Sai Silks (Kalamandir) Q2 FY26 Results: PAT Up 69%, Upward Revision of FY26 Guidance

Guidance of 20% revenue growth with improving margins in FY26. 15% growth for the next 3-5 years with improving margins available at undemanding forward valuations

1. Ethnic Apparel Retailer

sskl.co.in | NSE: KALAMANDIR

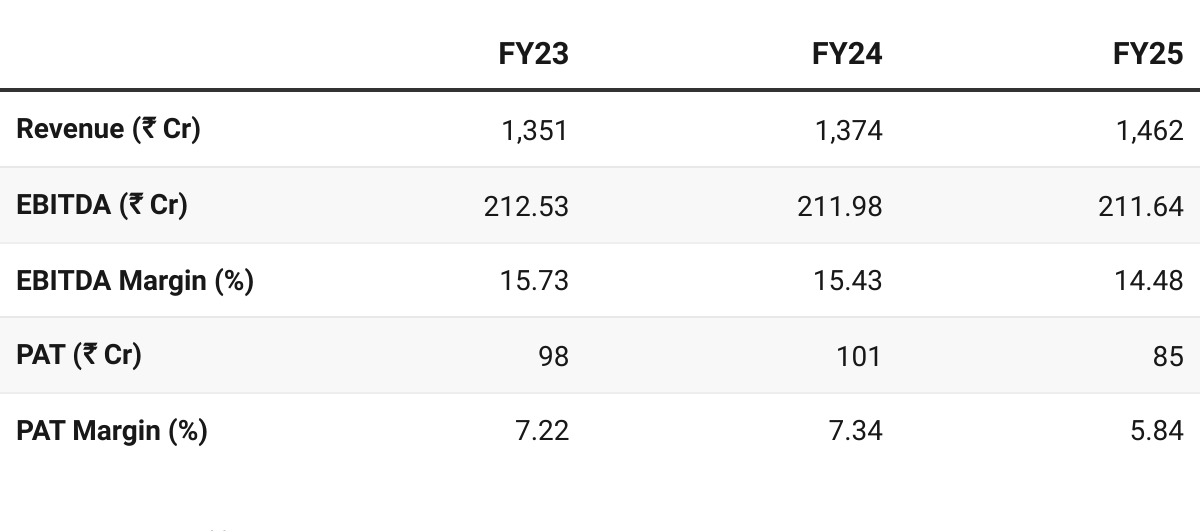

2. FY23-25: Weak Performance — Declining profitability

3. FY25: PAT down 15% & Revenue up 6% YoY

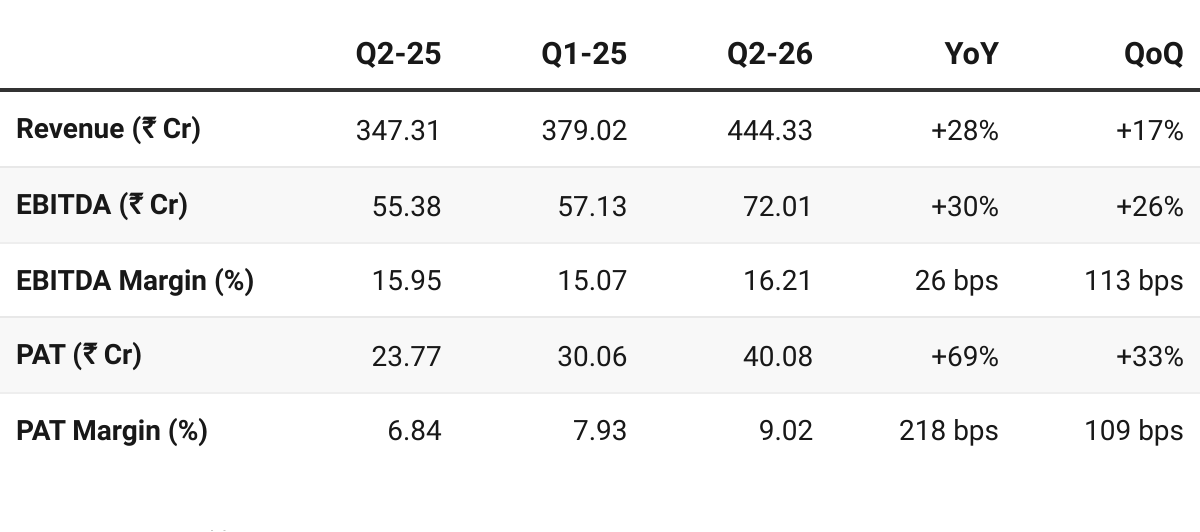

4. Q2-26: PAT up 69% & Revenue up 28% YoY

PAT up 33% & Revenue up 17% QoQ

Revenue from Operations: Driven by early festive & wedding demand, stronger footfalls, and new stores coming online.

EBITDA: Expansion in gross margins and store productivity gains helped operating leverage. Stable gross margins; better mix from premium and semi-premium saree formats.

Same Store Sales Growth (SSSG): 17.5% — Indicates healthy recovery in footfalls and wedding/festive buying.

5. H1-26: PAT up 171% & Revenue up 34% YoY

Varamahalakshmi Silks (Premium): Continued to be the growth driver; improving productivity (~₹35,000/sq.ft) with target of ₹45–50k in next 2 quarters.

Valli Silks: New, digital-first format — smaller (3,000–3,500 sq.ft), ~25 % lower capex, faster expansion; strong consumer traction in early stores.

Kalamandir & Mandir: Stable performance; selective upgrades & conversions to Wi format to align with changing consumer trends.

KLM Fashion Mall: Signs of recovery — Q2 sales ~₹125 Cr; product mix tilted more toward ethnic value fashion; digital vouchers boosted conversions.

6. Business Metrics: Reflecting Weak Past Profitability

7. Outlook: ~20% Revenue Growth in FY26

7.1 Management Guidance and Future Outlook

Original Guidance: Given that this is a normalized year, 15% growth year-on-year should be possible, not just for this year, but the next 3 to 5 years also, this is the kind of growth we should be able to expect.

Revised Guidance: In the last year in the second half we did about 850 crores we should be doing in the range of about 925 or so which will on a total come to approximately 1750 or so and that would end up anywhere between 18 to 20% on a overall growth

FY27 EBITDA Margin: And our target for FY ‘27 should be in the range of about 20%.

FY27 PAT Margin: You should be able to see a good number uh I mean a PAT of about 8.5 to 9% kind of a pat number overall for the next year

7.2 H1 FY26 Performance vs FY26 Guidance

Revenue and Profitability On Target

Revenue : Upward revision in revenue growth form 15% to ~20% — indicating strong momentum based on Q3 wedding/festive demand.

Margins: EBITDA 15.7 % and PAT 8.5 % are in-line, showing faster-than-expected operating leverage from new-store maturity.

Expansion: Retail area and store count targets nearly achieved mid-year; H2 to focus on optimizing productivity rather than aggressive new openings.

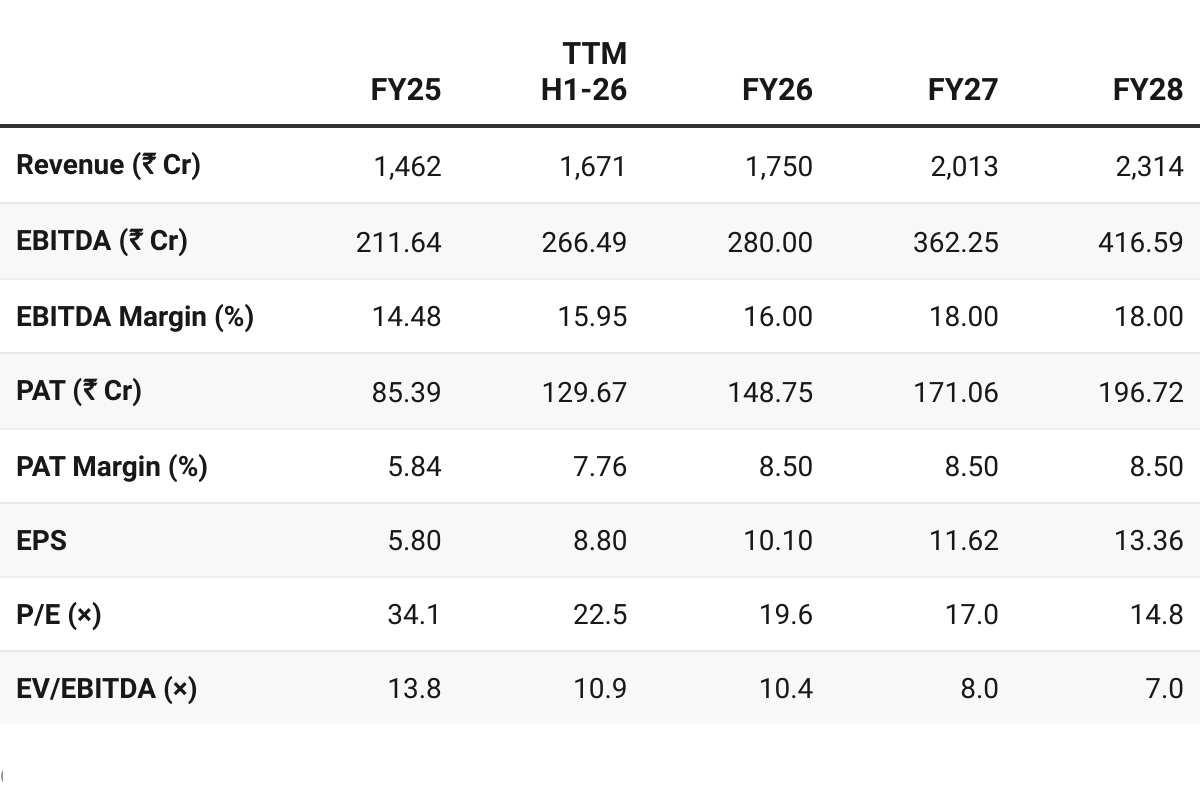

8. Valuation Analysis

8.1 Valuation Snapshot

CMP ₹197.8; Mcap ₹2,947.94 Cr

P/E: 23× → 19× (FY26E) → 15× (FY28E)

Forward PE looks quite reasonable for retailer delivering 15% growth

Create opportunity for slight re-rating.

EV/EBITDA: 10.4× (FY26E) → reasonable for a retailer with 16 % margins, 18–20 % growth

Opportunity for a significant re-rating given the forward multiples of FY28

KALAMANDIR generated ₹158.05 Cr of free cash flow in H1 FY26

Even with muted profitability in FY25 KALAMANDIR generated ₹54.25 Cr of free-cash flow

Available at free cash-flow yield of 5.36% (not annualized) on current market price which makes the valuations very attractive.

The outlook for H2 FY26 is strong and hence accounting for the capex planned in FY26 KALAMANDIR could deliver a strong free cash flow performance

See, I told you there is already out of IPO proceeds, there are INR200 crores available in the bank, which we will be spending for expanding to the extent of 60,000 square feet that we are planning this year.

8.2 Opportunity at Current Valuation

Re-rating Potential

Re-rating potential: At ~19× FY26E P/E and 10× EV/EBITDA, trades at a discount to retailers (explained by the weak performance for FY23-25). Sustained execution as per guidance could drive a significant re-rating and create an opportunity in the stock.

Conservative valuations: Valuations have been done at lower end of the guided 8.5-9% PAT margin guidance, leaving room for a positive surprise if the management executes strongly.

Structural tailwinds: Ethnic-wear market is consolidating rapidly toward organized retail, aided by rising disposable income, premiumization, and a revival in wedding/festive consumption.

The low hurdle of undemanding forward valuations in an environment of strong industry tail-winds create the opportunity

8.3 Risk at Current Valuation

Execution Track-record

FY23-25: The execution track-record for FY23-25 has been weak.

H1-26 has been strong but the momentum has to be sustained for FY26 and beyond.

Execution as per guidance is paramount

Once can be confident about a strong FY26 but one needs to keep watch on FY27 execution even though the management has promised 15% growth the next 3 to 5 years

Routine typical risks which exist for a retailer also impact KALAMANDIR

Seasonality & festive dependence: Over 50 % of annual sales occur in H2 during wedding/festival months.

Execution risk in rapid expansion: Rollout (8–10 % area growth p.a.) may stretch management bandwidth.

Margin pressure from competition — Rising presence of regional value chains and discount platforms may trigger price wars.

Inventory & working-capital intensity: — High festive stocking can inflate inventory days and impact profitability.

Concentration risk (South India) — Majority of stores located in 4 southern states.

Adjacent-state pilots (Maharashtra, Odisha, Kerala) from FY27 will broaden footprint.

Previous coverage of KALAMANDIR

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer