Syrma SGS: 59% growth in FY24 on the back of 52% revenue CAGR for FY21-23 at a PE of 67

No significant challenge for SYRMA in growing faster than the industry while maintaining double-digit EBITDA margin in FY24. Undertaking capex to 3X the manufacturing size.

1. Electronics System Design & Manufacturing (ESDM) and Original Design Manufacturer (ODM) business

syrmasgs.com | NSE: SYRMA

Syrma SGS Technology Ltd (SYRMA), a leading Electronics System Design and Manufacturing (ESDM) Company, is dedicated to technology based solutions and the Original Design Manufacturer (ODM) business.

Products

Printed Circuit Board Assembly (PCBA)

Box Build: electromechanical assembly, firmware and software loading, validation, testing and packing

RFID Tags and inlays and custom-made RFID readers

End-of-line Tester Development

Magnetics: OEM manufacturer for high frequency transformers, chokes, coils and inductors.

End-of-line Tester Development: In-house end-of-line tester development services.

Electro-Mechanicals: Turnkey manufacturing assistance through specialised sheet metal manufacturing services.

BLDC Modules for Fans

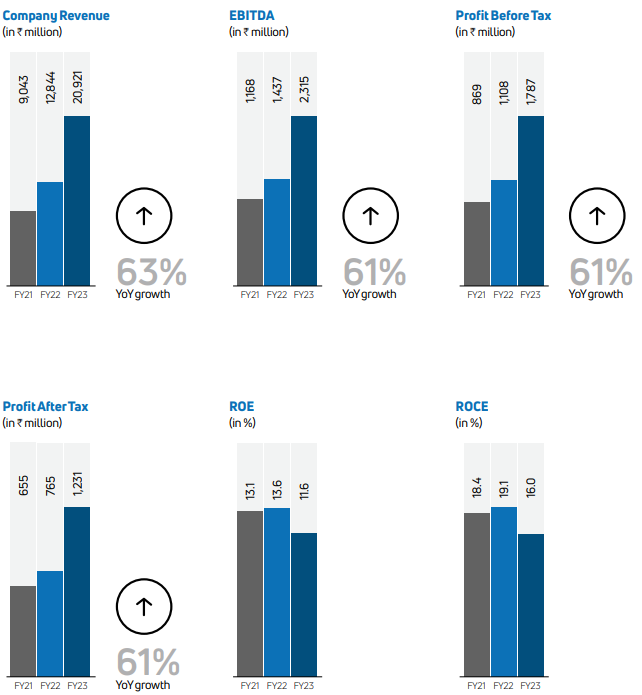

2. FY21-23: SYRMA revenue growing at a CAGR 52%

3. FY23: PAT up 63% and Revenue up 61% YoY

4. Q1-24: PAT up 65% and Revenue up 59% YoY

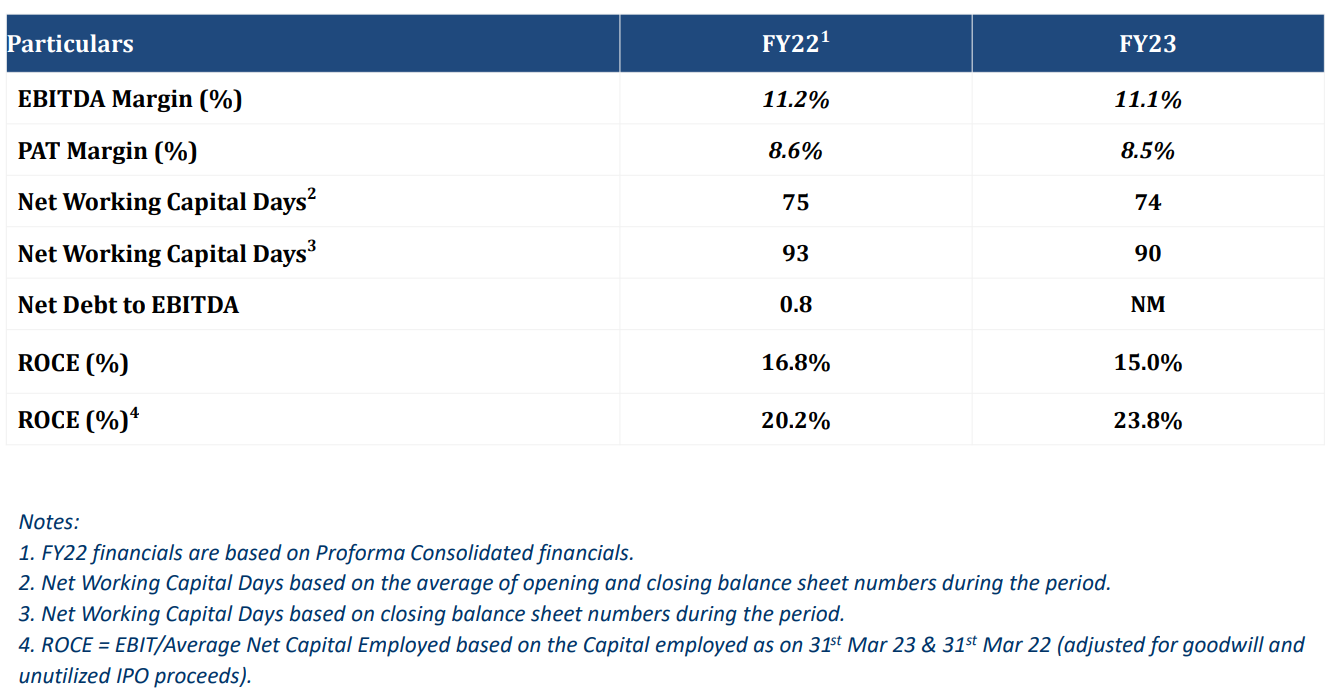

5. Business metrics improving along with return ratios

6. Outlook: 59% revenue growth in FY24

i. Industry superior growth, maintaining double digit EBITDA margin

And we maintain that our guidance which we had given on growing greater than the industry with maintaining EBITDA and that double-digit margin that by and large stands and there is no significant challenge to that.

ii. 59% revenue growth in FY24

Management is informing that FY24 will be similar to FY23 in terms of revenue run-rate going up across the four quarters.

Q1-23 contributed to 19% of FY23.

Modelling Q1-24 revenue to be also 19% of FY24 revenue leads to a FY24 revenue of Rs 3,327 cr

This implies to a 59% growth in FY24 which is as per the historic trend for FY21-23.

Since margins are being maintained, a similar 59% growth in PAT can be expected

Commentary on FY24 revenue: If we go by the historical trend then I think we can derive our figure. And when I am talking about FY23 we had a run-rate of Rs. 128 crores per month approximately in Q1, which went up to Rs. 148 in Q2, it went up to Rs. 175 in Q2 and about Rs. 200 in Q4. So, from Rs. 128 starting ending at Rs. 200; we are starting with Rs. 200 keeping our fingers crossed and looking at the customers and everyone I think we should be growing at a rate higher than Rs. 200 in the coming quarters, per month, because that has been the historical trend in the past years. So, I just shared Rs. 128 start of the year, Rs. 200 crores end of the year. So, this year we are starting at Rs. 200 crores, so I think by the same logic we should be ending at the last quarter of this year we should be at a higher run-rate than Rs. 200.

iii. Order book 1.7X FY23 revenue

Revenue visibility creates on confidence in the growth projection for FY24

Coming to our order book we have a total order book of approximately Rs. 3,500 crore odd, as on Jun end in hand and out of which about Rs. 2,200 crore to Rs. 2,300 crore is something we expect to deliver in the next 12 months’ time.

iv. Johari Digital: 1-1.5% incremental EBITDA impact from FY25

No material impact considered in FY24

We expect this would help us in accretion of revenue on a full-scale basis, on a full consolidation basis by about 5% to 7% to the revenue side and about 1% to 1.5% on the overall EBITDA side going forward.

v. Manufacturing capacity to 3X

Acquired a 16-acre plot of land from SIPCOT in Krishnagiri district which is next to Hosur. And we have signed off an agreement for acquiring a 6-acre building and plot in Chennai for the domestic business. These two plants when fully commissioned will have a factory covered area of 1.5 million+ which is approximately almost two times what we are having today.

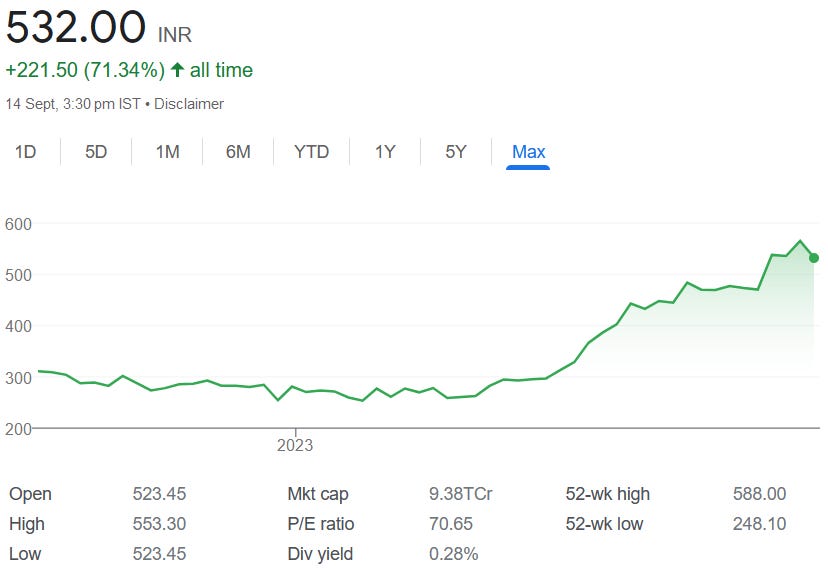

7. 59% revenue & PAT growth at a PE of 67

8. So Wait and Watch

If I hold the stock then one may continue holding on to SYRMA as long a there is no challenge to growing greater than the industry with maintaining double-digit EBITDA margin in a perspective. One should keep evaluating SYRMA on quarter by quarter basis. Looking beyond FY24, then FY25 also looks promising given the

strong order book visibility

acquisition of the EBITDA and revenue accretive 51% stake in Johari Digital

manufacturing capacity to go 3X of current capacity

9. Or, join the ride

If I am looking to enter the stock then

SYRMA is expected to deliver revenue & PAT growth of 59% in FY24 which makes the PE of 67 look fairly valued.

The strong order book and the tripling of the manufacturing capacity will ensure that the story will continue much beyond FY24

A stock with the momentum to grow at 50%+ across multiple years will make money over the long term.

Don’t like what you are reading?

Let us know at hi@moneymuscle.in

Will make it better.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades