Phantom Digital Effects: Guidance of 75-80% revenue growth & 33-35% EBITDA in FY24

Guidance for FY24 supported by an order book 1.2X FY23 revenue and coming on the back of a 159% revenue & 230% PAT growth in FY23. Available at a PE of 32

1. Phantom Digital Effects Ltd, a full fledged creative VFX studio

phantomfx.com | NSE - SM : PHANTOMFX

End-to-end services to production houses like completing a shot with final compositing, creating 3D elements, photo real creatures, and environments, Rig/Wire removal, paint clean-up, rotoscopy, 3D match move, 3D animation (storyboard & animation), Pre-visualization Game cinematics, Fire/water Fx and other natural phenomena 3D ride animation for commercials, feature films, and web series globally.

And the company is a TPN certified company. The TPN, which is Trusted Partner Network which is acknowledged by Motion Pictures Association of America. So, this certificate is very important for us to be a part of Marvel movies or Disney, Pixar any movies. So, this particular certificate gives us the validation for us to be a part of their movies as well.

~600 employees with offices cum studio locally and globally in Chennai, Mumbai, Hyderabad, Los Angeles, Vancouver, and Montreal

Experience of delivering 250+ projects and 3,100+ shots to over 550 clients

2. FY23: 159% growth in revenue & 230% PAT growth

This robust growth was led by increasing demand for our services and efficient execution of our healthy order book

FY23 growth

Revenue = Rs. 58 cr up 159%

PAT = Rs. 16 cr up 230%

PAT Margin = 28% in FY-23 vs 22% in FY-22

3. Q1-24: Strong growth from FY23 continues

On track to become a Rs 100 cr business in FY24

YoY Growth in Q1-24

Revenue = Rs 23.7 cr up 94%

PAT = Rs 6 cr up 47%

PAT Margin = 25.61% in Q1-24 vs 33.74% in Q1-23

4. Revenue visibility on the back of a strong order book

Order book = Rs 70 cr as of Q4-23 end = 1.2X FY23 revenue

The current order book comprises of 15 under execution orders with total contract value of ~Rs.700 Mn. expected to be completed in a period of nine months. Further order inflow worth 240 Mn. are expected from a large OTT platform.

5. Outlook for 75-80% revenue growth in FY24

i. 75-80% revenue growth in FY24:

Revenue is expected to grow by ~75-80% in FY24 led by inflow of demand for our services and effective execution of order book.

ii. Growth to be delivered with 33-35% EBITDA

EBITDA margins is expected to stay within a corridor of 33-35%

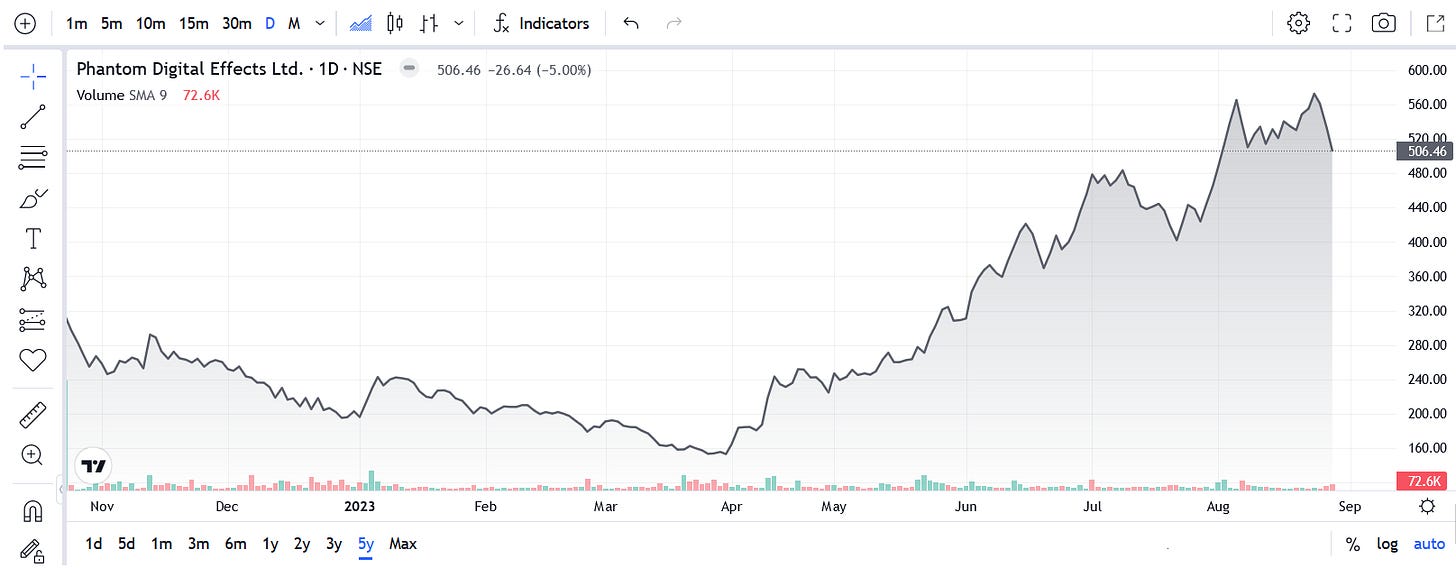

6. 75-80% revenue growth guidance for FY24 at a 32 PE

7. So Wait and Watch

If I hold the stock then one can hold on as PHANTOMFX has delivered 159% revenue growth for FY23. Additionally PHANTOMFX is providing visibility into FY24 with an order book of Rs 70 cr and the management guidance of 75-80% revenue growth in FY24. One needs to wait and watch for quarterly results to see if the company is delivering on the FY24 growth and profitability as guided by the management.

8. Look before you get in

If I am looking to enter the stock then

For the growth it has delivered in FY21-23 and Q1-24, the PE of 32 looks attractive.

Additionally the management guidance of 75-80% revenue growth with 33-35% EBITDA also makes PHANTOMFX quite attractive at a PE of 32.

PHANTOMFX has to grow from the sub Rs 100Cr revenue to around Rs 500 cr revenue for its business model to be proven over the long term. PHANTOMFX can be seen as a high risk, high reward bet.

Since its a bet, one should not enter in the stock in one shot.

Since its a bet, the size of the bet cannot be a significant part of the portfolio.

What if PHANTOMFX is able to keep the growth momentum going for another 3 years. One can easily have a multi-bagger in ones portfolio.

Don’t like what you are reading?

Let us know at hi@moneymuscle.in

Will make it better.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades