SKM Egg Products: PAT growth of 63% & Revenue growth of 13% YoY at PE of 7

A strong earnings growth cycle which started from FY23 is derailed by a weak Q3-24. Attractive valuations providing opportunities for re-rating of multiples.

1. Largest exporter of egg powder from India

skmegg.com | skmbesteggs.com | NSE: SKMEGGPROD

Accounts for 70%-75% of export of egg yolk & albumin egg powder from India

Today, we are one of Asia's biggest egg processing plant

SKM Egg Products Export (India) Ltd (SKML) is engaged in the manufacture and sale of egg powder and liquid egg with varieties of blends used in various segments in the food industry and also in health and pharmaceuticals sector.

SKML has an installed capacity to break 2 million eggs per day to produce 8,000 MT of egg powder annually.

SKML is a joint sector undertaking along-with Tamil Nadu Industrial Development Corporation Limited.

2. Spectacular performance in FY23

The growth in the income and improved profitability was largely driven by the healthy demand for the egg powder products from India in the export markets following outbreak of Bird flu in the US and UK regions and due to lower production cost of eggs in India compared to the other geographies.

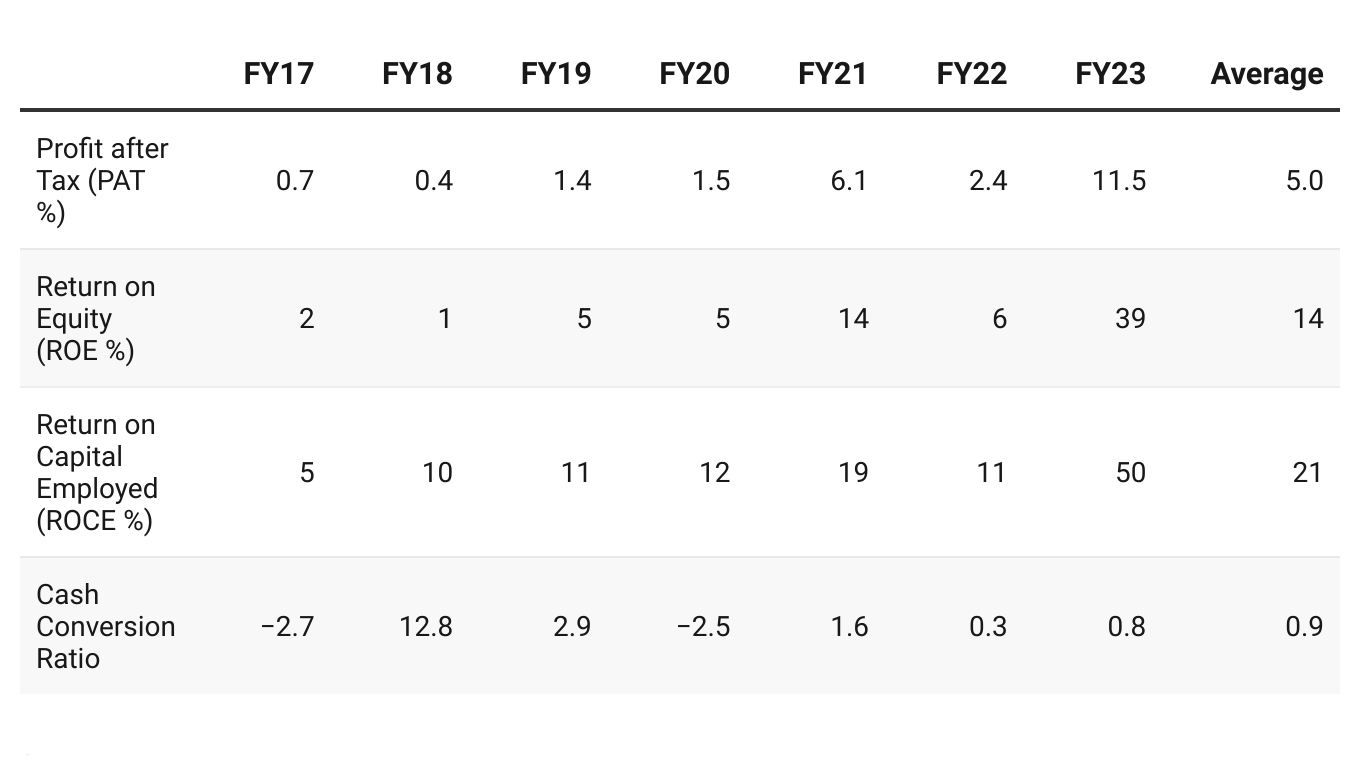

Performance of FY23 in contrast to an average stint thru FY19-22

3. Strong H1-24: PAT up 236% & Revenue up 32% YoY with expansion of margin

Standalone results

4. Weak Q3-24: PAT down 57% & Revenue down 16% YoY

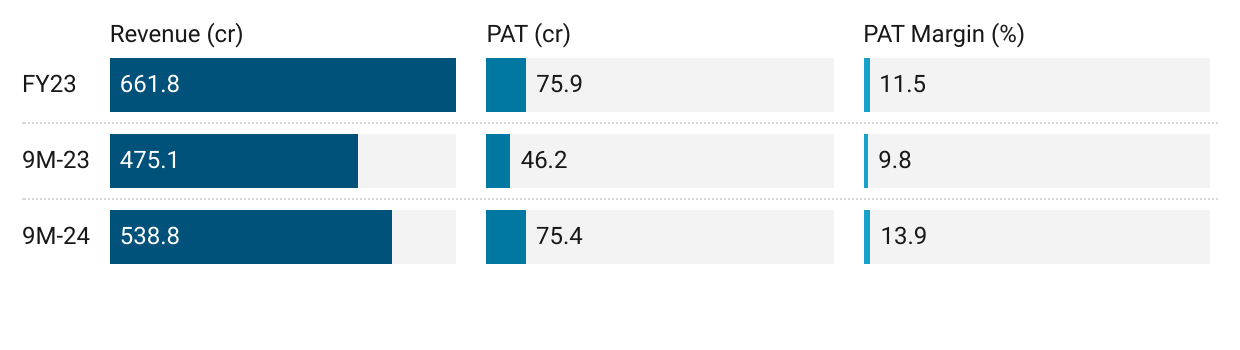

5. Strong 9M-24: PAT up 63% & Revenue up 13% YoY with expansion of margin

6. Return ratios & cash conversion are well maintained

No growth for FY18-22, yet an efficiently run company

7. PAT growth of 63% & Revenue growth of 13% YoY at a PE of less than 7

8. So Wait and Watch

If I hold the stock then one may continue holding on to .

Coverage of SKMEGGPROD was initiated after Q1-24 results. The investment thesis has not changed after a strong H1-24 and a very weak Q3-24. Even after a weak Q3-24 management looks on track to deliver a stronger FY24

At a PE of less than 7 there is a margin of safety in SKMEGGPROD. However one needs to keep a close watch on the business, 2 quarters of declining PAT and revenue. It may be difficult to deliver YoY growth in Q4-24 and the weakness in Q3-24 may not be a one-off.

Egg price reduces to ₹5.15 in Namakkal; poultry owners sustain 10 to 15 paise loss per egg

Keeping aside the short term pricing volatility the opportunity in SKMEGGPROD is if exports to Russia open up . SKMEGGPROD being the largest player would benefit from it.

Talks for egg exports to Russia from Namakkal at primary stage, says poultry owners

9. Join the ride

If I am looking to enter SKMEGGPROD then

SKMEGGPROD has delivered PAT growth of 63% and revenue growth of 13% in 9M-24 at a PE of less than 7 which makes the valuations quite attractive.

Additionally, SKMEGGPROD generated free cash flow of Rs 34 cr as of Q2-24 end on a market cap of Rs 673 cr, implying a 5% free cash flow yield (not annualized) which also makes the valuations look attractive.

While the valuations look attractive, the challenge is the balancing of the business momentum with the opportunity coming in from potential exports to Russia. A conservative approach would be to see the Q4-24 results and then take a call on SKMEGGPROD

The disclosures by SKMEGGPROD are limited to the disclosures made to the exchanges. In the absence of any public information about SKMEGGPROD, making a big entry into SKMEGGPROD is quite a difficult decision.

Previous coverage of SKMEGGPROD

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer