Quick Service Restaurant Wars Q3-25: Intense Price Wars, Rapid Expansion and Fight for Profitability

Quick Service Restaurants a High-Stakes Fight for Market Share, Delivery Dominance, and Profitability in India's ₹85,000 Crore QSR Industry

The Quick Service Restaurant (QSR) industry in India has undergone significant transformation, driven by aggressive expansion, intense competition, digital adoption, and shifting consumer preferences. As the sector continues to grow, brands are focusing on value-driven strategies, digital ordering, and delivery efficiency while navigating margin pressures and evolving market dynamics.

Stocks under coverage

Jubilant Foodworks (Domino’s) | NSE:JUBLFOOD | jubilantfoodworks.com

Devyani International (KFC, Pizza Hut, Costa Coffee) | NSE:DEVYANI | dil-rjcorp.com

Westlife Foodworld (McDonanlds) | NSE:WESTLIFE | westlife.co.in

Sapphire Foods India (KFC, Pizza Hut, Taco Bell) | NSE:SAPPHIRE | sapphirefoods.in

Restaurant Brands Asia Ltd (Burger King) | NSE:RBA | burgerking.in1. Growth and Market Expansion

Despite weak consumer sentiment, QSR brands are expanding aggressively, betting on long-term growth and urbanization-driven demand. Brands are focusing on:

Tier-2 & Tier-3 City Penetration: Domino’s, KFC, and McDonald's are expanding into smaller cities where QSR penetration is lower.

Metro Densification: High-street locations, malls, and business districts remain key for premium positioning.

Digital-First Store Models: Self-ordering kiosks, AI-driven order personalization, and drive-thru formats are gaining popularity.

QSR Store Expansion (Q3 FY25)

While store expansion remains aggressive, margin pressures and operational efficiency are critical to sustain profitability.

2. Competitive Intensity and Value Proposition

The Indian QSR landscape is witnessing a battle for consumer loyalty, driven by price wars, menu innovations, and tech-driven engagement.

A. Price Wars & Affordable Meals

McDonald's McSaver Meals: Budget meal bundles targeting value-conscious consumers.

KFC & Pizza Hut Epic Savers: Tiered pricing for individual and family combos.

Domino’s Free Delivery Strategy: Removing delivery fees to encourage direct orders.

B. Premiumization & Innovation

McDonald's McCrispy Range competes with KFC's fried chicken.

Domino’s Cheese Burst & Chicken Feast drive high-ticket purchases.

Popeyes Chicken Sandwich & Wings challenge KFC’s dominance in metros.

C. Digital Transformation & Personalization

70%+ of orders are now digital, with brands investing in app-based exclusive deals & AI-driven recommendations.

Self-order kiosks & QR-based table ordering improve customer convenience.

With increased promotional spending and aggressive pricing, brands must balance growth with profitability.

3. The Rise of Delivery and Aggregators

A. The Dominance of Delivery

40-70% of revenue now comes from delivery, making it the fastest-growing QSR segment.

Domino’s delivery orders grew 24.7% YoY, with a focus on 20-minute delivery.

McDonald's and KFC see 42-50% of revenue from online orders.

B. Aggregators vs. Direct Ordering

QSR brands rely on Swiggy & Zomato for reach but face high commissions (20-30%).

Domino’s removed delivery fees, pushing users toward its own app for profitability.

McDonald's & KFC offer app-exclusive discounts to reduce aggregator dependency.

Popeyes is integrating direct delivery for better control over margins.

C. Future of Delivery

AI-driven logistics: Optimizing routes & reducing wait times.

Hybrid model: Maintaining both aggregator partnerships and in-house ordering platforms.

Increased competition: With Domino’s 20-minute delivery model, aggregators must improve fulfillment speed.

Brands that balance aggregator reliance with direct ordering will gain a long-term competitive advantage.

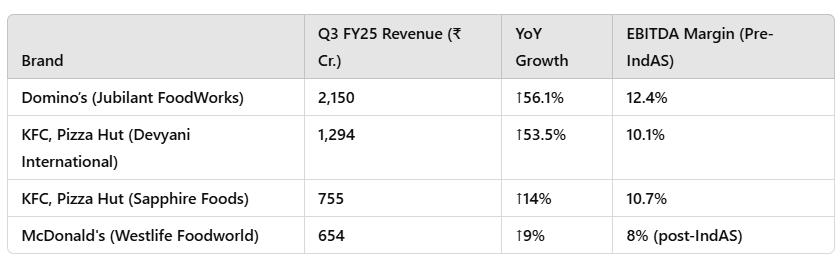

4. Financial Performance & Profitability Pressures

A. Revenue Growth Across QSR Players

B. Margin Pressures Due to:

High input costs: Chicken, dairy, and coffee prices have surged.

Rising operational costs: Real estate & labor expenses remain high.

Promotional spending & discounts: Higher value-driven campaigns have eroded profitability.

Key Takeaway: While revenue growth remains strong, margins are under pressure due to food inflation and discounting strategies.

5. Future Outlook and Industry Trends

A. Opportunities for Growth

Tier-2 & Tier-3 Expansion: Rising disposable income & urbanization.

Tech-Driven Ordering: AI-powered recommendations & dynamic pricing models.

Loyalty Programs & Personalization: McDonald's & Domino’s lead in digital engagement.

B. Challenges & Risks

Profitability vs. Expansion: High store openings but delayed breakeven timelines.

Aggregator Dependency: Brands need to reduce reliance on Swiggy/Zomato for margins.

Inflation Impact: Rising commodity costs may force menu price hikes.

Conclusion: Who Will Win in the Indian QSR Battle?

The Indian QSR industry is at a crucial inflection point. Brands that focus on:

1️⃣ Balancing affordability with premiumization

2️⃣ Optimizing delivery & reducing aggregator reliance

3️⃣ Leveraging AI-driven ordering & personalization

4️⃣ Improving unit economics & profitability

… will emerge as winners in India’s fast-growing $10 billion QSR market.

Disclaimer

Content Accuracy and Reliability: This information is generated using an artificial intelligence large language model (LLM). While every effort has been made to ensure the accuracy and completeness of the information, the summary may not fully capture all nuances or details of the original earnings call. The content provided is for informational purposes only and should not be construed as financial advice or a recommendation to buy or sell any securities.

Verification: Readers are encouraged to refer to the official earnings call transcript, company filings, and other authoritative sources for comprehensive and accurate information. The creators of this summary do not guarantee the accuracy, completeness, or timeliness of the information and accept no responsibility for any errors or omissions.

No Liability: The use of this summary is at your own risk. The creators and distributors of this content disclaim any liability for any loss or damage arising from the use of or reliance on this summary.

Consult Professional Advice: For investment decisions or financial advice, please consult a qualified financial advisor or other professional.