Shivalik Bimetal Controls: 3.4X revenue & 4X PAT opportunity

Shivalik is an efficiently run company with solid return ratios. 23-28% revenue growth and 26-32% PAT growth in the next 6-7 years.

Company Overview

Shivalik Bimetal Controls Limited (SBCL) is a global leader in next-generation thermostatic bimetal trimetal strips, electrical contacts and shunt resistors.

Launched just five years ago, Shunt Resistors business now contributes around 50% of total business in value terms. The Bimetals segment is the legacy segment for SBCL. Revenue from Electrical Contacts is considered within the Bimetals segment

Share Details

NSE:SBCL( shivalikbimetals.com)

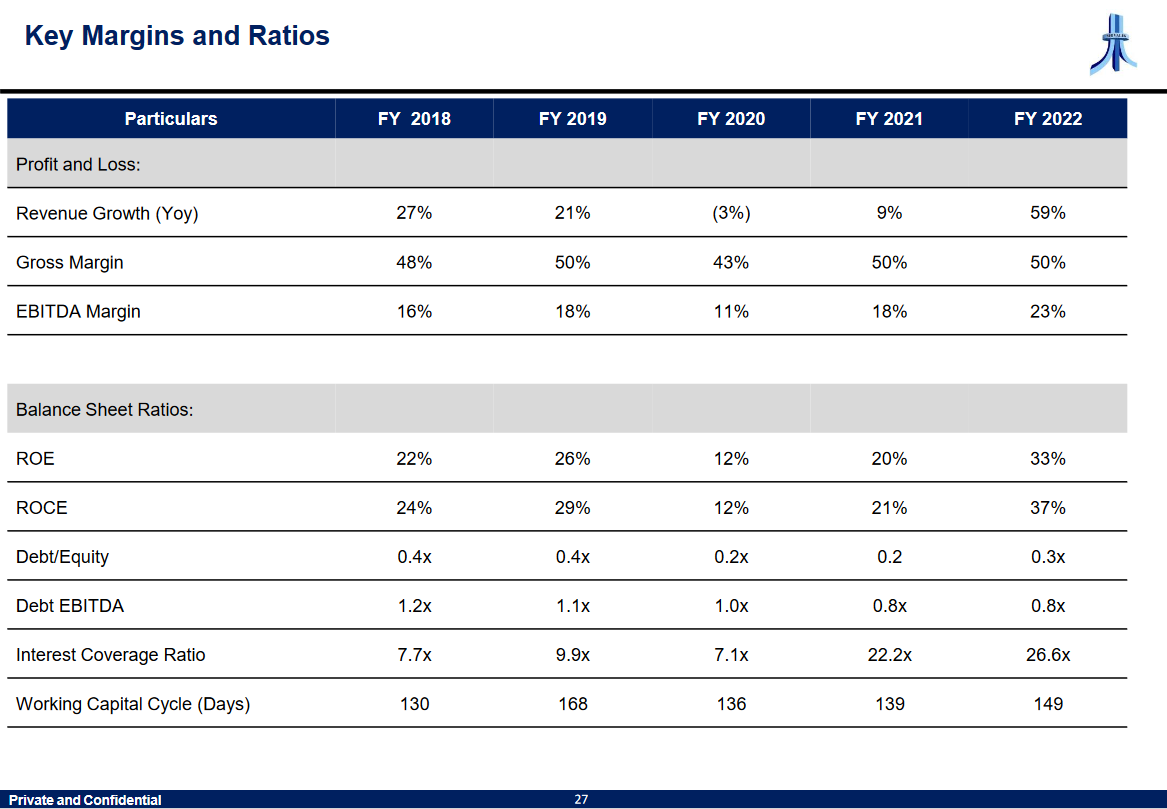

Quality: Returns on capital employed in cash

The return ratios are solid and cash conversion is good.

Growth

Top-line and bottom-line growth is solid and is driven by the growing global demand for electrical and battery management system using SBCL components. Free cash flow generation is an area of concern.

Growth Momentum

The revenue growth momentum is solid but is driven by the 40%+ top-line growth in the last two financial years.

Outlook

Sales potential post expansion of Rs 1600 cr, potential for the company to scale up to 3.4X on the base of FY23 revenue

The 3.4X growth will happen 6-7 years down the line implying a top-line growth in the range of 23%-28%. This is in line with the historic top-line growth of 24%, but significantly slower the 50% growth in the last two financial years.

The capacity utilization of 35% indicates that the company has the potential to grow volume by 2.86X (1/35%) without any further capex. This means that the gap between the 3.4X revenue growth and the 2.86X volume growth will have to be either achieved by productivity improvement or pricing improvement.

So, we are in the expansion mode for the last three years, which will be capitalized. And we have started capitalizing those things since ‘23-‘24 and it will take another year to fully equip. So, at this moment, if you include the capacity after expansion, we are about at 35% of the capacity utilization in both the products.

Growth will improve margins a little. Assuming the PAT margin improves a little from 17% to 20% in 6-7 years implies a PAT of 320 cr, or 4X. This would translate into a PAT growth of 26-32% in the next 6-7 years

The margin we have been making currently is sustainable and with the volume it will grow to a certain extent.

So What????

If I currently hold the stock, I may continue holding it based on my past returns, expectations for future returns, and the availability of alternative stock ideas. The intention is to retain it for as long as one can see SBCL delivering on its sales potential within the committed 6-7 years while maintaining margins.

If I don't currently own the stock, I may want to enter it.

It is an efficiently run company with solid return ratios.

23-28% top-line outlook for 6-7 years.

26-32% bottom-line growth for 6-7 years.

Majority of the capex is completed so free cash flow generation should be expected

The issue is that we have the stock currently at a PE of 52. If there is faith in the growth outlook then one can look to wait patiently and enter it on bad days and slowly build positions.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades