Stallion India Fluorochemicals Q1 FY26 Results: PAT up 23%, On-track FY26 Guidance

Guiding 30-35% CAGR for FY25-28 with 3-4% margin expansion. Attractive valuations 10x FY28E PE, for a ~₹1,000 Cr business growing at 30%+, delivering 14% margin

1. Refrigerant and Industrial Gases

stallionfluorochemicals.com | NSE: STALLION

Provider of refrigerant and industrial gases—expertise in debulking, blending, lab testing, and high-purity cylinder filling (custom formulations).

4 operational facilities—Khalapur (MH), Ghiloth (RJ), Manesar (HR), Panvel (MH)—with 2 more coming up; pan-India, logistics-optimized network.

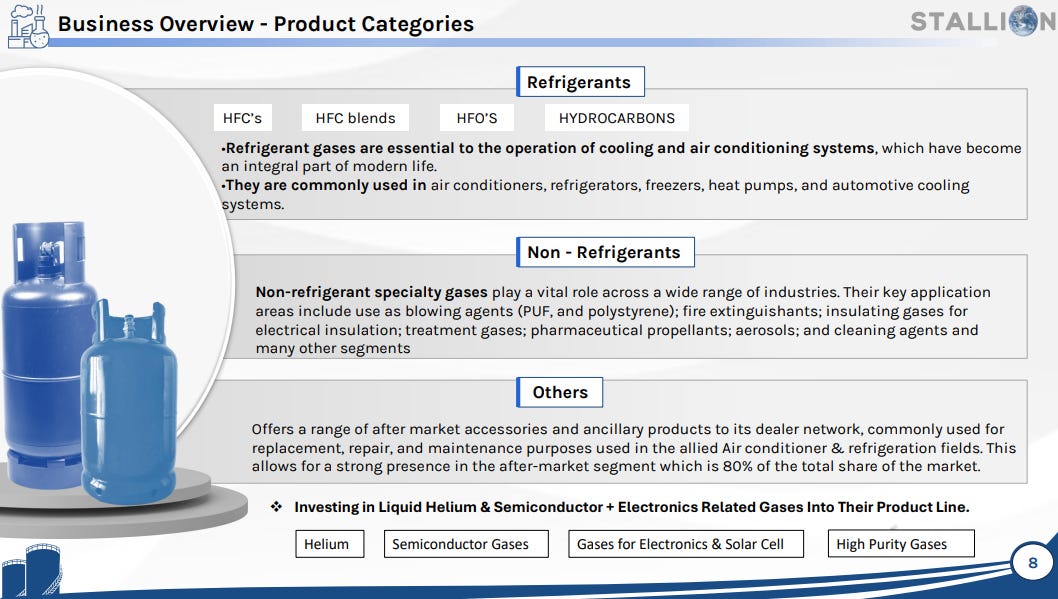

Products:

Refrigerants: HFOs, HFCs, hydrocarbon refrigerants, and HFC/HFO blends.

Non-refrigerant specialty gases: for blowing agents, fire suppression, insulation, pharma propellants, aerosols, cleaning, etc.

New adjacencies: investment into liquid helium and semiconductor/electronics gases; aftermarket accessories for AC&R dealers.

Positioning & advantages: Pan-India forward integration (debulking → blending → filling → distribution), proximity to demand centers, stringent quality control, long-term relationships, and aftermarket focus (≈80% of market, higher margins); ~10% India market share.

Strategic partnerships & milestones: Honeywell (HFCs/Solstice HFOs) and Daikin (HFC-32 sourcing/logistics); commercial HFO-1234yf supplies to Indian auto OEMs; new facilities at Khalapur and Ghiloth; listed on NSE/BSE after slump-sale acquisition of Stallion Enterprises.

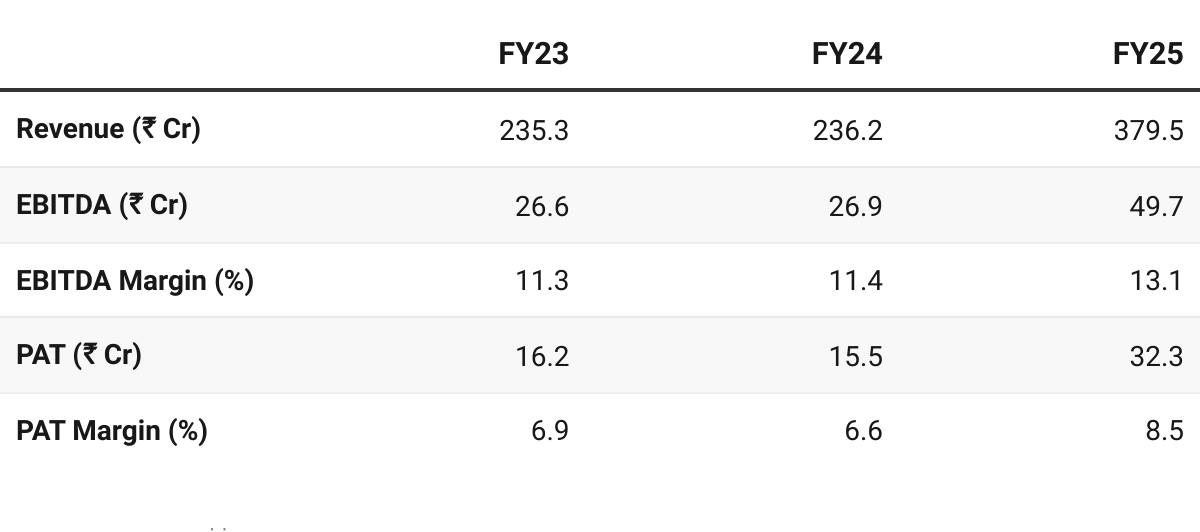

2. FY23–25: PAT CAGR of 41% & Revenue CAGR of 27%

FY23:

IPO — transition to a public limited company.

Acquisition of Stallion Enterprises — expanding blending capacity

FY24 — Signed global partnerships — Honeywell, Daikin

FY25 — Revenue surge post-integration of acquired entity

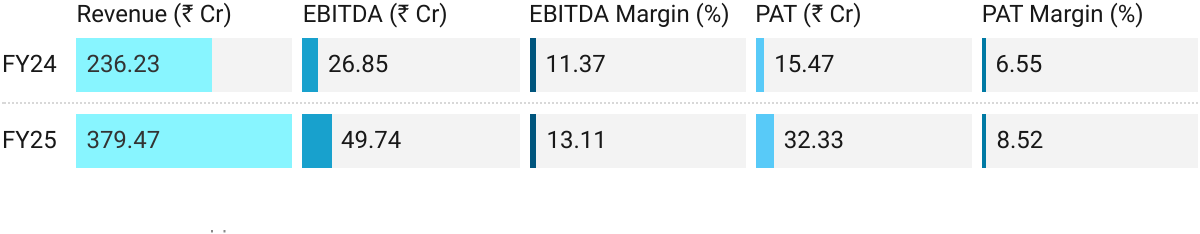

3. FY25: PAT up 109% & Revenue up 61% YoY

Operational PAT Strong than reported PAT — includes ₹10.70 Cr provision towards settlement of an old claim; excluding this, PAT would be ₹43.04 Cr

Capex Initiated: Work at Mambattu (AP) and Khalapur (MH) for HFO blending, helium, and semiconductor gases; commissioning targeted FY26-end

Backward Integration: Announced Bhilwara R-32 plant to reduce import dependence and secure supply.

Portfolio Diversification: Expanded eco-friendly HFOs, began investments in helium and semiconductor gases.

Market Position: ~10% share in India’s fluorochemicals market; only player with full forward integration and pan-India presence.

Customer Base: Strong aftermarket focus ensures stability and higher margins.

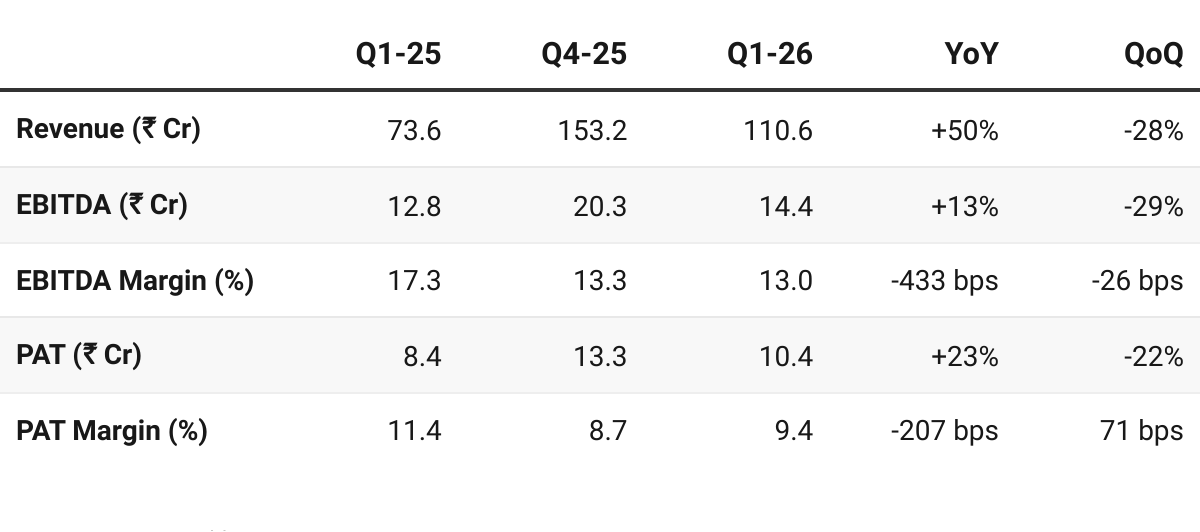

4. Q1 FY26: PAT up 23%, Revenue up 50% YoY

PAT down 22% & Revenue down 28% QoQ

Scale & growth: Seasonally soft quarter acknowledged by management.

Cost dynamics: Raw materials +54.99% YoY, other opex +65.03%, employee costs +410.86%, outpacing revenue growth; finance costs −81.17% YoY aiding PAT.

Capex execution: MoU signed for Bhilwara R-32 plant. Target start by mid-2026; will also make blends.

Upcoming capacities: Mambattu & Khalapur expected end-Nov commissioning → only one quarter contribution in FY26.

Q1 delivered strong YoY growth with margin compression from input/opex inflation; seasonality noted. Execution on Bhilwara, Mambattu, and Khalapur support tracking to full-year guidance.

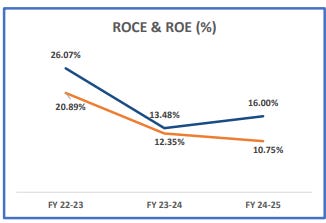

5. Business Metrics: Muted Returns — Capex+IPO

FY23–25 — returns compression during capex + equity expansion phase.

With strong PAT CAGR and margin uplift ahead, both ROCE and ROE should structurally improve from FY26 onward

6. Outlook: 30-35% Revenue CAGR till FY28

6.1 Guidance

We are confident of maintaining our target at 30-35% growth over the next three years, while enhancing profitability by over 3-4%.

Now when we get into manufacturing, the PAT out in the manufacturing segment would be over 24%. So, that 24% plus also for the helium and specialty gases, semiconductor gases, etc. that we are setting up that also will enhance the PAT significantly. So, we can see both these come on stream in 2026. We can see the PAT significantly enhanced from where we are. Meaning, at an average, it might, reach about, like, 17% or 18% considering that our current turnover also is growing. So, averaging between them, we should look at higher PATs, which would be beneficial for the company

Capex & Expansion Plans

Rajasthan (Bhilwara) R-32 Plant

10,000-ton capacity (in two stages; initial 5,000 tons by mid-FY26).

Backward integration into refrigerant molecule manufacturing.

Expected to add ₹135 Cr turnover in first year and ₹270 Cr thereafter at ~24% PAT margins.

Mambattu (Andhra Pradesh) Plant

HFO/HFC blending & debulking facility.

Now enhanced to 10 tanks + semiconductor & helium gas capabilities.

Operations expected by Nov–Dec 2025 (contributing from FY26–27).

Khalapur (Maharashtra) Expansion

Semiconductor and specialty gases, helium (1,200 MT per annum).

Also targeted to be ready by Nov 2025.

Future Manufacturing Plants (Post-2026)

Management plans a series of plants through FY29, scaling revenue to ₹2,500 Cr target by 2030.

Each new plant is expected to be larger than Bhilwara, with higher revenue potential.

Summary

FY26–28: 30–35% CAGR growth; margin expansion via backward integration & specialty gases.

Capex Drivers: R-32 manufacturing (Bhilwara), Mambattu blending (HFOs + helium + semicon gases), Khalapur semiconductor/helium.

Margins: PAT margins to move from ~10% → ~17–18% average; specialty/manufacturing businesses at 20–24%.

Vision: ₹2,500 Cr revenue target by FY30; Stallion positioning as India’s fully integrated fluorochemicals leader.

6.2 Q1 FY26 vs FY26 Guidance

On-track FY26 guidance on revenue growth

Revenue run-rate:

Q1 revenue (₹110.6 Cr) annualized = ~₹440 Cr.

Guidance ~₹500 Cr for FY26 — required run-rate of ₹130 Cr per-quarter

Company is slightly behind on Q1 run-rate, but STALLION expects H2 uplift

April to June, is the second weakest quarter. July to September is the weakest quarter in the business cycle.

October to December is the better quarter and the last quarter is the strongest quarter. So, the last two quarters are the strongest quarter.

Margins:

Q1 EBITDA margin (13%) is below FY25 (13.1%) and target uplift.

Input inflation, employee/opex surge compressed margins, but mgmt expects recovery once Mambattu/Khalapur (higher-value gases) come online.

PAT delivery:

On-track to exceed FY25 if H2 expansion contributes; however, achieving 3–4% PAT margin uplift may be back-end weighted.

On current trajectory, company should meet revenue guidance but margin improvement may be visible only from Q3–Q4 onwards.

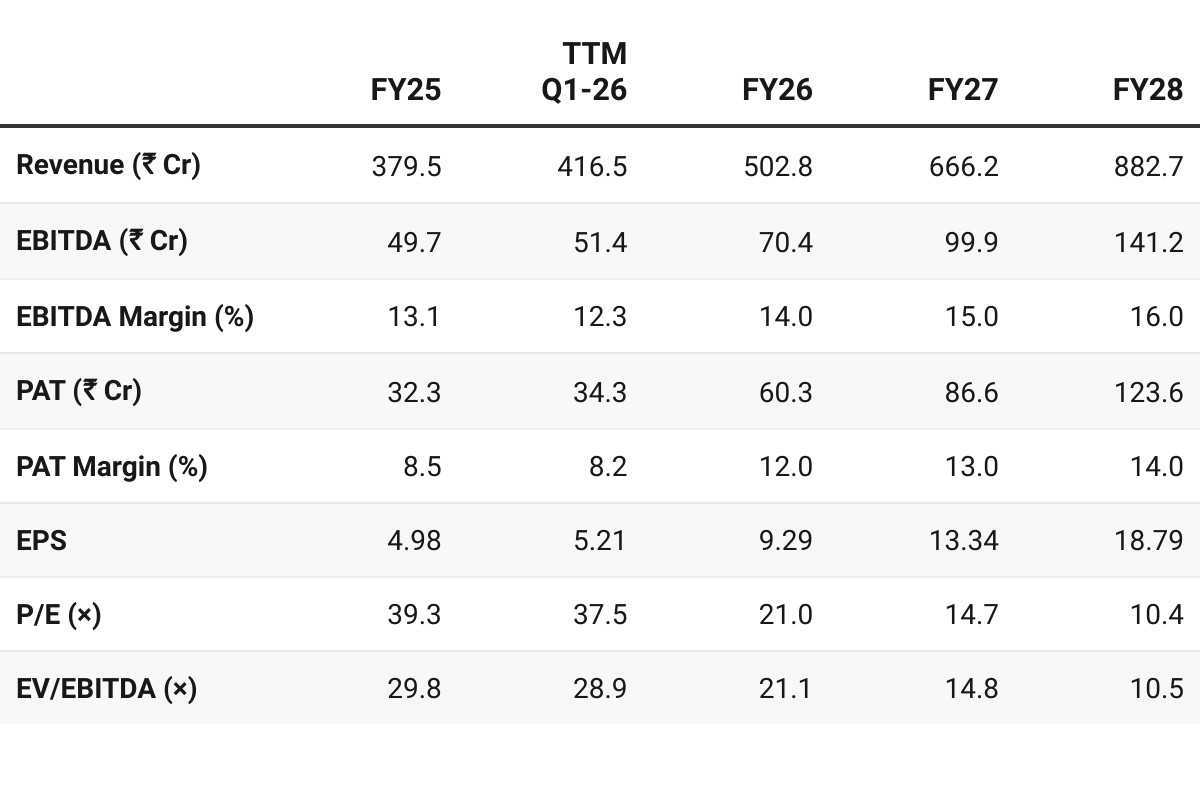

7. Valuation Analysis

7.1 Valuation Snapshot — Stallion India Fluorochemicals

CMP ₹195.5; Mcap ₹1,555.9 Cr;

Revenue growth assumed at mid-point of 30-35% growth guidance

Margins assumed to expand by 3% over FY28 — lower end of 3-4% margin expansion

Attractive Forward Valuation:

FY25–26: Expensive on trailing numbers (P/E ~39–21×).

FY27–28: Valuations become compelling (P/E 14–10×, EV/EBITDA 15–10×) with margins trending up.

Market is currently valuing Stallion as a growth stock, but as earnings visibility improves, multiples normalize → stock looks cheaper on FY27–28 forward earnings.

Valuation re-rating potential if execution is on track the guidance

Market hasn’t priced in growth yet → valuation compression, not rerating.

If stock were to sustain ~20× FY28 earnings, implied market cap → 2× upside potential.

7.2 Opportunity at Current Valuation

Re-rating of multiples — Delivering the 3 year guidance of 30-35% growth with 3-4% margin could lead to re-rating of multiples and create an upside

Margins — If PAT margins of 17-18% play out by FY29, the opportunity would be significantly bigger

Scaling revenue to ₹2,500 Cr target by 2030 is not considered the valuations but would create an opportunity even if something closer to ₹2,000 Cr is achieved by FY30

Structural Growth Drivers: Rising demand for refrigerants, specialty gases, and eco-friendly HFOs, supported by regulations (F-gas, energy efficiency) and India’s industrial expansion.

7.3 Risk at Current Valuation

Execution Risk on Capex: Delays or cost overruns in Mambattu, Khalapur, or Bhilwara projects could defer earnings ramp-up and margin expansion.

In its current stage of life-cycle it is working on capacity expansions for the first-time.

Raw Material Dependence: Current reliance on imports (HF, MDC) until backward integration scales; exposes margins to forex and supply chain volatility.

Cyclicality in End Markets: Though diversified, large exposures to auto, cooling, and real estate-linked sectors could face demand shocks in downturns.

Valuation Risk (Short-term): Currently trades at ~39× FY25 P/E, appearing expensive on trailing earnings; near-term de-rating possible if growth execution falters.

Help your group stay ahead. Share now!

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer