Sky Gold: PAT up 118% & Revenue up 51% in FY24 at a PE of 61

Guidance of PAT CAGR of 67% and Revenue CAGR of 53% for FY24-27 driving interest in SKYGOLD. The challenge is to deliver on the guidance for the next 3 years.

1. Jewelry company

skygold.co.in | NSE: SKYGOLD

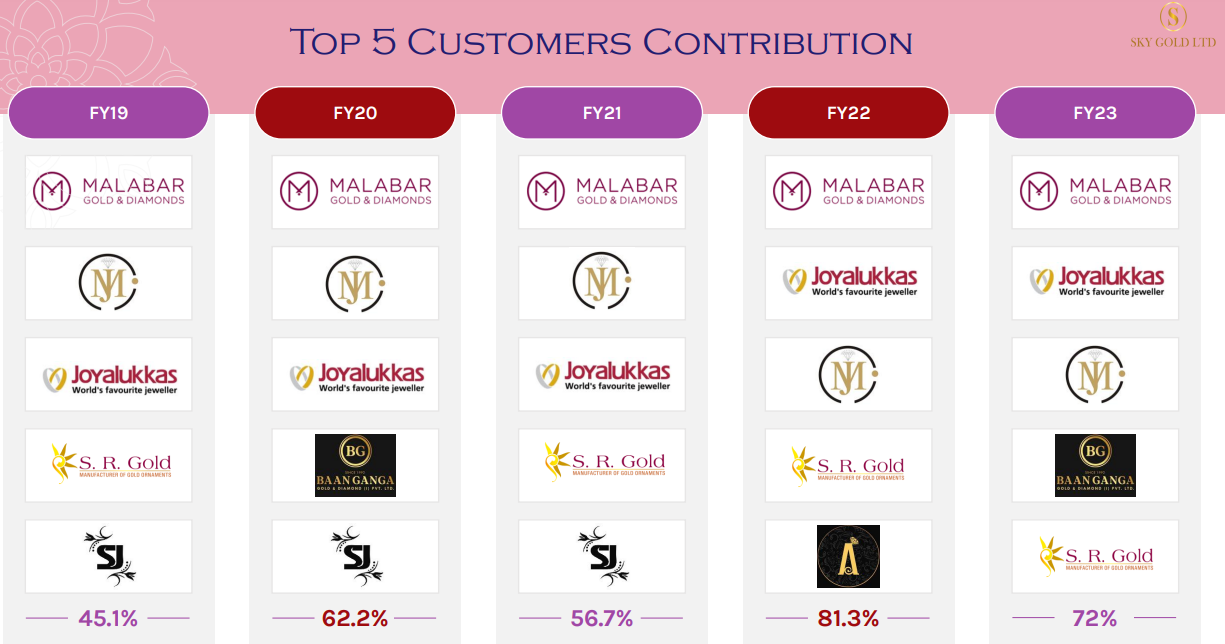

The Company works on B 2 B model with leading Jewellery Retailers like Malabar Gold & Diamonds, Joyalukkas , Kalyan Jewellers, GRT Jewellers and Samco Gold . The Company also works with large wholesalers . With this Sky Gold products are available at more than 2 ,000 showrooms across India .

2. FY20-24: PAT CAGR of 62% & Revenue CAGR of 25%

3. FY23: PAT up 10% & Revenue up 47% YoY

4. Strong 9M-24: PAT up 114% & Revenue up 39%

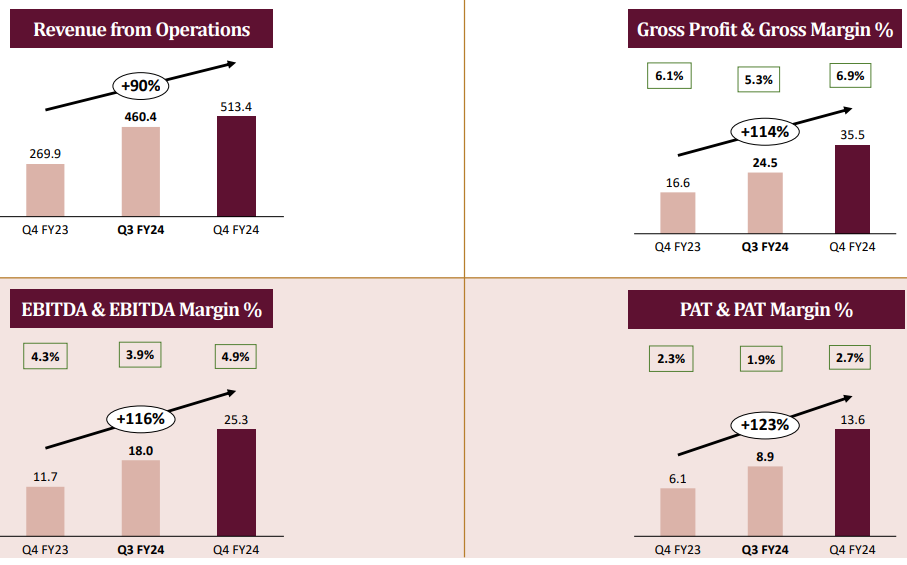

5. Strong Q4-24: PAT up 124% & Revenue up 90% YoY

PAT up 52% & Revenue up 12% QoQ

6. Strong FY24: PAT up 118% & Revenue up 51%

7. Business metrics: Strong return ratios

8. Strong outlook: PAT CAGR of 67% & Revenue CAGR of 53%

i. FY24-27: PAT CAGR of 67% & Revenue CAGR of 53%

Revenue growing from Rs 1,745.5 cr in FY24 to Rs 6,300 by FY27 implies a revenue CAGR of 53%

A 3% PAT margin on revenue of Rs 6,300 cr implies a FY27 PAT of Rs 189 cr up from Rs 40.5 cr in FY24, growing at a CAGR of 67%

9. PAT growth of 118% & Revenue growth of 51% in FY24 at a PE of 61

10. So Wait and Watch

If I hold the stock then one may continue holding on to SKYGOLD

SKYGOLD has delivered a strong FY24 and is following it up with an ambitious guidance for FY27. One can stay in for the long term guidance.

The challenge for SKYGOLD is the ability to deliver strong year on year performances. One can stay on as long as we can see SKYGOLD is broadly on track to deliver as per FY27 guidance.

11. Join the ride

If I am looking to enter SKYGOLD then

SKYGOLD has delivered PAT growth of 118% & Revenue growth of 51% in FY24 at a PE of 61 which makes the valuations fully priced in the short term.

Outlook for FY24-27 with a PAT CAGR of 67% & Revenue CAGR of 53% at a PE of 58 which makes the SKYGOLD valuations quite attractive over the longer term .

FY24 was the first year of strong performance in the last 5 years. The track record of growth of SKYGOLD has been limited. The FY24-27 guidance would require a long period of strong year on year performances which have not been delivered in the past. Hence entry in to SKYGOLD needs to be done cautiously.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer