Piramal Finance Q3 FY26 Results: PAT up 940%, On-track FY26 Guidance

Guidance of 3x PAT in FY26. Strong guidance in place till FY30. Post Q3-26 result, potential of re-rating. Trading at reasonable valuation with margin of safety

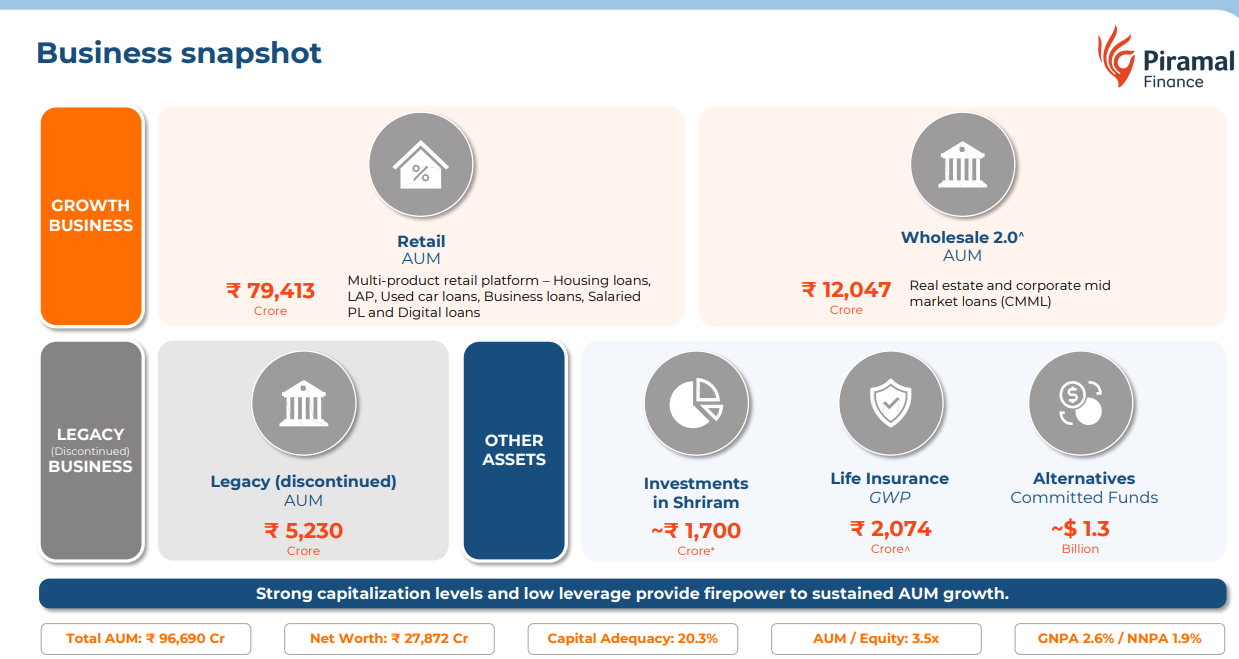

1. Financial Services company

piramalfinance.com | NSE: PIRAMALFIN

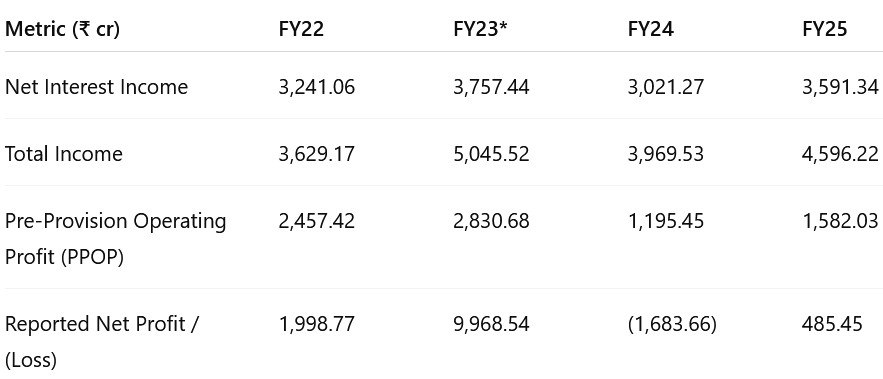

2. FY22-25: A period of transition

3. FY25: PPOP up 109% & Net Interest Income up 19% YoY

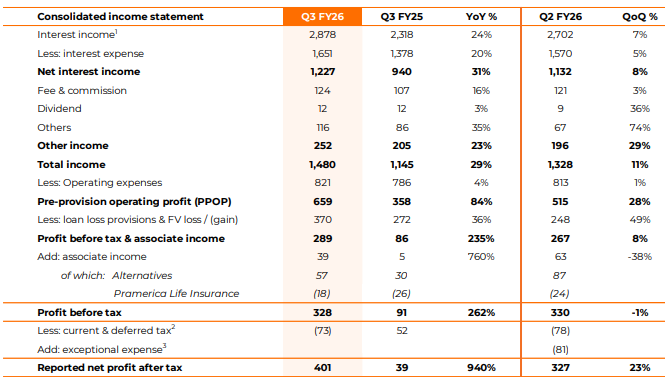

4. Q3-26: PAT up 940% & Net Interest Income up 31% YoY

PAT up 23% & Net Interest Income up 8% QoQ

Q3 saw a "flattening of disbursement trajectory," which management attributed to internal process-driven cyclicality rather than market environment, though this indicates that internal choices can impact short-term growth numbers

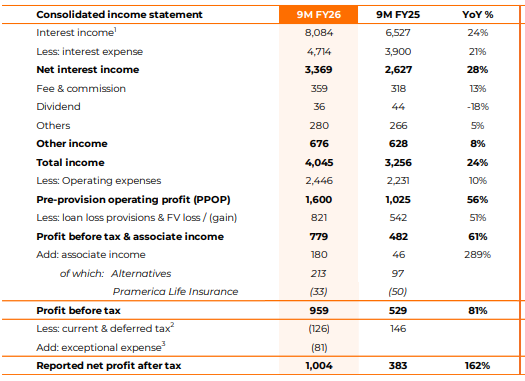

5. 9M-26: PAT up 162% & Net Interest Income up 28% YoY

6. Outlook: 25% AUM Growth; 2.5-3X PAT in FY26

6.1 Management Guidance and Outlook

Bottom-line growth driven by improving profitability

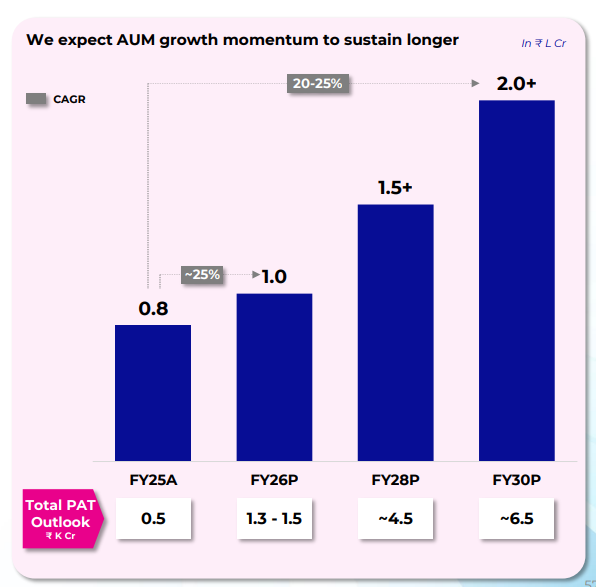

FY26 expected PAT growing from ~₹1,300-1,500 Cr to ~₹4,500 Cr in FY28 to ~₹6,500 Cr in FY30

Targeting Return on AUM (ROA) of 3%+ from the current 1.9%

To increase leverage (AUM by equity) from current 3.5x to 4.5-5x

New Product Segments: Move into “white spaces” such as gold loans and microfinance, where management intends to make meaningful progress in the coming quarter.

Monetization of Assets: Conclude the ₹600 Cr monetization of its stake in Shriram Life Insurance in Q4. Further monetization of other investments is anticipated in subsequent quarters.

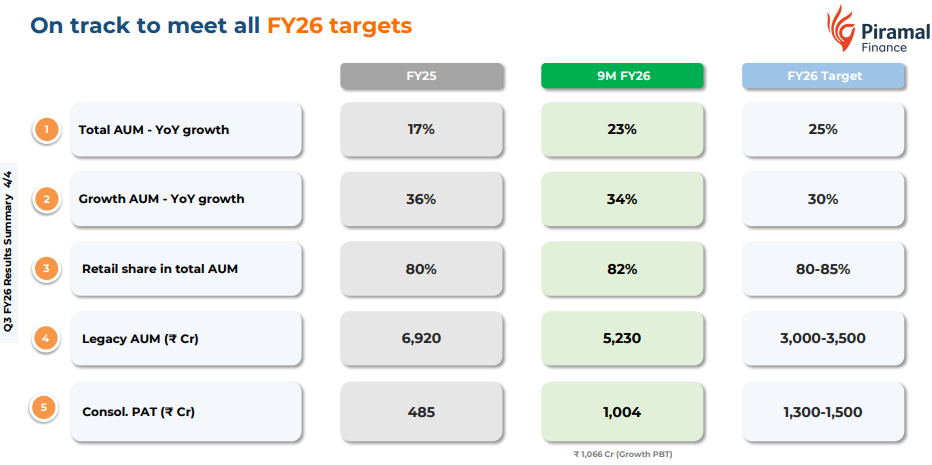

6.2 9M FY26 Performance vs FY26 Guidance

PIRAMALFIN confirming that its on-track to meet PAT guidance of ~₹1,400 Cr

On track to ending FY26 with a consolidated AUM exceeding ₹1 lakh crores

AUM growth of 25% — highly achievable given that the “growth book” (which constitutes 95% of the total book) is currently expanding at a 34%–35%

6. Valuation Analysis

6.1 Valuation Snapshot — Piramal Finance

Current Market Price — ₹1,796

Market cap — ₹40,501 Cr

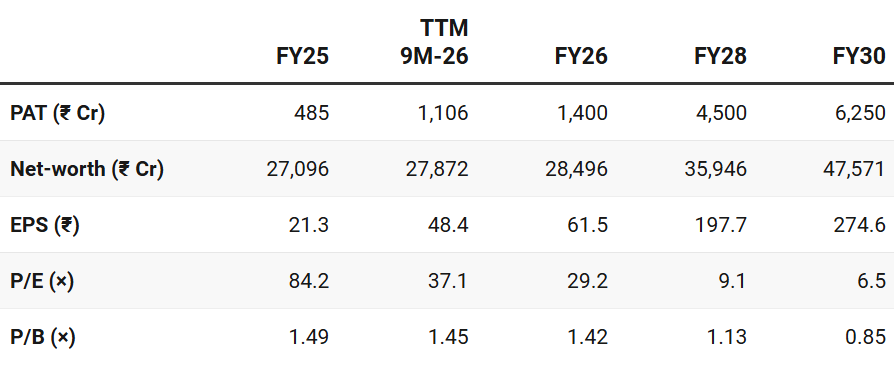

Despite profitability improving, PIRAMALFIN still trades at less than 1.5 P/B (×)on FY26 estimates.

For a company guiding to deliver ~80% PAT CAGR for FY26-28 — the P/B multiple deserves a re-rating closer to 2 P/B (×)

7.2 Opportunity at Current Valuation

Increased Profitability: RoA improving from 1.9% to 3% creates the opportunity as bottom-line grows faster than the top-line

AUM growth: 25% AUM CAGR FY26-28 to support bottom-line growth

Margin of safety: Even at a current P/B of 1.45(×) there exists a margin of safety in the perspective of the guidance for FY26 which is on-track.

The buffer from monetization of stake in Shriram Life Insurance in Q4 adds to the margin of safety

Rather than putting these one-off gains into the P&L statement to boost earnings, they will be used to strengthen the balance sheet

Projections not discounted: Weak past record in the last 5 years — market does not fully discount the growth projection of FY28 andFY30

Multiple Re-rating: Opportunity of being re-rated at around 1.5-2(×) P/B if FY26 guidance is delivered and PIRAMALFIN shows progress on executing FY28 guidance.

7.3 Risk at Current Valuation

Despite the visible turnaround, key risks remain:

Execution Risk: PIRAMALFIN is on-track to deliver FY26 guidance. The challenge is to consistently deliver on the FY28 guidance.

Residual legacy risk: ~₹5,000 Cr of legacy AUM still sits on the book; impairment or recovery delays could drag performance.

Asset quality while improving needs to be watched as it is not still the highest quality book

DHFL Liability Repayment: PIRAMALFIN has approximately ₹14,000-15,000 Cr of debt remaining from the DHFL acquisition. A "first big tranch" of principal payments is due next year. While they expect to replace this with new Non-Convertible Debts (NCDs), there is a risk regarding the replacement cost and timing of these large repayments

Previous coverage on PIRAMALFIN

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer