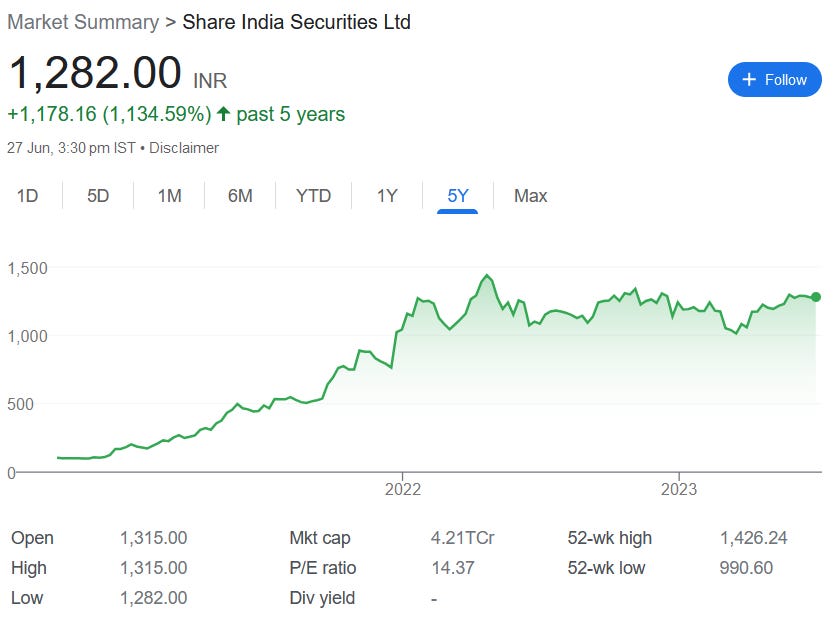

Share India Securities Ltd - High returns

High returns are available with high risk at a reasonable PE

Company Overview

Founded in 1984, Share India Securities Ltd is a financial service provider that uses technology to offer customized capital market tech-based solutions to clients. It offers financial products & personalized services, including equity broking, currency & commodity derivative, depository participant services, mutual fund advisory and distributorship, etc to retail and corporate clients

Share India Securities Limited (SISL) is a digital-first fintech conglomerate focused on cutting-edge low latency platform and AI/ML driven trading strategy solution provider to empower its proprietary and professional traders Clientele with superior technology.

Business segment

30% is coming from client business

around 10% comes from NBFC,

around 2% to 3% comes from various service-related businesses, including insurance, technology, and capital services

rest is proprietary trading

With 70% of the income coming in from proprietary trading, makes it a stock who are looking for high risk plays.

Share Details

NSE:SHAREINDIA

Quality: Returns on capital employed in cash

Given that 70% of the income is coming from from proprietary trading makes the return ratios look quite good

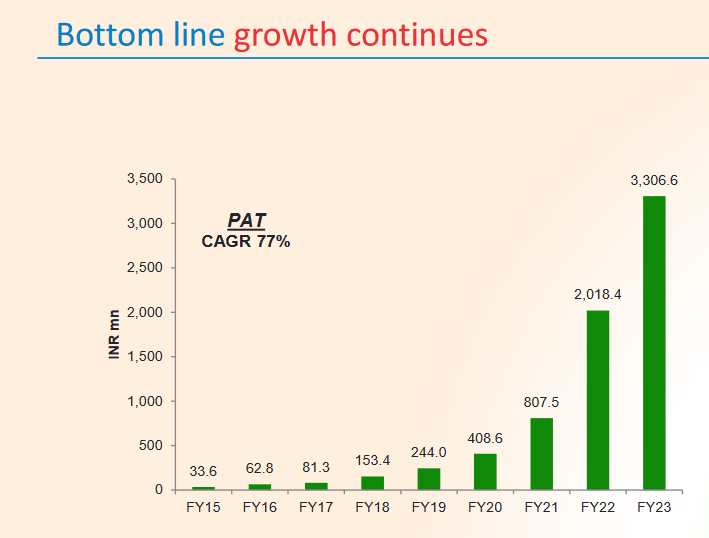

Growth

Since growth is primarily driven by proprietary trading, there can be questions around the sustainability of the growth.

Growth Momentum

Outlook

Looking at remarks made by the management during the Q4-23 earnings call, the company is guiding of 25-35% PAT growth in the next five years.

Since last 8 years, we are growing at 77% of CAGR like base is big now and a new set of challenges, we believe, if not 77%, at least we should grow between 25% to 35% CAGR in the next 5 years that is our goal

In coming years, as the scalability is there, we believe these margins are definitely going to go up only. There is no chance that margins will come down because we are not a much cost-heavy company.

So What????

If I own the stock, I may keep it based on my historic returns, future return expectations, and availability of alternative stock ideas. Its a high growth, high risk company and if I am sitting on historical returns then I may want to stay with it.

If I don’t own the stock, I may want to enter only if I am looking for something risky with high growth and available at PE of 14. This stock is not for the conservative investor. One should not invest a significant percentage of their capital in the company

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades