Shakti Pumps: PAT growth of 487% & revenue growth of 42% in FY24 at a PE of 28

Strong guidance of 25-30% revenue growth in FY25 with 15% EBITDA margin, supported by a strong order book. Capex plans in place to support doubling of revenue in 3 years

1. Manufacturing of pumps and motors

shaktipumps.com | NSE: SHAKTIPUMP

One of the leading domestic manufacturers in the Indian pump industry & holds dominant position with ~26%* market share in the domestic solar Pump Market under the PM KUSUM scheme

Corporate Structure

Business Segments

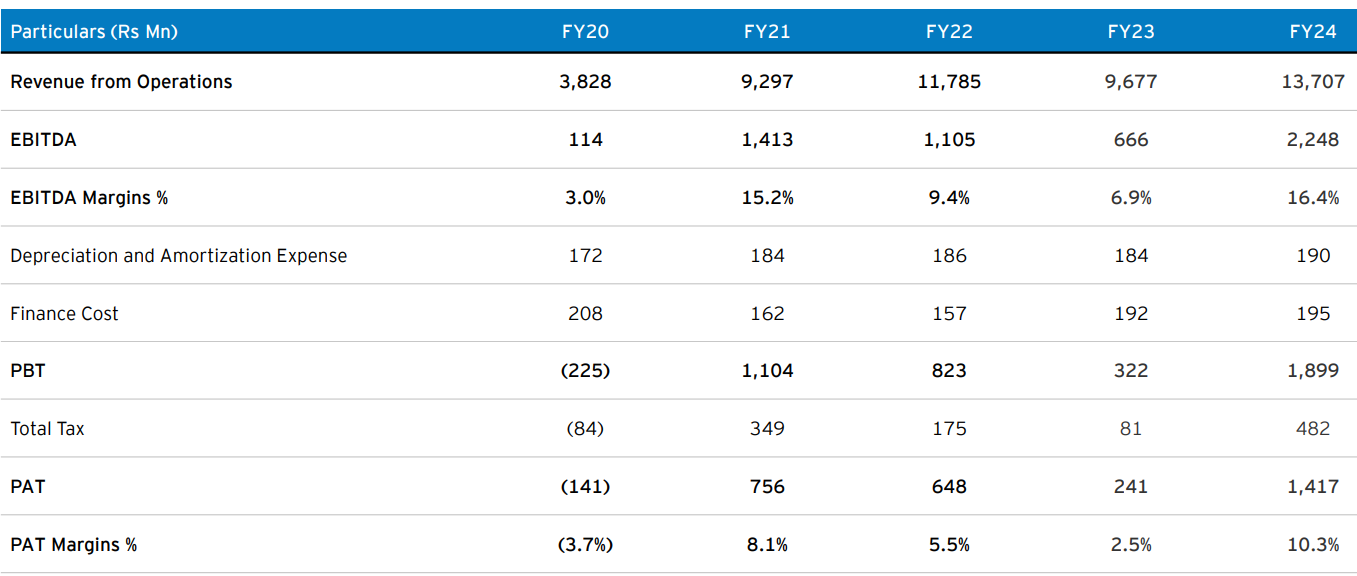

2. FY20-24: EBITDA CAGR of 111% & Revenue CAGR of 38%

3. Weak FY23: PAT down 63% & Revenue down 18% YoY

4. Weak H1-24: PAT down 36% & Revenue down 44% YoY

5. Strong 9M-24: PAT up 138% & Revenue down 3% YoY

6. Q4-24: PAT up 3888% & Revenue up 234% YoY

PAT up 98% & Revenue up 23% QoQ

7. Strong FY24: PAT up 487% & Revenue up 42% YoY

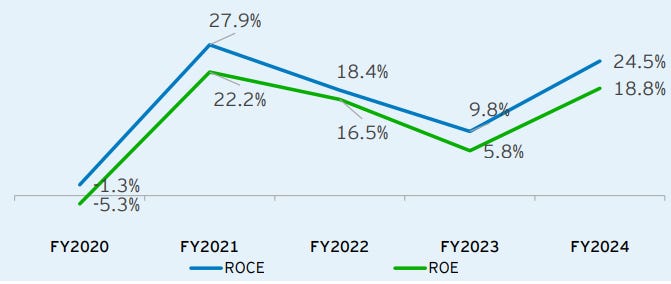

8. Business metrics: Strong & improving return ratios

Return on Capital Employed (ROCE) has risen to 24.5% from 9.8% in FY23 and Return on Equity has also improved moving up from 5.8% in FY23 to 18.8% in FY24.

9. Outlook: Revenue growth of 25-30%

i. FY25: Revenue growth of 25-30%

25% to 30% is our commitment.

This is minimum quote and can be more than this.

ii. EBITDA margins to sustain

EBITDA margin guidance of 15% for FY25 vs achievement of 16.4% in FY24

Our minimum commitment is that we want to work on 15% margin, so the guideline which was 12% is being revised to 3% and made it 15%.

iii. Strong order book providing revenue visibility

Rs 900 cr of orders to be executed within 90-120 days is pointing to a strong H1.

Order book execution: we have 18 months’ time for Rs. 1,500 crores and rest we have to complete within 90 days to 120 days.

iv. Capex to double revenue potential in 2 years

Q4-24 revenue was Rs 609 cr which is close to the Rs 2,500 cr revenue run-rate which would trigger the capex to double the capacity in 2 years. Doubling of capacity with 25-30% growth could mean revenue doubling in 3 years

The total capacity will be 2x. In our previous calls, we have been telling that as soon as sale of Rs. 2,500 crores come then after that we will do further planning for production capacity, and we see more orders ahead. In 2 years, we will complete our investment and then our capacity will become Rs. 5,000 crores

.

10. PAT growth of 487% & revenue growth of 42% in FY24 at a PE of 28

11. So Wait and Watch

If I hold the stock then one may continue holding on to SHAKTIPUMP

SHAKTIPUMP has delivered the strongest revenue & PAT in FY24.

Guidance of 25-30% revenue growth with 15% EBIDTA margin supported by a strong order book is creating a positive outlook for SHAKTIPUMP in FY25

We are expecting H1-25 to be strong as Rs 900 cr of revenues need be executed by SHAKTIPUMP in the first 90-120 days of FY25

One needs to be cautious on SHAKTIPUMP as its strong performance is based on its performance in H2-24. The weakness of FY23 continued into H1-24 and hence one needs keep a watch if the strong performance of H2-24 is sustained.

12. Or, join the ride

If I am looking to enter SHAKTIPUMP then

SHAKTIPUMP has delivered PAT growth of 487% & Revenue growth of 42% in FY24 at a PE of 28 which makes valuations reasonable in the short term.

The FY25 outlook for guiding for 25-30% revenue growth with 15% EBITDA and the support of strong order book providing visibility into H1-25 at a PE of 28 makes the valuation reasonable from the medium term.

The capex to support doubling of revenue in 3 years at a PE 28 makes the valuations reasonable from the longer term provided the order book is in place to support the growth.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer