Syrma SGS Technology: PAT growth of 43% & Revenue growth of 40% in 9M-25 at a PE of 64

Guidance of 30-35% revenue growth for the next few years. 20% EBITDA growth in FY25 followed by EBITDA growth of 35% in FY26. Order book in place to support the growth for FY26.

1. Electronic System, Design & Manufacturing (ESDM) company offering Electronics Manufacturing Services (EMS)

syrmasgs.com | NSE: SYRMA

Industry Segments

3. FY21-24: PAT CAGR of 24% & Revenue CAGR of 53%

4. Weak FY24: PAT up 1% & Revenue up 54% YoY

5. Q3-25: PAT up 161% & Revenue 24% YoY

PAT up 34% & Revenue 6% QoQ

6. 9M-25: PAT up 43% & Revenue up 40% YoY

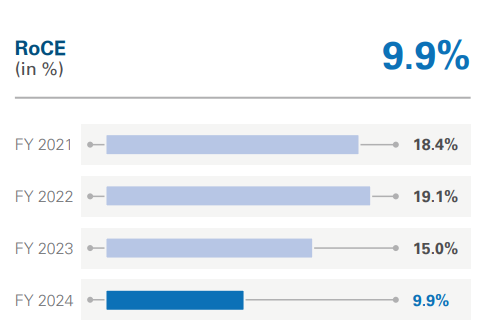

7. Business metrics: Return ratios impacted by a weak FY24

Expect ROCE of 14-15% for FY25, and expect it to increase towards 20% over the next two years. They anticipate a return on capital of 18-20% by FY27.

8. Outlook: 35% revenue growth in FY25

i. FY25: 20% EBITDA growth with 35% revenue growth

An EBITDA of ₹305-310 with a margin of 7% implies a revenue of ₹4429 cr in FY25 which implies a 35%+ growth.

The company had initially guided a 7% operating (EBITDA) margin for FY25.

This translates to an absolute EBITDA figure of around 305-310 crores.

Management is confident in achieving this margin and potentially exceeding it, with any movement expected to be "north of 7%".

ii. FY26: 35% growth in PAT & 30-35% growth in revenue supported by improved margins

A growth rate of about 30-35% for FY26 accompanied by a corresponding increase in margins.

The management is confident in achieving the guided figures for FY26.

The company expects significant business from onboarded automotive and industrial clients in FY26 and FY27. These clients are expected to yield sub-200 crores of revenue in FY26.

iii. Strong Order book:

As of December 2024, the order book stood at approximately 5,300 crores.

Order book is expected to be executed over a period of 9 to 15 months.

Order Book Composition:

Auto Segment: 30% or more.

Consumer Segment: Approximately 38 to 40%.

Industrial Segment: Approximately 20 to 22%.

Healthcare, IT and Railway segments: The remaining balance.

Industrial segment order book: The current order book on the industrial side is about 20 to 22% of the total order book.

New client impact: The onboarding of new clients in the automotive and industrial sectors is expected to contribute significant business in the future. In FY26, these clients are expected to yield sub-200 crores of revenue.

Metro business order book: The company anticipates that the metro business will rebound in the coming year, with new product development in the pipeline and a shift toward customer-centric approaches.

Management has expressed confidence that the company will continue to grow at the industry average with the margins they have guided.

9. PAT growth of 43% & Revenue growth of 40% in 9M-25 at a PE of 68

10. Hold?

If I hold the stock then one may continue holding on to SYRMA

Based on 9M-25 performance SYRMA looks on track to deliver a strong FY25 after a flat FY24

The outlook for FY26 is strong with 30-35% growth with margin improvement

Order book of ₹5,300 cr in place to be executed within 9-15 months provides visibility into the revenue for FY26.

11. Buy?

If I am looking to enter SYRMA then

SYRMA has delivered PAT growth of 43% and Revenue growth of 40% in 9M-25 at a PE of 64 which makes the valuations fully valued in the short term.

SYRMA is guiding for FY25 EBITDA growth of about 20% with 35% revenue growth in FY25 at a PE of 64 makes the valuations fully valued.

SYRMA is guiding for FY26 EBITDA growth of about 35% with 30-35% revenue growth in FY26 at a PE of 64 makes the valuations fully valued from a FY26 perspective.

SYRMA management is targeting to growth at 30-35% at least for the next few year with improved margins then value will emerge from a FY27 perspective which would require patience.

There may be volatility along the way given there is no margin of safety with at a PE of 64

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer