SG Mart: Revenue CAGR of 88% for FY24-27 at a PE of 59

SG Mart in its first year of operation delivered Rs 2,683 cr revenue in FY24. Guiding for for revenue CAGR of 88% for FY24-27. Outlook is supported by macro tailwinds for B2B marketplaces

1. A B2B market-place for construction materials

sgmart.co.in | BOM : 512329

Formerly known as Kintech Renewables Limited

SG Mart Business was started in June 2023.

SG Mart offers a wide range of products, now encompassing more than 27 product categories, and more than 1750 SKUs. These categories include steel construction products like TMT Rebars, HR Sheet, Welding rod, Binding wire, mesh net, tapping screw and barbed wire, among others. Additionally, in response to the increasing demand, the Company has introduced tiles, cement, bath fittings, laminates and paints.

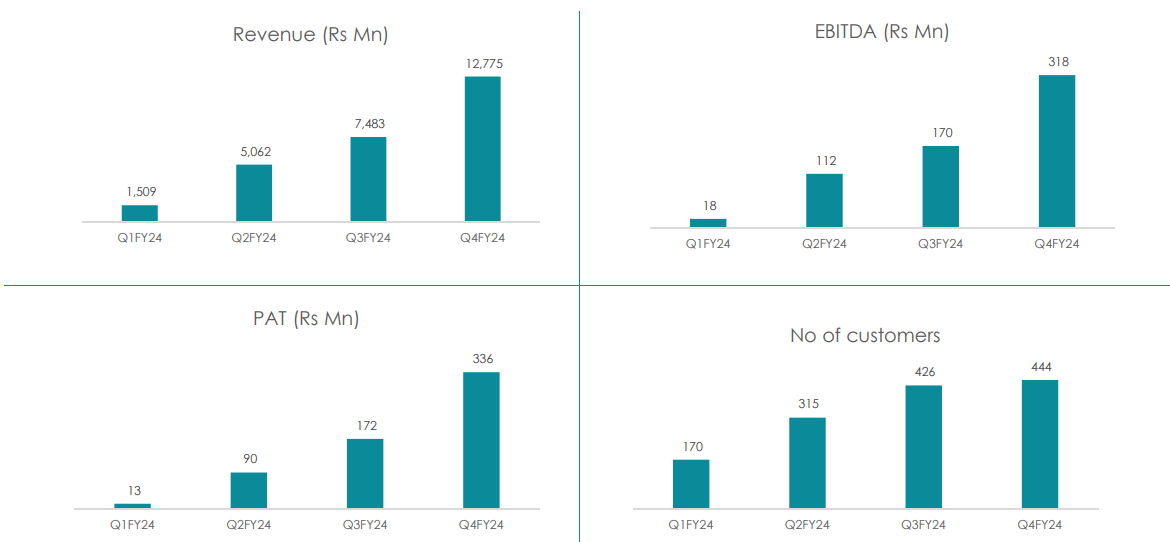

2. Strong Q3-24: PAT up 91% & Revenue up 48% QoQ

3. Strong Q4-24: PAT up 95% & Revenue up 71% QoQ

4. Strong FY24: QoQ growth in PAT & Revenue in all quarters

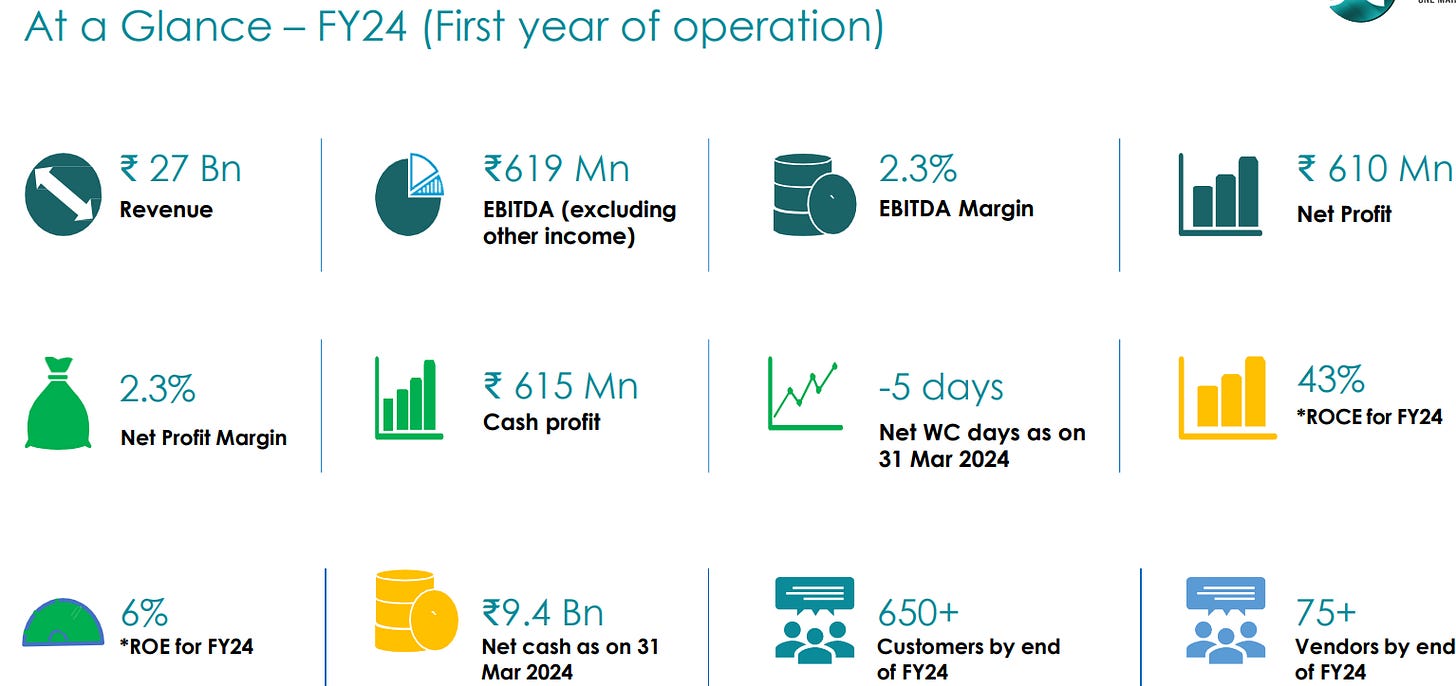

FY24 (First year of operation)

5. Business metrics: Strong return ratios

Business was started in June 2023.

ROCE & ROE have been calculated on actual numbers for FY24.

If annualized on Q4 basis, ROCE would be 87% and ROE would be 12%.

ROE looks low because of equity infusion of INR 8.8 Bn in Nov 2023 and INR 1.35 Bn in August 2023

6. Outlook: Revenue CAGR of 88% for FY24-27

Targeting Rs 18,000 cr revenue in FY27, a revenue CAGR of 88% from the Rs 2,682.9 cr revenue in FY24

Having surpassed INR 26 Bn in revenue in FY24, the company aims to achieve INR 180 Bn revenue by FY27.

7. Revenue CAGR of 88% for FY24-27 at a PE of 59

8. So Wait and Watch

If I hold the stock then one may continue holding on to SG Mart

SG Mart has delivered a strong FY-24 with strong sequential growth in revenue & PAT in Q3-24 and Q4-24.

SG Mart has a strong outlook till FY27 which provides a reason to continue till FY26

The outlook till FY27 is supported by macro tailwinds

9. Or, join the ride

If I am looking to enter SG Mart then

SG Mart is guiding for 88% revenue CAGR for FY24-27 at a PE of 59 which makes valuations quite attractive from a long term perspective.

SG Mart does not have a track record and hence it would be better to build positions in the stock over time as one feels more comfortable with the execution in FY25.

The real risk is the razor thin margins in the business. 2.3% PAT margin needs improve as the business scales up and operating leverage needs to kick in or else it may be difficult to make money in SG Mart.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer