Tarsons Product Limited - Very Expensive

Efficiently run company. Unsure if FY25 revenue guidance will be meet

Company Overview

Tarsons Products Ltd is a the leading Kolkata based labware company engaged in the designing, development, manufacturing and marketing of consumables, reusables and other products like benchtop equipment & instruments

Tarsons is catering to a diverse end user industry, with products used in laboratories across research organizations, academia institutes, pharmaceutical companies, CROs, diagnostic companies and hospitals. Tarsons claims a 9-12% market share in the highly fragmented Indian labware market

Tarsons has 5 vertically integrated manufacturing facilities in West Bengal. Two other facilities are also being planned.

Share Details

NSE:TARSONS( tarsons.com)

Quality: Returns on capital employed in cash

Return ratios have been sold and consistent over the years. Cash conversion is also solid. We are looking at the return ratios of an efficiently run company.

Growth

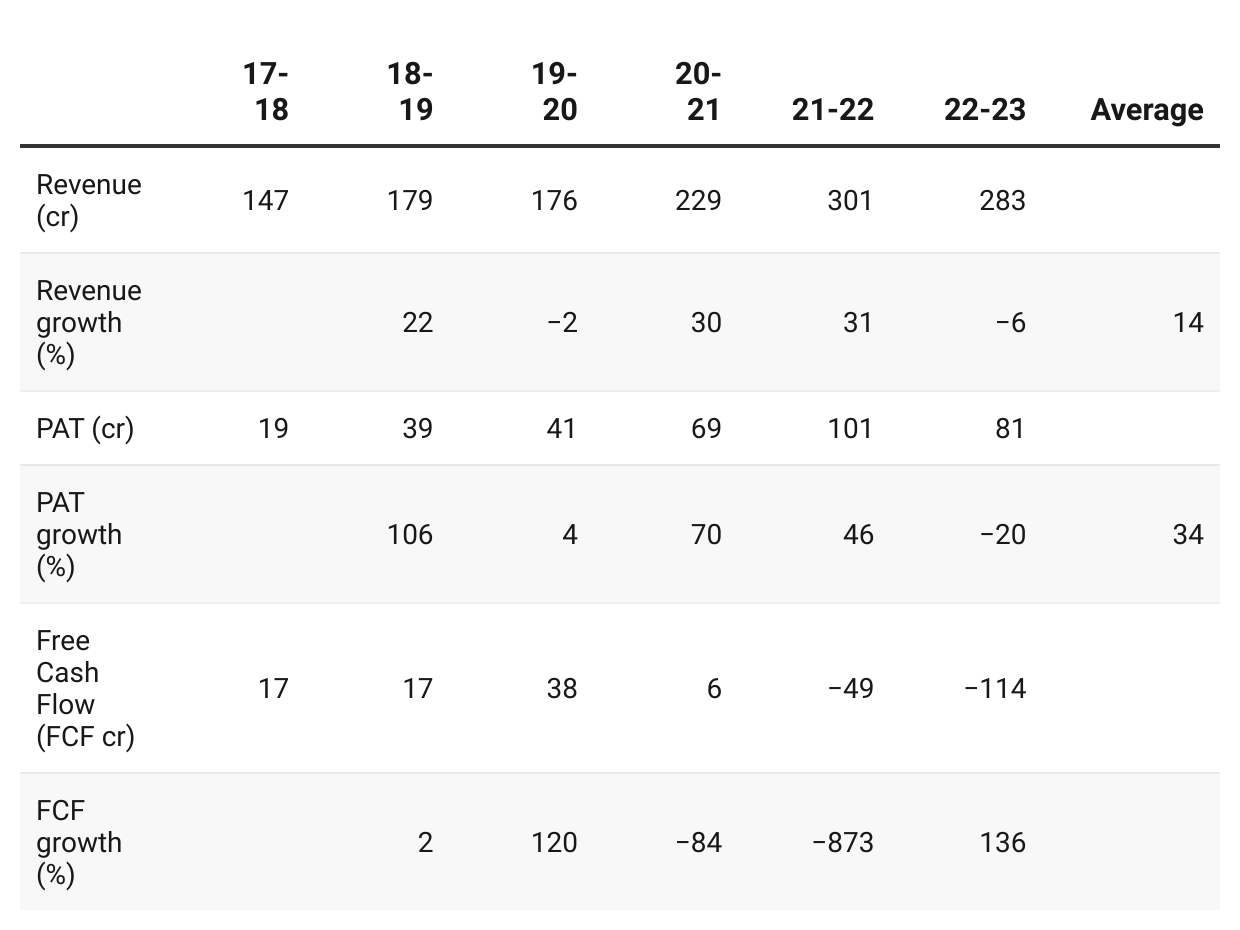

The top-line growth CAGR of 14% is nothing extra ordinary compared to other companies. The higher bottom-line growth is dirvine by better margins across the year.

Growth Momentum

The growth momentum is slowing down.

Outlook

TARSONS has grown the top-line at a historic CAGR of 17%. Against this historic growth the management was very confident of meeting its Rs 500 cr revenue guidance in FY25 in an earnings call in Aug-22

In Jun-23 the management did want to speak about the guidance.

So What????

If I currently hold the stock, I may continue holding it based on my past returns, expectations for future returns, and the availability of alternative stock ideas. Unless one entered the stock at is 52 week low there is no other level where a current holder of the stock would be making money out of it.

If I don't currently own the stock, I don’t want to enter it. TARSONS at a PE of 41 is very expensive for a historic top-line growth of 17% and a future where the management in Jun-23 does not want to speak of a guidance it was absolutely sure to meet in Aug-22.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades