Repco Home Finance: PAT growth of 40% & Revenue growth of 21% in H1-24 at PE of 7

REPCOHOME is on track to meet its guidance of guidance for FY24 along with 18% growth in PAT for FY24. It is available a price to book of around 1

1. Non-Banking Finance Company - Housing Finance Company

repcohome.com | NSE : REPCOHOME

2. FY19-23: No clear growth trajectory

3. Strong FY23: PAT up 55% and Revenue down 1% YoY

4. Strong Q1-24: PAT up 44% and Revenue up 21% YoY

PAT up 7% & Revenue up 7% QoQ

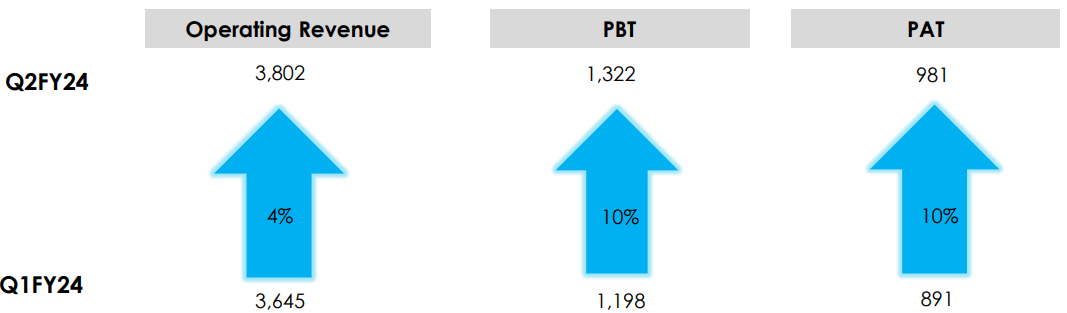

5. Strong Q2-24: PAT up 38% & Revenue up 19% YoY

PAT up 10% & Revenue up 4% QoQ

6. Strong H1-24: PAT up 40% & Revenue up 21% YoY

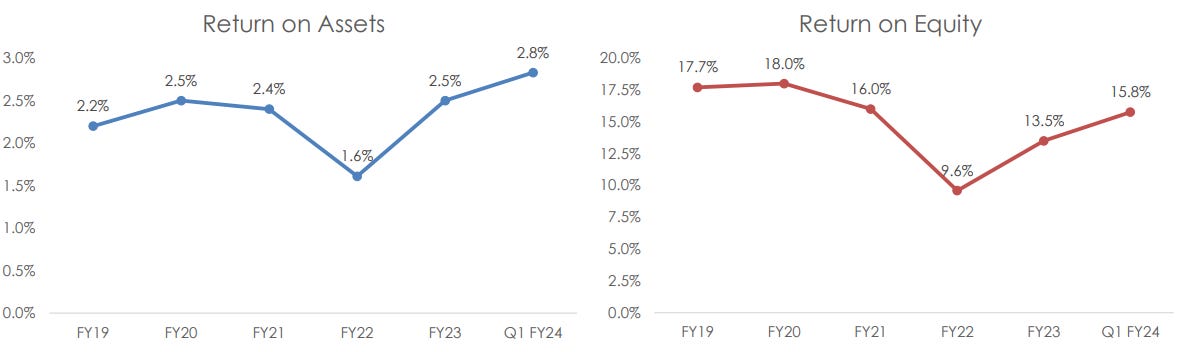

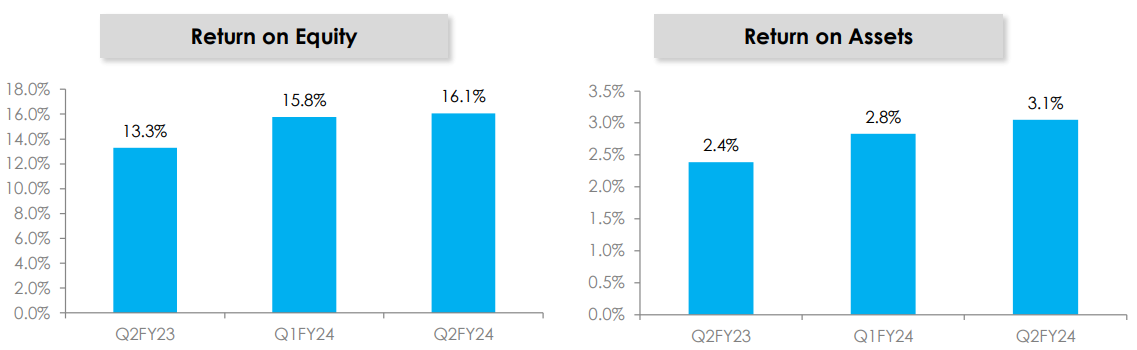

7. Business metrics: Improving return ratios

8. Outlook: 18% PAT growth in FY24

i. FY24: On-track to deliver as per guidance

Guidance:

Way forward, for the next year, we plan to grow sanctions and disbursements by 20%, and achieve an AUM growth of 12% on a conservative basis.

The GNPA numbers are planned to be brought down by at least INR100 crores during FY ‘23-‘24.

Achievement

In the remaining two quarters, our focus would be on taking the growth numbers to the next level and we are quite positive on this

We had planned a reduction of 100 Crores in GNPA for the entire financial year against which we have already reduced 82 Crores in a span of six months.

ii. FY24: On-track to deliver 18% PAT growth

Profit guidance of Rs 350 cr in FY24 implies an 18% growth over the FY23 PAT of Rs 296 cr.

Our profit guidance was 350 Crores for the whole year and we have achieved 187 Crores in the first half.

9. PAT growth of 40% & Revenue growth of 21% in H1-24 at a PE of 7

10. So Wait and Watch

If I hold the stock then one may continue holding on to REPCOHOME

Based on H1-24 performance, REPCOHOME looks on track to deliver the strongest PAT in FY24

On an annual run rate REPCOHOME is on track to deliver as per the guidance set out by the management.

REPCOHOME is in the middle of a strong run. For both the quarters of FY24, REPCOHOME has delivered QoQ growth in PAT.

11. Or, join the ride

If I am looking to enter REPCOHOME then

REPCOHOME has delivered PAT growth of 40% & Revenue growth of 21% in H1-24 at a PE of 7 which makes valuations quite reasonable.

Outlook for bottom-line growth of 18% for FY24 at a PE of 7 makes the valuations quite reasonable.

With a market cap Rs 2594 cr against a net worth of Rs 2477.4 cr as of Q2-24 end implies that REPCOHOME is available a price to book of just above 1 which makes the valuations quite attractive

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Disclaimer

It is an analysis of the company data and not a stock recommendation

Perspectives may change based on evolving understanding of the company.

Focus is on identifying potential stock ideas for long-term market-beating returns.

Content does not constitute explicit stock recommendations.

Investors should conduct thorough stock research and seek professional advice.

Information is for educational purposes and not financial advice or a call to action