SRM Contractors Q2 FY26 Results: PAT up 94%, On-track FY26 Guidance

Guidance of 75% growth in FY26. 2X in FY27. Stable margins, steady order-inflows, strong revenue visibility. SRM at reasonable valuations based on guidance

1. Engineering Procurement Construction Company

srmcpl.com | NSE: SRM

Operates in high-margin, high-entry-barrier hilly terrain EPC niche.

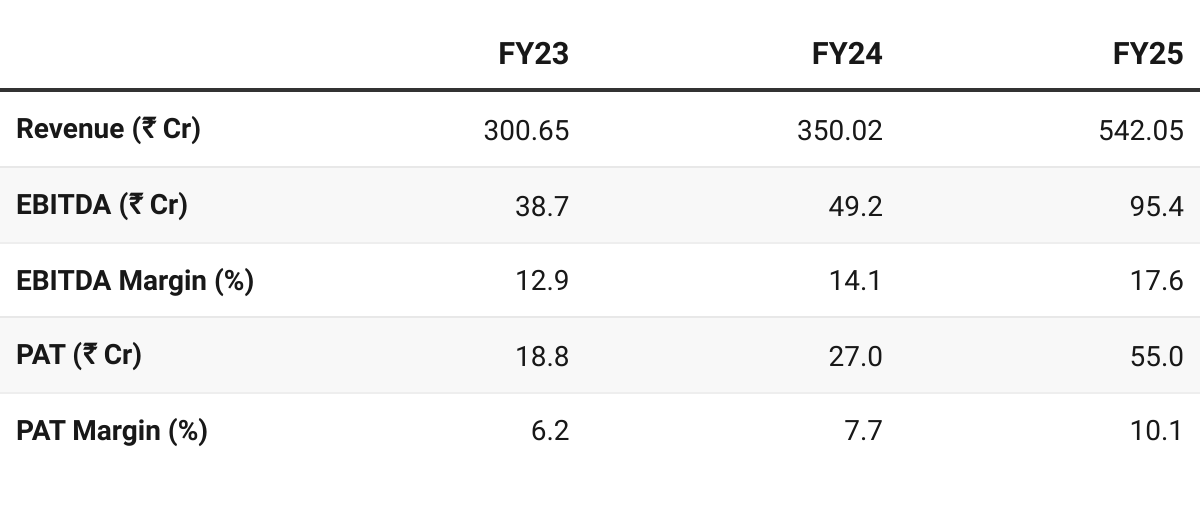

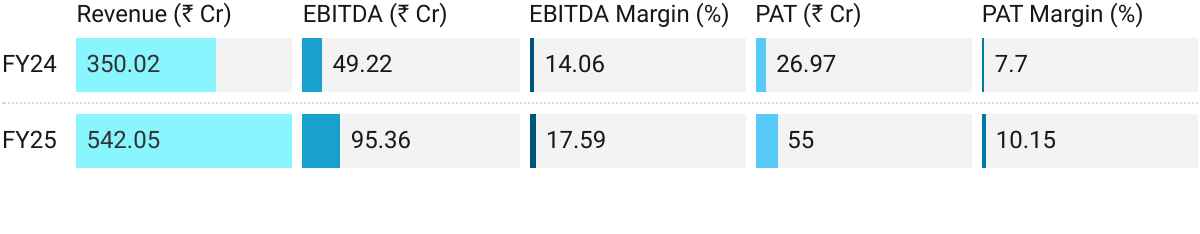

2. FY23–25: PAT CAGR of 71% & Revenue CAGR of 34%

3. FY25: PAT up 104% & Revenue up 55% YoY

Growth driven by road, bridge, and slope stabilization projects in J&K, Uttarakhand, and Gujarat.

J&K (41%), Uttarakhand (20%), Gujarat (18%), Ladakh (10%), Himachal (7%), Odisha (4%).

Margin improvement came from clustering of projects, equipment ownership, and backward integration.

Focus on clustering projects in J&K, Ladakh, Himachal, Uttarakhand to optimize logistics and margins.

IPO in FY25

Forayed into hydropower & aerial ropeways (planned vertical diversification).

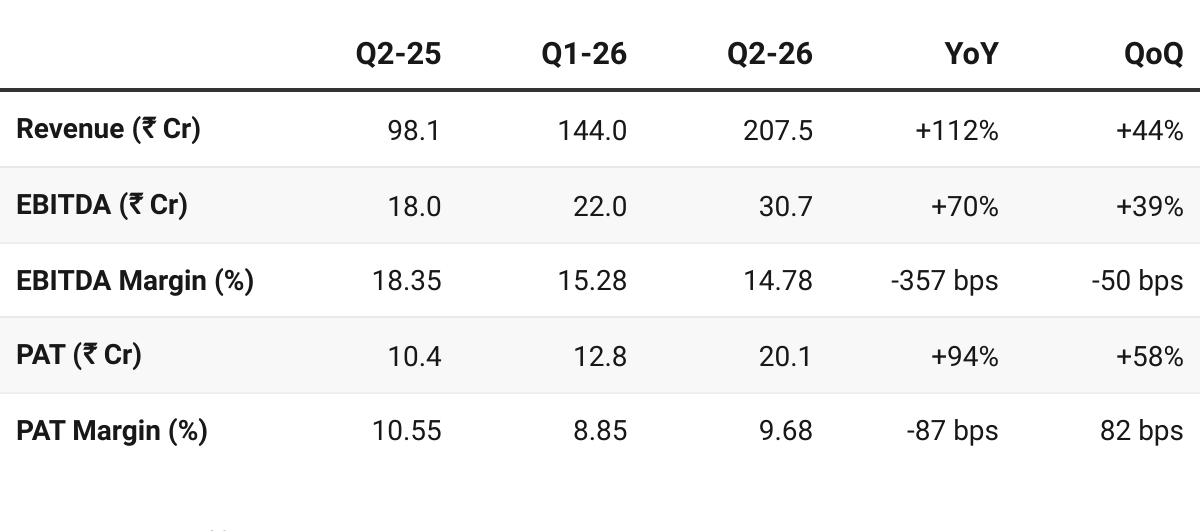

4. Q2 FY26: PAT up 94%, Revenue up 112% YoY

PAT up 58% & Revenue up 44% QoQ

5. H1 FY26: PAT up 117% & Revenue up 128% YoY

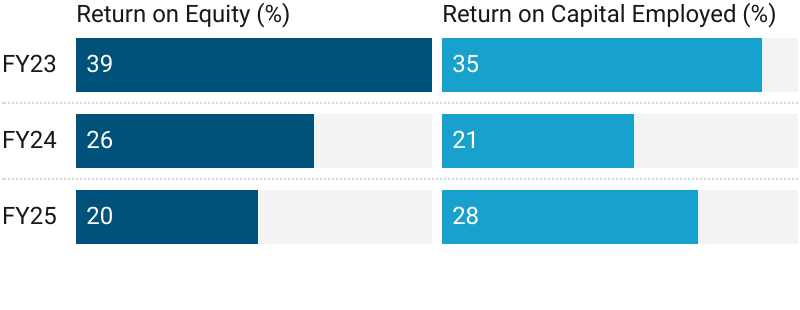

6. Business Metrics: Strong & Improving Returns

ROE muted by IPO funds in FY24 — yet to recover to FY23 levels

7. Outlook: 75% Revenue Growth in FY26

7.1 Guidance

FY26:

Looking ahead to financial year 2026, we are confident of achieving revenues in the range of INR900 to INR1,000 crores, with EBITDA margin firmly in higher double-digit zone

When when I say 900 to 1,000 it is from standalone SRM and 350 to 450 we are expecting from Maccaferri. So, we are having something 1100 to 1200 for consolidated.

EBITDA Margin: around 18 20%

FY27 Consolidated Revenue: I think it’s 2000 to 2200 for 26 27

Margin will be the same

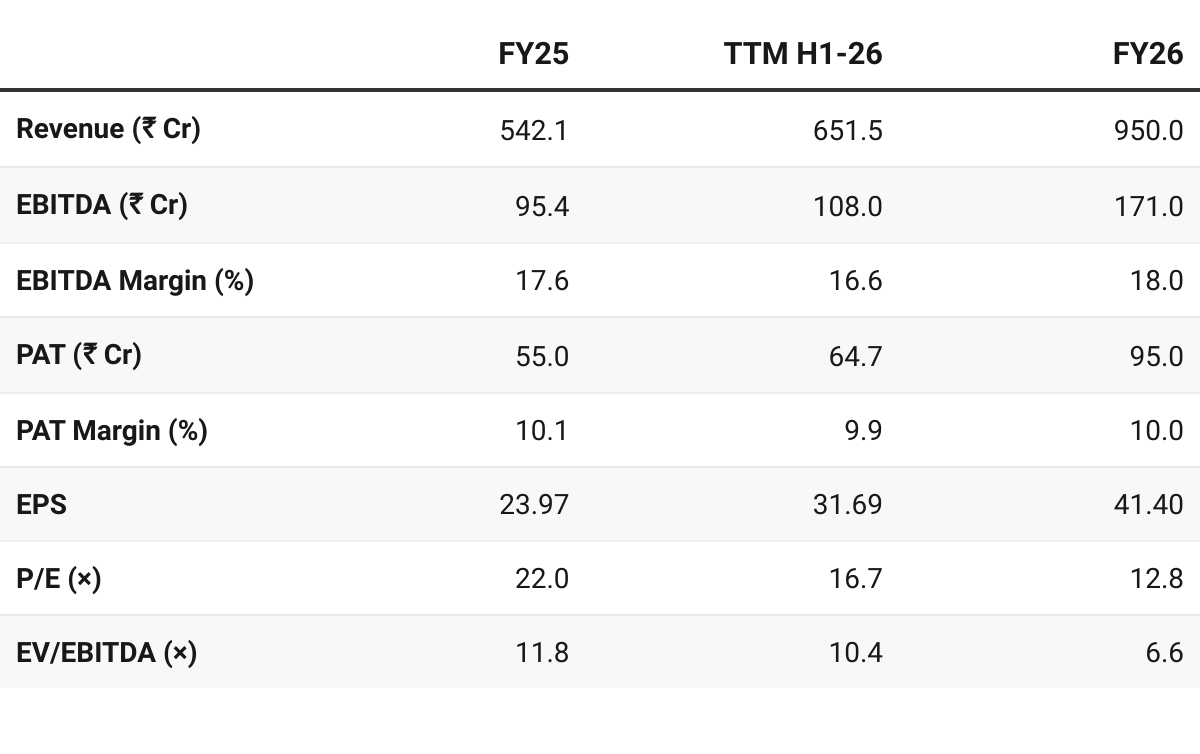

FY26 revenue of ₹950 Cr assumed at midpoint of ₹900-1000 Cr guidance implies a 75% growth over FY25

7.2 H1 FY26 vs FY26 Guidance — SRM Contractors

On-track FY26 guidance on revenue growth

Revenue:

70% of FY25 revenue was delivered in H2

For FY26 if we assume 65% revenue to be delivered in H2, it implies a FY26 revenue of ~₹1,000 Cr, in-line with management guidance

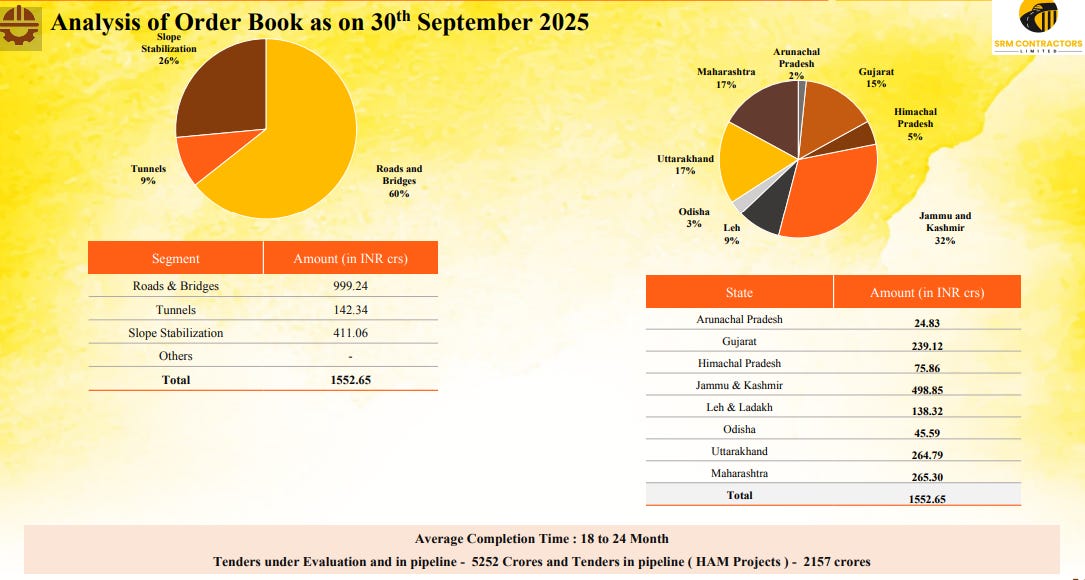

The ₹1,552 cr order book to be executed in 18-24 months provides strong revenue visibility.

Margins:

H1-26 PAT margin of 9.4% is marginally below the 10% guidance given

EBITDA at ~15% is significantly weaker than the 18-20% guidance.

With H2 expected to be the stronger half of the year, there is a chance to catch up. This provides an opportunity to meet the guidance.

Strong Order-book: Confidence in Guidance Execution

Average Completion Time : 18 to 24 Month

Tenders under Evaluation and in pipeline – 5252 Crores and Tenders in pipeline ( HAM Projects ) – 2157 crores

8. Valuation Analysis

8.1 Valuation Snapshot — SRM Contractors

CMP ₹528.2; Mcap ₹1,200.4 Cr;

Attractive Forward Valuation:

On FY26(E), SRM looks reasonably valued to attractive: EV/EBITDA ~6.6×, P/E ~12.8×, EV/Sales ~1.26× with net cash.

If ~₹900 Cr revenue and ~₹90 Cr PAT materialize, stock could see re-rating back to high-teens

8.2 Opportunity at Current Valuation

Valuation Upside: Acquisition impact not considered in the valuation analysis as SRM has not yet consolidated it in their results. Valuations would become more attractive based on consolidated numbers

~2x FY27 Revenue: Revenue doubling to ₹2,000+ Cr on a consolidated basis is not discounted in the price

Margin of safety: With single digit P/E for FY27(E) – valuations are not demanding

Provides a margin of safety if one quarter is weak

Sector Tailwinds: Government’s thrust on border connectivity, tunnels, highways, and hill-road infra aligns with SRM’s niche skill

Execution in high-entry-barrier terrains creates sustainable edge

Maccaferri acquisition: Advanced geotechnical/soil stabilization capabilities, and nationwide client base—broadening SRM’s portfolio and margins.

8.3 Risk at Current Valuation

Guidance Execution: FY27 expectation of ~₹2,000 Cr consolidated revenue is doubling from the FY26 expectation of ~₹1,000 Cr. This would need strong execution

Execution & Seasonality: Operations in high-altitude terrains face weather disruptions, short working seasons, and risk of cost/time over-runs.

Government Dependence: Heavy reliance on NHAI, NHIDCL, BRO, and state bodies

Exposes SRM to policy changes, budget allocations, and payment delays.

HAM Exposure Ahead: Planned diversification into HAM projects adds equity-funding and life-cycle risks beyond EPC.

Help your group stay ahead. Share now!

Previous Coverage of SRM

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer