PG Electroplast: 30% revenue growth & 28% operating profit growth to drive 44% growth in PAT

Order book for product business remains robust. On track to scale the product business significantly in FY24. TV manufacturing should kick in from FY25 & should scale up significantly

1. 2nd largest ODM for room AC’s & Washing Machines

pgel.in | NSE : PGEL

Largest manufacturer of plastic moulded components for Consumer Durables industry in India

PG Electroplast Ltd, (PGEL) specializes in Original Design Manufacturing (ODM), Contract Manufacturing (CM) and Plastic Injection Moulding and across multiple product lines

PGEL has seven manufacturing units across Greater Noida in Uttar Pradesh, Roorkee in Uttarakhand and Ahmednagar in Maharashtra and has 3400+ employees

Entered into a 50-50 joint venture with Jena India to manufacture LED televisions. Now company has an access to Google OEM license and we will start manufacturing Google certified LED TVs and other products also in the future. The JV company has already started setting up an integrated TV manufacturing facility in Uttar Pradesh and which we are very hopeful will be operational by the end of this financial year.

This business should scale up very significantly over the next couple of years in our opinion.

2. FY21-23 growth of 74%; FY16-23 growth of 35%;

3. FY23: PAT up 346% on revenue growth of 174%

FY2023 has been strong growth period as Consolidated Sales grew 95.7% and crossed INR 2147 crores for the company.

The Product business contributed 62.4% of the total revenues in FY23. Room AC business at INR 1041 crores grew 251% during the period while the Washing Machines business had a growth of 56.6% YoY and company sold over 4.58 Lakh washing machines during the period.

Order book for product business remains robust and the company is on track to scale the product business significantly in FY2024.

Operating margins have improved QoQ and YoY due cost control, softer commodity prices and operating leverage.

4. Q1-24: 2X+ PAT on a revenue growth of 26% YoY

Improvement in Margins

Operating profit margin to 9.71% in Q1-24 vs 8.2% in FY23

PAT margin to 5% in Q1-24 vs 3.6% in FY23

5. High quality earnings : Return ratios managed well

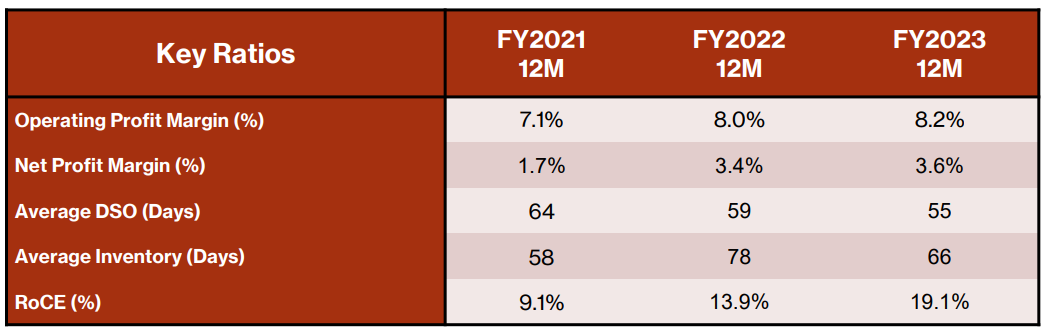

Net profit margin is showing an increasing trend over Fiscal 2021 to 2023 due to scale benefit and operating leverage.

Increasing asset turns driving the RoCE improvement for the company, which has scaled to high teens in FY23.

Company has undertaken numerous measures to improve capital efficiency by optimizing company structuring and utilizing various government programs and schemes like 15% tax rate, MOOWR, Central and State government incentives.

6. Outlook: 30% revenue growth & 28% growth in operating profit

Guidance for FY24

i. Don't see any very specific risks to the guidance

We don't see any major risks into this. There might be, you know, general risks, but you know, the way government is trying to ban imports of a lot of things from other countries. So, we have a very high dependence on imports from countries like China. And it is true for the whole of the AC industry and the consumer electronics industry. So, we have to be very watchful on those things. But other than that, I don't see any very specific risks to the guidance.

ii. PAT margin to increase by Product Linked Incentive (PLI) Scheme

PLI benefits of FY23 not yet claimed

We are eligible for the PLI benefits of the last year, but government has still not opened and finalized the formats and application for claiming that PLI.

PLI benefits to be booked by Q4-24

We hope to get the PLI benefit probably in the fourth quarter but once the application is lodged and we get our confirmation that is the time we will start booking.

Example to understand impact of PLI on margins:

The PLI scheme provided a subsidy of 4% to 6% on the value of the additional production firms generate. The value of the production includes inputs purchased from the outside. For instance, if a Rs 10,000 mobile phone assembled in India contains Rs 9,000 worth of purchased components, the production unit only adds Rs 1,000 in value, with a potential profit of Rs 200. However, under the PLI scheme, the company would receive a subsidy of 5% of Rs 10,000, which is Rs 500. This would increase the profit on additional production to Rs 700, raising the profit margin from 20% to 70%.

ii. PAT to grow by 44% in FY24 with PLI

PAT without PLI at 3.5-4% on sales guidance of Rs 2800 cr implies that PAT would be Rs 112-98 cr leading to a 26-44% growth in FY24. If we add PLI, one can easily expect PAT margins at 4% delivering 44% growth in FY24

PAT margins: We think that 3.5% to 4% without the incentives is probably something which is sustainable over a long term period.

PLI for FY23: This year we are supposed to get INR15 crores, which is for the last year

PLI for FY24: For next year we will be getting INR30 crores of PLI benefit which will be for this year.

7. 44% PAT growth in FY24 at a PE of 43

8. So Wait and Watch

If I hold the stock then one can definitely hold on to PGEL as long as the FY24 guidance holds. PGEL has a a track record of delivering 35% CAGR over a 7 year period. As long as PGEL continues on the 35% long term growth trajectory one can hold on. For a company growing at 35% over the long term there should be the flexibility to sustain a bad quarter on the way. The upcoming TV JV should be able to support the track record of growth from FY25 onwards

9. Or, join the ride

If I am looking to enter the stock then

PGEL is indicating a PAT growth of 44% for FY24 which makes the PE of 43 look reasonable.

The growth from the TV business will kick in from FY 25 and should be reflected in the guidance of FY25 and the business is expected to scale significantly of the next couple of years

Given that we are looking at a reasonably priced company with a good track record, one needs to enter PGEL in small steps on bad days over a period of time.

Don’t like what you are reading?

Let us know at hi@moneymuscle.in

Will make it better.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades