Pharmaceuticals: Q3-25 Performance & Outlook

Pharma shifting to high-margin chronic therapies, biosimilars & specialty drugs. Generics facing competitive pressures. US generics remain challenging , new launches & specialty focus driving growth.

Contents

Overall Trends: Q3-25 Indian Pharma Companies

Financial Performance Trends

Trends in India Business

Trends in the US Market

Product Pipeline Trends

Regulatory Compliance Trends

1. Overall Trends: Q3-25 Indian Pharma Companies

1.1 Revenue & Profitability Growth

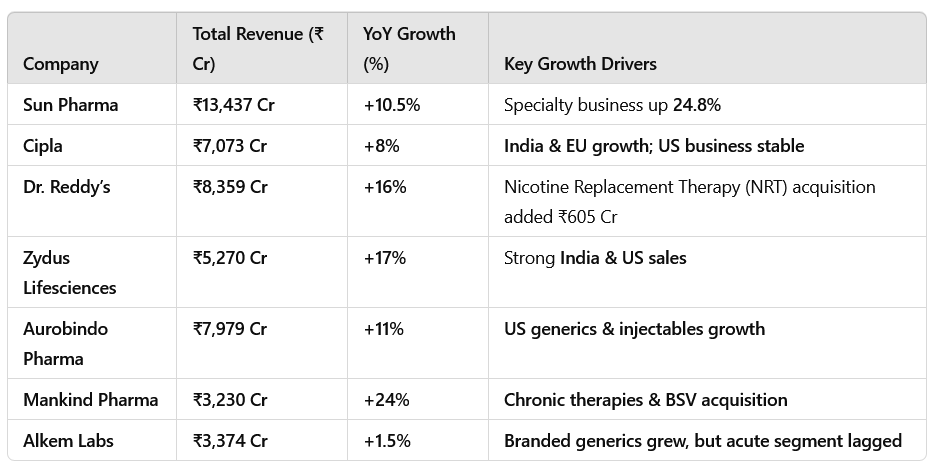

Most companies reported revenue growth in the range of 8% to 17% YoY.

Sun Pharma, Zydus Lifesciences, and Cipla recorded strong double-digit growth, while Aurobindo Pharma and Mankind Pharma also reported solid revenue increases.

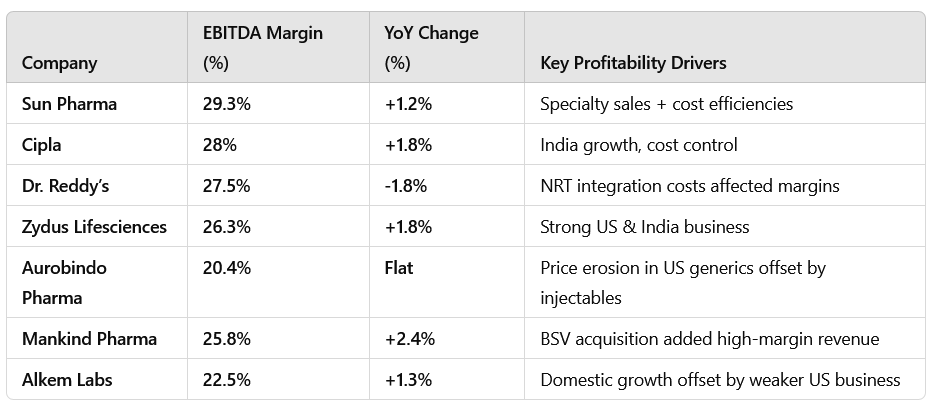

EBITDA margins improved, mainly due to better product mix, cost efficiencies, and strong specialty and chronic segment performance.

1.2 Domestic Market Performance

Strong growth in the chronic segment (cardiology, anti-diabetes, respiratory, oncology).

Cipla & Zydus Lifesciences outperformed the Indian Pharmaceutical Market (IPM), with Cipla’s One India Business growing at 10% YoY and Zydus reporting an 8% growth in its domestic formulations.

Mankind Pharma continued its expansion in high-margin chronic therapy areas, with chronic share increasing to 37.6%.

1.3 US Market & Specialty Business

The US market remains mixed, with price erosion in generics still a challenge (5-10% erosion across portfolios).

Companies with strong specialty and complex generics portfolios performed better.

Sun Pharma: Specialty business grew 24.8% YoY, led by ILUMYA, CEQUA, ODOMZO, and WINLEVI.

Cipla: North America revenue at $226M, but some impact from Lanreotide supply disruptions.

Dr. Reddy’s: US business impacted by lower Revlimid sales but offset by new launches.

1.4 Trade Generics & OTC Growth

Trade generics business in India showed mixed results:

Alkem Labs: Trade generics remained flat, while branded generics grew 7.5%.

Cipla: Trade generics are back to growth mode after model transition.

Zydus & Mankind: OTC business grew over 15% YoY, supported by volume growth.

1.5 Investments in R&D & Specialty Expansion

Biosimilars & Specialty Portfolio Expansion:

Dr. Reddy’s & Aurobindo are investing heavily in biosimilars like Rituximab, Denosumab, and Abatacept.

Zydus & Cipla are focused on 505(b)(2) products in the US.

Sun Pharma has acquired Antibe Therapeutics, focusing on pain management without opioids.

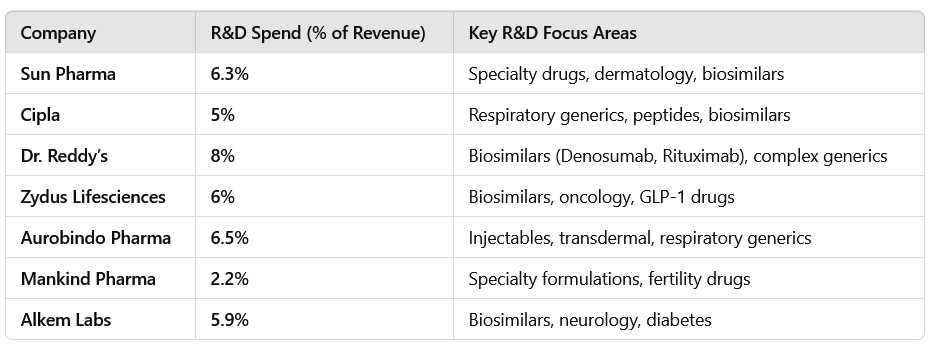

R&D spending stabilized at 5-7% of revenue, with most companies focusing on complex generics, biosimilars, and innovation-driven products.

1.6 International Markets & Emerging Markets Performance

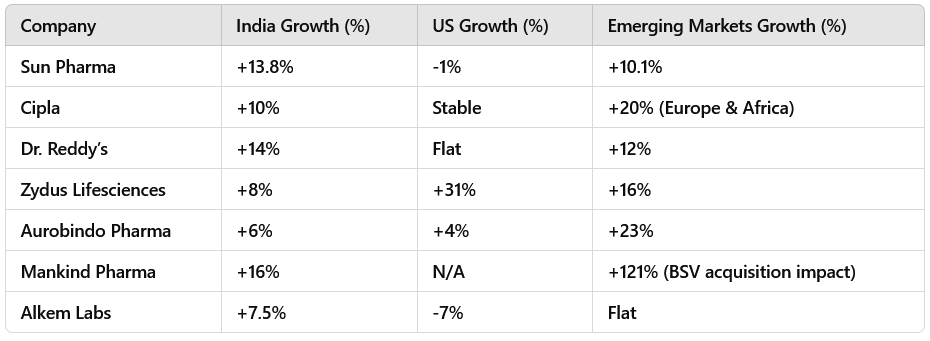

Aurobindo & Sun Pharma posted strong growth in emerging markets.

China & Europe expansion gaining momentum for Aurobindo.

Zydus & Cipla reported high double-digit growth in South Africa & Europe.

1.7 Key Challenges & Risks

USFDA inspections & regulatory issues: Cipla’s Goa plant clearance was a relief, but other companies (Aurobindo & Dr. Reddy’s) faced Form 483 observations.

Raw material cost volatility: Some companies benefitted from lower input costs, but uncertainty remains.

Price erosion in US generics continues to impact profitability, forcing companies to shift focus to specialty & complex generics.

1.8 The Big Picture

India’s pharmaceutical industry is shifting towards high-margin businesses (chronic therapies, biosimilars, and specialty drugs).

Trade generics are stabilizing, but competitive pressures are high.

US generics remain challenging, but new product launches and specialty focus are driving growth.

R&D investments in biosimilars and novel therapies are key growth drivers for the future.

2. Financial Performance Trends

Indian pharmaceutical companies reported mixed financial performance in Q3 FY25, with strong growth in specialty & chronic segments, price erosion challenges in US generics, and regulatory headwinds affecting product launches.

2.1 Revenue Growth: Strong Domestic, Mixed US Performance

Domestic revenue growth outpaced the market, driven by chronic therapies & branded generics.

US revenue performance was mixed, with some companies facing price erosion & regulatory delays.

Pharma companies posted double-digit growth in India & emerging markets, while the US market remained volatile due to pricing pressure.

2.2 Profitability: Specialty & Cost Control Driving Margins

Companies with strong specialty portfolios (Sun, Dr. Reddy’s, Cipla) expanded margins, while those relying on generics (Aurobindo, Alkem) faced pricing pressure.

Raw material cost stabilization supported gross margins.

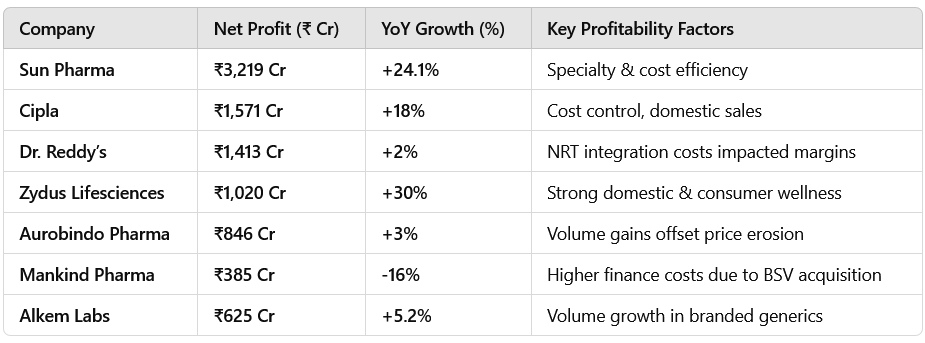

2.3 Net Profit Performance: Driven by Operational Efficiency

Net profits grew for most companies, supported by cost efficiency & domestic business strength.

Sun Pharma, Cipla, & Zydus Lifesciences posted strong net profit growth, while Dr. Reddy’s saw lower gains due to one-time integration costs.

2.4 Regional Growth: India & Emerging Markets Leading

India outperformed the US for most companies, driven by chronic therapies & branded generics.

Emerging markets (Europe, LATAM, Asia) grew in double digits.

2.5 R&D Investments: Focus on Specialty, Biosimilars & Injectables

R&D focus is shifting toward biosimilars, injectables, and specialty drugs to drive high-margin future growth.

Companies are spending 5-7% of revenue on R&D, with a focus on biosimilars, complex generics & injectables.

Sun Pharma & Dr. Reddy’s are leading investments in specialty drugs.

3. Trends in India Business

3.1 Strong Growth in Chronic Therapies

Chronic therapy segments (cardiology, anti-diabetes, respiratory, oncology, neurology) continued to outperform the market.

Cipla: Chronic mix improved to 61.5% of revenues.

Zydus Lifesciences: Cardiology, respiratory, and oncology outperformed.

Mankind Pharma: Chronic business grew 1.3x the market, with CVM (cardio-metabolic-vascular) segment improving from 4th to 3rd rank.

3.2 Volume & New Launches Driving Growth

Unlike previous quarters where price increases drove growth, Q3 FY25 growth was led by volume expansion and new product launches.

Sun Pharma: Gained market share with volume-led growth and new launches.

Zydus Lifesciences: Reported 8% secondary sales growth, led by chronic expansion.

Alkem Labs: Flagship brands saw 8% value growth, with 32 brands increasing market share YoY.

3.3 Acute Therapy Growth Remains Weak

The acute segment saw lower growth across most companies.

Mankind Pharma: Acute segment growth was soft due to market-wide slowdown and internal restructuring.

Cipla: Acute portfolio performance was weak, impacting overall branded business growth.

Alkem Labs: Outperformed the acute market, growing 5.9% vs. market growth of 5.7%, but still slower than the chronic segment.

3.4 Trade Generics & OTC Business: Mixed Performance

The trade generics segment had mixed results due to pricing pressure and higher competition.

Alkem Labs: Trade generics business was flat, while branded generics grew 7.5%.

Cipla: Trade generics returned to growth post-restructuring.

Mankind Pharma: OTC business grew 30% YoY in Q3 FY25.

Zydus Lifesciences: OTC business up 13% YoY, led by personal care & nutrition products.

3.5 Expansion into High-Margin Specialty & Super-Specialty

Companies are shifting toward high-margin specialty segments in India.

Mankind Pharma: Acquisition of BSV (Bharat Serums & Vaccines) strengthens high-entry barrier portfolios in oncology, nephrology, and fertility.

Cipla: Foracort remains India’s #1 respiratory brand, and expansion into biologics and inhalation therapies continues.

3.6 Field Force Expansion & Digital Initiatives

Companies are increasing medical representative (MR) strength to expand doctor coverage.

Sun Pharma: Field force at 14,000+ MRs.

Cipla: Added 1,800 field reps in chronic therapies.

Mankind Pharma: Restructuring its field force for greater efficiency in high-growth areas.

Digital transformation continues:

Cipla launched CipAir, an AI-powered asthma screening tool.

Zydus & Sun Pharma investing in doctor engagement platforms.

3.7 Price Growth in NLEM (National List of Essential Medicines) Affected Profitability

Companies with a high NLEM exposure faced challenges in price hikes, as NLEM pricing remains controlled by the government.

Alkem Labs: Large NLEM portfolio impacted pricing, but volume growth helped offset losses.

Mankind Pharma: Focus on volume expansion to counter lower price hikes.

4. Trends in the US Market

The US market remains a mixed bag for Indian pharma companies in Q3 FY25. While specialty businesses and complex generics showed strong growth, price erosion in the generics segment continues to be a major challenge.

4.1 Price Erosion in US Generics Continues

Price erosion remains in the range of 5-10% YoY, affecting most companies.

Dr. Reddy’s: Reported a flat YoY performance in the US, with continued price erosion offsetting volume growth.

Cipla: Price erosion in some segments was higher than expected, but it remains within a high single-digit range.

Aurobindo Pharma: The company reported mid-single-digit price erosion, but managed to offset it with new launches.

4.2 Specialty Business Driving Growth

Indian pharma companies are shifting focus to specialty products in the US, which have higher margins and lower competition.

Sun Pharma: Specialty business grew 24.8% YoY, driven by:

ILUMYA (Psoriasis)

CEQUA (Ophthalmology)

ODOMZO (Oncology)

WINLEVI (Dermatology)

Cipla: Respiratory franchise performing well, with Albuterol market share reaching 21%.

Dr. Reddy’s: Biosimilars & complex generics in focus, with Denosumab and Rituximab filed for approval.

4.3 New Product Launches Supporting Growth

Cipla: New approvals for Esomeprazole Granules, Potassium Phosphates Injection, and Phytonadione Injectable.

Aurobindo Pharma: Launched 7 new products in Q3 and received 8 ANDA approvals.

Dr. Reddy’s: Filed 15-20 ANDAs for the full year and continues to launch complex injectables.

Zydus Lifesciences: Launched 5 products, including Sitagliptin 505(b)(2) franchise with CVS Caremark.

4.4 Growth in Injectables & Biosimilars

The injectables market is seeing high growth, with companies investing in expanding their US injectable portfolio.

Aurobindo Pharma: Focus on injectables & complex generics, with 60-70% capacity utilization at Eugia-3.

Zydus Lifesciences: Entered 505(b)(2) segment with Sitagliptin, a specialty diabetes treatment.

Dr. Reddy’s: Expanding biosimilars pipeline, with Denosumab filed in both US & EU.

4.5 Regulatory Challenges & FDA Inspections

FDA inspections remain a key risk, with multiple plants receiving Form 483 observations.

Dr. Reddy’s CTO-2 plant (Bollaram, Hyderabad): Received 7 observations from USFDA.

Aurobindo Pharma: Expecting inspections at its China & US plants before full commercialization.

Cipla’s Goa Plant: Received VAI (Voluntary Action Indicated) classification, clearing regulatory hurdles.

Sun Pharma: Facing US opioid litigation settlement.

4.6 Revlimid & GLP-1 Opportunities

Revlimid (Lenalidomide) impact:

Dr. Reddy’s & Cipla reported flat Revlimid sales QoQ, as market penetration reached saturation.

Sun Pharma reported lower Revlimid sales in Q3, impacting overall US revenue.

GLP-1 (Weight Loss & Diabetes) Focus:

Dr. Reddy’s & Aurobindo: Developing Semaglutide generics for US/Canada markets.

Alkem Labs: Filed for GLP-1 approval in India, aiming for first wave entry.

4.7 Expansion of US Manufacturing & Capacity

To counter tariff concerns, companies are investing in US-based manufacturing.

Cipla: Investing $100M in its US facilities for DPI/MDI (inhalation) and injectable production.

Aurobindo Pharma: Expanding Dayton & Raleigh plants to manufacture OSD & transdermal products.

Dr. Reddy’s: Ramping up biologics & transdermal manufacturing for US/EU markets.

5. Product Pipeline Trends

✅ Specialty drugs (dermatology, ophthalmology, oncology) & complex generics are driving future growth.

✅ Biosimilars (Denosumab, Rituximab, Omalizumab) are gaining traction in US & EU.

✅ GLP-1 therapies (Semaglutide, Tirzepatide) are a big focus for diabetes & weight-loss markets.

✅ Injectables (oncology, depot injections, respiratory) are seeing high growth potential.

✅ Regulatory approvals & ANDA filings are shifting towards high-margin, low-competition products.

Overall, Indian pharma companies are transitioning from traditional generics to high-margin specialty drugs, injectables, and biologics to counter price erosion and drive profitability.

Would you like company-specific insights on pipeline products? Let me know! 🚀

5.1 Specialty & Complex Generics: Driving Future Growth

Sun Pharma: Specialty business led by ILUMYA (psoriasis), CEQUA (ophthalmology), ODOMZO (oncology), and WINLEVI (dermatology).

Dr. Reddy’s: Expanding transdermal & respiratory portfolios. Filed Denosumab (osteoporosis) in US & Europe.

Zydus Lifesciences: Entered the 505(b)(2) market with Sitagliptin, targeting diabetes treatment.

Cipla: Respiratory expansion continues, with Albuterol and potential Advair & Symbicort generics.

5.2. Biosimilars & Biologics Pipeline Gaining Momentum

Biosimilars are a long-term focus, with companies preparing for high-margin, low-competition opportunities.

Dr. Reddy’s:

Filed Rituximab (oncology) in UK.

Denosumab (osteoporosis) submitted in the US & Europe.

Omalizumab (Xolair biosimilar) in Phase III clinical trials.

Aurobindo Pharma:

Focusing on biosimilar production at its US & China plants.

Scaling up Pen-G API for antibiotic biosimilars.

Zydus Lifesciences:

Completed Phase III trials for a biosimilar antibody-drug conjugate (ADC).

Awaiting DCGI approval for new biosimilars.

Sun Pharma: Exploring biosimilar development but has not committed fully.

5.3 GLP-1 & Diabetes Pipeline Expansion (Semaglutide, Tirzepatide, etc.)

GLP-1s are expected to be a multi-billion-dollar opportunity, with Indian pharma looking to capture the generic wave. GLP-1 receptor agonists (used for weight loss & diabetes) are a major focus area for Indian pharma.

Dr. Reddy’s & Aurobindo Pharma: Developing Semaglutide (Ozempic/Wegovy biosimilar) for the US & Canada.

Alkem Labs: Filed for GLP-1 approval in India; aims to be among the first entrants in the domestic market.

Zydus Lifesciences:

Signed a deal with CVS Caremark for Sitagliptin (diabetes).

Developing novel diabetes biologics.

5.4 Respiratory & Inhalation Therapies

Inhalation therapies & respiratory biologics remain a focus, especially in the US & India.

Cipla:

Advair (fluticasone/salmeterol) launch expected in FY26.

Symbicort (budesonide/formoterol) filing completed.

Partnered inhalation drug launch in FY26.

Dr. Reddy’s:

Expanding respiratory biologics portfolio.

Toripalimab (immuno-oncology drug) launched in India.

5.5 Injectable & Complex Generic Expansion

Injectables remain a major high-growth segment, with companies building strong US portfolios.

Aurobindo Pharma:

Filed 4 new ANDAs in Q3 and received 8 approvals.

Expanding injectables & depot injections portfolio.

Dr. Reddy’s:: Investing in complex injectables & high-barrier formulations.

Cipla:

Lanreotide (Somatuline Depot generic) supply to normalize by Q4 FY25.

Launched Phytonadione Injection, Esomeprazole Granules, Potassium Phosphates Injection.

Zydus Lifesciences: Entered the US oncology injectables space with new filings.

5.6 Oncology & Immunotherapy Pipeline

Oncology continues to be a high-value segment, with a shift toward biologics & targeted therapies.

Sun Pharma:

Expanding dermatology-oncology portfolio, with global ILUMYA expansion.

Acquired Antibe Therapeutics (pain management without opioids).

Zydus Lifesciences:

Developing ADC biosimilars for targeted cancer treatment.

Ongoing Phase II trials for novel oncology treatments.

Dr. Reddy’s:

Launched Toripalimab (immuno-oncology drug) in India.

5.7 ANDA Filings & USFDA Approvals

Companies are increasing filings in specialty areas, including injectables, biosimilars & respiratory drugs.

Dr. Reddy’s: Filed 23 ANDAs in Q3, focusing on complex generics & biosimilars.

Aurobindo Pharma: 60+ ANDAs pending approval, focusing on injectables & oral solids.

Cipla: Filed multiple 505(b)(2) applications, focusing on respiratory & peptides.

Zydus Lifesciences:

10 ANDA filings & 3 approvals in Q3.

Strengthening neurology, oncology & dermatology pipeline.

6. Regulatory Compliance Trends

Regulatory compliance remains a major focus area for Indian pharmaceutical companies, particularly for USFDA inspections, Form 483 observations, and site clearances. The overall trend suggests increased regulatory scrutiny, especially for injectables, biosimilars, and high-risk manufacturing sites.

6.1 Increased USFDA Inspections & Form 483 Observations

Several Indian pharma companies faced USFDA inspections, with some receiving Form 483 observations.

Stricter compliance measures are being implemented to prevent import alerts and maintain supply chain integrity.

USFDA inspections are becoming more frequent, especially for API plants, sterile injectables, and biosimilar facilities.

Companies Facing USFDA Observations in Q3 FY25:

Dr. Reddy’s

Bollaram (CTO-2) plant received 7 observations after an inspection in November 2024.

Responded within the stipulated timeline; awaiting further action from USFDA.

Aurobindo Pharma

Ramping up regulatory compliance at US & China facilities before commercialization.

Some pending approvals delayed due to additional FDA queries.

Cipla

Goa plant received a VAI (Voluntary Action Indicated) status, indicating minor compliance issues but no major concerns.

Bengaluru Virgonagar plant received 8 Form 483 observations; awaiting USFDA classification.

Sun Pharma

Ongoing regulatory scrutiny due to the US opioid litigation; company agreed to a $38M settlement for certain plaintiffs.

Zydus Lifesciences

No major regulatory concerns reported in Q3 FY25, but closely monitoring compliance at US & India sites.

6.2 Manufacturing Site Remediation & Compliance Upgrades

Companies are proactively addressing compliance gaps to avoid costly regulatory actions.

Companies are investing in compliance improvements to meet stringent USFDA & EMA (European Medicines Agency) requirements.

Many companies are remediating their plants to prevent potential warning letters & import bans.

Key Actions Taken:

Cipla

Completed remediation of its Goa facility (which had earlier faced FDA scrutiny).

Strengthening quality & compliance at Bengaluru & Indore sites.

Dr. Reddy’s

Strengthening data integrity systems across manufacturing sites.

Implementing AI-based compliance monitoring for batch production records.

Aurobindo Pharma

Enhancing quality control measures at its China API plant before commercialization.

Dayton (US) & Raleigh (US) injectable plants undergoing pre-approval compliance checks.

Sun Pharma

Investing in IT-based quality control systems to minimize human errors & automate batch reporting.

6.3 Biosimilars & Injectables Facing Stricter Oversight

Biosimilar approvals are becoming more complex, with regulators demanding extensive clinical & quality data before approvals.

Biosimilars & injectables require higher regulatory scrutiny due to their complex manufacturing & sterility requirements.

Companies Focusing on Biosimilar & Injectable Compliance:

Dr. Reddy’s

Filed Denosumab & Rituximab in the US & EU, requiring GMP certifications from FDA & EMA.

Expanding injectable capacity while ensuring compliance with sterility norms.

Aurobindo Pharma

Eugia-3 (injectables) ramping up production with 60-70% capacity utilization.

Undergoing pre-approval inspections for key filings.

Sun Pharma

Focusing on dermatology & ophthalmology biosimilars to avoid complex regulatory delays.

6.4 Global Compliance Trends: EMA, TGA, and WHO Inspections

Europe & other global markets are tightening their compliance requirements, forcing companies to maintain high-quality standards globally.

Besides USFDA, companies are also undergoing EMA (Europe), TGA (Australia), and WHO (World Health Organization) inspections.

Recent Global Regulatory Inspections:

Aurobindo Pharma

China plant received EMA clearance for solid oral dosages; awaiting USFDA inspection.

Zydus Lifesciences

EU-GMP compliance obtained for biosimilars; expanding European footprint.

Sun Pharma

EMA inspection completed at a key oncology formulation site.

6.5 Regulatory Delays & Impact on Product Approvals

Regulatory delays are impacting product launches, especially for biosimilars & complex injectables.

USFDA’s additional scrutiny is leading to slower ANDA approvals.

Regulatory timelines for approvals are increasing, forcing companies to plan launches well in advance

Companies Facing Regulatory Delays:

Cipla

Advair generic delayed to H2 FY26 due to additional regulatory review.

Abraxane launch postponed to late FY26, awaiting final approval.

Dr. Reddy’s

US FDA delays impacting niche product approvals in oncology & respiratory segments.

Aurobindo Pharma

Waiting for inspection clearance before full-scale biosimilar commercialization.

Disclaimer

Content Accuracy and Reliability: This summary of the earnings call is generated using an artificial intelligence large language model (LLM). While every effort has been made to ensure the accuracy and completeness of the information, the summary may not fully capture all nuances or details of the original earnings call. The content provided is for informational purposes only and should not be construed as financial advice or a recommendation to buy or sell any securities.

Verification: Readers are encouraged to refer to the official earnings call transcript, company filings, and other authoritative sources for comprehensive and accurate information. The creators of this summary do not guarantee the accuracy, completeness, or timeliness of the information and accept no responsibility for any errors or omissions.

No Liability: The use of this summary is at your own risk. The creators and distributors of this content disclaim any liability for any loss or damage arising from the use of or reliance on this summary.

Consult Professional Advice: For investment decisions or financial advice, please consult a qualified financial advisor or other professional