SKM Egg Products: Largest exporter of egg powder in the midst of spectacular growth available at a PE of 10

Accounts for 70%-75% of export of egg yolk & albumin egg powder from India. Attractively priced on PE and free cash flow yield

1. Largest exporter of egg powder from India

skmegg.com | skmbesteggs.com | NSE: SKMEGGPROD

Accounts for 70%-75% of export of egg yolk & albumin egg powder from India

Today, we are one of Asia's biggest egg processing plant

SKM Egg Products Export (India) Ltd (SKML) is engaged in the manufacture and sale of egg powder and liquid egg with varieties of blends used in various segments in the food industry and also in health and pharmaceuticals sector.

SKML has an installed capacity to break 2 million eggs per day to produce 8,000 MT of egg powder annually.

SKML is a joint sector undertaking along-with Tamil Nadu Industrial Development Corporation Limited.

2. Spectacular performance in FY23

The growth in the income and improved profitability was largely driven by the healthy demand for the egg powder products from India in the export markets following outbreak of Bird flu in the US and UK regions and due to lower production cost of eggs in India compared to the other geographies.

Performance of FY23 in contrast to an average stint thru FY19-22

3. Momentum of FY23 continues in Q1-24

Superlative results YoY

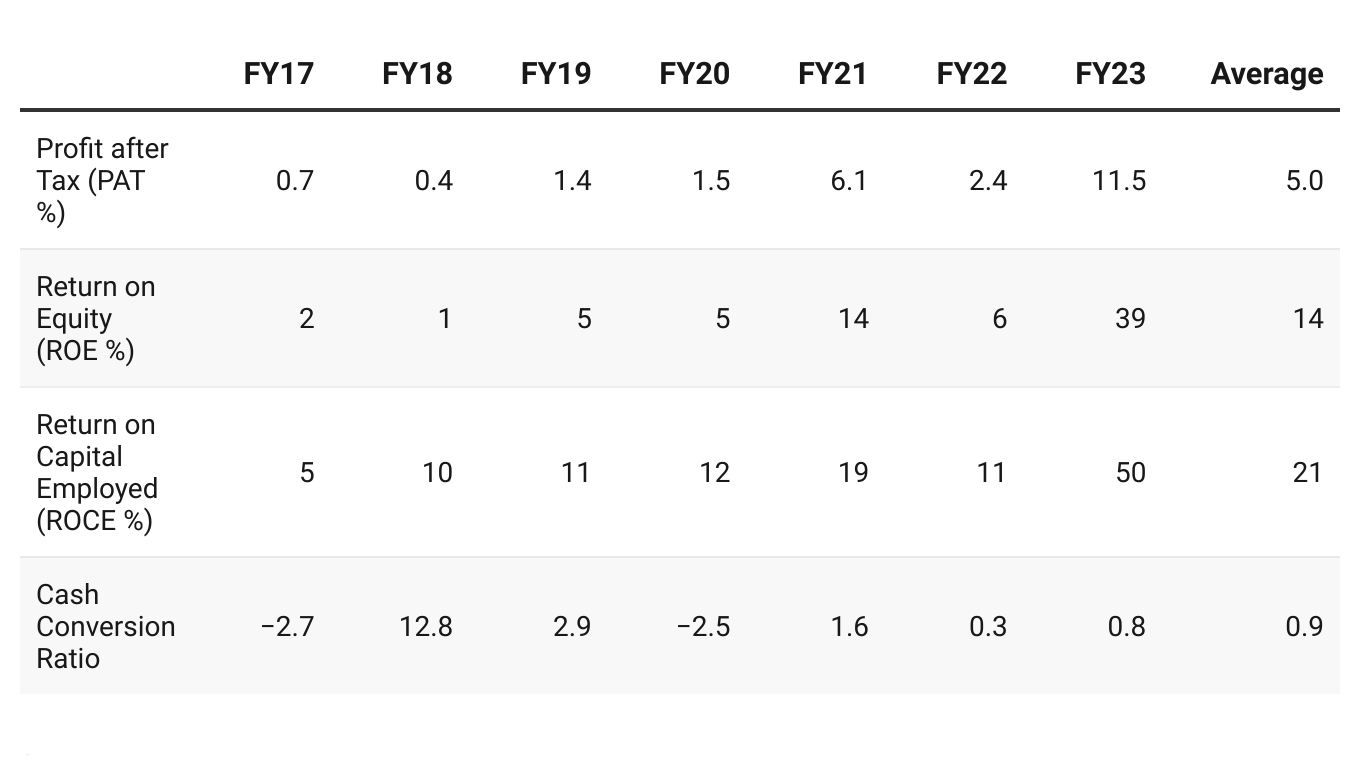

4. Return ratios & cash conversion are well maintained

No growth for FY18-22, yet an efficiently run company

5. 2X+ & 50% revenue growth in FY23 & Q1-24 respectively at a PE of 10

6. So Wait and Watch

If I hold the stock then one may hold on as SKML is in the middle of a period of spectacular growth and one can play it quarter by quarter till growth lasts. On one side there are risks involved as SKML does not have a consistent track record of growth before FY23. On the other side there is a margin of security given that PE is at less than 10.

7. Join the ride

If I am looking to enter the stock then

PE at 10 looks very attractive.

Additionally, SKML generated free cash flow of Rs 32 cr on a market cap of about Rs 1,000 cr, yielding a 3.2% free cash flow yield which also makes the valuations look attractive.

Absence of a consistent track record of growth is a definite negative and increases the risk.

Even though growth was lackluster, SKML maintained its position as a market leader in egg exports from India.

If the growth momentum is maintained for FY24 of which the first quarter was very strong, the potential for not only earnings growth but also the potential of rerating of PE multiple will create a strong upside for the stock and open up opportunities for making money in the stock.

Don’t like what you are reading?

Let us know at hi@moneymuscle.in

Will send you better stuff.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades

Any update on this for Q3-2024