Suryoday Small Finance Bank: PAT growth of 178% & NII growth of 29% in FY24 at a PE of 9.3

Strong guidance of 30-35%+ advance growth for FY25 after achieving its guidance for FY24. SURYODAY has a roadmap for strong growth till FY28. It is available at reasonable valuations of P/B of 1.1

1. A Small Finance Bank

suryodaybank.com | NSE : SURYODAY

2. FY21-24: PAT CAGR of 163% & Net Interest Income CAGR of 33%

3. FY23: Back in profits & Net interest income (NII) up 28% YoY

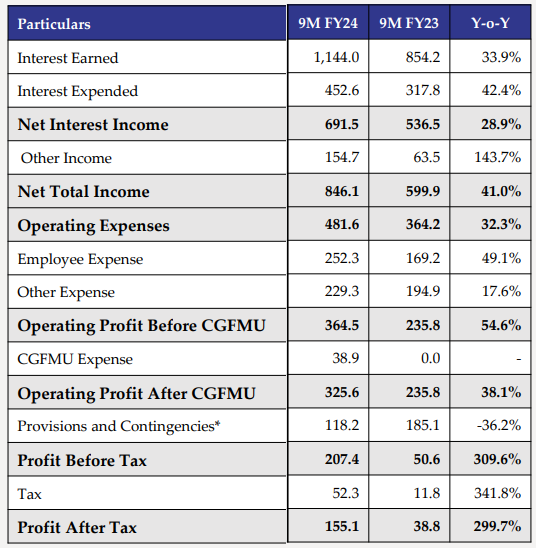

4. Strong 9M-24: PAT up 300% & NII up 29% YoY

5. Q4-24: PAT up 57% & NII up 37% YoY

PAT up 6% & NII up 8% QoQ

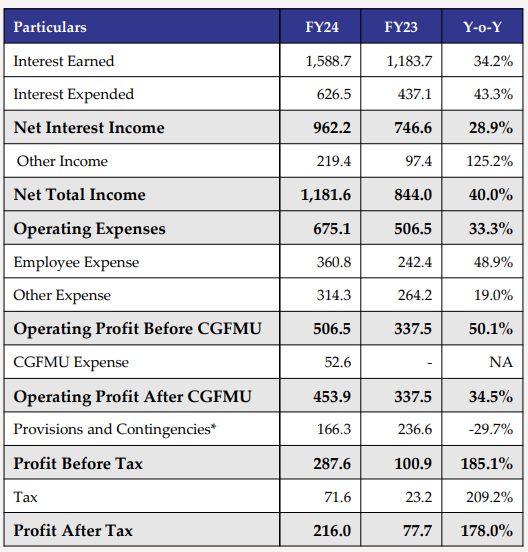

6. Strong FY24: PAT up 178% & NII up 29% YoY

7. Return ratios: Improving return ratios

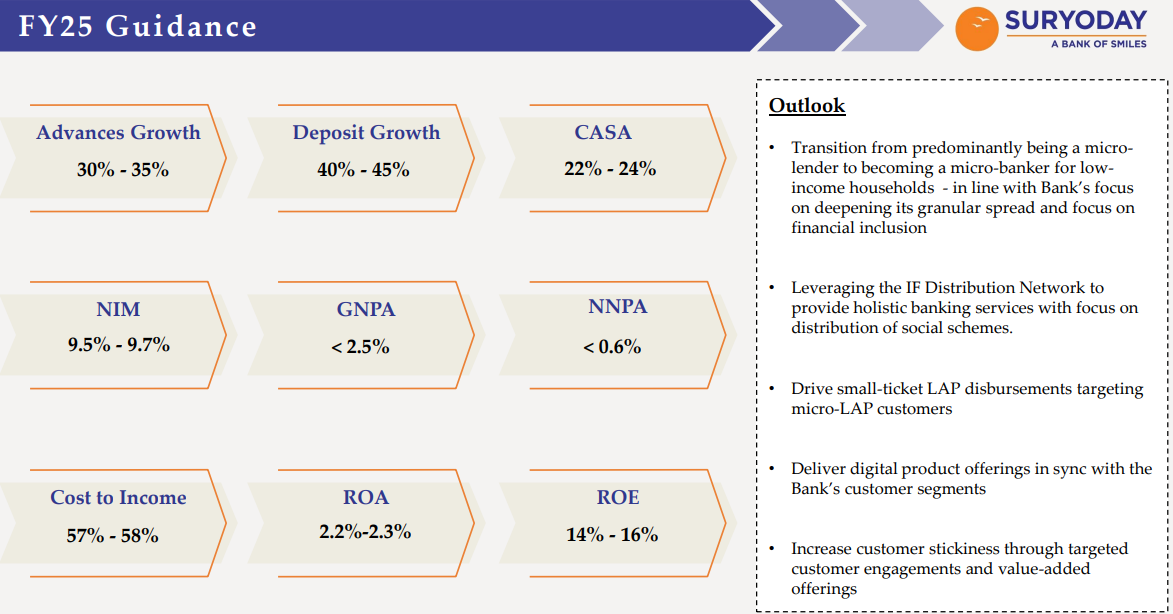

8. Outlook: Guiding for 30%+ advance growth in FY25

i. FY25: Strong guidance for growth with improving asset quality

ii. Strong roadmap for FY28

Growth CAGR for FY23-28

Gross Advances = 30%

Deposits = 35%

9. PAT growth of 178% & NII growth of 29% in FY24 at a PE of 9.3

10. So Wait and Watch

If I hold the stock then one may continue holding on to SURYODAY

Coverage of SURYODAY was initiated after Q3-24 results. The investment thesis has not changed after a strong FY24 against the guidance for FY24. The delivery of a strong FY24 has increased confidence in the management to deliver a FY25 as per the guidance

SURYODAY is in the middle of a strong run and has delivered sequential QoQ growth in PAT in all the four quarters of FY24

SURYODAY has a strong roadmap for growth till FY28.

11. Or, join the ride

If I am looking to enter SURYODAY then

SURYODAY has delivered PAT growth of 178% & NII growth of 29% in FY24 at a PE of 9.3 which makes valuations quite reasonable for the short term.

Outlook for growth in advances of 30%+ and deposit growth of 40% in FY25 at a PE of 9.3 makes the valuations quite reasonable from a longer term.

With a share price of Rs 188 against a book value per share of Rs 169.96 as of Q4-24 end implies that SURYODAY is available a price to book of 1.1 which makes the valuations quite attractive

One needs to keep a watch on asset quality even though NPA’s are trending down with 70%+ of GNPA covered by provisioning as indicated in the provisioning coverage ratio

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer