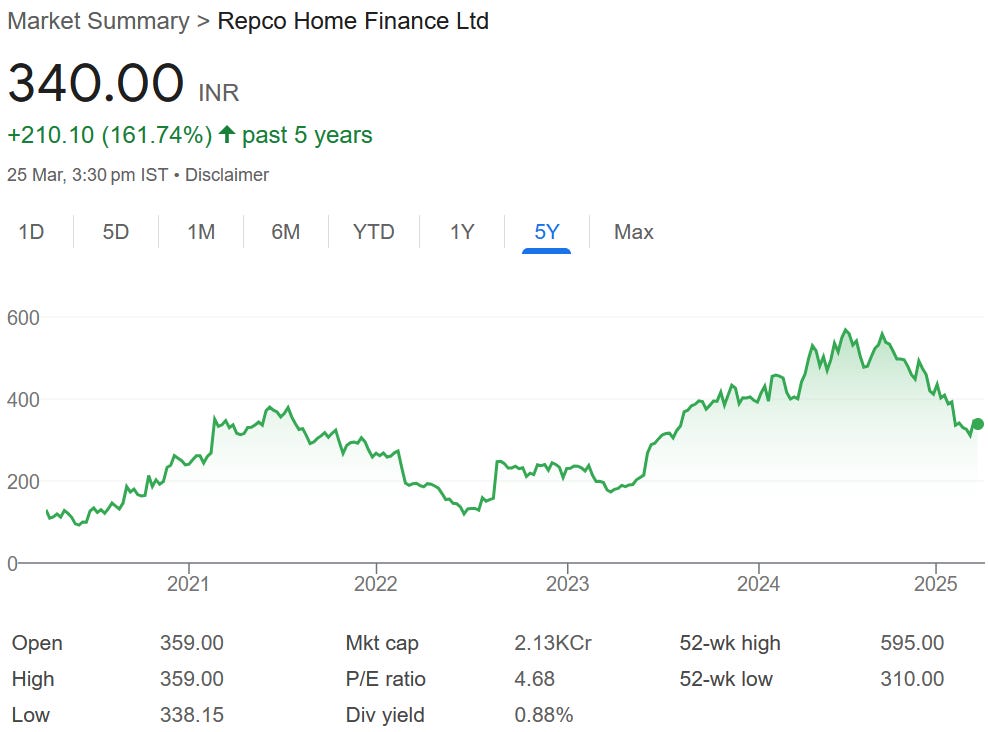

Repco Home Finance: PAT growth of 13% & Net Interest Income growth of 6% in 9M-25 at a PE of 4.7

High-reward contrarian bet with a strong margin of safety where hurdle for re-rating is low. For a 17% AUM CAGR of FY25-27 with strong profitability the valuations at a P/B of 0.66 are attractive.

1. Housing Finance Company

repcohome.com | NSE : REPCOHOME

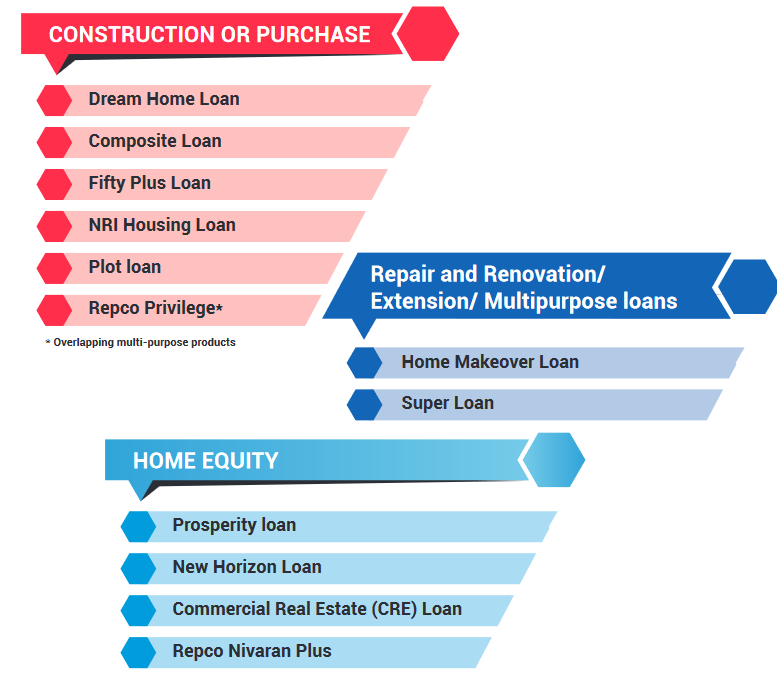

The Company is present in 2 segments – Individual Home Loans and Home Equity. The Company provides a variety of tailor-made home loan products to individual borrowers

2. FY20-24: PAT CAGR of 9% & Net Interest Income CAGR of 7%

PAT growth picked up in FY22: CAGR of 44% for FY22-24

3. Strong FY24: PAT up 33% & Net Interest Income up 17%

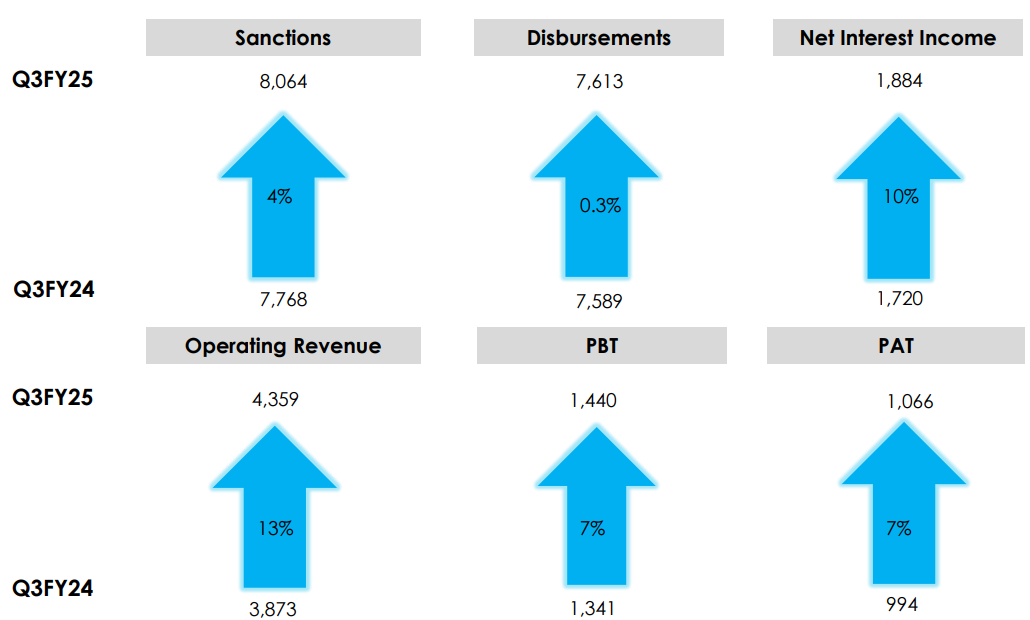

4. Q3-25: PAT up 7% & Net Interest Income up 10% YoY

PAT down 5% & Net Interest Income up 7% QoQ

5. 9M-25: PAT up 13% & Net Interest Income up 6% YoY

6. Business metrics: Improving return ratios

FY25 guidance: ROA should be anywhere around 3%. And ROE should be around the same. We were around 15.8%. Hopefully, we should be able to maintain around the same range.

8. Outlook: 17% AUM CAGR for FY25-27

1. Business Growth & Disbursement

FY25 Disbursement Guidance: Management expects ₹3,300–3,350 crore disbursals organically by March 2025.

Q4 FY25 Target: ₹950–1,000 crore in disbursements.

AUM Target: ₹14,600 crore by March 2025 (vs ₹14,155 crore as of Dec 2024).

Loan mix focus: Strategic push towards home loans (currently 74% of book), in line with NHB expectations, moving away from non-housing loans (home equity).

2. Profitability Metrics

Net Interest Margin (NIM): Held strong at 5.5% in Q3 FY25. Management expects to maintain NIMs, with floating rate loans on both asset and liability sides helping manage interest rate cycles.

Credit Costs: Expected to remain low for FY25 and manageable in FY26. FY25 YTD credit cost was -0.14%.

Return Metrics: ROA at 3.1% and ROE at 14.6% for Q3 FY25. These are expected to stay stable.

3. Asset Quality & NPAs

GNPA is expected to improve to ~₹520 crore by March 2025 (from ₹546 crore in Q3).

Focus on recoveries through mega auctions and OTS (one-time settlement) proposals.

Stage 3 loans are well-provided with a coverage ratio of 61.8%.

Stage 2 loans are being reduced and targeted to be below 10% by March 2025.

4. Growth Strategy

Continued expansion in non-Tamil Nadu states like Karnataka, Andhra Pradesh, Telangana, and Maharashtra.

Aim to have 235 outlets by March 2025 (from 230 currently).

Sales force and DSA channels are now contributing significantly to disbursements (42% via DSA, 25% via sales vertical, 31% branch).

5. Challenges

Growth Headwinds: Karnataka regulatory disruption impacted disbursements (₹50 crore impact estimated). Also, conscious slowdown in non-housing loans to improve portfolio quality.

BT (Balance Transfer) Outflows: ₹100 crore/month in BT outs due to competitive bank rates. However, matched by similar BT in volumes.

Cost of Borrowing: Stands at 8.7%; expected to reduce marginally due to repo rate cuts and new NHB funding (₹150 crore sanctioned).

6. Medium-Term Outlook (FY26 and beyond)

FY26 targets not finalized, but internal discussions suggest a more ambitious disbursement goal.

Management expects structural changes and branch expansions to start yielding tangible loan book growth from FY26 onward.

The company aims for stronger, quality-led growth rather than just volume-driven expansion.

i. FY25: 8% AUM growth

AUM expected to grow by 8% from Rs 13,513 cr as of FY24 end to Rs 14,600 cr by FY25 end.

Going by the current trend, we are likely to surpass INR3,300 crores organically on the disbursement front and an AUM of approximately INR14,600 crores by March 2025.

ii. FY27: Roadmap to 17% AUM growth CAGR

AUM expected to grow from Rs 14,600 cr as of FY25 end to Rs 20,000 cr by FY27 at a CAGR of 17%

3-year broad road map of reaching an AUM of at least INR20,000 crores by 2027, with an addition of 40 branches per year.

The GNPA is expected to grow below 2% by then

9. PAT growth of 13% & Net Interest Income growth of 6% in 9M-25 at a PE of 4.7

10. Do I stay?

If I hold the stock then one may continue holding on to REPCOHOME

REPCOHOME management has delivered a very tepid business performance in 9M-25 and there could be a case to exit it.

However, at P/E of less than 5 REPCOHOME is among the lowest in the NBFC/HFC space.

Core Profitability is Strong with NIM at 5.5%, ROE of 14.6%, low credit cost (negative in FY25 so far).

Even in a tough low growth environment, REPCOHOME is delivering PAT growth

Asset Quality Improving

GNPA declining organically—now at 3.9% with strong provisioning (61.8% PCR).

Very low historical principal write-offs → low capital erosion risk.

The biggest reason to continue with REPCOHOME is the upside optionality in the stock if execution kicks In

Branch expansion, tech infra, and sales force are already built.

If disbursements pick up in FY26, operating leverage could kick in fast.

Even moderate AUM growth + better sentiment = re-rating candidate.

11. Buy?

If I am looking to enter REPCOHOME then

REPCOHOME has delivered PAT growth of 13% & net interest income growth of 6% in 9M-25 at a PE of less than 5 which makes valuations quite attractive.

Outlook for AUM CAGR of 17% for FY25-27 with ROA of 3at a PE of 8 makes the valuations quite reasonable from a longer term perspective.

With a current market cap Rs 2,127.09 cr against a net worth of Rs 3,194.24 cr as of H1-25 end implies that REPCOHOME is available a price to book of 0.66 which makes the valuations quite attractive

While REPCOHOME looks attractive on valuations, but sentiment is weak. REPCOHOME is for value investor comfortable with holding through uncertainty where the hurdle for re-rating is low. This could be a high-risk, high-reward contrarian bet. However, a catalyst (like disbursement pickup or rating upgrade) may be needed for meaningful re-rating.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer