Suryoday Small Finance Bank: PAT growth of 47% & NII growth of 31% in Q1-25 at a PE of 9

Guidance of 30-35%+ advance growth for FY25. SURYODAY at attractive valuations with P/B of 1.09. Q1-25 results show its on track to achieve guidance for FY25. Has a strong roadmap FY28.

1. A Small Finance Bank

suryodaybank.com | NSE : SURYODAY

2. FY21-24: PAT CAGR of 163% & Net Interest Income CAGR of 33%

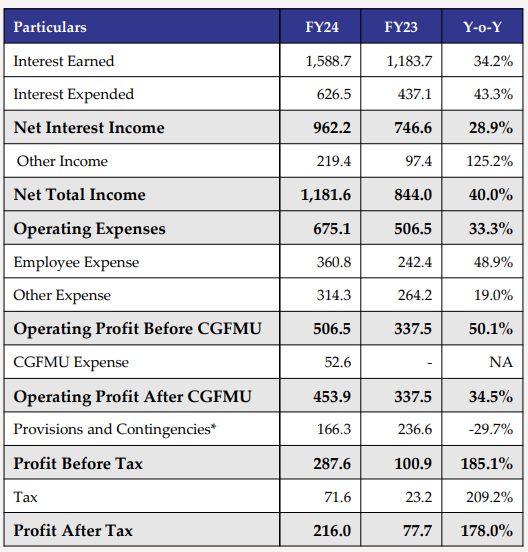

3. FY23: Back in profits & Net interest income (NII) up 28% YoY

4. Strong FY24: PAT up 178% & NII up 29% YoY

5. Q1-25: PAT up 47% & NII up 31% YoY

PAT up 15% & NII up 8% QoQ

7. Return ratios: Improving return ratios

Q1-25

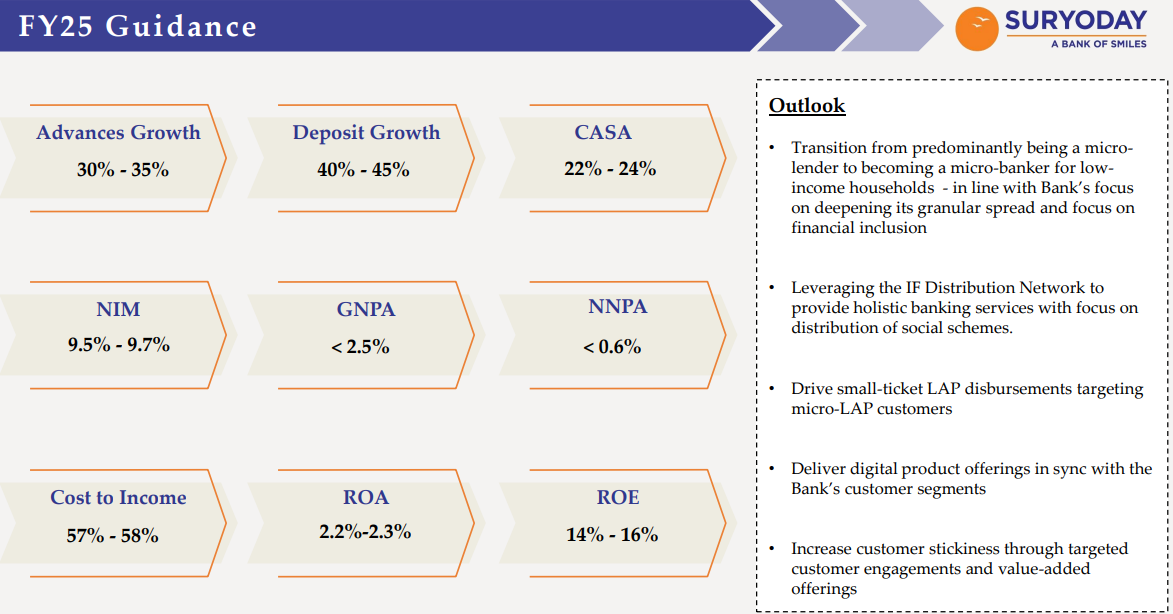

8. Outlook: Guiding for 30%+ advance growth in FY25

i. FY25: Strong guidance for growth with improving asset quality

Q1-25: We are on track to achieve our stated guidance for FY25.

ii. Strong roadmap for FY28

Growth CAGR for FY23-28

Gross Advances = 30%

Deposits = 35%

9. PAT growth of 47% & NII growth of 31% in Q1-25 at a PE of 9

10. So Wait and Watch

If I hold the stock then one may continue holding on to SURYODAY

Coverage of SURYODAY was initiated after Q3-24 results. The investment thesis has not changed after a strong FY24. Q1-25 has been strong and gives confidence in the management to deliver a FY25 as per the guidance

SURYODAY is in the middle of a strong run and has delivered sequential QoQ growth in PAT in the last nine quarters starting Q1-23

SURYODAY has a strong roadmap for growth till FY28.

11. Or, join the ride

If I am looking to enter SURYODAY then

SURYODAY has delivered PAT growth of 47% & NII growth of 31% in Q1-25 at a PE of 9 which makes valuations quite reasonable for the short term.

Outlook for growth in advances of 30%+ and deposit growth of 40% in FY25 at a PE of 9 makes the valuations quite reasonable from a longer term.

With a share price of Rs 192.51 against a book value per share of Rs 176.81 as of Q4-24 end implies that SURYODAY is available a price to book of 1.09 which makes the valuations quite attractive

One needs to keep a watch on asset quality even though NPA’s are trending down with 84+ of GNPA covered by provisioning as indicated in the provisioning coverage ratio

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer