Prudent Corporate Advisory Services Ltd - On a roll

FY23, was an exceptional year. Anticipating the momentum to carry forward into FY24

Company Overview

Founded in 2003 & headquartered in Ahmedabad, Prudent Corporate Advisory Services is one of India’s fastest-growing financial services group. Prudent is the fifth largest mutual fund distributor in terms of commission received. Mutual fund distribution market share for Prudent as of March 2023 was claimed to be 22.1% by the company.

Other Financial Products

Gennext - a wholly owned subsidiary is registered as an insurance broker for life and general insurance with IRDAI

Stock Broking

Other financial products such as PMS, AIF, Liquiloans, Bonds, Corporate Fixed Deposits, Smallcase, NPS, Unlisted Securities & LAS.

CAMS Ranking as of March 2023

Third largest based on total AUM in retail

Fifth largest based on total folios

Share Details

NSE:PRUDENT

Closing Price = 921.30 (26-Jun-23)

52 Week High = 1108. Trading at 17% below 52 wk high.

52 Week Low = 466.6. Trading at 97% above 52 wk low.

P/E = 33

Market Cap = 3,805 cr ( ~$ 464 million)

Quality: Returns on capital employed in cash

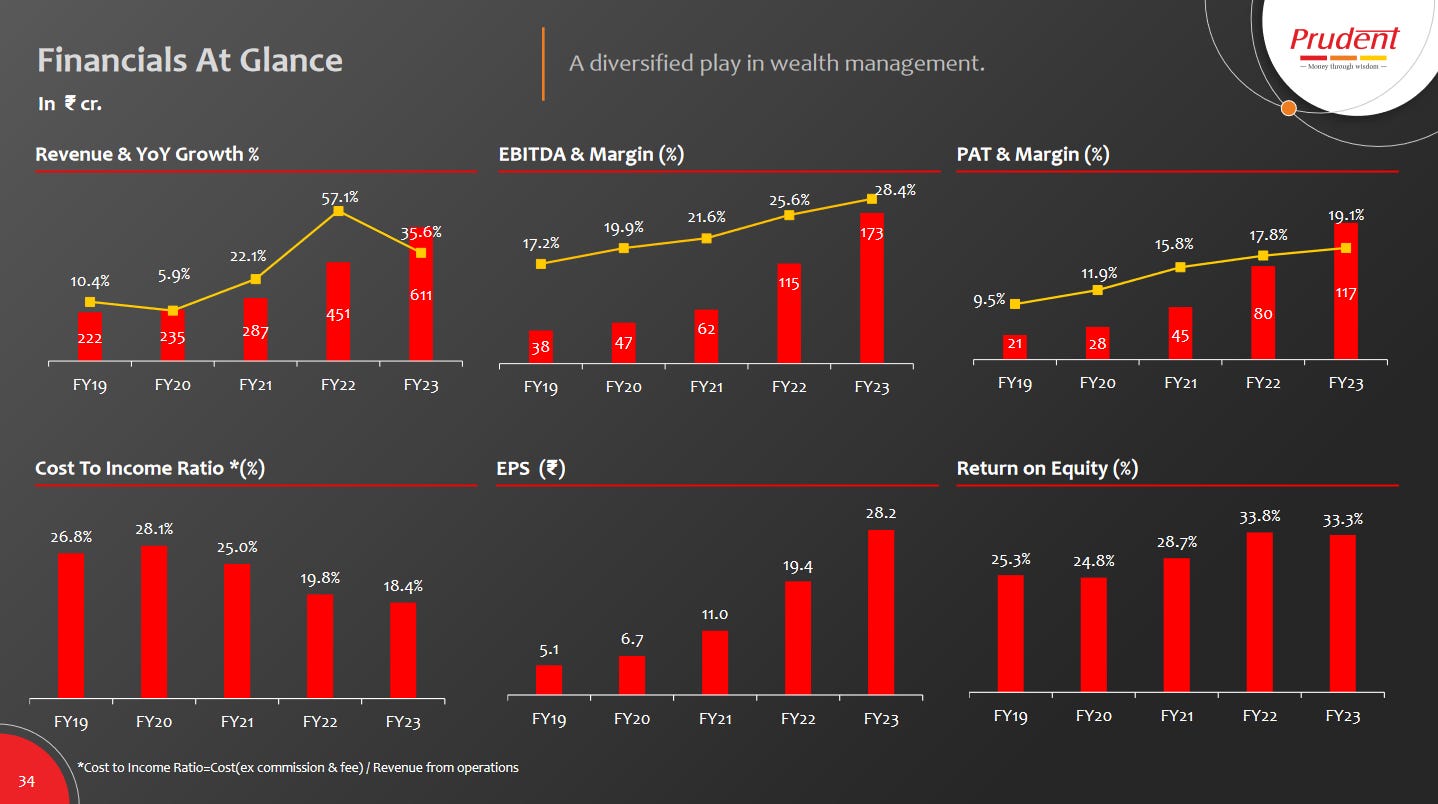

The company is growing without compromising on its return ratios. Growth has not impacted its ability to generate cash. The growth delivered by PRUDENT is a high quality growth.

Growth

The top-line, bottom line and the free cash have grown together. PAT has grown faster than the top-line on account of operating leverage

Growth Momentum

The growth momentum looks strong and the management is anticipating that it would continue in FY24.

Outlook

In the Q4-23 earnings call the PRUDENT management sounded confident and is anticipating that the momentum of FY23 will carry forward in FY24. However, there is concern and uncertainty around the impact of changes in the total expense ratio for mutual funds.

Growing at almost 2x of industry equity AUM led by organic and inorganic route

We are confident in achieving a net sales growth of 10% to 11%, and we expect the remaining 10% to come from mark-to-market gains. This overall growth projection positions us to achieve an annualized growth rate of 20% over the long term.

Our goal is to reach the milestone of 1 trillion AUM within the next 3-4 years.

We have been actively exploring inorganic opportunities in the industry. This provides us with the potential to achieve the 1 lakh crore mark even earlier through strategic acquisitions.

Challenges on the horizon for FY24, primarily driven by the SEBI consultation paper on Total Expense Ratio (TER). However, we are in the business of volume and we believe that volume do compensate for the margin compression in absolute basis points which we may witness going forward given that we we are growing at almost twice the rate of the industry in the equity AUM front.

Summing up FY23, it was an exceptional year for us, and we anticipate that this momentum will carry forward into FY24.

So What????

If I own the stock, I may keep it based on my historic returns, future return expectations, and availability of alternative stock ideas. Its a good company and if I am sitting on historical returns then I may want to stay with it and watch the story unfold.

If I don’t own the stock, I may want to enter it and build a position in the stock as and when I get a good price. The stock is trading at a PE of 33 and looks reasonable priced at this time given the growth outlook along with the uncertainity around the consultation paper by SEBI on Total Expense Ratio (TER). I would look out for corrections or greater visibility TER on to enter into the stock.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades