SJ Logistics Q2 FY26 Results: PAT up 43%, FY26 Guidance Lowered

Guidance of 30%+ growth for FY25-27 with margin expansion. Though guidance was lowered, SJ Logistics valuations are attractive given strong earnings in Q2 FY26

1. Logistics and Supply Chain Services Provider

sjlogistics.co.in | NSE - SME: SJLOGISTIC

Core Offerings of SJ Logistics

Ocean Freight Forwarding (Flagship Business)

Project Cargo / ODC (Over-Dimensional Cargo) – Transmission towers, heavy machinery, earth-moving equipment, large equipment for infrastructure projects

Textiles & Yarn – Long-standing vertical with clients in India, Singapore, SE Asia, supplying to Latin America & Africa.

Other commodities – Agro products, pharmaceuticals, chemicals, ferro metals.

NVOCC (Non-Vessel Owning Common Carrier)

Own/leased containers, taking vessel slots from main shipping lines.

Covers Gulf, Upper Gulf, East Africa, North Africa, Russia, Mediterranean.

Air Cargo — IATA-certified. Early-stage vertical launched in FY25

Others:

Warehousing & Domestic Logistics

Specialized Logistics Solutions

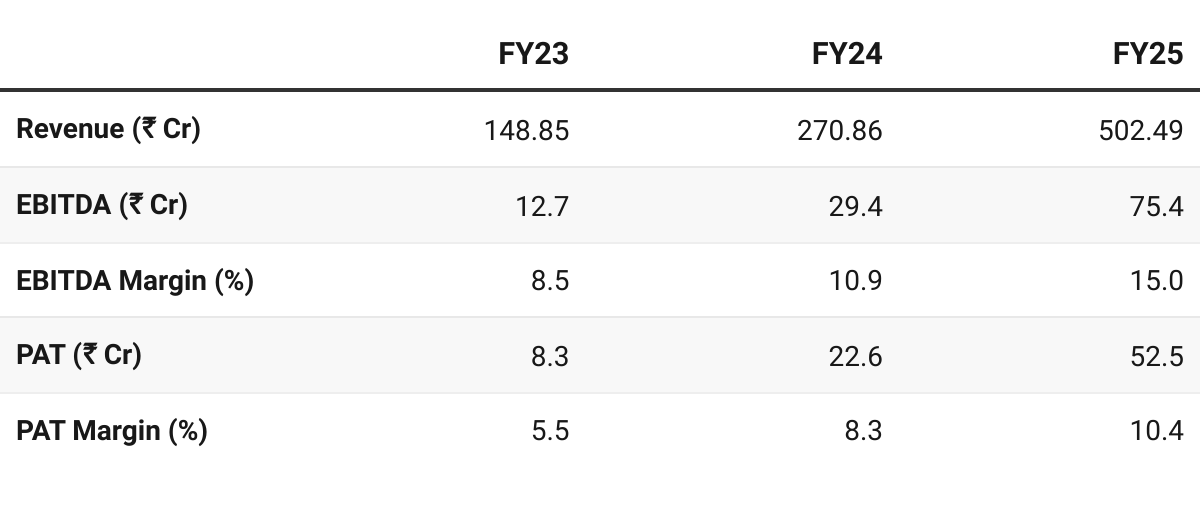

2. FY23–25: PAT CAGR of 152% & Revenue CAGR of 84%

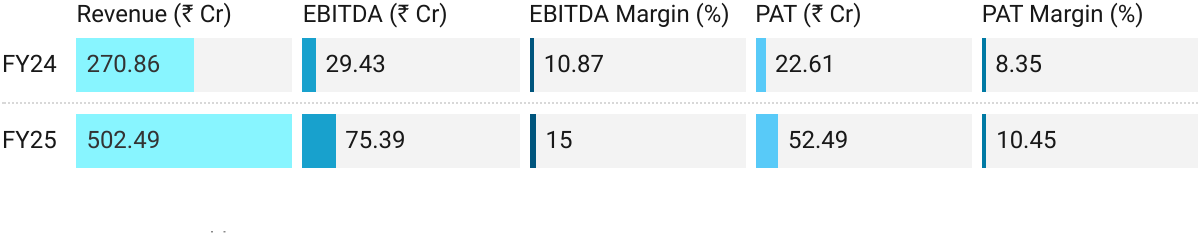

3. FY25: PAT up 132% & Revenue up 86% YoY

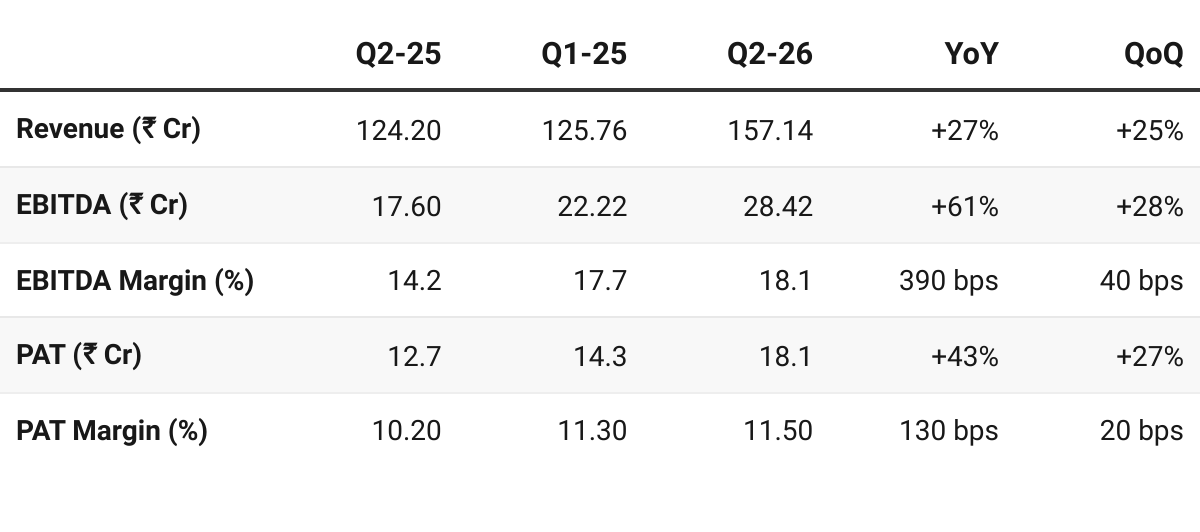

4. Q2 FY26: PAT up 43%, Revenue up 27% YoY

PAT up 27% & Revenue up 25% QoQ

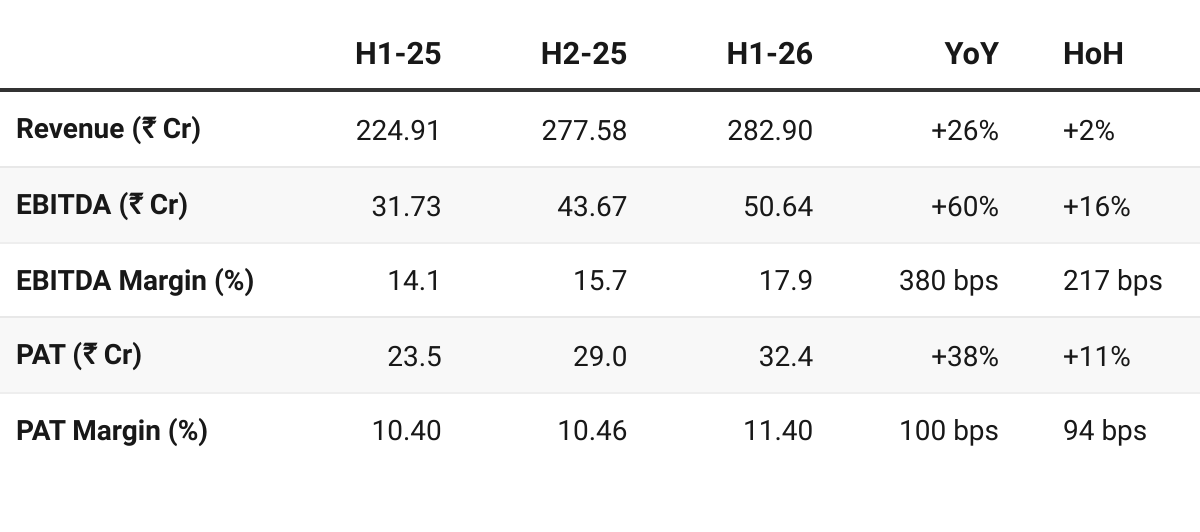

5. H1 FY26: PAT up 38%, Revenue up 26% YoY

PAT up 11% & Revenue up 2% HoH

Ocean Cargo: Backbone of the business,

Rs. 243.5 crores, up by 12.8% from Rs. 215.9 crores

Healthy traction across yarn, commodity and project cargo categories.

NVOCC division delivered exceptional growth,

Scaling from Rs. 2.1 crores to Rs. 31.9 crores.

Air Cargo division registered revenues of Rs. 7.5 crores

Together, these segments highlight the strength of our diversified portfolio and our ability to capture growth across multiple logistic platforms.

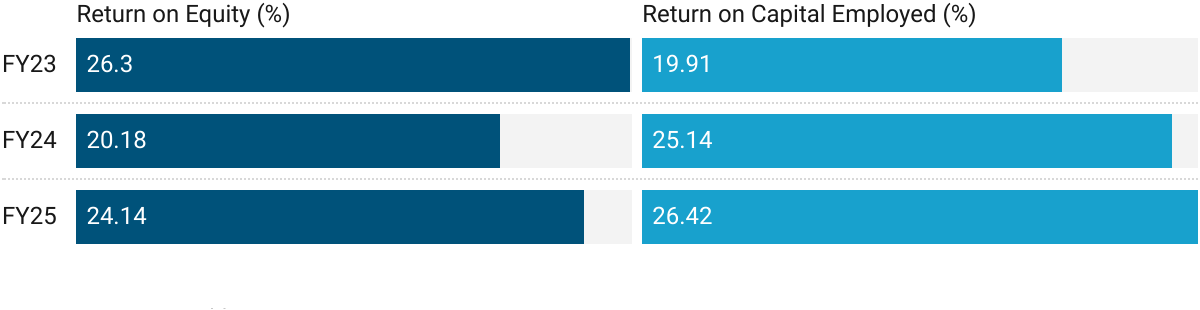

6. Business Metrics: Strong & Improving Returns

ROE muted by IPO funds in FY23 — yet to recover to FY23 levels

7. Outlook: 35-40% Revenue Growth in FY26

7.1 Guidance

FY26:

Revenue: it will be between 30% to 35%.

Lowered from the 35-40% growth talked about in the Q1 FY26 call

And when I talk about the PAT, it will definitely be more than 12% to 12.5%.

FY27 — I am targeting, suppose another 35% to 40% growth next year from this financial year.

Below the target of ₹1,000 Cr revenue talked about in Q1 FY26 earnings call

7.2 H1 FY26 vs FY26 Guidance — S J Logistics

Guidance lowered. On-track FY26 guidance on revenue growth

Guidance lowered a bit

Growth guidance for both FY26 and FY27 has reduced from the targets talked about during the Q1 FY26 call

PAT margin has also been reduced from 12-13% during Q1 call to more than 12% to 12.5% during the Q2 FY26 call

Revenue Acceleration Needed: To deliver the lower end of the 30-35% growth in FY26, the required run-rate is ₹185 Cr for the remaining 2 quarters.

H2 FY26 needs to deliver 34% growth YoY to meet the 30% growth guidance for FY26.

The run-rate looks feasible given that H2 is typically the stronger part of the year, but it would demand consistently strong performance for the rest of the year.

Improvement in profitability of the business as compared to FY25 both on EBIDTA and PAT has been the strongest part of the H1 performance by SJ Logistics

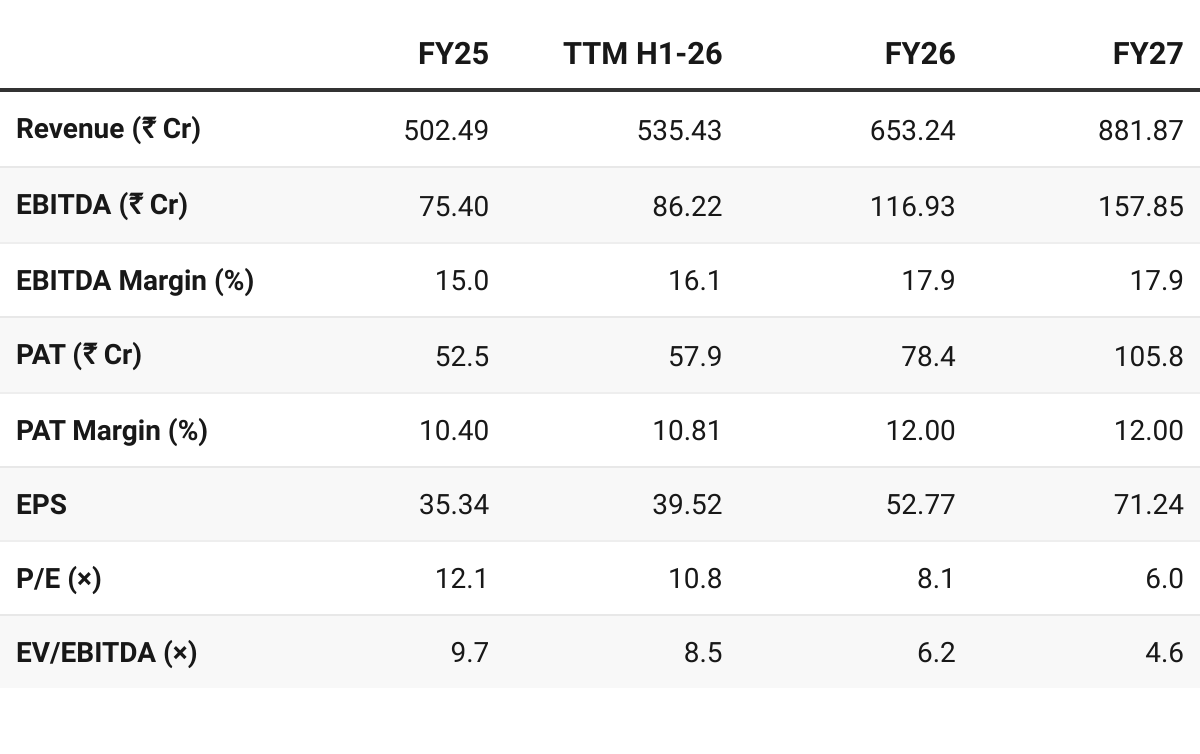

78. Valuation Analysis

8.1 Valuation Snapshot — S J Logistics

CMP ₹426; Mcap ₹651.49 Cr;

Attractive Forward Valuation:

Current multiples do not price in FY26 growth as the quality of earnings is poor

H1 Fy26 revenues are receivables — not cash for SJ Logistics

By FY27, at just 6× P/E / 4.6× EV/EBITDA, the stock looks deeply undervalued for a business promising to deliver 30%+ CAGR with margin expansion.

Looking potentially undervalued on FY26E and FY27E, provided execution stays on track and quality of earnings improve. Multiples leave room for re-rating. Undemanding valuations — leave room for small misses in execution

8.2 Opportunity at Current Valuation — SJ Logistics

Deep Value vs Growth Profile:

Forward valuations are attractive, well below logistics sector averages

Current pricing does not factor in the ~30% revenue CAGR and 12-12.5% PAT margins expected over FY25–27.

The projections for FY26 and FY26 for the forward valuations are at the lower end of the guidance providing a margin of safety

Potential Re-rating:

Even a modest re-rating to 10× FY27E EPS would imply an attractive upside potential

7.3 Risk at Current Valuation

Guidance being lowered

Lowering of guidance does not reflect well on the management

Though valuations provide a margin of safety toward lowering of guidance

However a pattern of lowering guidance should be a red-flag

Quality of earnings

The quality of earnings is poor.

Profits are not getting converted in to cash

SJ Logistics delivered ₹283 Cr of revenue in H1 of which ₹195 Cr is receivables.

Growth is being funded by debt, rather than cash from the business

Execution in NVOCC Ramp-up:

Doubling container fleet to 5,000 in FY26 is ambitious. Delays in utilization, shipping line slot constraints, or lower cycle turns could reduce contribution.

Profitability in NVOCC depends on route mix (high vs low yielding lanes) and maintaining >90% utilization.

Working Capital Intensity:

Project Cargo receivable cycle stretches to 135–160 days due to voyage times and compliance clearances.

While management controls cargo custody to mitigate defaults, higher scale could stress liquidity and increase reliance on short-term debt.

Geopolitical & Trade Risks:

Heavy dependence on Latin America and Africa exposes business to tariff changes, regulatory shifts, and political instability.

Volatility in shipping routes (e.g., Red Sea disruptions, Russia trade sanctions) could create cost pressures or execution delays.

Concentration in High-Margin Segments:

Growth story is increasingly tied to Project Cargo and NVOCC. A slowdown in infrastructure/export demand or competitive pressure could impact both growth and margins.

At current levels, SJ Logistics offers compelling risk-reward. Valuations are deeply attractive with scope for significant upside if execution in NVOCC and Project Cargo sustains. Risks lie in execution, working capital intensity, and geopolitical dependencies.

Previous Coverage of SJ Logistics

Help your group stay ahead. Share now!

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer