Senores Pharmaceuticals Q1 FY26 Results: PAT up 94%, On-track FY26 Guidance

Doubling FY26 PAT with 50% growth in revenue. Potential to deliver 20-30% revenue CAGR in FY27. At reasonable forward valuations with leeway for execution risks

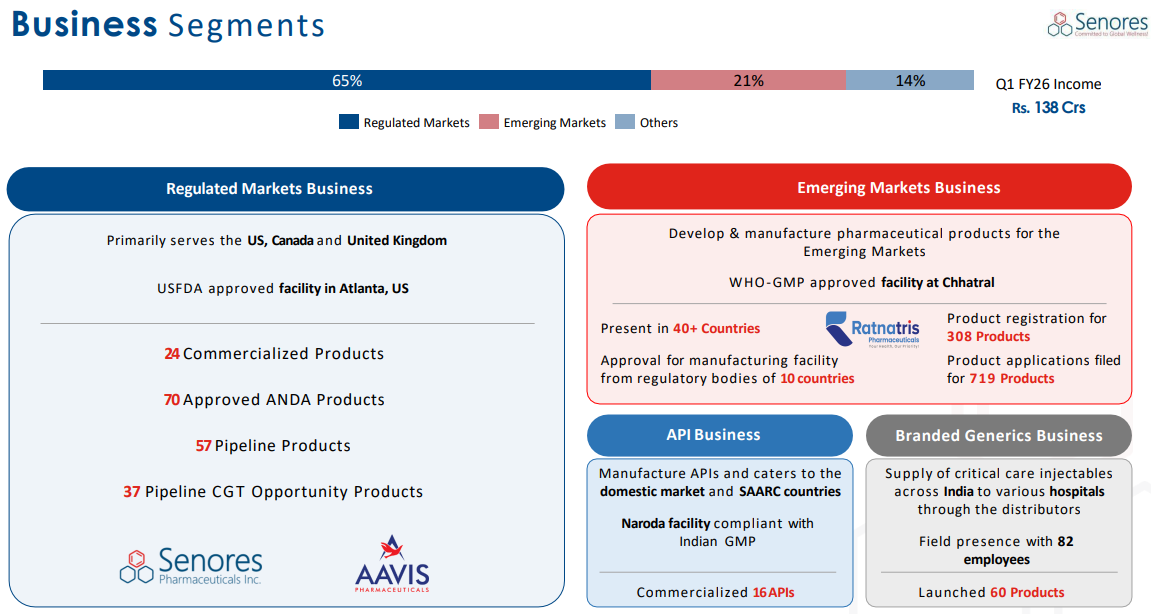

1. Pharmaceutical Company

senorespharma.com | NSE: SENORES

Listed in Dec-24 — limited track record

A. Regulated Markets Business

Largest vertical — serving US, Canada, and the UK.

Operations from US FDA-approved manufacturing facility in Atlanta, US.

It comprises two main components:

Own Products (ANDA Business):

Q1-26: 24 commercialized ANDA and 70 approved ANDA

57 pipeline products, with 37 identified as having Competitive Generic Therapy (CGT) opportunity. CGT status grants 180 days of market exclusivity with lower price erosion due to less competition.

Pipeline spans — cardiovascular, CNS, pain management, muscle relaxants, antidepressants, endocrine, SSRI, calcium blockers, and respiratory.

60%-70% of US business comes from government contracts and controlled substances.

Long-term contracts and fixed pricing, leading to lower price erosion and predictable revenue streams

CDMO/CMO Segment (Contract Development & Manufacturing Organization / Contract Manufacturing Organization):

Q1 FY26: 27 commercial CDMO/CMO products & 53 products in pipeline

Gaining steady traction and scaling up, with significant growth expected.

Emerging Markets Business

Covering over 40 countries across Far East Asia, CIS, Latin America & Africa

WHO-GMP approved facility at Chhatral

Q1-26: 308 approved products and 719 products under registration

Business models — distributor, P2P (peer-to-peer), and own brands.

EBITDA margins ~6% in Q1 FY26

Target to reach double-digit — eventually 15%-18% in the long-term

Other Segments

API Business (Active Pharmaceutical Ingredients):

APIs primarily for backward integration

Facility in Naroda

Recently commissioned greenfield API facility in Chhatral, Gujarat

Intend to manufacture APIs for regulated and semi-regulated markets

Filing DMF for US FDA approval for the new API facility, expected around Q2 FY27.

Commercialized 16 APIs across 11 therapeutic areas.

Branded Generics / Critical Care Injectables (India):

Supplying critical care injectables directly to hospitals across India, bypassing mid-level distributors.

Expect INR 50 crores in revenue in FY26.

Key Strengths and Differentiators:

US Manufacturing: US FDA and DEA-approved facility in Atlanta, US, is an advantage, insulating them from tariff-related risks and enabling them to cater to controlled substances and government contracts (BAA compliant).

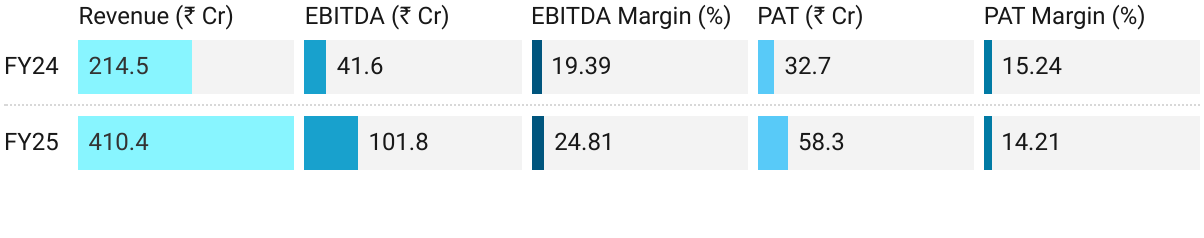

2. FY25: PAT up 78% & Revenue up 91% YoY

Segmental Performance

a) Regulated Markets (US, Canada, UK)

Revenue: +69% YoY — Share of total: ~60%.

Drivers: 22 commercialized products, 61 approved ANDAs, expansion of CDMO/CMO partnerships.

Margin: >40% EBITDA, the anchor of profitability.

b) Emerging Markets (CIS, LATAM, SE Asia, Africa)

Revenue: +174% YoY — Share of total: ~30%.

Drivers: 285 registered products, 636 under registration; shift in portfolio from Africa → CIS/LATAM improved realizations.

Margin: ~7% (vs ~1% in FY24).

c) Others (API + Critical Care Injectables + Other Op. Income)

Revenue: +76% YoY, — Share of total: ~10%.

API plant (Gujarat) commenced; injectables business still small but growing.

Strategic Developments in FY25

ANDA Acquisitions: 14 from Dr. Reddy’s, 1 from Breckenridge.

Ratnatris Acquisition: Consolidated EM presence (now 69% subsidiary).

API Expansion: Commenced operations at Gujarat greenfield plant.

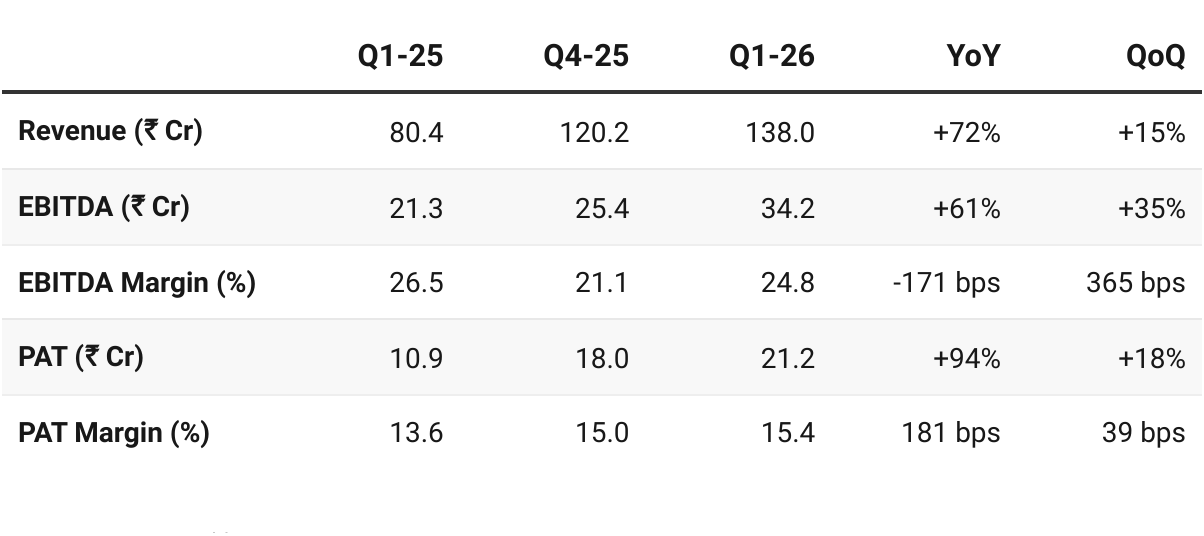

3. Q1 FY26: PAT up 94% & Revenue up 72% YoY

PAT up 18% & Revenue up 15% QoQ

Regulated: Execution in line with expectations; ANDA launches + CDMO ramp-up provide visibility.

Emerging Markets: Profitability improvements evident; portfolio registrations rising.

Branded Generics: Significant traction; pan-India presence targeted by FY26-end.

Cash Flow Discipline: Q1 OCF positive; intent to maintain this trend.

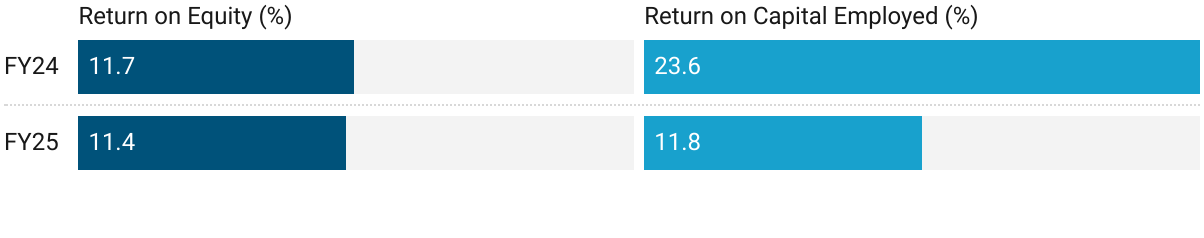

5. Business Metrics: Reasonable Return Ratios

Funds from IPO in muted FY24 return ratios

6. Outlook: Doubling PAT in FY26

6.1 FY26 Guidance

We remain confident of delivering 50% growth in top line and about 100% growth in PAT for FY26 over FY25.

So, taking all together we have guided that we should do definitely about INR 600 crores top line this year. INR 600 crores to INR650 crores as the range that we have talked about. And a very strong growth in profitability as well.

On an annualized basis we will see the company in a stable EBITDA margin of 25% to 26%.

We believe Senores is well positioned to remain largely insulated from any tariff-related developments.

Our entire formulation manufacturing is done locally in the US as we speak. In terms of APIs, we procure very small quantities from China and some quantities from Europe. In case of any escalation of tariffs for this region, the impact on our business would be negligible.

Regulated markets are expected to continue contributing around 60%- 70% of total revenue, with emerging markets continuing to account for about 30%.

So, this year from our US regulated side, we expect to do about INR 400 odd crores. And on a steady state going forward basis, you can assume between 20% to 30% CAGR growth, you know.

So, inorganic growth was largely on product side of the business. We have already done close to 20 plus ANDA acquisitions so far and we'll be continuing to look for more as long as it fits in our strategy. So, that's been our focus and that's what we've been executing as well.

6.2 Q1 FY26 vs FY26 Guidance — Senores Pharmaceuticals

On-track FY26 guidance but Catch-Up Needed in H2

Revenue Run-Rate: Q1 revenue of ₹138 Cr annualizes to ~₹550 Cr (below guidance). However, management expects back-ended launches (ANDA + CDMO/CMO) to drive stronger H2 — so guidance of ₹600–650 Cr remains achievable.

Profitability: EBITDA margin of 24.8% is below guidance (25–26%). PAT margin expansion to 15.4% supports the doubling of PAT target.

Launch Execution: 2 new ANDA launches and 4 approvals in Q1, plus 5 new CDMO products commercialized — providing visibility for ramp-up in coming quarters.

Segmental Outlook:

Regulated: Strong momentum (+69% YoY).

EM: QoQ decline but profitability improved.

Branded Generics: 4.5× YoY growth, emerging as a meaningful lever.

Positive Sign: Turning operating cash flow positive in Q1 strengthens confidence in guidance delivery.

7. Valuation Analysis

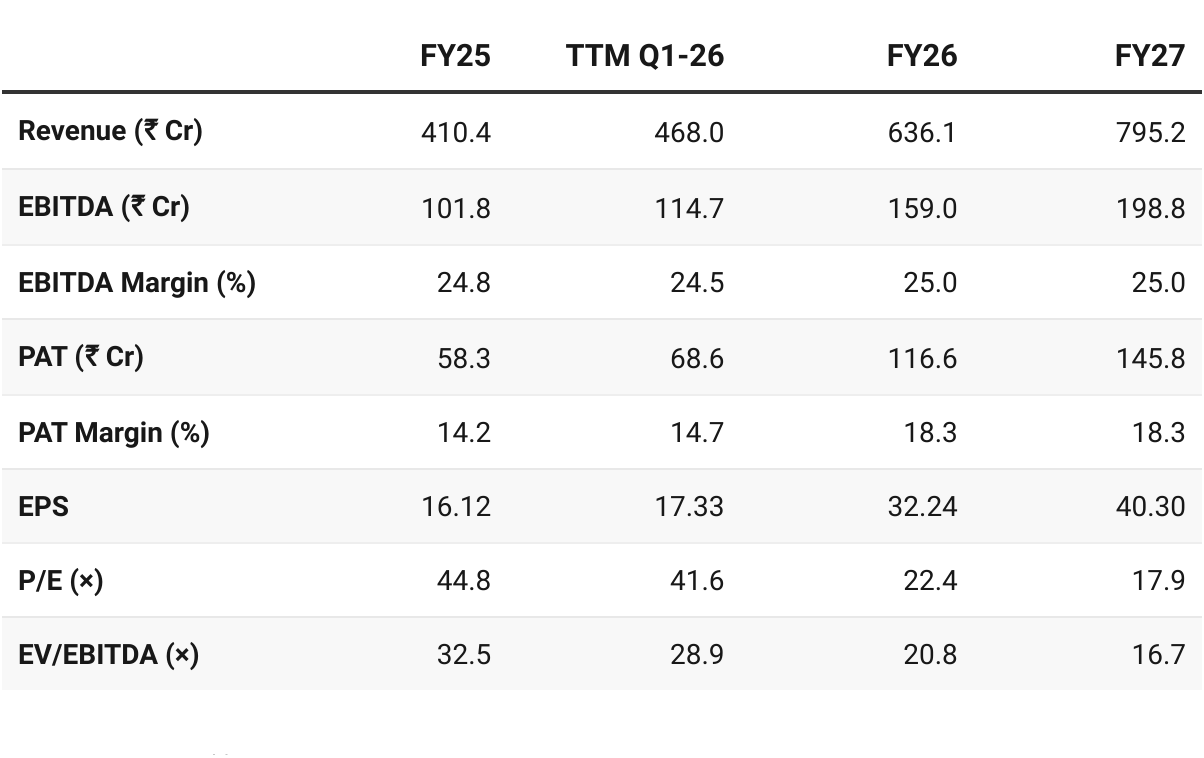

7.1 Valuation Snapshot — Senores Pharmaceuticals

CMP ₹721.5; Mcap ₹3,311.94 Cr

Assumption: Overall business will also grow in the 20–30% CAGR range beyond FY26, since the Regulated Markets (the largest and fastest-growing segment) will anchor that trajectory.

Attractive Forward Valuation:

PE (x)

TTM — very high, priced for growth.

FY27E — halves in FY26 as earnings scale up and moves into mid-cap pharma peer range

EV/EBITDA (x):

TTM — very expensive

FY27E — more reasonable as FY26E EBITDA nearly doubles and moves into attractive range for specialty/regulated pharma

Scope for valuation re-rating in FY27 if growth trajectory sustains.

FY27 valuations are undemanding — provide flexibility to sustain a quarter or two where performance is not as per guidance

Fully valued on FY26E and but attractive on FY27E, provided execution sustains with 20-30% CAGR and stable margins of 25-26%. Multiples leave room for re-rating if FY27 is delivered.

7.2 Opportunities at Current Valuation

US-Regulated Market: Strong positioning with 70 approved ANDAs, DEA/BAA compliant Atlanta facility, and ~60–70% US business anchored in government contracts & controlled substances — providing sticky revenues and tariff insulation.

Launch-Led Growth: Visibility of 30+ ANDA launches annually and steady ramp-up of CDMO/CMO contracts (27 commercialized, 53 in pipeline) underpinning growth momentum.

Emerging Markets Turnaround: With 308 approvals & 719 filings, EM profitability is improving (margins from ~7% → double digits by FY27) as the mix shifts to CIS/LATAM/SE Asia.

New Growth Engines: Branded Generics scaling rapidly in India (target pan-India by FY26 end), and injectables capex (US facility) positions SPL for a high-margin vertical from FY27–28.

Valuation Comfort: FY27E P/E of 18× and EV/EBITDA of ~17×, in line with mid-cap pharma peers but with superior growth visibility (20–30% CAGR), leaving scope for re-rating.

7.3 Risks at Current Valuation

Execution Risk: Scaling Branded Generics pan-India and commercializing injectables (FY27–28) requires flawless execution; delays could push back growth.

Working Capital Intensity: Despite PAT growth, FY25 saw negative operating cash flows; sustained strain could limit free cash flow generation.

Regulatory Dependence: Heavy reliance on USFDA/DEA compliance for Atlanta facility; any adverse inspection outcome is a material risk.

Emerging Market Volatility: Profitability still low (~7% in FY25); geopolitical and currency risks in EM could impact margin expansion.

Concentration: ~65% of revenues from Regulated markets; while a strength, it also exposes SPL to US generics pricing pressures and competitive intensity.

Help your group stay ahead. Share now!

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer