SJS Enterprises - Very Bullish management

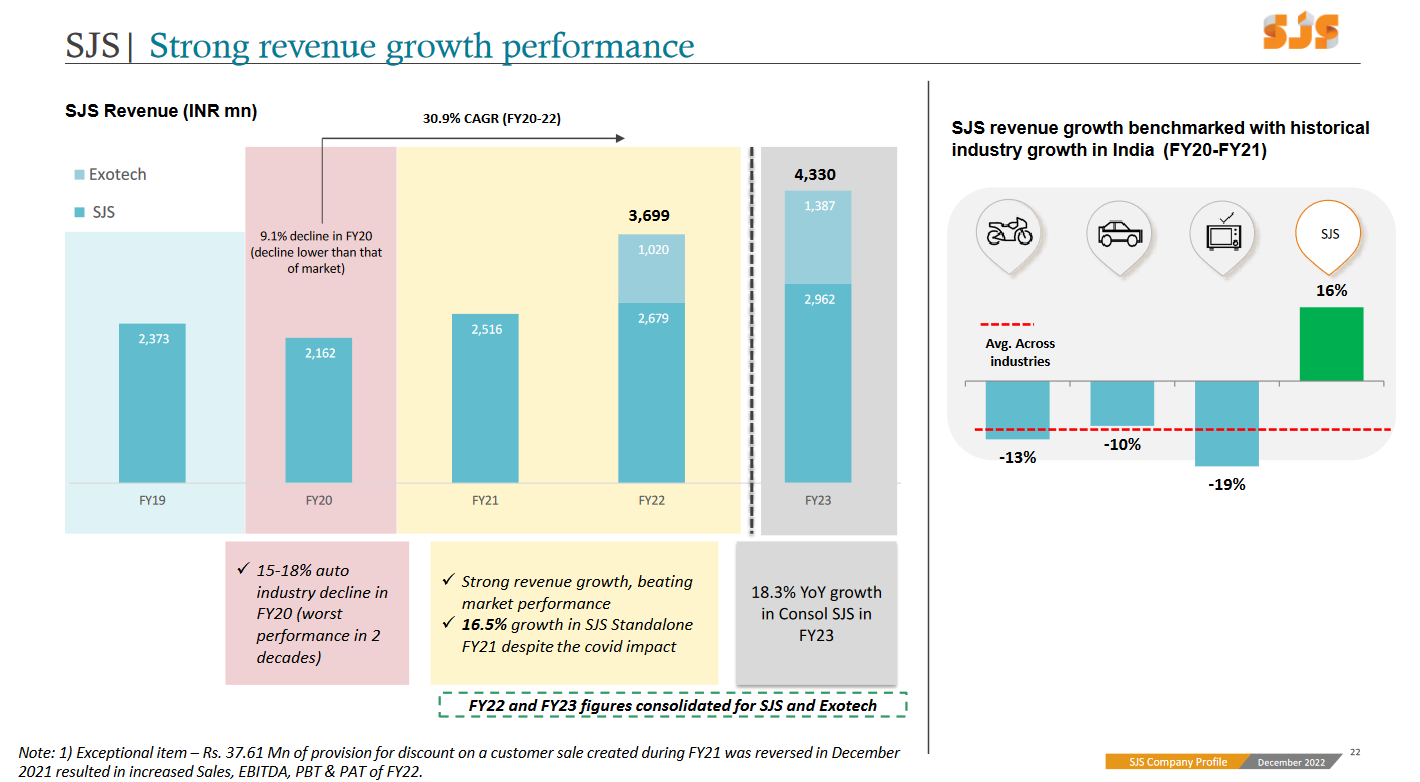

50% growth in FY24. Organic growth for FY23-26: expected at ~20-25% CAGR

Company Overview

SJS Enterprises Ltd (SJS) is one of the leading players in the Indian decorative aesthetics industry. Its product offerings include decals and body graphics, 2D appliques and dials, 3D appliques and dials, 3D lux badges, domes, overlays, aluminum badges, in-mould label or in-mould decoration, lens mask assembly and chrome-plated, printed and painted injection moulded plastic parts.

It has manufacturing facilities located in Bengaluru and Pune.

Acquisitions

Acquired Exotech Plastics in 2021.

Completed the acquisition of a 90.1 percent stake in Walter Pack Automotive Products India Private Ltd (WPI) in Jul-23.

Share Details

NSE:SJS ( sjsindia.com)

Quality: Returns on capital employed in cash

Return ratios have been sold and consistent over the years. Cash conversion is also solid.

Growth

The top-line and bottom-line have been growing solidly and generating free cash flow.

Growth Momentum

The growth momentum is stable and consistent

Outlook

Organic growth over FY23-26: expected at ~20-25% CAGR, with best-in-class margins

Inorganic growth expected to boost organic growth trajectory

FY24 Outlook

Over 50% YoY revenue growth

Current order book to be executed in FY24 is over 85% of FY24 forecasted revenue

PAT growth of ~40% YoY for FY24

Along with Walter Pack acquisition, we are looking to grow SJS consolidated revenue in FY24 by over 50%. The EBITDA and PAT should grow by a little bit lower by around 40% as we balance higher growth with margins

Our medium-term story remains absolutely intact, with 20% to 25% revenue growth over the next 3 years from FY23-26.

The management and the promoter are extremely bullish about the future and have increased their stake through a preferential allotment

Joe as a promoter of the company, he believes strongly in the business. So he wanted to increase his stake. So that is the reason of this preferential allotment and that was also, so 1 reason was that we believe in the company and we would like to have a greater stake. The second, of course, is it helped us with our cash flow for the Walter Pack acquisition. So these are the 2 main reasons why Joe increased his stake.

SJS is confident about its ability to carry out acquisitions based on which they have gone ahead with the Walter Pack acquisition and may do more acquisitions in the future

Within 2 years of the acquisition, we have been able to successfully integrate the business which has resulted in doubling of revenues at Exotech, coupled with improvement in EBITDA margins. After the successful acquisition of Exotech, we have become more confident of acquiring and integrating companies that could take SJS to the next level of growth.

So What????

If I currently hold the stock, I may continue holding it based on my past returns, expectations for future returns, and the availability of alternative stock ideas. If I intend to hold it then I will watch the guidance till FY26 play out.

If I don't currently own the stock, I might consider SJS given that the stock is available at a PE of 27and has the potential of growing by 20-25% till FY26 organically along with the possibility of inorganic growth.

Additionally SJS generated a free cash flow of Rs 56 crore on a market cap of around Rs 1,820 crore which means that its available at a free cash flow yield of around 3% which makes it quite attractive in terms of valuation.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades