Sharda Motor: PAT up 44% & Revenue up 5% in FY24 at a PE of 16

Free cash flow yield of 7.2% makes valuation attractive. 19% market cap in surplus cash. SHARDAMOTR guiding 10% faster than industry on the back of legislative tailwinds driving content per vehicle

1. Auto-ancillary Company

shardamotor.com | NSE: SHARDAMOTR

Exhaust Systems - Indian Market Share of ~30%

Suspension Systems - Indian Market Share of ~10%

2. FY20-24: PAT CAGR of 51% & Revenue CAGR of 34%

3. Strong FY23: PAT up 29% & Revenue is up 20% YoY

4. Strong 9M-24: PAT up 44% & Revenue is up 5% YoY

Catalyst used in exhaust systems is no longer procured by SHARDAMOTR and explains the impact on top-line

But on the other hand, if a customer really insists that due to business model reasons that they want us to procure the catalyst, then we would, but it would be a strong exception. We are trying our best that for all the new business that we are developing, it would be without the catalyst.

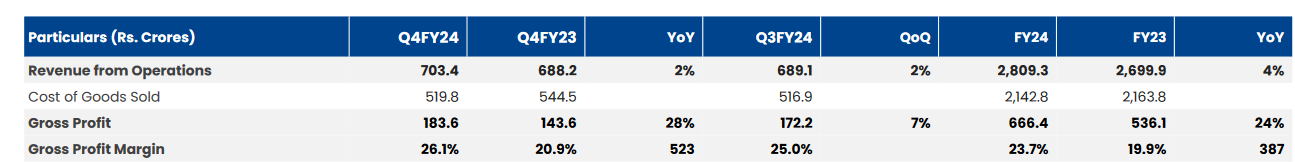

5. Strong Q4-24: PAT up 44% & Revenue up 2% YoY

PAT up 16% & Revenue up 2% QoQ

6. Strong FY24: PAT up 44% & Revenue up 4% YoY

7. Business Metrics: Strong return ratios

8. Outlook: Momentum of last 2 years to continue

i. Strong Tailwinds - Leading to increase in content per vehicle

ii. FY25 & FY26 guidance to repeat momentum of last 2-3 years

We don't give any specific guidance in terms of numbers, but we remain to be very optimistic. And in a longer-term period to have a similar growth pattern that we've seen in the last couple of years. But as such, in terms of numbers, we don't have any guidance that we are giving at this point.

iii. Growth without significant capex

Capex will remain to be incremental, how it has been. There will be different stages but it will all remain to be incremental for the next 2, 3 years and a similar pattern, maybe slightly higher, lower, depending how it's been for the last couple of years. And it will be taken more than enough by the profitability that we are expecting.

iii. Potential for inorganic growth in power train agnostic products

We have a significant amount of liquidity. And do remain to be debt free. In addition to that, we also have a few surplus line. So our first preference has always been to utilize this for an M&A opportunity. But at the same time, we are long-term focused as well as very conservative when it comes to valuations on products. So we are working on various opportunities, and there is no time line in terms of M&A.

9. PAT growth of 44% & Revenue growth of 5% in FY24 at a PE of 16

10. So Wait and Watch

If I hold the stock then one may continue holding on to SHARDAMOTR

Top-line growth in FY24 at 4% looks very weak however, SHARDAMOTR is using gross profit growth as the proxy of volume growth. Gross profit as an indicator needs to be watched and is quite strong with 24% growth in FY24.

So if you look at gross profit as an indicator growth in gross profit, it generally correlates with volumes. But of course, with various caveats attached to it, I would say, for the time being, it's better to monitor gross profit. We are also monitoring the movement vis-a-vis gross profit and industry volume growth.

SHARDAMOTR is in the middle of a strong run it has increased it top-line and PAT consecutively for the last 5 quarters starting in Q4-23.

Strong outlook to outgrow industry by 10%

So our guidance that our sales/gross profit would be up more 10% versus industry has been there, and we will continue to see that as well as our content per car increase this time.

11. Join the ride

If I am looking to enter SHARDAMOTR then

SHARDAMOTR has delivered PAT growth of 44% and revenue growth of 4% in FY24 at a PE less than 16 which makes the valuations reasonable.

SHARDAMOTR generated Rs 340 cr of free cash flow in FY24 on a market cap of Rs 4,721 cr which translates into a free cash flow yield of 7.2% which makes valuations quite attractive. The outlook for future free cash flow generation is strong given low CAPEX requirements

Projects in pipeline requiring only incremental CAPEX with high cash generation ability

Rs 900 cr of surplus cash including mutual funds & bonds on a market cap of Rs 4,721 cr implies 19% of market cap is in surplus cash and equivalents adding a strong margin of safety to the balance sheet

The company continues to be debt free with surplus funds of approximately Rs 900 cr including investments in bonds and mutual funds

Previous coverage of SHARDAMOTR

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer