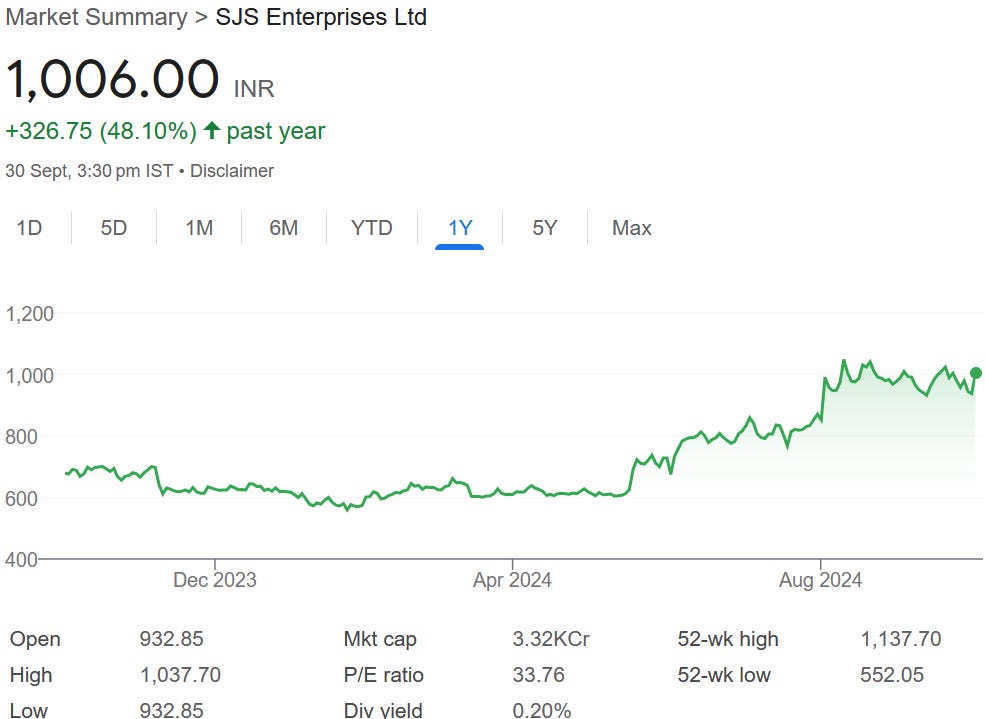

SJS Enterprises: PAT growth of 57% & revenue growth of 61% for Q1-25 at a PE of 34

SJS has strong revenue visibility for FY25, with 85% of expected revenue backed by its order book. SJS guiding for growth 1.5 times the underlying industry, with inorganic growth as an addition

1. Why is SJS interesting?

sjsindia.com | NSE: SJS

SJS is a solid company that generates strong free cash flow and has no debt. It aims to grow 1.5 times faster than the underlying industry while keeping its EBITDA margins around 25%. For FY25, SJS's growth is backed by a strong order book, with 85% of its revenue expected from projects that enhance visibility.2. Premium aesthetics products manufacturer

Wide product range: Decals, appliques/dials, overlays, logos/3D lux, aluminium badges, in-mold decoratives (IMD), optical plastics and lens mask covers for diverse applications

3. FY20-24: PAT CAGR of 47% & Revenue CAGR of 14%

4. Strong FY23: PAT down 29% & Revenue up 18%

5. Strong FY24: PAT up 27% & Revenue up 45% YoY

6. Q1-25: PAT up 57% & Revenue up 61% YoY

PAT up 4% & Revenue up 1% QoQ

7. Business metrics: Strong return ratios

8. Strong outlook: Revenue growth supported by order book

i. Strategy of organic & inorganic growth in place

Strategy for organic growth over FY24-26

Products: Focus on development of new technologies & advanced products

Key Customers: Growing mega accounts

Exports: Increasing global presence

Capacity Expansion

Inorganic Growth Expected to Boost Organic Growth Trajectory

ii. FY25: Strong top-line growth supported by a strong order book

SJS expects to outperform the underlying industry growth by over 1.5x

Current order book to be executed in FY25 is over 85% of FY25 forecasted revenue

iii. FY25: EBITDA Margin of 25% is sustainable

we continue to drive growth, outperforming the market and maintain an EBITDA margin of close to 25%

9. PAT growth of 57% & Revenue growth of 61% in Q1-25 at a PE of 22

10. So Wait and Watch

If I hold the stock then one may continue holding on to SJS

SJS is indicating towards a strong outlook for FY25.

SJS to continue its strong financial performance trajectory

SJS expects to outperform the underlying industry growth by over 1.5x on account of :

Premiumisation + Building Mega OEM Accounts + Exports + WPI Acquisition = Higher than industry sales growth for SJS

Current order book to be executed in FY25 is over 85% of FY25 forecasted revenue

Maintain robust margin profile of business for FY25 as we balance higher growth with margin

The strong outlook is supported by an extremely strong Q1-25. Organic revenue growth was a strong 21%. The acquisition of WPI in Jul-23 took the overall growth to 61%

11. Join the ride

If I am looking to enter SJS then

SJS has delivered PAT growth of 57% and revenue growth of 61% in Q1-25 at a PE of 34 which makes the valuations fairly priced in the short term.

SJS generated free cash flow of Rs 75.6 crore in FY24, resulting in a free cash flow yield of 2.3% based on its current market cap of Rs 3,323 crore.

In Q1 FY25, SJS reported free cash flow of Rs 39.7 crore, giving a yield of 1.2% (not annualized).

Expectations of strong free cash flow generation implies in FY25 that valuation of SJS are reasonable.

I mean we are already generating a large amount of free cash, so we will shore up revenue and by the end of this financial year, we should again have corpus available with strong cash generation abilities.

While SJS is open ended and guiding to outperform the underlying industry growth by over 1.5x, a PE 34 looks fully valued from a FY25 perspective

The opportunity in SJS exists over the longer term as new acquisition and entry into non automotive segments via appliance manufacturers and consumer electricals will play out.

On the other hand, the ability to SJS to handle a relatively weak quarter is limited given its PE of 34.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer