Talbros Automotive Components: 20%+revenue, 28-31% EBITDA CAGR till FY27

2X revenue by FY27, delivering an EBITDA margin of 15-16% and ROCE of 20%+ while keep net debt below Rs 100 cr

1. Talbros Automotive Components Limited (TACL)

A leading auto component manufacturer

talbros.com | NSE: TALBROAUTO

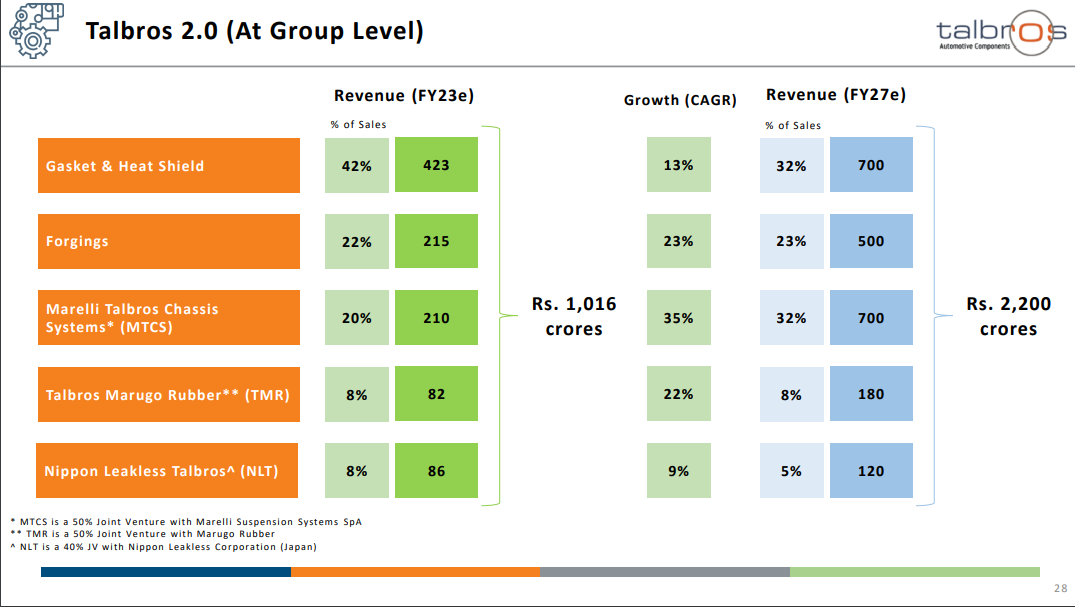

2. Talbros group to grow at 21% CAGR till FY27

Talbros group includes Talbros Automotive Components Limited (TACL) and its various joint venture partners

The revenue of the Talbros group targeted to grow from Rs 1,037 cr in FY23 to Rs 2,220 cr by FY27

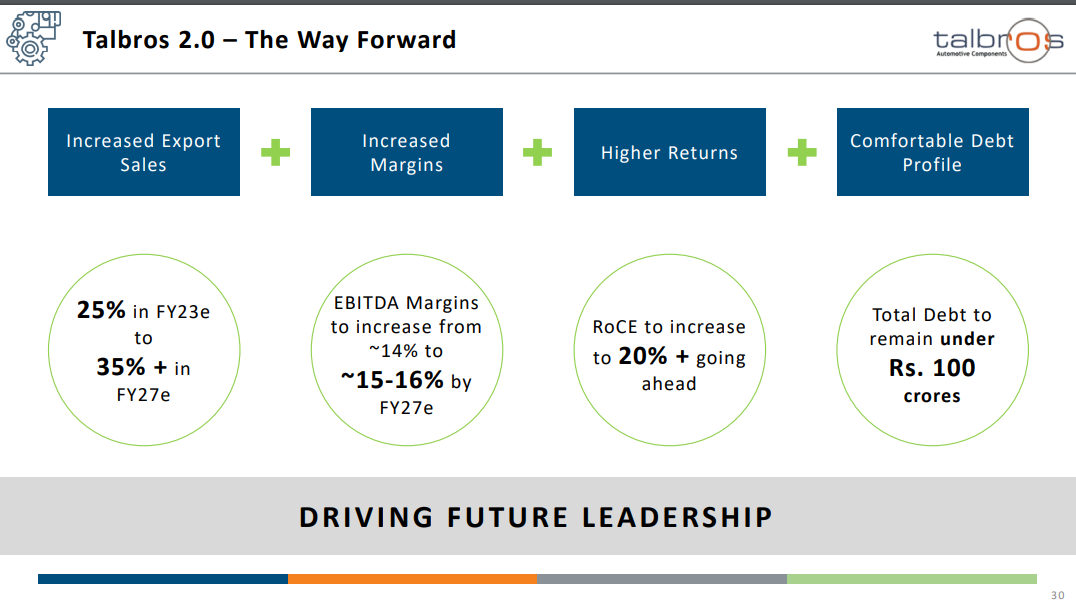

3. Growth quality to improve on the way to FY27

EBITDA margins from 14% to 15-16%

ROCE = 20%+

Reduction of debt ==> Total Debt < Rs 100 cr

4. TACL (ex JV share) to grow at 20% CAGR

TACL revenue excluding the share of the joint venture partners to grow from Rs 818 cr in FY23 to Rs 1,688 cr in FY27

5. EBITDA growth at a CAGR of 28-31% for the next four years

TACL revenue excluding the share Rs 1,688 cr in FY27

EBITDA margin of 15-16% implies an EBITDA of Rs 253-270 cr by FY27

FY23 EBITDA at Rs 94 cr to grow to Rs 253-270 cr by FY27

This implies that EBITDA will grow at a CAGR of 28-31% till FY27

6. EBITDA growth target of 28-31% looks reasonable

Barring FY20, EPS has grown year on year every year from FY17

EPS grew from Rs 9.9 in FY17 to Rs 45.02 in FY23

EPS grew at CAGR of 29% over a period of seven years

Target of 28-31% EBITDA growth is in rage with EPS growth delivered previously.

7. Strong Q1-24: On track for FY27 growth

Q1-24 performance gives the initial confidence that TACL is on track to hit the targets for FY27.

YoY Revenue growth at 20% against the FY27 target of 20%

YoY EBITDA growth at 34% against the FY27 target of 28-31%

Talbros Automotive Components Limited has begun FY24 with strong performance both in business growth and profitability standpoint.

Overall business growth and operational efficiencies have resulted in healthy margins.

Management commentary on Q1-24 results

8. Strong Q1-24: On track for FY27 growth quality

EBIDTA margin in the 15-16% target range and can be sustained

We achieved EBITDA Margin of 15%, which we believe shall be sustainable going forward.

9. Growth supported by an order book Rs 1400 cr

New Multi year orders worth over Rs.1,000 cr received as of Q4-23

These orders are to be executed over a period of next 5 years covering the company's product lines – gaskets, heat shields, forgings and chassis.

Revenue contribution of the Rs 1,000 cr orders will be Rs150-200 cr per year

I think you should divide it by INR150 crores to INR200 crores year-on-year. By the time it comes into production and cycle and SOPs and all.

New Multi year orders worth over Rs. 400 crores received in July-23

These orders are to be executed over a period of next 5-7 years.

10. EPS CAGR of 29% for FY17-23 at a PE of 23

Valuations at a 23 PE, attractive considering past EPS CAGR of 29%

11. So Wait and Watch

If I hold the stock then one must

Wait and watch for quarterly results to see if the management is delivering on the targets for FY27

12. Or join the ride

If I am looking to enter the stock then

Valuations are reasonable. PE of 23 for EBITDA growth of 28-31%

Strong track record of delivering EPS growth year on year at a CAGR of 29%

The story is expected to play out till FY27 so no hurry to enter the stock. One can seek out bad days to enter the stock in multiple steps. No pressing reason to enter fully in one day.

Don’t like what you get every morning?

Let us know at hi@moneymuscle.in

Will send you better stuff.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades