Tata Power Company: PAT CAGR of 25% & Revenue CAGR of 13% for FY24-30 at a PE of 35

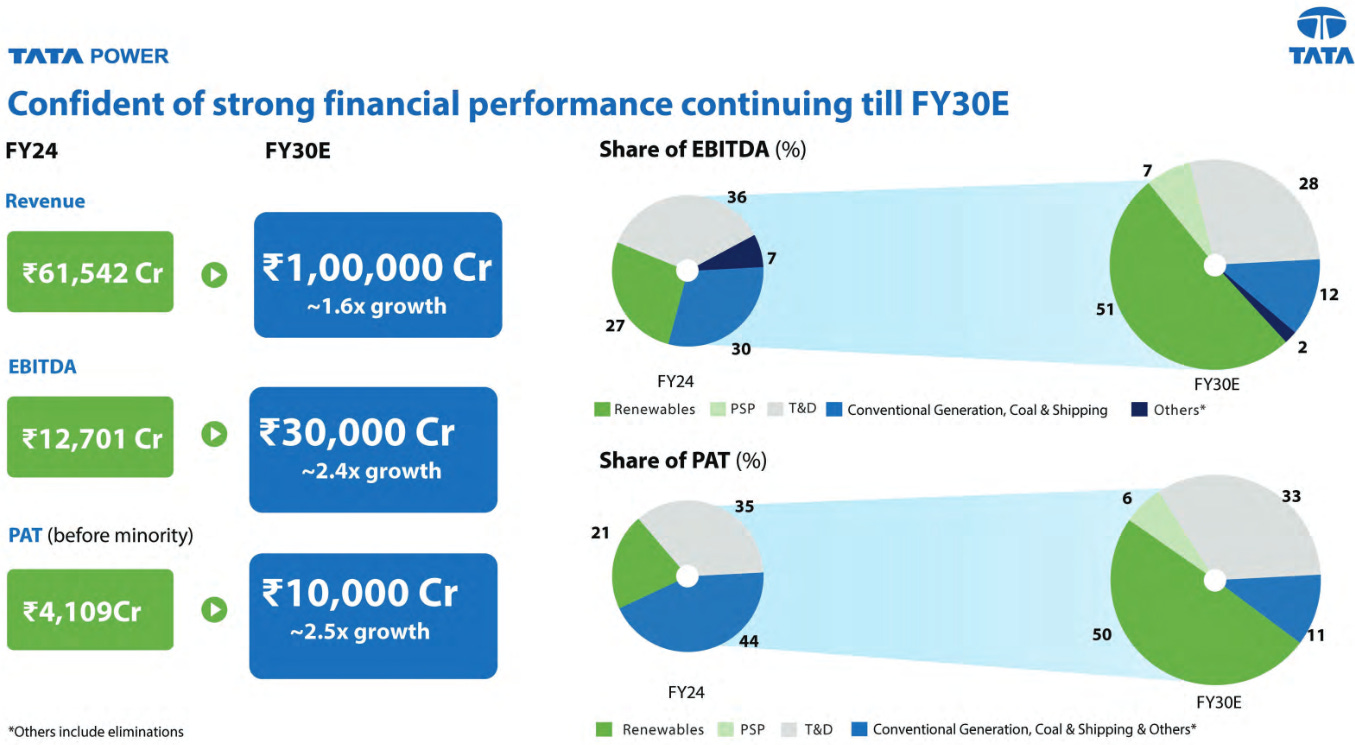

TATAPOWER FY30 guidance for PAT of Rs 10,000 cr to be 2.5x FY24 PAT and Revenue of Rs. 1,00,000 crore at 1.3x FY23 Revenue. PAT Margin to expand from 6.7% in FY24 to 10% by FY30.

Money Muscle is away. Limited coverage till 3-Jan-25. HAPPY NEW YEAR

1. India’s largest vertically-integrated power company

tatapowercom | NSE: TATAPOWER

2. FY20-24: PAT CAGR of 34% & Revenue CAGR of 21%

3. Strong FY24: PAT up 12% & Revenue up 10% YoY

4. Q2-25: PAT up 7% & Revenue down 1% YoY

5. H1-25: PAT up 6% & Revenue up 5% YoY

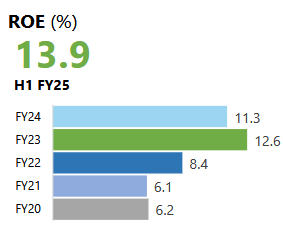

6. Business metrics: Improving return ratios

7. FY24-30 Outlook: PAT CAGR of 25% & Revenue CAGR of 13%

8. FY24-30 guidance of PAT CAGR of 25% & Revenue CAGR of 13% at a PE of 35

9. Hold?

If I hold the stock then one may continue holding on to TATAPOWER.

TATAPOWER is in the middle of a strong run and has delivered 20th consecutive quarter of PAT growth with highest ever H1 EBITDA in H1-25. One can keep riding the momentum

TATAPOWER is indicating towards a strong H2-25.

Increased Renewable Energy Capacity Addition: Tata Power anticipates a significant increase in the pace of renewable energy capacity addition in the third and fourth quarters of FY25. Majority of their third-party order book is expected to be completed by the end of March.

Stabilisation of Cell Manufacturing: The first 2 gigawatt of the cell manufacturing plant is expected to be fully stabilised by the end of November, with the second 2 gigawatt line to be commissioned and stabilised by the end of December. This will lead to a massive improvement in the performance of the manufacturing plant from the next quarter onwards.

Ramp-Up of Module Production: The module plant is already operating at full capacity. With the stabilisation of cell production, the company expects to see a greater output of modules for their projects. The company anticipates that a large quantity of its own projects, as well as third-party projects, will be commissioned in Q3 and Q4.

Commissioning of Large Projects: A substantial portion of utility-scale projects and first-party EPC projects are expected to be commissioned in the third and fourth quarters, with most third-party projects being completed before March. This will contribute to the company’s revenue and capacity.

Pumped Hydro Projects Progress: The company plans to start work on its 1000 MW pumped hydro project from 1st January 2025. The 600 MW Bhutan project is also scheduled to commence work from January 2025, with diversion tunnel work already started.

Transmission Projects Commissioning: Two of the four transmission projects currently under implementation are expected to be commissioned in FY25, with the remaining two in FY26. The work on the newly secured 765kV transmission line in Odisha will also begin in the next few months.

Resolution of Mundra Plant Issues: The Mundra plant, which experienced issues in the previous quarter due to a damaged coal conveyor system, is now operating at full capacity. The company expects it to achieve 95% to 97% availability in November and December.

Potential Finalisation of SPPA: Although the extension of Section 11 has delayed the finalisation of supplementary power purchase agreements (SPPA) for the Mundra plant, the company anticipates that these discussions will conclude in the next few months.

Growth drivers for TATAPOWER are strong

Aggressive expansion of its renewable energy capacity with a focus on hybrid solar and wind projects, and the addition of energy storage solutions.

With its module plant at full capacity and the cell plant scaling up, will ensure a reliable supply of materials.

Investment in pumped hydro storage projects is another significant growth driver, enabling the provision of peaking power and grid integration of renewable energy.

Increased rooftop solar installations, especially in key states, and participation in transmission and distribution projects will also fuel expansion.

Strong industry tailwinds are in place to support the growth of TATAPOWER

Key tailwinds for Tata Power include supportive government policies, increasing demand for clean energy, the need for energy storage, domestic manufacturing support, grid modernization, positive regulatory actions, and favourable credit ratings. These factors position Tata Power well for continued growth and success in the renewable energy sector

10. Buy?

If I am looking to enter TATAPOWER then

TATAPOWER has delivered PAT growth of 6% & Revenue growth of only 5% in H1-25 at a PE of 35 which makes valuations quite expensive in the short term.

TATAPOWER has given a FY24-30 guidance of PAT CAGR of 25% & Revenue CAGR of 13% at a PE of 35 makes valuations look attractive from a longer term.

Given the tepid performance in H1-25, stronger growth has to come through in H2-25 or else the valuations will become even more expensive.

At a PE of 35 the margin of safety in TATAPOWER is quite limited. In its journey to meet the FY24-30 guidance the stock can see a strong reaction if performance is not in line with the guidance.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

Excellent Read.