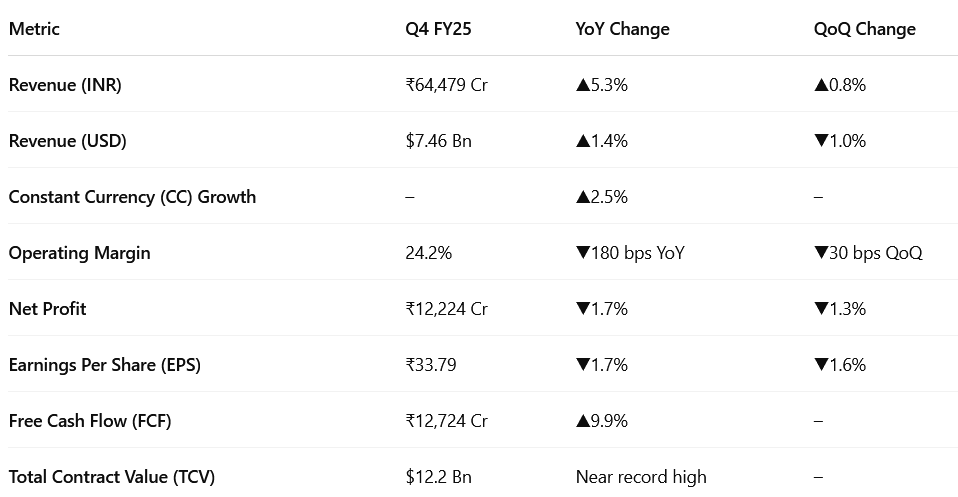

1.1 Quarterly Financial Highlights – Q4 FY25

Despite muted top-line growth, TCS preserved its margins and delivered strong cash conversion, with FCF at 125% of net income—a hallmark of its operational discipline.

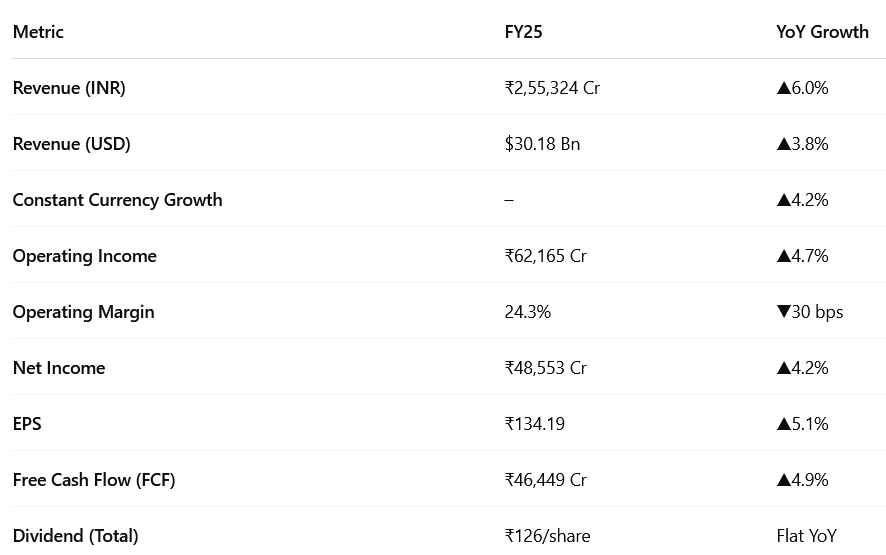

1.2 Full-Year Performance – FY25

TCS delivered a consistent performance through the year, maintaining margins above 24% while improving FCF and sustaining its generous dividend payout. The lack of mega deals did not impact TCV, which remained robust at $39.4 billion for the year

1.3 Segment-Wise Growth (YoY CC – Q4 FY25)

India, MEA, and APAC were standout regions, while North America—TCS’s largest market—faced headwinds due to delayed tech spending.

1.4 Vertical-Wise Growth (YoY CC – Q4 FY25)

BFSI and energy drove steady growth, while discretionary-heavy sectors like manufacturing and consumer tech remained cautious.

1.5 Operational Metrics

TCS emphasized talent readiness for AI, cloud, and enterprise tech, with internal reskilling and digital onboarding being central to its FY25 execution strategy.

2. TCS Strategy: AI Transformation, Cost Efficiency & Navigating Global Headwinds

TCS’s management is balancing short-term caution with long-term conviction. The strategy is clear:

Stay prudent on costs while preparing for reacceleration.

Invest in AI and GenAI capabilities early to lead when the market turns.

Play both sides of the transformation cycle—cost takeout + innovation.

It’s not just about surviving the downturn. It’s about emerging stronger from it.

2.1 Short-Term Caution: Global Uncertainty, Spending Delays

TCS observed increased volatility and decision-making delays beginning mid-February 2025, especially in North America.

Consumer sentiment in the US dropped sharply, leading to cutbacks in discretionary tech spend across retail, CPG, travel, and hospitality.

Manufacturing clients—especially in automotive—are re-evaluating tech investments due to EV slowdown and inventory corrections in ICE vehicles.

In insurance and healthcare, clients are delaying project sign-offs and focusing on core system stability and compliance.

Despite strong deal wins, revenue conversion is taking longer, suggesting a wait-and-watch approach from enterprise clients.

2.2 AI & GenAI: From Experiments to Business-Driven Deployments

TCS is transitioning rapidly from GenAI pilots to production-grade use cases with real business impact:

Over a third of new deals now include AI or GenAI components.

Use cases span across:

Contracts and legal operations (GenAI-led automation)

Customer support systems (AI copilots, chatbots)

Compliance and governance (risk analytics, documentation AI)

Supply chain visibility and digital twins (via TwinX™)

Notable wins include:

An AI Factory build for a European energy major.

A risk prediction AI solution for a North American utility.

A unified AI platform for supply chain visibility for a global biopharma client.

“AI for IT is improving productivity. AI for Business is helping us win new revenue streams. This is not hype—it’s becoming tangible.” – TCS Leadership

2.3 Strategic Themes: Modernization, Efficiency, and Cost Optimization

In parallel to AI-led innovation, clients are sharply focused on cost transformation and efficiency initiatives:

Many clients are using “AI for IT” and vendor consolidation to drive down costs.

These savings are then being reinvested into AI for Business and cloud modernization.

Cloud deals are evolving from lift-and-shift to sovereign cloud, data lakes, and FinOps initiatives.

ERP modernization and platform upgrades (S/4HANA, Salesforce, etc.) remain resilient across verticals.

TCS is positioning itself as a full-stack transformation partner, offering integrated solutions across:

Consulting → Delivery → AI-enabled Platforms

Examples: ignio™, Quartz™, TCS BaNCS™, OmniStore™, TCS iON™

2.4 Operational Focus: Talent, Margins, and Productivity

No job cuts or hiring freeze. Headcount remains steady at ~608K, and freshers are being onboarded at scale.

A significant portion (40%) of new hires are digitally ready, compared to 17% last year.

Over 5.2 million competencies were acquired by employees in FY25, with a strong focus on AI, cloud, cybersecurity, and data engineering.

Promotions went ahead as scheduled, but FY26 salary hikes have been deferred until the macro environment stabilizes.

Margin outlook: TCS aims to move closer to 26% operating margins in FY26, driven by:

AI-led delivery efficiency

Pyramid optimization

Better utilization as growth recovers

3. TCS Stock Valuation: P/E, Free Cash Flow Yield, and Market Sentiment

TCS typically trades at a premium, but not a frothy one. Given its industry-leading margins, balance sheet, and client depth, the valuation appears fairlyvalued, especially after the recent correction.

As of April 11, 2025, TCS stock is trading at ₹3,238, down ~18% YoY, and near its 52-week low of ₹3,056. With investor sentiment dampened by slowing topline growth and macro uncertainty, it’s important to look beyond price action and evaluate whether the valuation justifies a long-term buy case.

3.1 Key Valuation Metrics

3.2 Valuation vs Free Cash Flow

Let’s look at TCS from a Free Cash Flow Yield perspective, a favorite for long-term investors:

FCF Yield = FCF / Market Cap = ₹46,449 Cr / ₹11.75 Lakh Cr = 3.95%

This compares favorably to:

Indian IT average: ~3.0–3.5%

Long-term government bonds: 7–8% (pre-tax)

👉 A nearly 4% FCF yield from a stable, zero-debt company with 24% operating margins and high client stickiness is a strong signal of underlying value.

3.3 What the Market Is Pricing In

The stock’s ~18% decline over the past year reflects:

Slowing CC revenue growth (2.5% in Q4)

Weakness in North America (▼1.9% YoY)

Delayed decision-making in discretionary-heavy verticals

Wage hike deferral and margin pressures

However, forward guidance from management remains constructive, with confidence in H2 FY26 recovery, strong AI monetization potential, and no signs of structural weakness.

3.4 Valuation Re-rating Triggers Ahead

3.5 Conclusion: Fairly Priced with Long-Term Upside

At ~24x earnings and ~25x FCF, TCS is not cheap, but it offers a rare mix of stability, optionality, and scalability.

For long-term investors, TCS’s current valuation presents:

A defensive entry point with downside protection via dividends and FCF

Optional upside from AI/GenAI adoption, cloud modernization, and eventual recovery in key verticals

If you're looking for compounding with low volatility, TCS continues to be one of India’s safest tech bets—and right now, it’s trading at a price that finally reflects some margin of safety.

4. What TCS Q4 FY25 Means for Long-Term Investors: Risks, Opportunities & Entry Points

TCS’s Q4 FY25 results—and more importantly, its management commentary—reveal a company in the midst of a strategic transformation, not a cyclical slowdown. While near-term growth appears muted, the long-term investment case remains compelling for those focused on quality, consistency, and compounding.

4.1 Short-Term Weakness ≠ Structural Decline

TCS is seeing moderation in revenue growth (Q4 CC growth of 2.5%) and margin pressure due to slower deal ramp-ups and cost adjustments. But this softness is largely attributed to:

Macro headwinds: Delayed client spending in the US

Sector-specific issues: Auto, insurance, and retail

Timing gap: TCV conversion lagging due to cautious enterprise sentiment

Importantly, there’s no loss of competitiveness or client confidence—deal wins remain strong, especially in AI, cloud, and modernization.

4.2 GenAI Is a Long-Term Growth Driver, Not a Gimmick

TCS is one of the few Indian IT firms that’s actively embedding GenAI in both internal delivery and client solutions:

1 in 3 new deals now includes AI/GenAI elements

Projects are moving beyond pilot to production deployment

Use cases span customer service, risk, supply chain, legal, and IT ops

Investor insight: While GenAI monetization is still early, it offers non-linear upside—and TCS is investing aggressively in platforms (ignio™, TwinX™, Quartz™, etc.) to capture it.

4.3 Valuation Offers a Reasonable Entry Point

With a P/E of ~24x and FCF yield nearing 4%, TCS is:

Trading below its 5-year average valuation

Still offering high ROIC, strong cash flow, and dividend stability

A better alternative vs. lower-growth peers or expensive high-beta tech

For long-term investors, current prices bake in short-term concerns, while offering exposure to:

AI-led services growth

Higher productivity in delivery

Margin expansion from internal AI use

Geographic diversification

4.4 Business Is Resilient and Evolving, Not Stagnating

Despite muted topline growth, TCS continues to:

Deliver >24% operating margins

Win large, diversified deals (TCV of $12.2B in Q4)

Sustain 125%+ FCF conversion of net income

Avoid layoffs, maintain hiring & skill-building momentum

TCS isn’t just defending its moat—it’s rebuilding the future of IT delivery with AI, platforms, and full-stack transformation capabilities.

4.5 What to Watch: Triggers for a Rerating

4.6 Final Investor Takeaway

TCS is in a transition phase, not a downturn. It’s trading at a fair-to-attractive valuation while preparing for a multi-year AI-led growth cycle.

Investors seeking:

Consistent cash flows

High-quality business model

Optionality from new tech (GenAI, cloud, platforms)

A defensive yet future-ready stock

…will find TCS well-positioned to deliver reasonable compounded returns over a multi-year horizon — even from today’s subdued levels.

Disclaimer

Content Accuracy and Reliability: This summary of the earnings call is generated using an artificial intelligence large language model (LLM). While every effort has been made to ensure the accuracy and completeness of the information, the summary may not fully capture all nuances or details of the original earnings call. The content provided is for informational purposes only and should not be construed as financial advice or a recommendation to buy or sell any securities. Verification: Readers are encouraged to refer to the official earnings call transcript, company filings, and other authoritative sources for comprehensive and accurate information. The creators of this summary do not guarantee the accuracy, completeness, or timeliness of the information and accept no responsibility for any errors or omissions. No Liability: The use of this summary is at your own risk. The creators and distributors of this content disclaim any liability for any loss or damage arising from the use of or reliance on this summary. Consult Professional Advice: For investment decisions or financial advice, please consult a qualified financial advisor or other professional

I loved the sector-wise and vertical-wise bifurcation, along with the detailed explanation of AI, as it is quite uncertain what the future holds for all Indian IT companies.