Suryoday Small Finance Bank: PAT growth of 300% & NII growth of 29% in 9M-24 at a PE of 9

SURYODAY is on track to meeting its FY24 guidance. It has a roadmap for strong growth till FY28. It is available at reasonable valuations of P/B of 1

1. A Small Finance Bank

suryodaybank.com | NSE : SURYODAY

2. FY19-23: Back in profits in FY23

3. FY23: Back in profits & Net interest income (NII) up 28% YoY

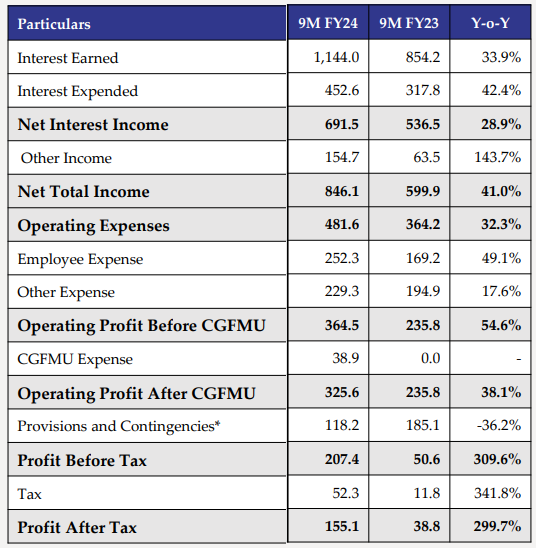

4. Strong H1-24: PAT up 372% & NII up 26% YoY

5. Q3-24: PAT up 217% & NII up 34% YoY

PAT up 14% & NII up 11% QoQ

6. Strong 9M-24: PAT up 300% & NII up 29% YoY

7. Return ratios: Recovering in FY23

8. Outlook: Guiding for 25%+ growth till FY26

i. Strong guidance for growth

ii. Strong roadmap for FY28

Growth CAGR for FY23-28

Gross Advances = 30%

Deposits = 35%

9. PAT growth of 300% & NII growth of 29% in 9M-24 at a PE of 9

10. So Wait and Watch

If I hold the stock then one may continue holding on to SURYODAY

Based on 9M-24 performance, SURYODAY looks on track to deliver the strongest PAT after FY20

SURYODAY is in the middle of a strong run and has delivered sequential QoQ growth in PAT in all the three quarters of FY24

SURYODAY is delivering as per its guidance for FY24 and one can wait for Q4-24 to look ahead for the FY25 guidance.

SURYODAY has a strong roadmap for growth till FY28.

11. Or, join the ride

If I am looking to enter SURYODAY then

SURYODAY has delivered PAT growth of 300% & NII growth of 29% in 9M-24 at a PE of 9 which makes valuations quite reasonable for the short term.

Outlook for growth in advances of 30% and deposit growth of 35% till FY28 at a PE of 9 makes the valuations quite reasonable from a longer term.

With a share price of Rs 164.45 against a book value per share of Rs 164.2 as of Q3-24 end implies that SURYODAY is available a price to book of 1 which makes the valuations quite attractive

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer