Salzer Electronics: PAT growth of 107% & revenue growth of 23% for H1-25 at a PE of 30

Revenue CAGR of 40% for FY24-26. FY25 guidance of 20%+ revenue growth & EBITDA growth of 30%. Outlook for doubling revenue in 4 years. Potential to add Rs 1,500 cr revenue per year from smart meters.

1. Industrial Switchgears, Wires & Cables & Energy management business

salzergroup.net | NSE: SALZERELEC

Largest manufacturer of Cam Operated Rotary Switches – Market leader with 25% share

2. FY20-24: PAT CAGR of 16% & Revenue CAGR of 20%

3. FY23: PAT up 76% & Revenue up 32%

4. FY24: PAT up 19% & Revenue up 12%

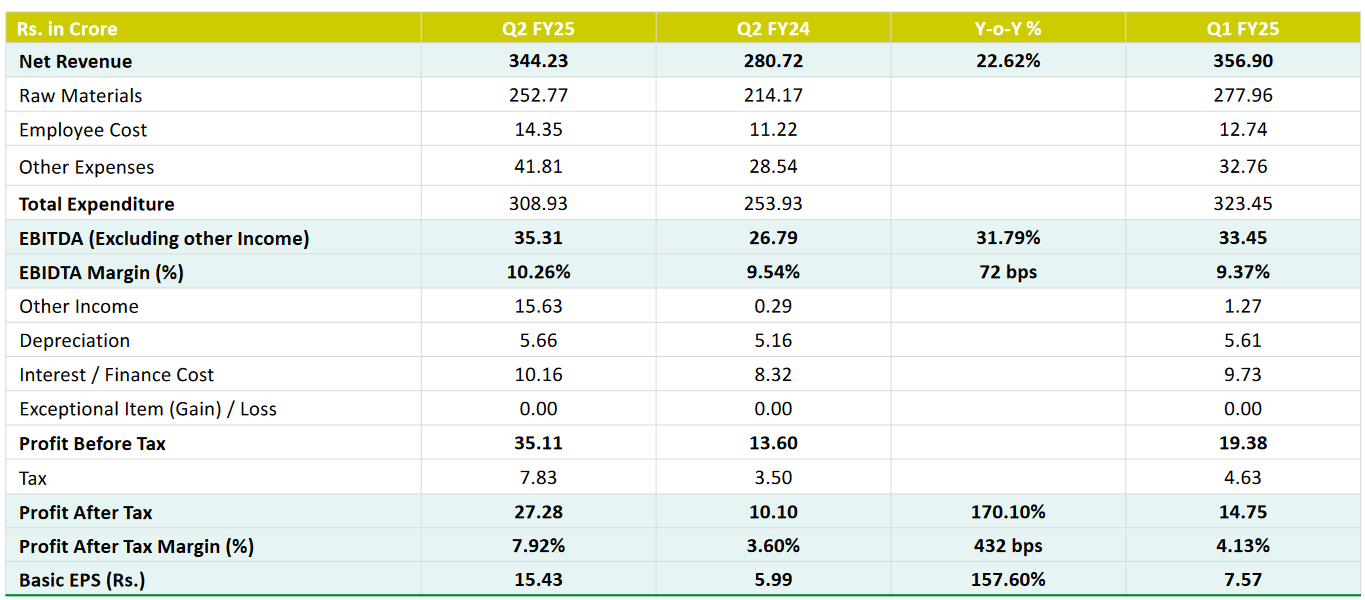

5. Q2-25: PAT up 170% & Revenue up 23% YoY

The other income includes profit on sale of shares of our subsidiary, Kaycee Industries Limited.

So even without that, our PAT will be at INR13.5 crores, which is still a 33.5% growth compared to last quarter.

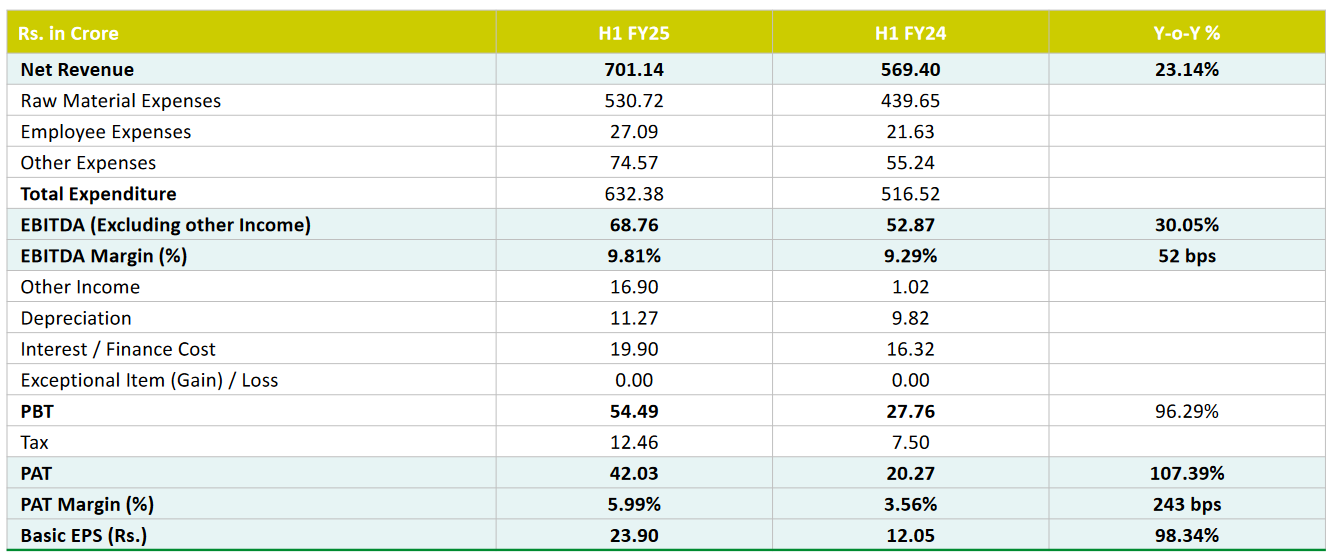

6. Strong H1-25: PAT up 107% & Revenue up 23%

7. Business metrics: Improving return ratios

8. Strong outlook: Revenue growth of 20%+

i. FY25: Confirming guidance of 20%+ revenue growth

We already mentioned in last quarter, we are definitely expecting to grow between 20% and 23% in the top line as well as in the bottom line. It looks like I think we are in line with that projection as of now.

ii. FY25: EBITDA growth of 30%

Revenue growth of 20% with EBITDA margin expanding from 10% to 11% implies an EBITDA growth of 30%. H1-25 EBITDA growth is in line with the projections.

Yes, excluding top meter, EBITDA margins, we have improved to around 70 basis points this year compared to last year. So we expect this to go up by another 1 percentage point in the coming year.

iii. FY24-26: Revenue CAGR of 40% with margin expansion

FY26 revenue of Rs 2,300 cr (1600+700) is a 40% CAGR over the FY24 reveneu of Rs 1166 cr

FY26, we anticipate robust revenue growth, projecting a 20% increase in our existing businesses, aiming to reach close to around INR 1,600 crores in total revenue. The Smart Meter segment alone is expected to contribute an additional INR 700 crores approximately,

Targeting a margin of at least 11% EBITDA by FY26 as we drive operational efficiencies across divisions.

iv. FY24-29: Potential to add Rs 1,500 cr revenue per year

The Smart Meter facility will add incremental revenues starting from FY25 with Rs 7500 cr incremental revenue over the next 5 years

This year, Salzer Electronics achieved noteworthy milestones in product development. Most notably, we successfully created a Smart Meter facility and received BIS certification.

The current smart metering manufacturing capacity of 4 million units per year, when used fully, could result in revenues of Rs.1,000 crore

Once this capacity is completely utilized, the company could go in for doubling of capacity, to around 80 lakh meters per year.

v. Doubling in 4 years: 26% revenue CAGR till FY27

On doubling SALZERELEC: I'm confident that we will be able to do this definitely in 4 years. But if things work out well, yes, maybe we can do this one more year earlier.

9. PAT growth of 107% & revenue growth of 23% in H1-25 at a PE of 30

10. Hold?

If I hold the stock then one may continue holding on to SALZERELEC

The performance of SALZERELEC has not been exciting in FY24. The guidance for 20%+ revenue growth & 30% EBITDA growth in FY25 provides a reason to continue in the stock. Management is confident of achieving the guidance after H1-25 is in line with guidance.

The revenue CAGR of 40% for FY24-26 and doubling revenue in 4 years with margin expansion is a reason to stay in for the ride.

The real excitement in SALZERELEC is on account of Rs 7500 cr incremental revenue to be added over the next five years on account of smart meters. smart meters will not only add to incremental revenue but add incremental margin of 12-15% from FY25 compared to the FY24 EBITDA margin of 10%

EBITDA Margin of Smart Meters Business: I think definitely, it will be between 12% and 15% for the first year.

The strong revenue and margin outlook is dependent of Rs 600 cr of revenue kicking in from smart meters in FY26 and revenue from EV chargers coming in from FY27. One needs to keep a watch on delays in the rollout of smart meters and EV chargers.

'27 can be a good year for EV chargers. Though in FY '26, we might want to see some revenues, but it's not going to be significant enough in this INR 2,300 crores growth projection.

11. Buy?

If I am looking to enter SALZERELEC then

SALZERELEC has delivered PAT growth of 107% and 34% of organic PAT growth with revenue growth of 23% in FY24 at a PE of 30 which makes the valuations fully priced in the short term.

The guidance of SALZERELEC to deliver EBITDA growth of 30% in FY25 on the back of revenue growth of 20% with EBITDA margin expansion from 10% to 11% at a PE of 30 makes the valuations acceptable over the medium term

Guidance for revenue CAGR of 40% for FY24-26 with margin expansion at a PE of 30 which makes the valuations attractive from a longer term perspective.

Guidance for doubling in 4 years with a revenue CAGR of 26% with margin expansion at a PE of 30 which makes the valuations attractive from a longer term perspective.

The outlook of incremental revenues and incremental margins provides opportunity in SALZERELEC provides opportunity in the stock over the longer term. One needs to keep a watch on the execution as FY26 will be the first year of the smart meter business and FY27 for EV chargers.

Previous coverage of SALZERELEC

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer