Power Mech Projects: PAT growth of 33% & revenue growth of 17% in 9M-25 at a PE of 29

Revenue CAGR of 32-38% for FY25-27 supported by strong margin expansion & an order book which provides revenue visibility till FY27. Typical infrastructure execution issues is a risk

1. Industrial services & construction Company for power & infrastructure sector

powermechprojects.com | NSE: POWERMECH

2. FY20-24: PAT CAGR of 17% & Revenue CAGR of 18%

3. FY24: PAT up 19% & Revenue up 17% YoY

4. Q3-25: PAT up 40% & Revenue up 21% YoY

5. 9M-25: PAT up 33% & Revenue up 17% YoY

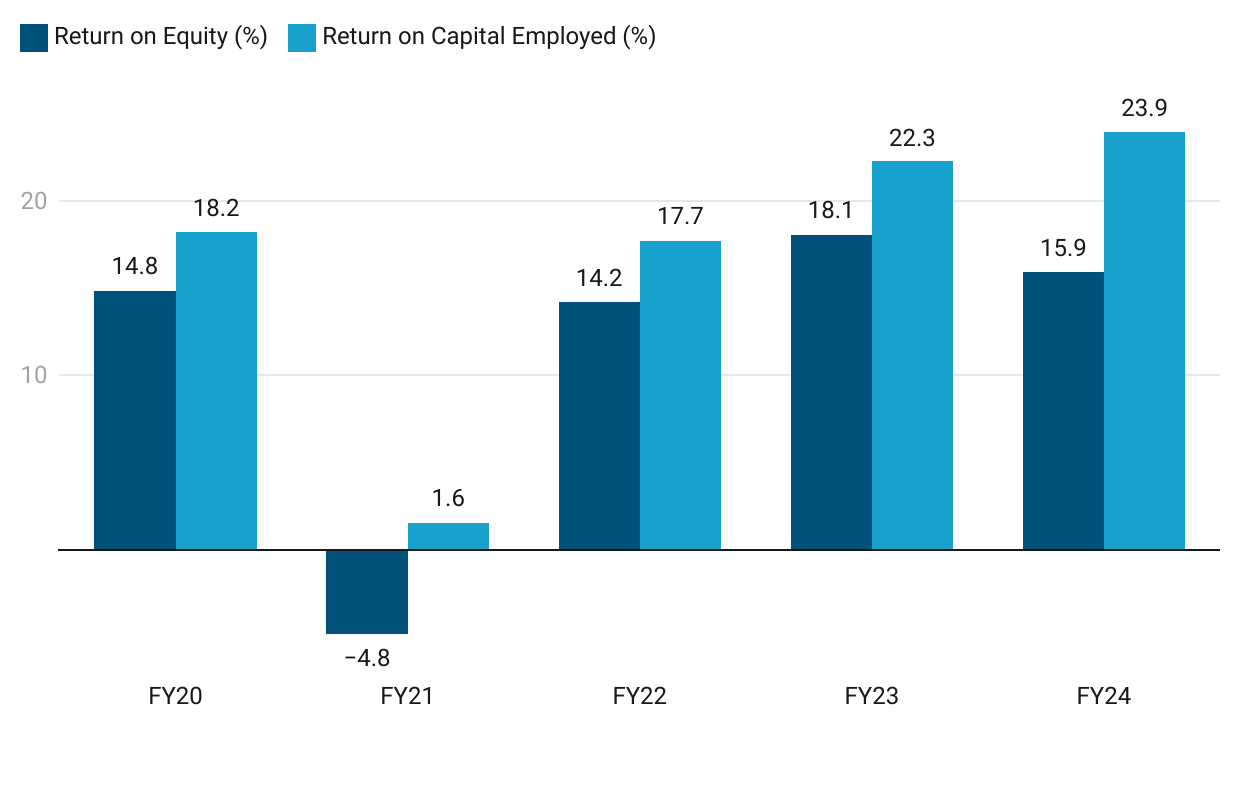

6. Business metrics: Strong & Improving return ratios

7. Outlook: 30%+ revenue growth in FY25

i. FY25: 18-23% revenue growth

We may touch revenue of around 5,000 to 5,200 for FY 25, and we have executed around 3,400 crores for the 9 months period.

We are short by 1,800 crore to achieve the projected numbers and the water utility certifications are pending. Roughly around 200 crore works are there in the work in progress. and another 1,600 to 1,700 crore we can execute in Q4.

ii. EBITDA margin improvement & reduction in taxes to drive overall margins

Current Margins

EBITDA Margin (Q3 FY25): 11.87% (vs 12.66% in Q3 FY24)

Dip due to increased overheads and delayed billing in some infra projects (esp. Jal Jeevan Mission)

PAT Margin (Q3 FY25): 6.5% (vs 5.6% in Q3 FY24)

Rise driven by lower taxes, better other income

Margin Guidance & Outlook

Core Business (Non-MDO)

Current Average EBITDA Margin: ~12.2%

Expected Improvement of 1–1.5% over the next 2–3 years

Higher O&M contribution (EBITDA margin: 16–17%)

Shift to higher-value civil and mechanical contracts

Better overhead optimization via integrated site execution

MDO (Mining Development & Operations) Business

FY26 Target EBITDA Margin: Still in ramp-up phase, margins subdued

FY28 Onwards (at peak scale): EBITDA margin expected at 20–22%

Key Margin Catalysts

O&M Growth: Backlog up 47% YoY. Provides stable, high-margin recurring revenue

Civil Works & ETC Pricing Power: Realization up by 20–30% YoY due to reduced competition

Operating Leverage: Site-level integration of civil, mechanical, and O&M reduces cost overhead

Client Preference Shift: More customers outsourcing end-to-end O&M → better profitability

Margin Headwinds (Short-term)

Startup costs for new O&M projects

Election-related delays in certification of govt infra bills

Delays in realizing water project receivables

iii. FY25-27: Revenue CAGR of 32-38%

FY25 expected revenue of Rs 5,000-5,200 cr growing to Rs 7,000-7,500 cr by FY26 and Rs 9,000-9500 cr by FY27 implies a revenue growth of 35-50% in FY26 and followed by a revenue growth of of 20-36% in FY27. This translates into a 32-38% revenue CAGR for FY25-27

So, the target for '26 and '27 guidance is that earlier we have target of INR 7,500 crores for '26 and for '27 , INR 9,500 crores. It is including the MDO revenues. But there is a delay in terms of starting up the projects in MDO. we expect to reach between INR 7,000 crores to INR 7,500 crores in '26, and maybe around INR 9,000 crores in '27

iv. Strong order book: Revenue visibility till FY27

Core EPC/Infra/O&M Order Book of Rs 18,000+ cr gives revenue visibility till FY27

FY25 Guidance (Full Year)

Order Inflows: ₹7,000–8,000 crore (down from original ₹10,000–12,000 Cr)

Management cited election-related tender delays as the key reason

FY26 Outlook

Order Inflow Target: ₹10,000 crore+

Multiple tailwinds:

NTPC, BHEL, and L&T have placed ~28,900 MW of new power orders in the past 2 years

₹27,000–30,000 crore of ETC/civil/BOP subcontracts are expected from these

BOP tenders from Koradi, Singareni, etc., likely to hit in the next 6–9 months

Execution capacity: ₹1,800–2,000 Cr/quarter

Management expects ~40% order book conversion ratio. Implies ~₹7,500 Cr revenue possible in FY26 from current backlog

Segment-wise Backlog Movement (YTD FY25)

O&M pipeline expanding: Recurring, high-margin backlog growing steadily

8. PAT growth of 33% & Revenue growth of 17% in 9M-25 at a PE of 29

9. Hold?

If I hold the stock then one may continue holding on to POWERMECH

The tepid performance of POWERMECH on the top-line is balanced by the strong bottom-line performance in 9M-25

The outlook for 30% revenue CAGR for DFY25-27 supported by improving margins and strong order book is a reason to continue with POWERMECH

The order backlog: Rs 18,000+ cr ex-MDO gives strong 2-year revenue visibility till FY27

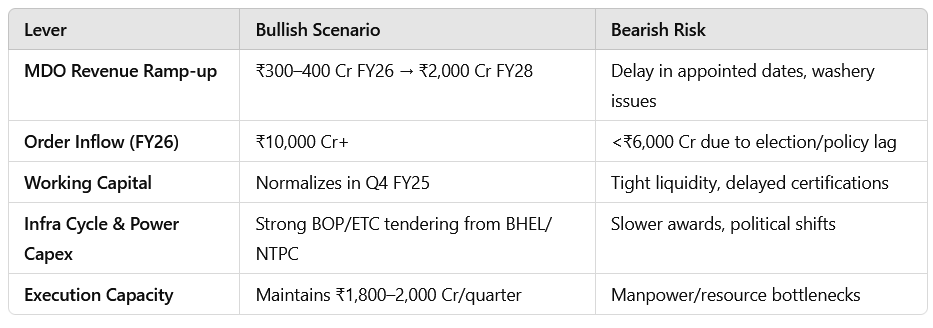

For POWERMECH to deliver on its potential one needs to keep a watch on the following execution levers

10. Buy?

If I am looking to enter POWERMECH then

POWERMECH has delivered PAT growth of 39% & Revenue growth of 17% in 9M-25 at a PE of 29 which makes valuations fully priced in the short term.

POWERMECH guidance for 18-23%+ revenue growth in FY25 with higher PAT growth at a PE of 29 makes valuations look fully priced from FY25.

POWERMECH guidance for 32-38% revenue CAGR for FY25-27 with EBITDA & PAT margin expansion at a PE of 29 provides opportunities from FY26 and beyond.

POWERMECH is trading at a full valuations in the short term, backed by strong growth expectations. If management executes well in FY25-27 and MDO scales up, current levels could be justified. However, upside from here may depend on Q4 performance and fresh order wins.

Previous coverage of POWERMECH

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer