Shriram Pistons & Rings: PAT growth of 49% & revenue growth of 18% in FY24 at a PE of 19

A free cash flow generator, SHRIPISTON is available at reasonable free cash-flow yields. SHRIPISTON is guiding for inorganic growth potential to deliver on higher than historic growth rates.

1. Manufacturer of Pistons, Piston Pins, Piston Rings, & Engine Valves

shrirampistons.com | NSE : SHRIPISTON

Products are marketed to EMs and Aftermarkets under the brands SPR and USHA, catering to both domestic and international markets.

#1 Exporter of Pistons, Piston Rings, Pistons Pins & Engine Valves

Customer Segments

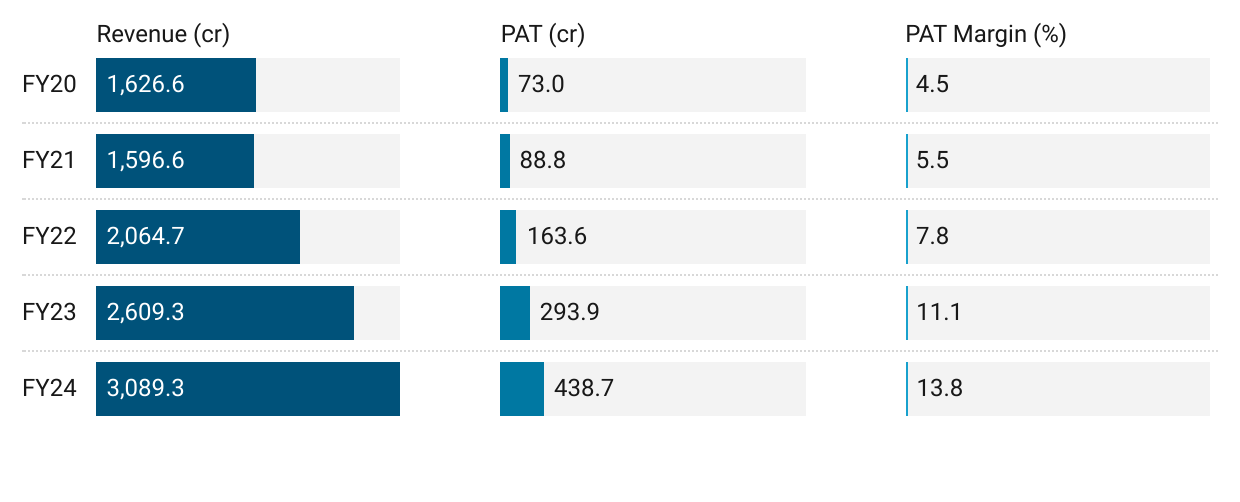

2. FY20-24: PAT CAGR of 57% and Revenue CAGR of 17%

3. Strong FY23: PAT up 80% & Revenue up 26% YoY

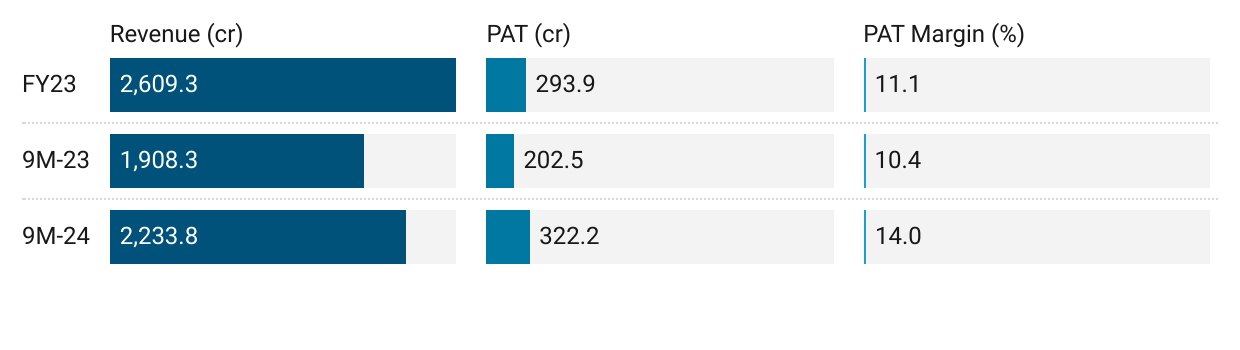

4 Strong 9M-24: PAT up 44% & Revenue up 20% YoY

5. Strong Q4-24: PAT up 30% & Revenue up 12% YoY

PAT up 11% & Revenue up 10% QoQ

6. Strong FY24: PAT up 49% & Revenue up 18% YoY

7. Business metrics: Strong & improving return ratios

8. Outlook

i. FY25: Trend of bottom line growing faster than top-line to continue

primary focus remains on sustaining the growth momentum, not only in terms of the top line but also bolstering the bottom line.

ii. Management not indicating tailwinds in the medium to long term

iii. Possibility of inorganic growth

Expectation is to improve further on the CAGR. And we are looking at various ways of improving our top line, bottom line as a group, because with multiple actions taking place on acquisitions, mergers, there is no limitation with the kind of money that we are generating.

Areas where we will continue to invest for our mergers and acquisitions will be any area which is agnostic to the ICE engine.

We are sitting on cash; we are ensuring that we are deploying our cash quite well and we will continue to invest into more mergers and acquisitions.

9. PAT growth of 49% & Revenue growth of 18% in FY24 at a PE of 19

10. So Wait and Watch

If one holds the stock then one may continue holding on to SHRIPISTON.

Coverage of SHRIPISTON was initiated after Q1-24 results. The investment thesis has not changed after a strong FY24. The delivery of a strong FY24 has increased confidence in the management to deliver a stronger FY25

SHRIPISTON story is driven on bottom-line growth as EBITDA margin has nearly doubled from around 12% in FY20 to 23%+ in FY24. Management is indicating that FY25 would continue the trend of bottom-line growing faster than the top-line.

11. Or, join the ride

If I am looking to enter SHRIPISTON then

SHRIPISTON has delivered PAT growth of 49% & Revenue growth of 18% in FY24 at a PE of 19 which makes the valuations reasonable.

SHRIPISTON is a consistent free cash flow generator. It generated FCF of Rs 394 cr in FY24 on its current market cap of Rs 8,691cr. This makes the free cash flow yield of 4.5% which makes the valuations reasonable.

With a historic revenue CAGR in the high teens, it is imperative for the bottom-line to grow faster than the bottom-line for the stock to remain interesting at a PE of around 20. With EBITDA margin around 23%+, the headroom to expand margins may be limited.

With possibility of M&A, the inorganic growth will be added to mix. However, full impact of the growth may not be visible in FY25. One may need to wait till FY26 for the impact of organic growth to be fully visible.

Previous coverage of SHRIPISTON

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer