Repco Home Finance: PAT growth of 18% & Net Interest Income growth of 8% in Q1-25 at a PE of 8

Guiding 20-25% PAT growth in FY25. On track to deliver FY25 guidance of AUM growth. FY24-27 AUM CAGR of 14% for REPCOHOME. Available at an attractive P/B of 1.2

1. Why is REPCOHOME interesting

repcohome.com | NSE : REPCOHOME

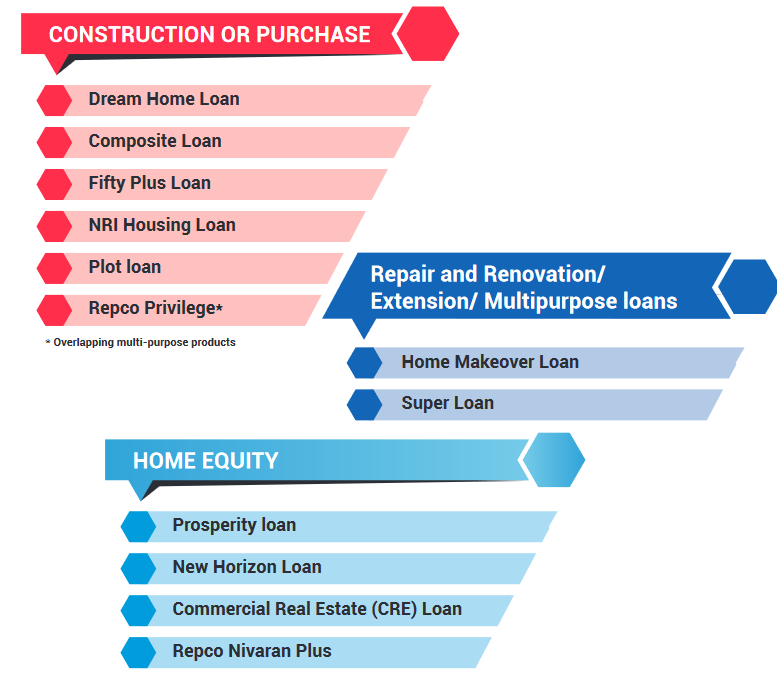

Very attractive valuations in terms of PE and P/B for a company guiding for 20-25% PAT growth in FY25. Roadmap of 14% AUM growth CAGR for FY24-27 provides opportunity from a longer term perspective. 2. Housing Finance Company

The Company is present in 2 segments – Individual Home Loans and Home Equity. The Company provides a variety of tailor-made home loan products to individual borrowers

3. FY20-24: PAT CAGR of 9% & Net Interest Income CAGR of 7%

PAT growth picked up in FY22: CAGR of 44% for FY22-24

4. FY23: PAT up 55% & Net Interest Income down 1%

5. Strong FY24: PAT up 33% & Net Interest Income up 17%

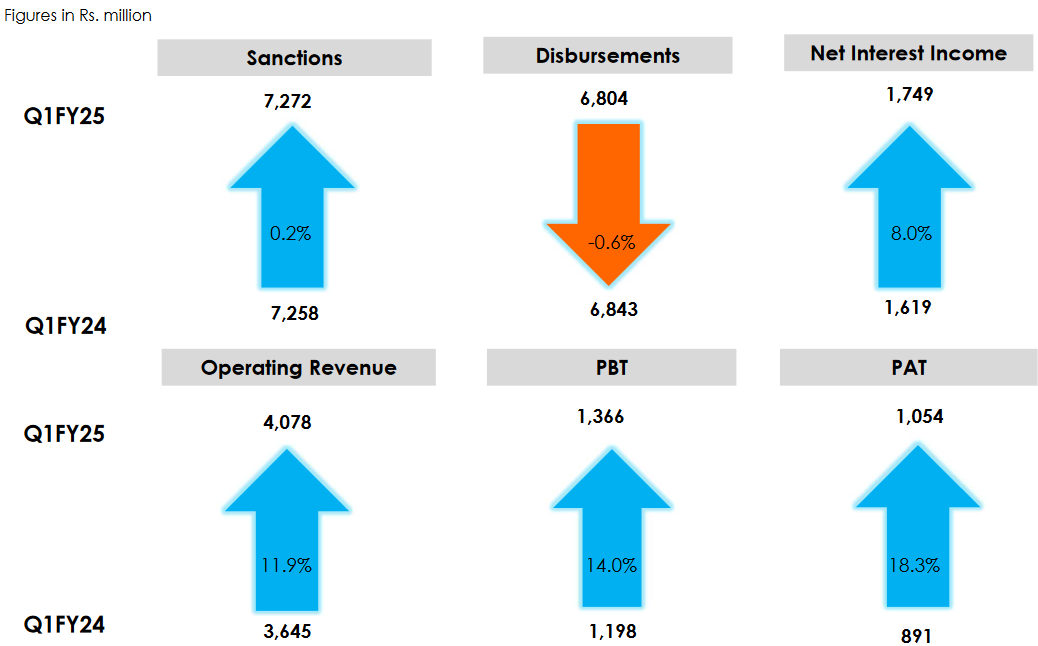

6. Q1-25: PAT up 18% & Net Interest Income up 8% YoY

PAT down 2% & Net Interest Income up 1.5% QoQ

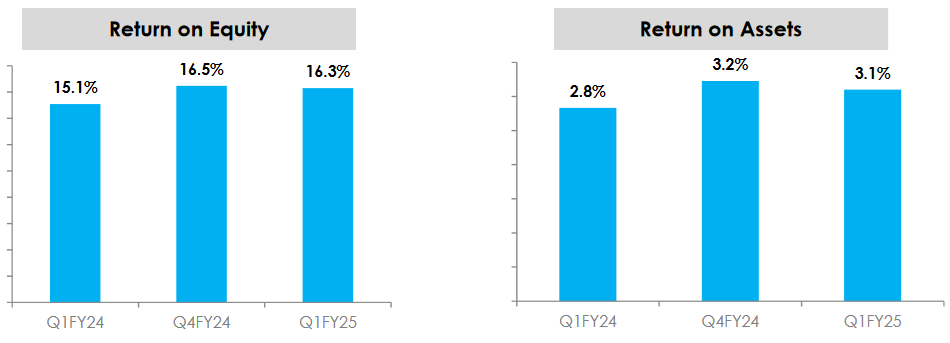

7. Business metrics: Improving return ratios

FY25 guidance

ROA should be anywhere around 3%. And ROE should be around the same. We were around 15.8%. Hopefully, we should be able to maintain around the same range.

8. Outlook: 20-25% PAT growth in FY25

i. FY25: 11% AUM growth

AUM expected to grow by 11% from Rs 13,513 cr as of FY24 end to Rs 15,000 cr by FY25 end.

the company is confident of reaching a disbursement of INR3,600 crores to INR3,800 crores, an AUM of INR15,000 crores, stage 2 numbers between 7% and 9% and GNPA below 3% by March '25.

ii. FY25: 20-25% PAT growth

While there may be a dip in our NIM and spread percentages as we plan to move a relatively price-demanding clientele, we are confident of maintaining our profitability growth of 20% to 25%.

have an advantage of the additional provision that we have. So that will help us in meeting this 20% to 25% of profit target.

iii. FY27: Roadmap to 14% AUM growth CAGR

AUM expected to grow from Rs 13,513 cr as of FY24 end to Rs 20,000 cr by FY27 at a CAGR of 14%

3-year broad road map of reaching an AUM of at least INR20,000 crores by 2027, with an addition of 40 branches per year.

The GNPA is expected to grow below 2% by then

9. PAT growth of 18% & Net Interest Income growth of 8% in Q1-25 at a PE of 8

10. Do I stay?

If I hold the stock then one may continue holding on to REPCOHOME

Based on Q1-25 performance, REPCOHOME management is confident to meet its guidance for FY25 in terms of AUM growth and PAT growth

We do not want to change whatever is the projection that we have already given you.

The outlook for profitability growth of 20% to 25% in FY25 provides a reason to continue with REPCOHOME

REPCOHOME is expecting a a stronger Q2 and Q3 compared to Q1-25

We are sure that in the second and third quarter we will improve.

11. Do I enter?

If I am looking to enter REPCOHOME then

REPCOHOME has delivered PAT growth of 18% & net interest income growth of 8% in Q1-25 at a PE of 8 which makes valuations quite reasonable.

Outlook for bottom-line growth of 20-25% for FY25 at a PE of 8 makes the valuations quite reasonable

Outlook for AUM CAGR of 14% for FY24-27 at a PE of 8 makes the valuations quite reasonable from a longer term perspective.

With a market cap Rs 3,414 cr against a net worth of Rs 2,770.9 cr as of Q1-25 end implies that REPCOHOME is available a price to book of 1.2 which makes the valuations quite attractive

While REPCOHOME is guiding for GNPA below 3% by FY25 and GNPA below 2% by FY27, one needs to keep a watch on asset quality.

Previous coverage of REPCOHOME

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer