Senores Pharmaceuticals Q3 FY26 Results: PAT up 105%, On-track FY26 Guidance

Doubling FY26 PAT with 50% growth in revenue. Guidance of 25-30% revenue CAGR & 20-30% PAT CAGR for next 3-5 years. Trading at reasonable forward valuations

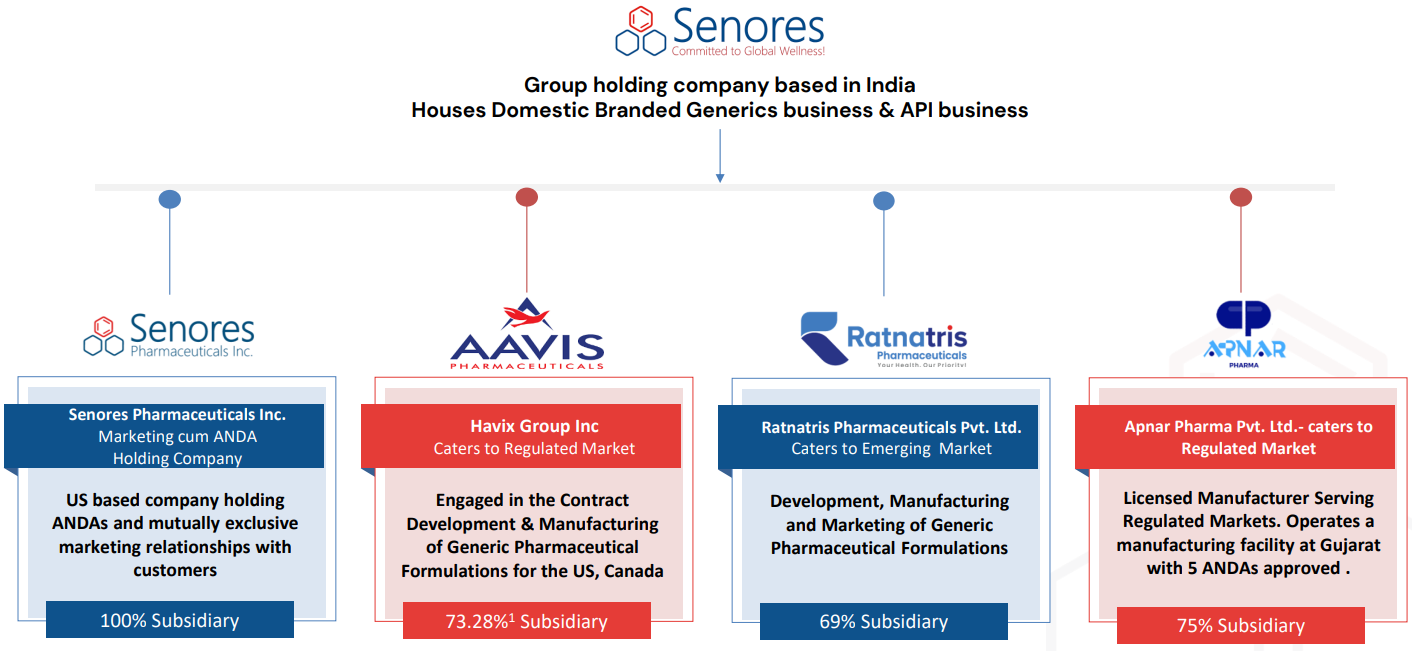

1. Pharmaceutical Company

senorespharma.com | NSE: SENORES

US Manufacturing:

US FDA and DEA-approved facility in Atlanta, US

Insulating them from tariff-related risks

Enabling them to cater to controlled substances and government contracts (BAA compliant)

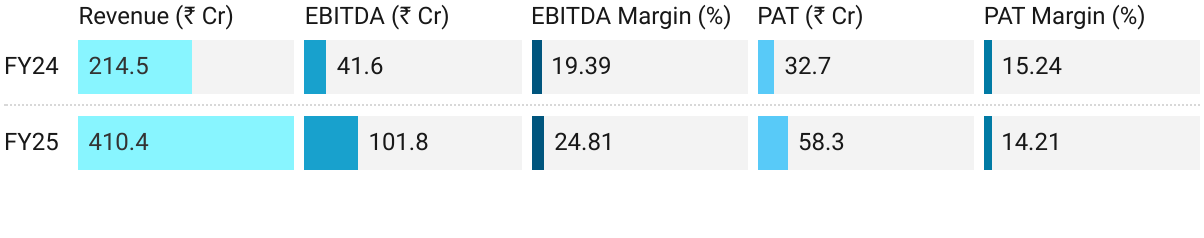

2. FY25: PAT up 78% & Revenue up 91% YoY

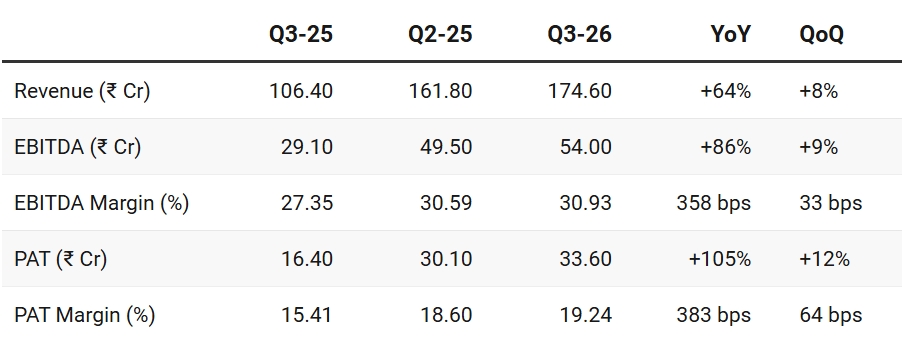

3. Q3 FY26: PAT up 105% & Revenue up 64% YoY

PAT up 12% & Revenue up 8% QoQ

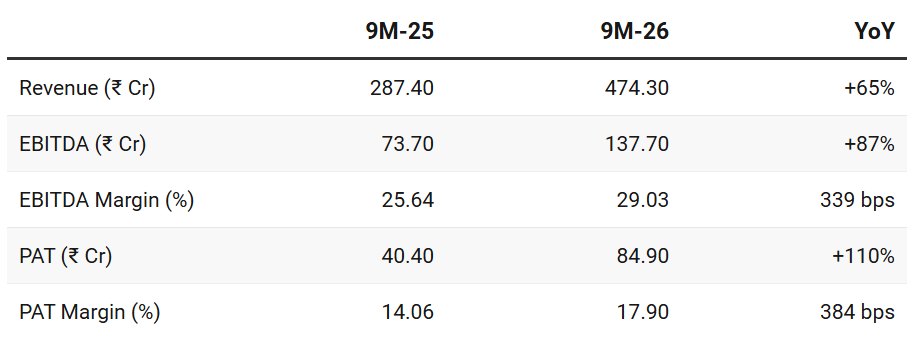

4. 9M FY26: PAT up 110% & Revenue up 65% YoY

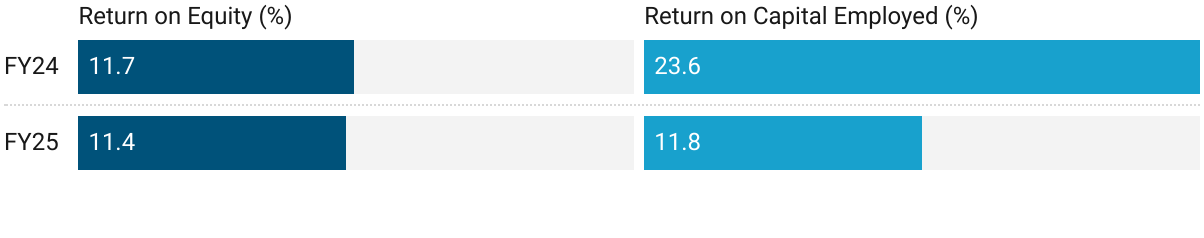

5. Business Metrics: Reasonable Return Ratios

Funds from IPO in muted FY24 return ratios

6. Outlook: Doubling PAT in FY26

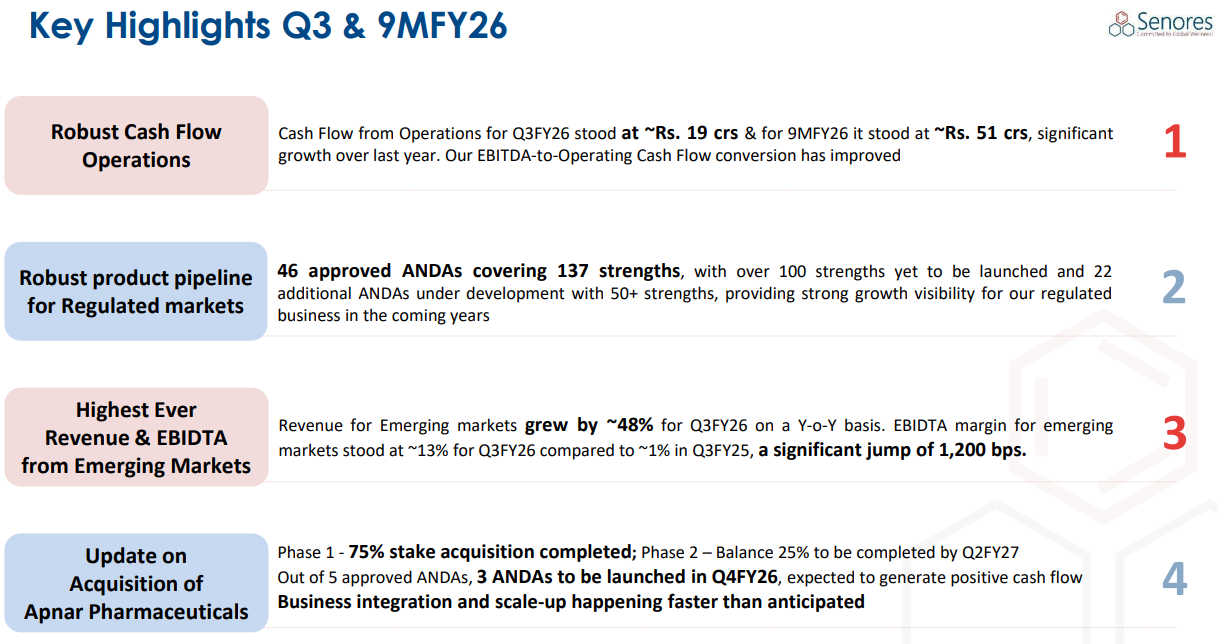

All in all, we have delivered a strong performance in the quarter and nine-months and remain on track to deliver on our full year guidance.

6.1 FY26 Guidance

FY26

We remain on track and confident of delivering at least 50% growth in top line and 100% growth in PAT for FY26 over FY25.

Margin — in the similar range what we have achieved in H1

FY27 Onwards

Revenue Growth: So post this year FY 27 I think sustainable growth on a CAGR basis should be between 25 and 30%. That is what we’ve targeted. I mean with a positive launches it this could well exceed but from our internal target perspective — at least 30% CAGR sustainable growth over over next 3 to 5 years is very much visible for us and which will continue to deliver. So that’s that’s what our internal targets have been

PAT Growth: 20 to 30% is what we are looking at from next year onwards

PAT as a percentage will improve by couple of hundred bips that’s what we are looking at

6.2 9M FY26 Performance vs FY26 Guidance

On-track FY26 guidance

Revenue: 9M revenue growth of 64%— on-track guidance of 50%+ revenue growth

PAT: 9M PAT growth of 110%— on-track guidance of 100%+ PAT growth

Profitability: Margin expansion in Q3 on YoY and QoQ basis

Cash Flow: Strong Performance on cash generation.

Cash Flow from Operations for Q3FY26 stood at ~Rs. 19 crs & for 9MFY26 it stood at ~Rs. 51 crs, significant growth over last year. Our EBITDA-to-Operating Cash Flow conversion has improved

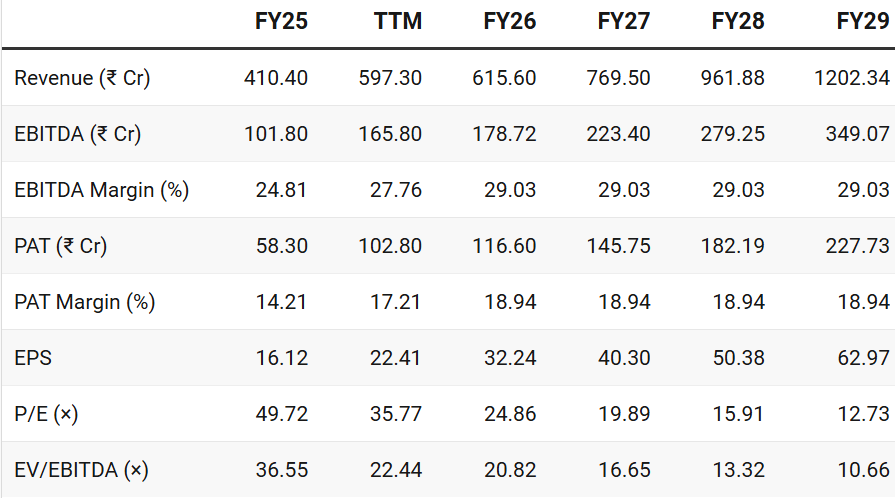

7. Valuation Analysis — Senores Pharmaceuticals

7.1 Valuation Snapshot

Current Market Price — ₹801.5

Market cap ₹ — 3,691.20 Cr

Assumptions:

Revenue growth at 25% beyond FY26 — lower end of guidance

PAT growth in-line with revenue growth

Stable margins

Attractive Forward Valuations

FY27 valuations are not demanding — provide flexibility to sustain a quarter or two where performance is not as per guidance

Reasonably valued on FY26E and but attractive on FY27E, provided execution sustains with 20-30% CAGR and stable margins. Multiples leave room for re-rating if FY27 is delivered.

7.2 Opportunities at Current Valuation

Long runway for growth:

The opportunity lies in the guidance of 20-30% revenue CAGR from FY27 onwards for the next 3-5 years.

Forward projections are conservative — growth assumed at the lower end of the guidance

Impact of sterile manufacturing facility not considered in the growth projections

Growth assumptions are strong but not extraordinary

SENORES targets 25-30% growth for the next 3-5 years for the opportunity to play out.

It is not a continuation of the exceptional 50% growth targeted in FY26

Opportunity exists even if growth is at the lower end of the guidance

FY27 Valuation — P/E of 20× & EV/EBITDA of ~17×

Implies that growth beyond FY26 has not been fully discounted.

Potential for re-rating of multiple in FY27

8.3 Risks at Current Valuation

Execution Risk:

While FY26 looks on track, delivering 25-30% for the next 3-5 years will require exceptionally consistent performance

All strategic initiatives need to fall in place

Regulatory Dependence: Heavy reliance on USFDA/DEA compliance for Atlanta facility; any adverse inspection outcome is a material risk.

Concentration: ~65% of revenues from Regulated markets; while a strength, it also exposes SENORES to US generics pricing pressures and competitive intensity.

Previous Coverage of SENORES

Help your group stay ahead. Share now!

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer