SJ Logistics Q1 FY26 Results: PAT up 33%, On-track FY26 Guidance

Guidance of 35-40% FY26 revenue growth. At 5x FY27E PE, attractive valuations for a ₹1,000 Cr business growing at 40% for FY25-27 delivering 12-13% PAT margins

1. Logistics and Supply Chain Services Provider

sjlogistics.co.in | NSE - SME: SJLOGISTIC

S J Logistics (India) Ltd - Not suited for all

Limited Trading Volume - Entry and exit is a problem

Minimum Purchase = 250 stocks = ₹1+ lakh required to enterCore Offerings of SJ Logistics

Ocean Freight Forwarding (Flagship Business)

Project Cargo / ODC (Over-Dimensional Cargo) – Transmission towers, heavy machinery, earth-moving equipment, large equipment for infrastructure projects

Textiles & Yarn – Long-standing vertical with clients in India, Singapore, SE Asia, supplying to Latin America & Africa.

Other commodities – Agro products, pharmaceuticals, chemicals, ferro metals.

NVOCC (Non-Vessel Owning Common Carrier)

Own/leased containers, taking vessel slots from main shipping lines.

Covers Gulf, Upper Gulf, East Africa, North Africa, Russia, Mediterranean.

Air Cargo — IATA-certified. Early-stage vertical launched in FY25

Others:

Warehousing & Domestic Logistics

Specialized Logistics Solutions

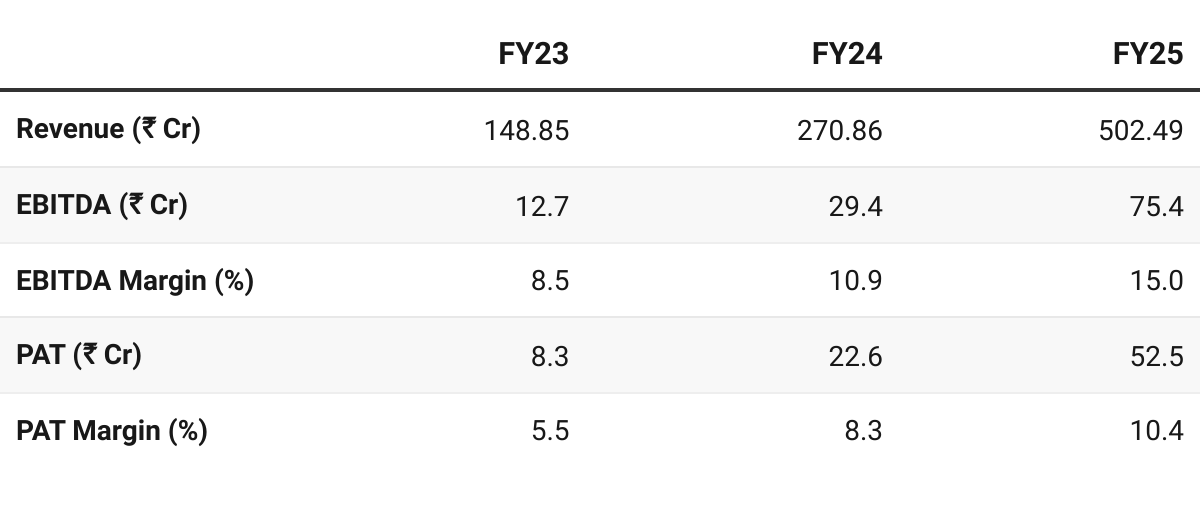

2. FY23–25: PAT CAGR of 152% & Revenue CAGR of 84%

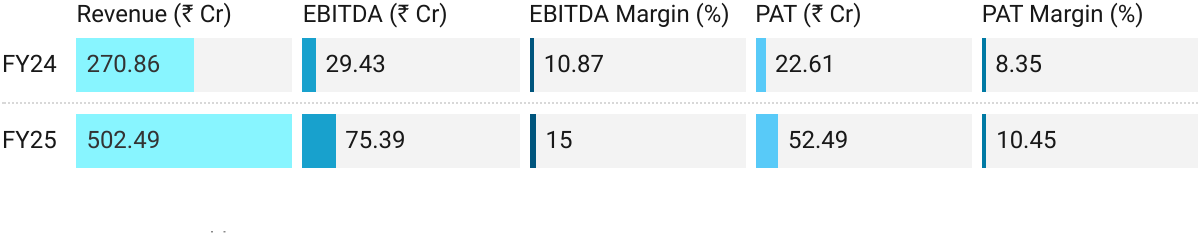

3. FY25: PAT up 132% & Revenue up 86% YoY

Growth driven by Project Cargo (153% YoY) & Yarn/Textiles (+35% YoY).

Revenue Mix

Ocean Freight: ODC/Project Cargo + Yarn/Textiles — 87% of revenue

Air Cargo: ~2.8% of revenue; launched mid-year, showing early traction.

NVOCC: ~3.2% of revenue

Other verticals: Agro, pharma, chemicals contributed smaller but steady flows.

Business Drivers

Project Cargo Growth:

Strong demand from transmission tower manufacturers in India for exports to Latin America and Africa.

Projects run over 2–3 years, providing revenue consistency.

High gross margin — 18–30%

Textile/Yarn Cargo:

Stable growth; international clients in Singapore and Southeast Asia.

Lower gross margin —12–15% ; provides volume stability.

Geographic Diversification:

Strong presence in Latin America, Africa, and SE Asia.

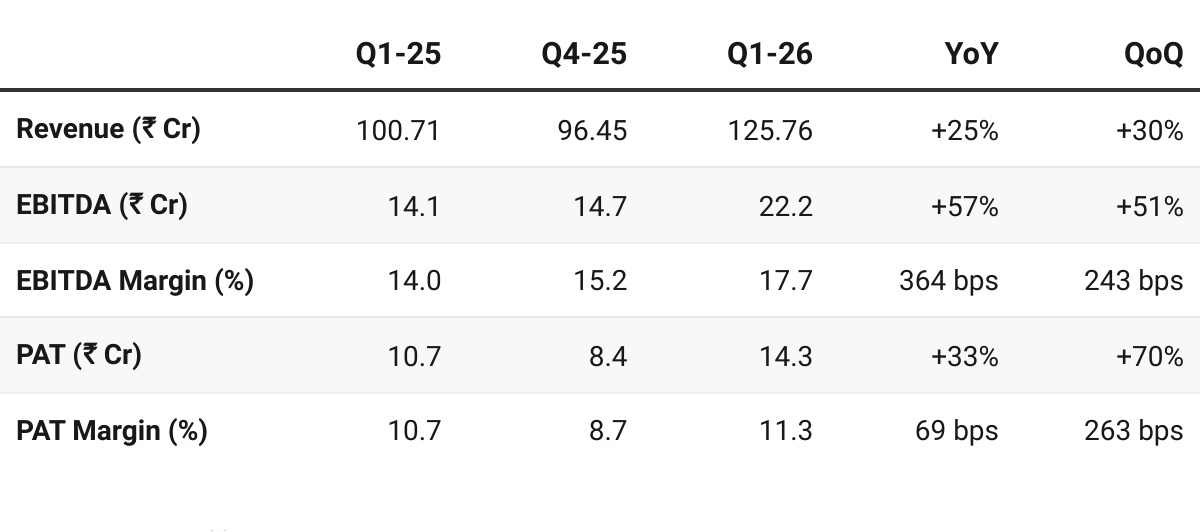

4. Q1 FY26: PAT up 33%, Revenue up 25% YoY

PAT up 70% & Revenue up 30% QoQ

Strong Start given a history of seasonal softness in Q1

The first quarter is always less second quarter is always better than the first one

Margin Expansion: Record margins driven by project cargo and NVOCC scaling.

Warehouse Addition: 50,000 sq ft leased in Bhiwandi to support consolidation and faster turnaround

Growth Engines: NVOCC and Air Cargo doubled revenue YoY, now contributing 6.6% of topline.

Geopolitical Risks:

Minimal exposure to US; focus on Latin America, Africa, and Russia mitigates tariff risks.

Management sees disruptions (e.g., Red Sea, tariffs) as opportunities to extract higher margins.

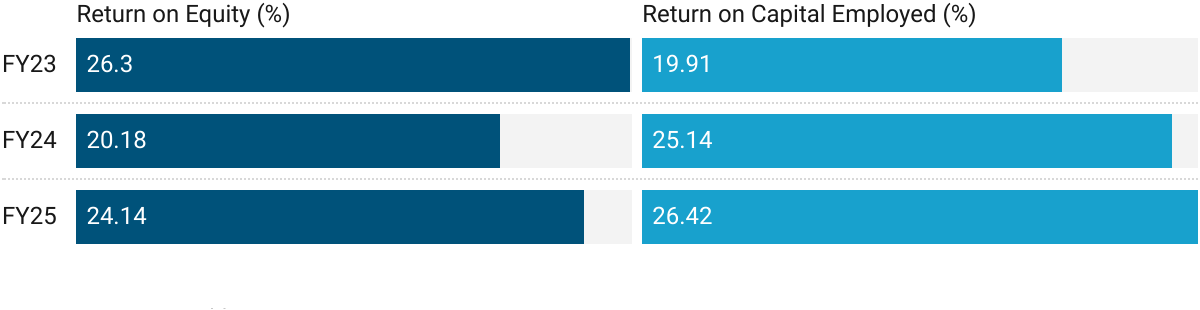

5. Business Metrics: Strong & Improving Returns

ROE muted by IPO funds in FY23 — yet to recover to FY23 levels

6. Outlook: 35-40% Revenue Growth in FY26

6.1 Guidance

FY26: We are targeting 35% to 40 % growth in the top line as well as around 12% to 13% on PAT.

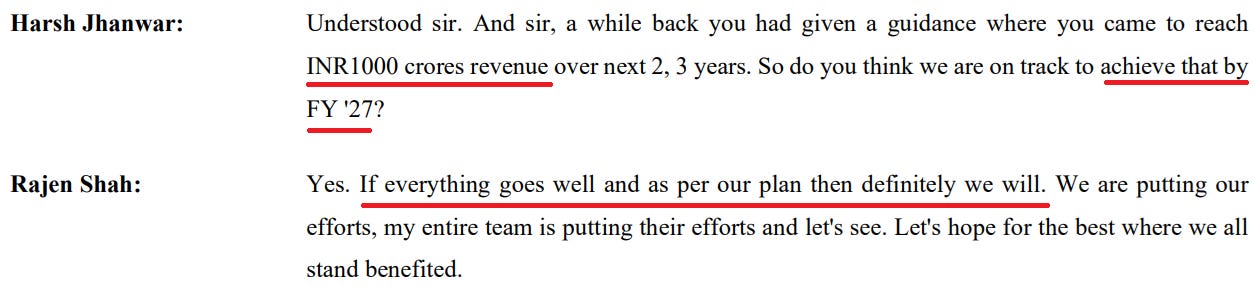

FY27 — Targeting ₹1,000 Cr revenue

Business Mix Outlook

Project Cargo / ODC:

From ~38% in FY24 to ~50% in FY25.

Targets 70–75% revenue contribution from Project Cargo within 2 years

Higher margins (20–30% vs 12–15% for yarn/textiles).

NVOCC:

Strong growth focus in FY26

Revenue expected at ₹75–100 Cr

Gross margins 15–18%.

To expand to 5,000 containers by FY26-end from ~2,500 currently

Expansion via lease/hire purchase, no outright capex → remain asset-light

Scaling up further in FY27 with full fleet utilization.

Air Cargo — Early-stage but scaling:

Q1 FY26 contributed 3.3% of topline (₹4.1 Cr), growing >100% YoY.

Focus to increase from FY27 onwards once NVOCC stabilizes.

Textile/Yarn Cargo: Steady but relatively slower growth vs project cargo.

Capex & Balance Sheet

Debt: Currently ~₹25 Cr, expected to end FY26 with ₹45–50 Cr debt, mainly for container leasing.

Working Capital: Receivable cycle (90–160 days for project cargo) is managed via strong cargo control; management does not foresee liquidity stress.

Strategic Outlook Beyond FY26

₹1,000 Cr topline by FY27 — 30–35% CAGR over FY25–27.

Geographic Expansion:

Strengthening Gulf, Upper Gulf, East Africa, & Russia trade lanes under NVOCC.

Latin America to remain a key focus for project cargo and textiles.

Vertical Scaling:

FY26: NVOCC as the growth engine.

FY27: Greater push into Air Cargo using IATA license and partnerships.

Margin Focus: Increasing share of high-margin segments (project cargo, NVOCC) expected to structurally lift PAT margins to 12–13% in FY26 and sustain/improve thereafter.

6.2 Q1 FY26 vs FY26 Guidance — S J Logistics

On-track FY26 guidance on revenue growth

Revenue Acceleration Needed: Q1 annualized revenue (₹503 Cr) is short of the ₹690–700 Cr guidance → requires a higher run-rate in Q2–Q4.

Q1 is historically the softest quarter. Stronger growth expected from Q2 onwards (management reaffirmed trajectory).

Confidence in FY26 Targets: Management reiterated 35–40% topline growth with PAT margin expansion despite Q1 lagging FY26 run-rate.

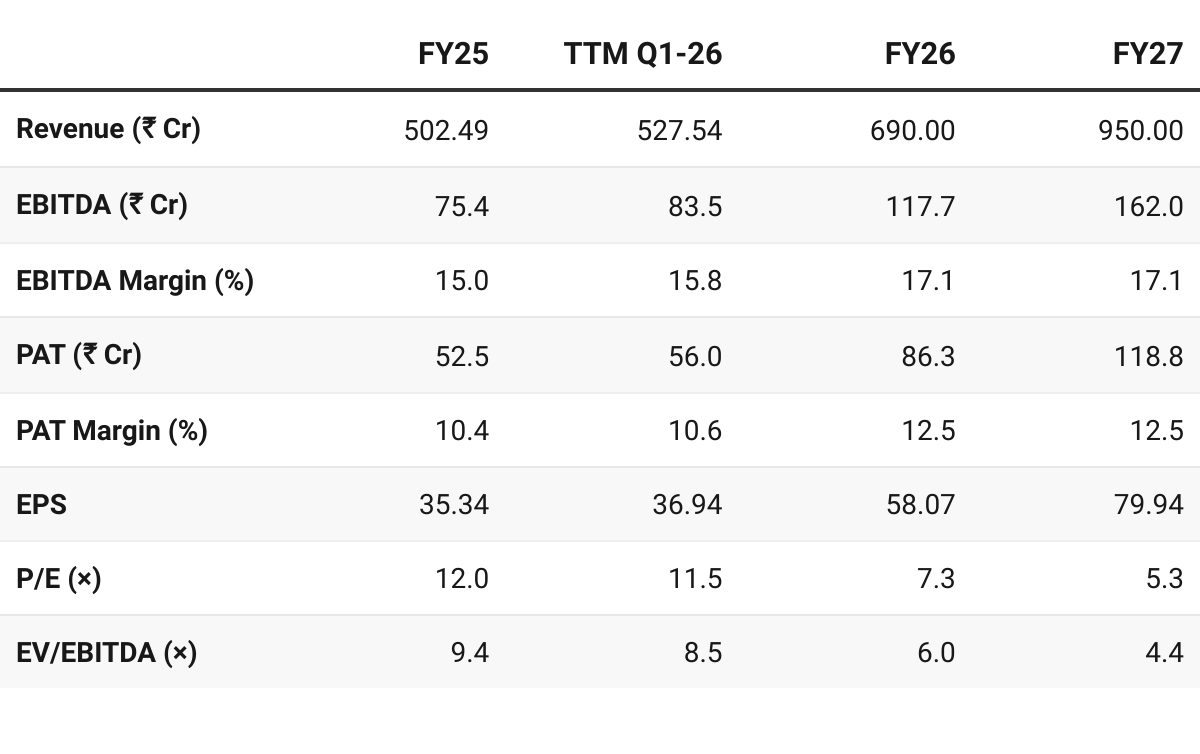

7. Valuation Analysis

7.1 Valuation Snapshot — S J Logistics

CMP ₹424; Mcap ₹648.43 Cr;

Attractive Forward Valuation:

Current multiples do not price in FY27 growth trajectory.

Is it an opportunity or does the market know something that we don’t?

By FY27, at just 5.3× P/E / 4.4× EV/EBITDA, the stock looks deeply undervalued for close to ₹1,000 Cr business delivering ~40% CAGR with 12-13% PAT margins.

If ~₹1,000 Cr revenue and ~₹120 Cr PAT materialize, stock could see significant re-rating (5× P/E is deep value vs other logistics players).

Looking potentially undervalued on FY26E and FY27E, provided execution stays on track. Multiples leave room for re-rating. Undemanding valuations — leave room for small misses in execution

7.2 Opportunity at Current Valuation — SJ Logistics

Deep Value vs Growth Profile:

Forward valuations are attractive, well below logistics sector averages

Current pricing does not factor in the ~40% revenue CAGR and 12-13% PAT margins expected over FY25–27.

Margin Expansion:

Mix shifting from textiles (12–15% gross margin) to Project Cargo (20–30%) and NVOCC (15–18%) ensures sustainable uplift in margins

Scaling Growth Engines:

NVOCC container base doubling to 5,000 by FY26-end; expected revenue contribution of ₹70–100 Cr in FY26, scaling further in FY27.

Air Cargo already doubling YoY and positioned for stronger contribution from FY27.

Project Cargo growing consistently with long-term contracts, providing revenue visibility.

Potential Re-rating:

Even a modest re-rating to 10× FY27E EPS would imply an attractive upside potential

7.3 Risk at Current Valuation

Execution in NVOCC Ramp-up:

Doubling container fleet to 5,000 in FY26 is ambitious. Delays in utilization, shipping line slot constraints, or lower cycle turns could reduce contribution.

Profitability in NVOCC depends on route mix (high vs low yielding lanes) and maintaining >90% utilization.

Working Capital Intensity:

Project Cargo receivable cycle stretches to 135–160 days due to voyage times and compliance clearances.

While management controls cargo custody to mitigate defaults, higher scale could stress liquidity and increase reliance on short-term debt.

Geopolitical & Trade Risks:

Heavy dependence on Latin America and Africa exposes business to tariff changes, regulatory shifts, and political instability.

Volatility in shipping routes (e.g., Red Sea disruptions, Russia trade sanctions) could create cost pressures or execution delays.

Concentration in High-Margin Segments:

Growth story is increasingly tied to Project Cargo and NVOCC. A slowdown in infrastructure/export demand or competitive pressure could impact both growth and margins.

Limited Track Record as a Listed Entity:

Recently listed (Dec 2023 on NSE Emerge); still building consistency in public-market execution and disclosure.

Any missteps in guidance delivery could dampen investor confidence.

At current levels, SJ Logistics offers compelling risk-reward. Valuations are deeply attractive with scope for significant upside if execution in NVOCC and Project Cargo sustains. Risks lie in execution, working capital intensity, and geopolitical dependencies.

Help your group stay ahead. Share now!

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer