Polyplex Corp Ltd. - Attractively priced

Good company available at an attractive price for long term gains

Company Overview

Polyplex Corporation Ltd. (Polyplex) has the seventh-largest capacity of polyester (PET) film globally. Its portfolio also includes BOPP, Blown PP/PE and CPP films.

Share Details

NSE: POLYPLEX ( polyplex.com)

Quality: Returns on capital employed in cash

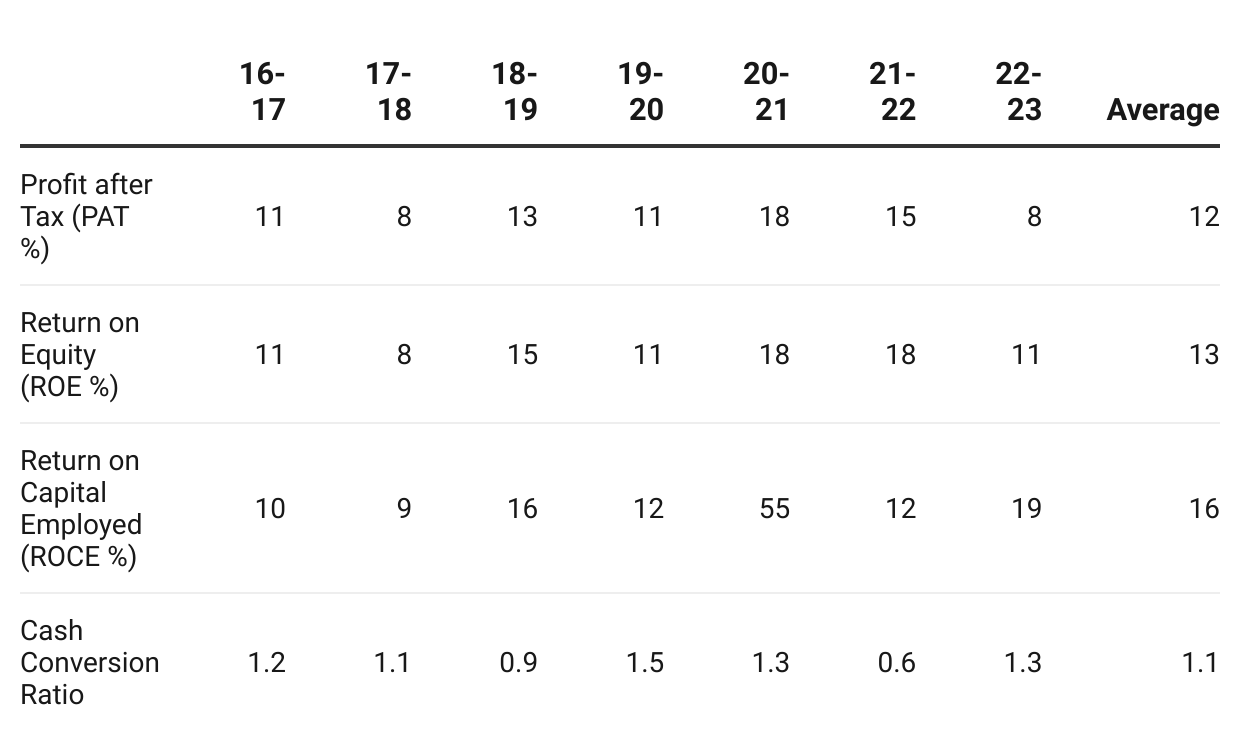

On the surface the return ratios look quite ordinary while cash generation is solid. However, the return ratios start looking quite good when we account for the cash on the balance sheet. The ROE and ROCE move from around 15% to 20% when we account for the cash on the balance sheet.

Growth

The top-line growth is healthy averaging 15% but the bottom-line lags at 9%. The bottom-line not only lags but is also volatile. The free cash flow is lagging the bottom-line but is consistently positive and adding to the balance sheet every year as seen in the analysis on the return ratios.

Growth Momentum

The chart reiterates the fact that the top line growth is consistent, but the bottom line is inconsistent.

Outlook

The guidance is not indicating something better than FY23 on the margin front which implies that PAT growth in FY24 may be worse than the -36% PAT growth seen in FY23.

So What????

If I own the stock, I may keep it based on my historic returns, future return expectations, and availability of alternative stock ideas. However, I should not expect something spectacular from the stock in the short term. I should be open to seeing the stock going down or moving around where it is for some time to come, unless there is some clarity on the margin expectations.

If I don’t own the stock, I may want to enter if I am looking for a cheap stock of a well run company. A PE of 12 indicates that the stock is cheap but does not tell the complete story. The company generated a free cash flow of Rs 529 crore in FY23 on a market cap of Rs 4,128 crore which translates into a free cash flow yield of 12.8% which makes the price quite attractive from a valuation perspective.

Another way to look at the valuations is that stock is trading at price to book ratio of 1.16 which also makes it attractive from a valuation perspective.

I could look to get in if I get it closer to its 52 week lows. Even at current levels one could look to make returns out of it from the long term given the margin on safety in terms of valuation. It is an efficiently run company and one can look to make money out of it in the long term.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades