Senco Gold Q1 FY26 Results: PAT Up 104%, On-track to FY26 Guidance

Revenue guidance of ~20% growth in FY26, supported. Valuations provide upside opportunity in growth momentum continues in FY27 but gold price volatility is a risk

1. Jeweler — Gold and Diamonds

sencogoldanddiamonds.com | NSE: SENCO

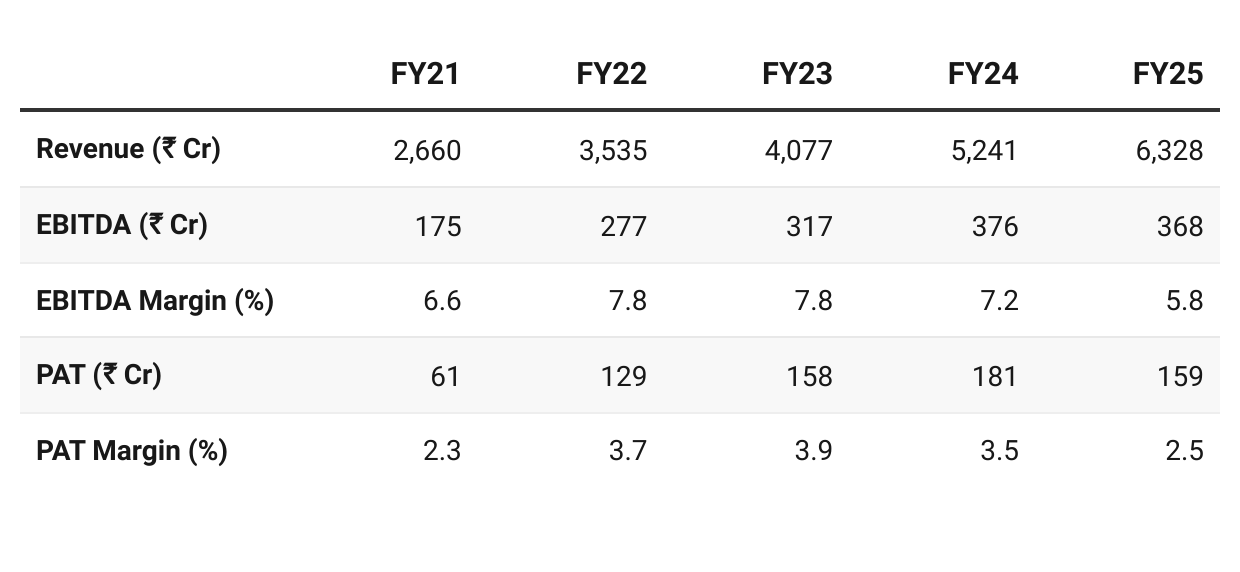

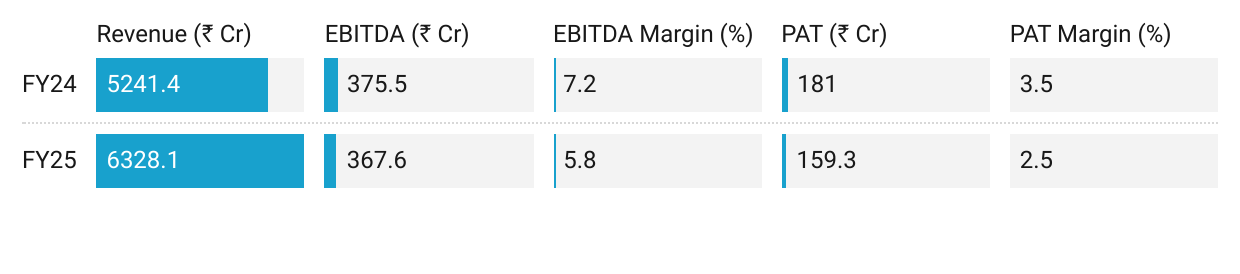

2. FY21–25: PAT CAGR 27% & Revenue CAGR 24%

3. FY25: PAT up 167% & Revenue up 71% YoY

Underlying Growth: Despite reported margin compression, core performance was strong — adjusted EBITDA/PAT grew double digits.

Resilient Demand: FY25 was supported by wedding and festive demand and increasing contribution from studded jewellery.

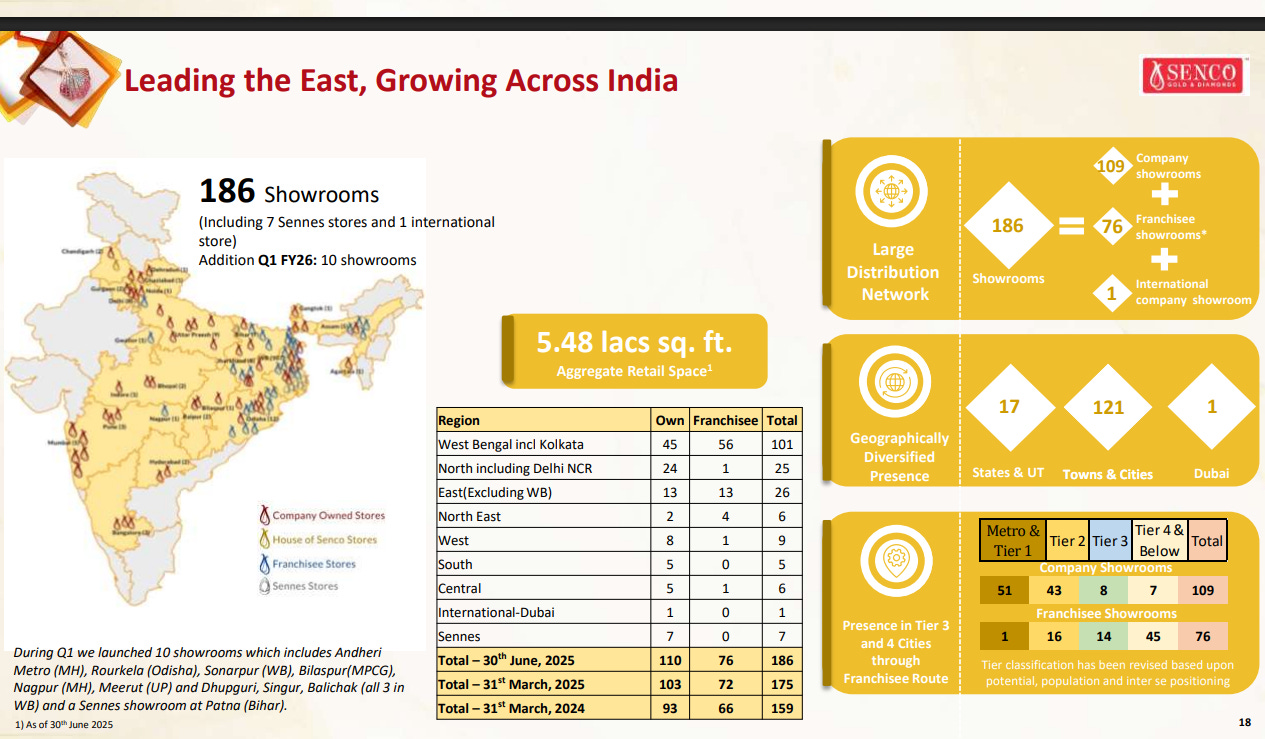

Expansion Strategy: Aggressive franchise-led growth continues to drive revenue, with focus on Tier II/III markets.

Margins: Management acknowledged short-term margin pressure but guided for stable-to-improving profitability in FY26 as studded jewellery mix rises further.

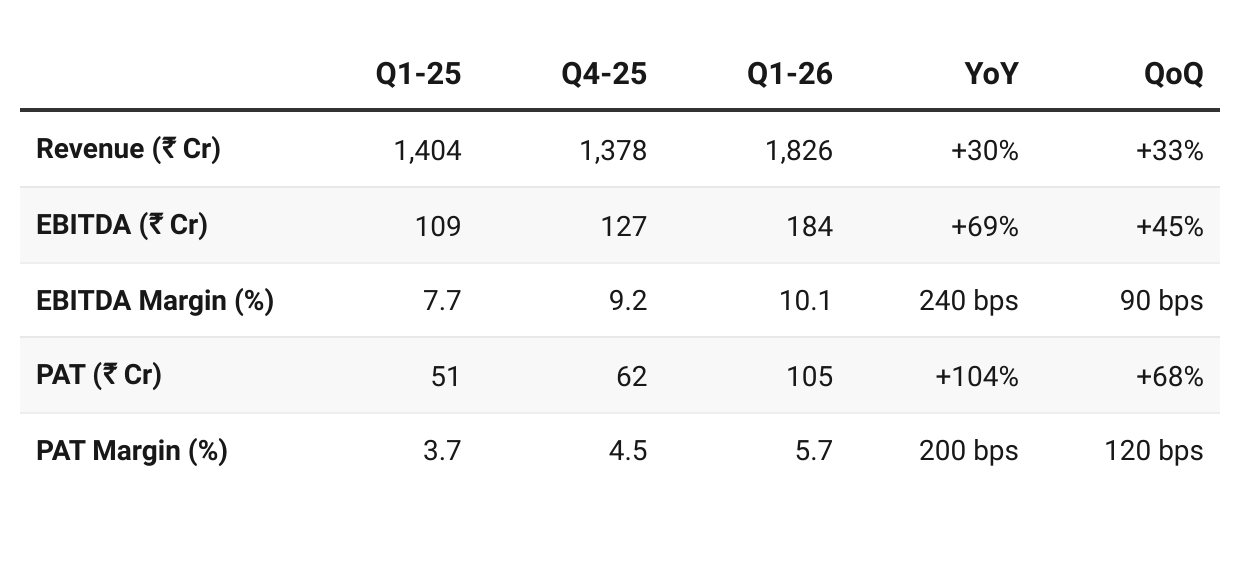

4. Q1-26: PAT up 104% & Revenue up 30% YoY

PAT up 68% & Revenue up 33% QoQ

Growth: Demand for wedding jewelry and rising share of light-weight daily wear and studded jewelry.

Q1 FY26 saw retail revenue growth of upward of 28% and same-store sales growth (SSSG) of upward of 19%.

Margin expansion driven by premiumisation (studded jewelry mix) and better operating leverage.

Added 6 new showrooms in Q1 (5 franchisee + 1 company-owned), taking total showroom count to 199.

Franchise-driven expansion continues to support asset-light growth.

Omni-channel platform contributed to incremental sales, particularly in smaller towns.

Q1 FY26 was a strong quarter with 15% revenue growth, 28% EBITDA growth, and 33% PAT growth, confirming the momentum in studded jewellery and franchise-led expansion.

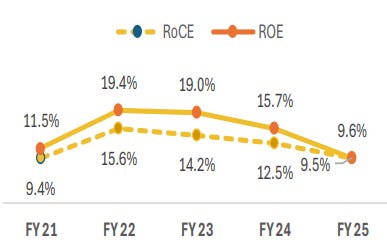

5. Business Metrics: Return Ratios — Impacted by Scaling

ROE & ROCE movement due to higher Pan India expansion

In 3 to 4 years, it will inch back to 17% to 18%.

6. Outlook: 20% Growth in FY26

6.1 FY26 Guidance — Senco Gold

~20% revenue growth with improving margins in FY26

Growth:18% to 20% growth for the whole financial year shall continue to remain as we cross quarter 2, move on to quarter 3, have the Dhanteras season and experience it and how consumers are behaving on it. We will be in a better position to up our guidance. But for now, I think that we should all aim for looking at a guided number of a 20% growth.

Margins: EBITDA of anywhere between 6.8% to 7.2% and our endeavour to achieve a PAT of 3.5% to 3.7% shall continue to remain.

7% EBITDA should be a conservative way of looking at the full year guidance. And as we progress with the year, we will keep on updating you.

Q2-26 outlook: Growth compared to last Q2, this particular Q2 will again remain in the range of 18% to 20%, maybe 16% to 18% as on-date, if you look at it. And going forward, we are all planning for the Q3. We have the Durga Puja, the festivities starting from September.

The management will be in a "better position to up our guidance" after Q3 and the Dhanteras season.

Store Expansion: )pen 20 stores.

10 owned stores + 10 franchisees

Internal efforts are to open more franchisee stores.

Hope to open 11 or 12 franchisees instead of 10.

Factors and Strategies Influencing the Outlook:

Diamond Jewellery: +35% volume, +50% value in Q1 FY26; stud ratio up to 11% (target 15%). Each +1% in stud ratio → +20–30 bps EBITDA margin. Rising diamond prices seen as a tailwind.

Making Charges: Raised selectively to offset higher gold loan rates; increases retained, boosting profitability.

Hedging: Q1 at 55–60% (vs 75–80% last FY); policy 50–80%. Lower hedging cut margins by 100–120 bps in Q1, but impact seen as temporary.

Lightweight Jewellery: Focus on 9k/14k/18k pieces for younger buyers; avg. ticket ₹50–60k. 9k jewellery (₹3,500–3,800/gm) gaining traction; margins higher when studded.

Old Gold Exchange: ~40% of sales vs 25% two years ago, supporting demand despite liquidity constraints.

Efficiency: Store-level stock/design optimization to offset high gold prices and lower average ticket sizes.

Market Shift: Ongoing transition from unorganized to organized jewellery players remains a structural growth driver.

Outlook Beyond FY26:

Store Expansion: Open 18–20 stores annually, funded by profits and debt.

Franchise Focus: Shift mix to 65–70% franchisee, 25–30% owned in 2–3 years to improve liquidity and ROCE metrics; challenge is finding capital-ready partners.

Regional Strategy: Expand deeper in Eastern & Northern India, avoiding direct South India competition.

Potential Melorra Acquisition: Strategic to capture younger, digital-savvy buyers (esp. 9-carat jewelry); talks ongoing.

6.2 Q1 FY26 Performance vs FY26 Guidance

Revenue Growth

Strong beat in Q1; management confident of ~18–20% full-year growth, with a muted Q2-25

A festive Q3 (Durga Puja, Diwali, Dhanteras) expected to be a key driver.

EBITDA Margin

Q1 FY26: EBITDA margin 10.1% (vs 7.7% YoY). vs Guidance: 6.8–7.2% for FY26

Assessment: Q1 margin materially above guidance. Management cautious, attributing this to temporary hedging/operational factors. Sustainable full-year margins expected near 7%.

Store Expansion

Q1 FY26: 6 new stores (5 franchisee, 1 owned) vs plan of 18–20 in FY26.

On track to meet guidance; franchisee-led growth remains focus, with potential to exceed 20 stores.

Product Mix / Strategic Levers

Q1 FY26: Diamond jewellery +35% volume, +50% value; stud ratio >11% (vs 9–9.5% last year).

Guidance: Target stud ratio ~15% medium term; every +1% adds 20–30 bps EBITDA margin.

Assessment: Positive trajectory, studded jewellery and lightweight categories driving margin tailwinds.

Working Capital / Inventory

Guidance: Maintain adequate liquidity, balance sheet strength while funding expansion.

Assessment: Investment in inventory consistent with growth ambitions; no red flags.

Verdict: Q1 FY26 performance on-track to deliver management’s FY26 guidance, with a possibility of upgrades

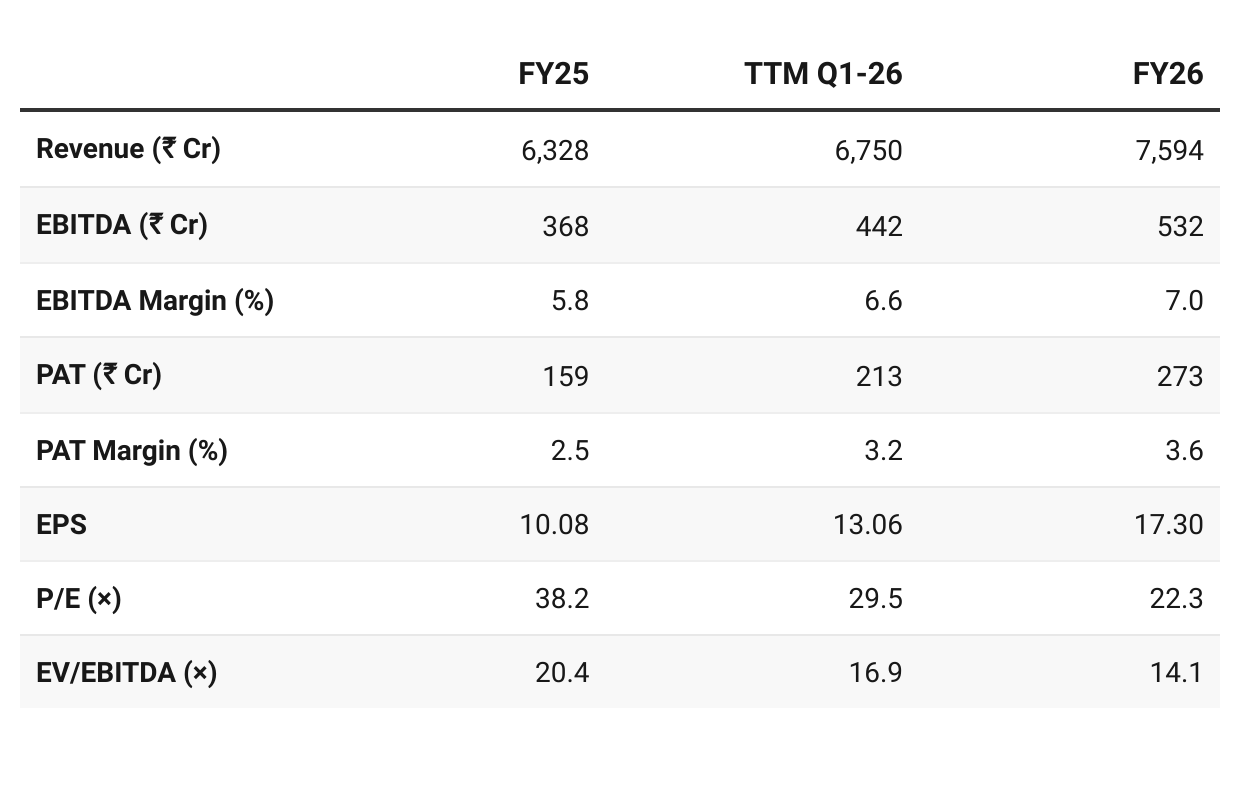

7. Valuation Analysis

7.1 Valuation Snapshot — Senco Gold

CMP ₹385; Mcap ₹6303.15 Cr

Revenue, EBITDA Margin, PAT Margin based on mid-point of guidance range.

Valuations: Rich on FY25 numbers, but look reasonable on FY26 forward multiples with P/E at 22× and EV/EBITDA at 14×.

FY25 vs FY26: Valuations appear rich on FY25 numbers but reasonable on FY26 forward metrics (P/E ~22×, EV/EBITDA ~14×).

Guidance Upside: Management has indicated potential upward revision to growth guidance post Q3, which could improve valuation comfort.

FY27 Outlook: If ~20% growth momentum sustains into FY27, valuations could turn attractive and open room for a rerating.

7.2 Opportunity at Current Valuation

Guidance Upside: Management has hinted at possible guidance upgrades post-Q3, supported by strong Q1 momentum.

Product Mix Tailwinds: Rising studded jewelry contribution and growing adoption of lower-carat gold enhance margins and broaden customer reach.

With this high gold price, 18-carat, 14-carat, 9-carat, these are the future, and we need to focus, whether be it in diamond Jewellery or plain gold Jewellery, so that we can continue to have the younger generation coming and buying from Senco or people who have a lower ticket size can come and buy from our brand.

Valuation Comfort Ahead: If ~20% historic growth momentum sustains into FY27, valuations could look increasingly attractive and support a rerating.

7.3 Risk at Current Valuation

Gold Demand Pressure: High gold prices continue to weigh on plain gold jewelry volumes.

Hedging Volatility: Current gains from lower hedging could reverse, negatively impacting margins in volatile periods.

Execution Challenges: Scaling the franchise model requires reliable partners; execution missteps could delay expansion.

Competitive Intensity: Strong regional competition, particularly in North and East India, may limit market share gains.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer