Som Distilleries & Breweries: 43% PAT growth & 57% revenue growth in H1-24 at a PE of 36

SDBL is on the path of recovery since FY23 and the momentum continues in H1-24 with strong performance in Q1 and Q2. Outlook for 50%+ growth in FY24 makes SDBL look reasonable priced

1. Production of beer and blending and bottling of IMFL

somindia.com | NSE: SDBL

Product portfolio consists of beer, rum, brandy, vodka and whisky

Three key millionaire brands (sales more than 1 mn cases per annum) – Hunter, Black Fort and Power Cool

New products introduced with seasonal themes to increase consumer traction and engagement –flavors of RTD drinks

Beer accounted for 95.8% of total volumes and 92.7% of the revenue during H1 FY2024

2. FY23 the strongest year for FY19-23

FY23 turned profitable after two years of losses

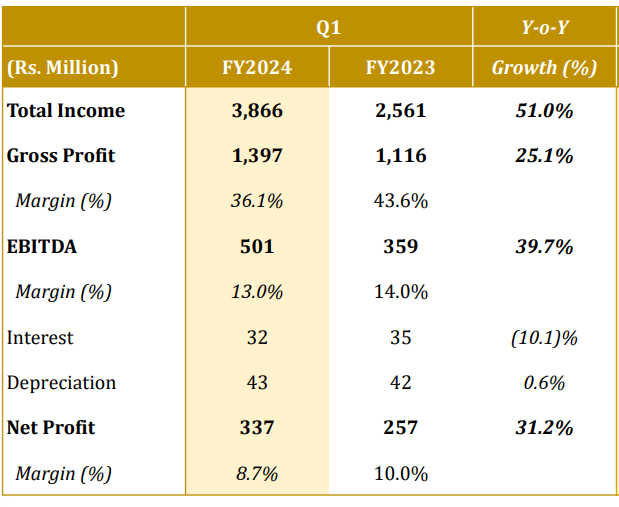

3. Strong Q1-24: PAT up 31% & Revenue up 51% YoY

The inflationary trend in the prices of the raw materials is yet to normalize especially in glass bottles

4. Strong Q2-24: PAT up 80% & Revenue up 68% YoY

The costs remained stable in the quarter due to a favorable mix of new and old bottles, although the price increase that occurred in the glass bottles has not yet normalized

Net Sales for Q2 FY 23-24 stood at Rs.248.0 crores against Rs.147.9 crores for the same period last year, a growth of 67.7%.

PAT for Q2 FY 23-24 stood at Rs.14.9 crores against Rs.8.3 crores for the Q2 FY 22-23, a growth of 80%.

5. Overall H1-24 looking strong: PAT up 43% & Revenue up 57%

H1-24 vs FY23 pointing towards a strong FY24

Strong H1-24 yet concern on margin

Net Sales for 1H FY 23-24 stood at Rs.634.6 crores against Rs.404 crores for the same period last year, a growth of 57.1%.

PAT for 1H FY 23-24 stood at Rs.48.5 crores against Rs.33.9 crores for the Q2 FY 22-23, a growth of 43%.

6. Strong return ratios in FY23

7. Outlook: Possibility of 50%+ top-line growth in FY24

SDBL will consider revising the FY24 revenue guidance of Rs 1,000 cr only after Q2-24 (we are waiting for the latest commentary on this topic)

Rs 1,000 cr in FY24, implies 24% top-line growth. However FY23 was split 50:50 between H1 and H2. Assuming no changes in the nature of the business we are could be looking at 50%+ online growth in FY24 revenue.

I think we'll have a better idea about where we end after we end Q2. So I think for all practical purposes, let's stick to about Rs. 1,000 crores.

8. 43% PAT growth & 57% revenue growth in H1-24 at a PE of 36

9. So Wait and Watch

If I hold the stock then one may continue holding on to SDBL

SDBL has started its growth in journey in FY23 and the momentum is expected to carry forward into FY24

SDBL has delivered a strong H1-24 where both Q1-24 and Q2-24 were good on a YoY basis.

H1-24 does not look good from a margin perspective and one needs to be on the look out for such signs in Q3

SDBL has new revenues coming in from H2-24 which will drive growth in the remaining part of FY24.

SDBL has already started supply some brands of beer in Chhattisgarh and the numbers will soon start showing up. It has recently prepared to enter Rajasthan from Q3FY24 with Beer and expects a meaningful contribution from the state from Q4FY24

SDBL has entered into a bottling arrangement with Carlsberg from its Odisha plant which will begin from July 2023. This arrangement will consume 20% of capacity of the plant.

11. Or, join the ride

If I am looking to enter the stock then

SDBL has delivered a strong H1-24 with PAT up 43% & revenue up 57% at FY24 forward PE of 36 which makes the valuations reasonable.

If one feels that the growth momentum guided for FY24 will continue into FY25, then the valuations could start looking attractive

SDBL has used equity dilution to fund its growth and needs to be kept in mind by someone entering the stock

Rs 100 cr of equity raised in 2018 via private placement

Rs 35 cr of equity raised by issuing warrants to promoters in 2018

Rs 17 cr rights issue in February 2022 at Rs 35/share

Rs 27.2 cr of warrants issue to promoters & non-promoter in Sept-Dec 2022 at Rs.72.

Rs 49 cr rights issue in April 2023 at Rs 140/share

Rs. 148.5 cr worth warrant issue to promoter at Rs.275 in July 2023 (25% money received) and shares issued to non promoter.

On September 05, 2023, the company’s board approved fund raise of ~Rs 350

October 9: SDBL company announced it was not going ahead with the proposed QIP

Don’t like what you are reading?

Let us know at hi@moneymuscle.in

Will make it better.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades